Six weeks ago we highlighted the US stock market's resilience to the ongoing political drama in Washington and beyond.

In that post, we noted:

the fundamental pillars of support for US stocks (earnings) are as strong as they've been in years. According to the earnings mavens at Factset, 'the estimated earnings growth rate for the S&P 500 is 9.1%. If 9.1% is the actual earnings growth rate for the quarter, it will mark the highest year-over-year earnings growth reported by the index since Q4 2011 (11.6%).'

With more Trump-related drama stealing the headlines while US stocks quietly power on to fresh all-time highs, we wanted to check back in on the proverbial "trump card" for US stocks: earnings.

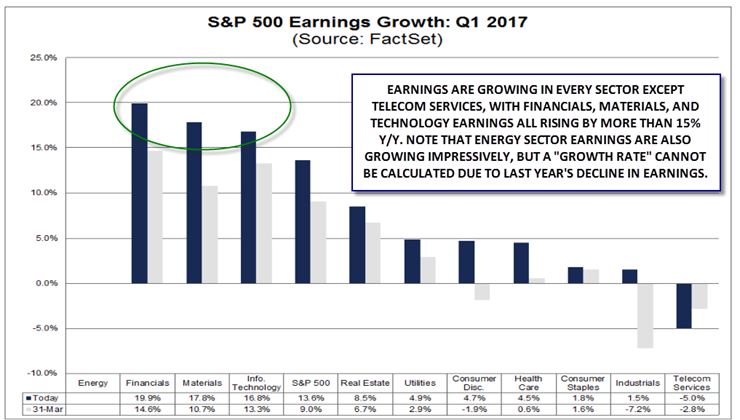

At the start of the week, 91% of the companies in the S&P 500 had reported Q1 earnings and if anything, profits are exceeding the already lofty early indications of six weeks ago. According to FactSet's excellent Earnings Insight data, 75% of reporting S&P 500 companies have beat EPS estimates and 64% have beaten revenue estimates (both figures are well above their 1- and 5-year averages). Impressively, the expected earnings growth for the S&P 500 is tracking at 13.6% year-over-year, which if realized, would be the strongest growth in earnings since Q3 2011!

Of course much of this growth is attributable to the energy sector, which actually reported a loss on a sector-wide basis in Q1 of last year. Still, even if the energy sector were completely excluded, the S&P 500 earnings growth would be tracking at a still impressive 9.4%. Revenue growth has been similarly strong, both with and without the energy sector.

Source: FactSet Earnings Insight

Perhaps most important for forward-thinking investors, analyst projections are optimistic for the rest of the year as well:

- For Q2 2017, analysts are projecting earnings growth of 6.8% and revenue growth of 4.8%.

- For Q3 2017, analysts are projecting earnings growth of 7.5% and revenue growth of 4.8%.

- For Q4 2017, analysts are projecting earnings growth of 12.4% and revenue growth of 5.2%.

- For all of 2017, analysts are projecting earnings growth of 9.9% and revenue growth of 5.3%.

While valuations for US stocks are unambiguously stretched across a variety of measures, it's hard to see the case for a big bearish reversal as long as corporate earnings continue to accelerate. In other words, turn off the TV, set your newspaper on fire and focus on the fundamentals.