“No, no! The adventures first, explanations take such a dreadful time.”

― Lewis Carroll, Alice's Adventures in Wonderland & Through the Looking-Glass

“To hell with facts! We need stories!”

― Ken Kesey

As the literary geniuses above note, humans are a storytelling species. When given the choice between a complex explanation of a phenomenon and a simple, coherent narrative, we'll choose the latter every time.

Unfortunately for traders, it's been a rough couple of months for the dominant narratives, especially when it comes to the political sphere:

- Going back to the US election, it was widely expected that a surprise victory by Donald Trump would be a disaster for investors — until stocks surged.

- Then traders reasoned Trump's intense early focus on growth neutral (arguably anti-growth) immigration and trade policies could hurt stocks by pushing back the promised fiscal stimulus...but stocks still rallied.

- Most recently, last week's failure of the Republicans health care reform bill supposedly undermined the Republicans' "mandate"...instead US stocks have seemingly already started to recover after a 1% dip.

And these examples only cover the US! We could spill another couple thousand words on the failure of issues like Brexit, European political risk, and Chinese growth concerns to lead to reversals in global equity markets.

So what gives?

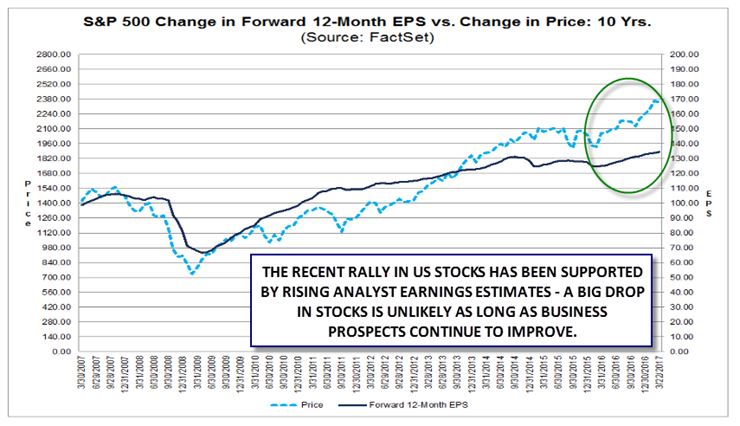

At the risk of highlighting another overly simple narrative to explain the strong recent performance in US stocks, the fundamental pillars of support for US stocks (earnings) are as strong as they've been in years. According to the earnings mavens at Factset, "the estimated earnings growth rate for the S&P 500 is 9.1%. If 9.1% is the actual earnings growth rate for the quarter, it will mark the highest year-over-year earnings growth reported by the index since Q4 2011 (11.6%)."

The Factset report goes on to mention that analysts have made smaller cuts to earnings estimates than the recent average and that fewer S&P 500 companies than usual have issued negative EPS guidance. In other words, corporations are quietly more optimistic about their short-term business prospects, and this outlook is being reflected by the recent rise in US stocks:

Source: Stockcharts.com

While valuations for US stocks are unambiguously stretched across a variety of measures, it's hard to see the case for a big reversal as long as corporate earnings continue to accelerate.

Perhaps traders are learning the lesson that the great authors we featured at the beginning of this report know all too well: Sometimes the simple, timeless stories are the best!