The S&P 500 traded flat Tuesday. While it would have been nice to extend Monday’s rebound, holding ground is still constructive. If traders remained nervous, another round of selling would have hit the market today as owners took advantage of this strength to lock-in profits. Instead most owners remain confident and choose to keep holding for higher prices.

Conventional wisdom tells us complacency is bad. What it fails to mention is periods of complacency last far longer than anyone expects. Confident owners don’t sell and that keeps supply tight. In a self-fulfilling prophecy, when confident owners don’t sell a dip, we stop dipping. Tight supply has propped up this market all year-long and it doesn’t look like last week’s headlines and volatility changed that.

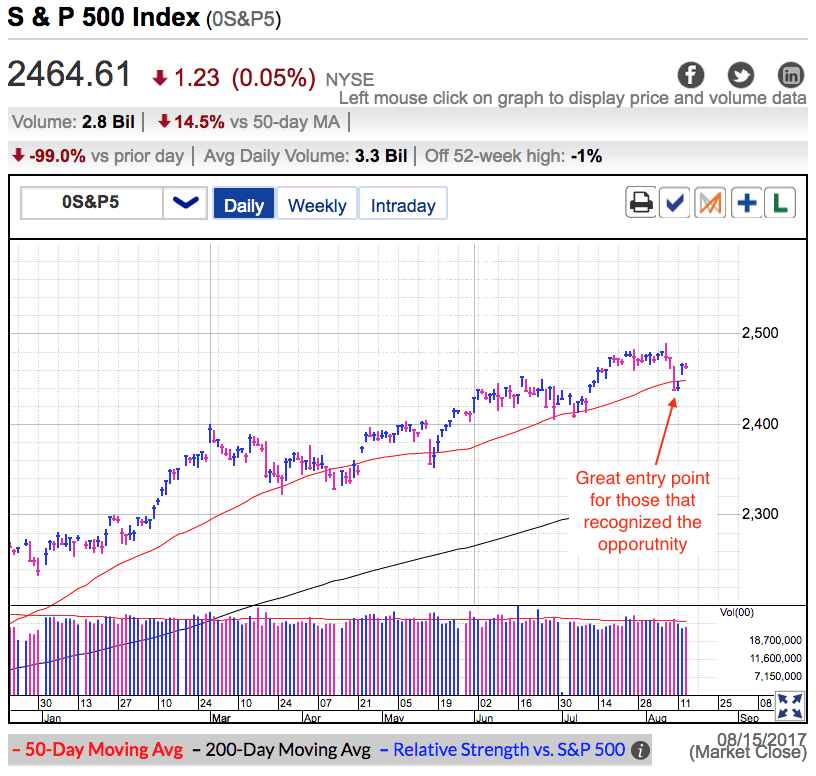

Last week I told readers “North Korea still doesn’t matter and how to profit from it“. Those that listened are a little richer this week. I don’t have a crystal ball and I wasn’t predicting the future. There is no magic in this, it is simply a matter of using common sense. This was not the first time a war of words broke out with North Korea and it won’t be the last. But these things never go anywhere because neither side can afford to escalate it beyond words. And that is exactly what happened this time. Reactive traders who acted without thinking were simply giving money away to those who better understood the situation.

Something will eventually break this bull market. Every bull market eventually dies and this one will be no different. While it is okay to be cautious after eight years of strong gains, being bearish just because we’ve “gone too far” is a great way to give away money. Don’t fight what is working.

Confident owners keep supply tight and the only way this market will crack is by convincing these stubbornly confident owners to sell. So far Brexits, rate hikes, and a dysfunctional Congress haven’t spooked owners. Over the last several years, every time an owner got nervous and sold a dip, he came to regret it. After making that mistake one too many times, most owners have now swung to the other extreme and are not selling anything for any reason. And for the time being this supreme confidence is working. Markets don’t dip when no one sells bad news.

As a trader, I enjoyed last week’s bout of volatility and am hoping more is on the way this fall. While this calm has been nice for many investors, it would be foolish to expect this period of historically low volatility to last much longer. I expect a return to more normal levels later this fall when big money managers return from summer vacation and start positioning for year-end.

But the thing to remember is volatility can occur in either direction. At this point nothing is convincing confident owners to sell and I doubt there is much that will change their mind. That means the likely outcome is we will see underperforming managers be forced to chase stocks higher into year-end. There is a smaller probability that further dysfunction in D.C. could finally get to this market when we don’t get the promised tax reform. But so far this market doesn’t seem to care about politics and is why I think this outcome is less likely than a chase higher into year-end.

The great thing about being an independent traders is our account size allow us to enter and exit full positions with the click of a mouse. That means we don’t need to know what will happen this fall and can instead wait for the market to tells us what it wants to do. Until then expect this slow creep higher to continue for a few more weeks. Markets that refuse to go lower will eventually go higher. Keep doing what is working and enjoy the ride.