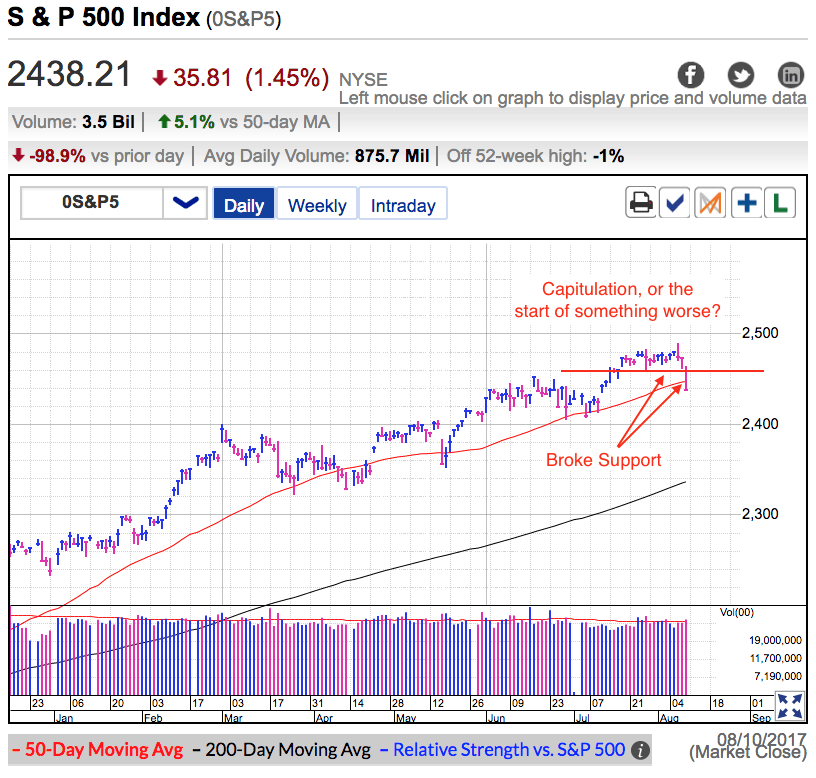

The S&P 500 sold off for a third day following Trump’s “Fire and Fury” threat to North Korea. The first two days of selling were relatively benign, but Thursday's defensive selling crashed through 2,460 support and the 50dma. This was the biggest single-day loss since mid-May and it puts us back to levels not seen in a month.

Thursday’s selloff felt especially dramatic since it came following a period of historically low volatility. Many traders assumed there was nothing to worry about and we would coast into the end of summer. Unfortunately for them Thursday's steep selloff reminds us there is no such thing as easy money in the market.

It is hard to talk about what is going on in the stock market without first dipping into geopolitics. This isn’t the first time we’ve gotten into a war of words with North Korea and it won’t be the last. But this situation is unique because no one knows how far Trump or Kim Jong Un will take it since both leaders are new to this high-stakes game of chicken. One miscalculation by either side could escalate this situation from words into something far more deadly.

Kim Jong Un’s primary “Trump” card continues to be the thousands of artillery cannons armed with chemical and biological weapons pointed at Seoul’s ten-million plus citizens. There is nothing North Korea can do to prevent us from bombing their nuclear program, but they can retaliate by attacking the civilians in Seoul.

Millions of hostages are what makes this situation so much different from the ones we face in the Middle East. Trump can talk a tough game, but unless he is willing to sacrifice millions of South Korean civilians, his hands are tied just like they were for all of his predecessors.

Most of the time these situations with North Korea diffuse themselves over a few weeks and things return to “normal”. There is a 99.9% probability this is what will happen here too, but that hasn’t stopped traders from reacting strongly to these headlines.

What started out as a little uneasiness earlier in the week turned into a mass exodus Thursday. This weakness was compounded by all the technical traders using stop-losses to automatically get them out of the market. While this strategy sounds good in theory, it can be tricky in practice because people often use similar support levels to trigger their stop-losses. That means any dip through a widely followed level will trigger another wave of autopilot selling.

2,460 has been support for several weeks and we violated that on Thursday morning. That led to the first cascade of selling that pushed us down to the 50dma. Then Trump told the world his “Fire and Fury” threat wasn’t strong enough and that was enough to extend the selloff under the 50dma.

While this selloff feels scary, the thing to remember is risk is a function of height. Last week when we were trading at record highs and everyone was in a cheery mood was actually a far riskier place to own stocks than jumping in and buying this dip. While it definitely doesn’t feel like it, the discounts sellers are offering make this a safer place to buy stocks because a big chunk of the selloff has already been realized.

For months I’ve been saying this is a buy-and-hold market. Holding is an easy thing to do when the market is gently gliding higher, but holding through a dip hard to do when everyone around us is selling. Our natural instinct is to join the crowd and get out before things get worse, but then that is no longer buy-and-hold.

Every dip this year bounced and this time will be no different. If you don’t think the U.S. will start a war with North Korea, then this is a better place to be buying stocks than selling them. It takes courage to go against the herd, but take comfort in knowing it is a lot safer to buy this fear than last week’s complacency. Many of us have been praying for a buyable dip, here it is. Don’t lose your nerve now.