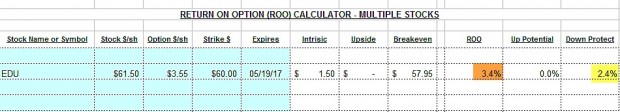

When we sell an in-the-money covered call, we are taking a defensive posture and using the intrinsic value component of the premium to protect the time value initial profit. As an example, let’s look at New Oriental Education & Technology (NYSE:EDU) on April 7, 2017:

- EDU priced at $61.50

- $60.00 (ITM) call priced at $3.55

- Expiration for the May contract is 5/19/2017

Initial profit and protection calculations using the Ellman Calculator

The results show an initial time value profit of 3.4% (brown field) with a downside protection of that profit of 2.4% (yellow field). This means that EDU can drop up to 2.4% by expiration and a 3.4%, 6-week return will have been realized. From an option-seller’s perspective, in-the-money strikes offer an alternative that can be employed when markets are bearish or volatile, when chart technicals are mixed or when the option-seller has a low risk tolerance.

This begs the question then as to why option-buyers are willing to spend the additional cash to own these strikes. After all, we are getting an insurance policy protecting our time value and that protection is paid for by the option-buyers, not us.

Reasons why in-the-money strikes are purchased

The Delta factor

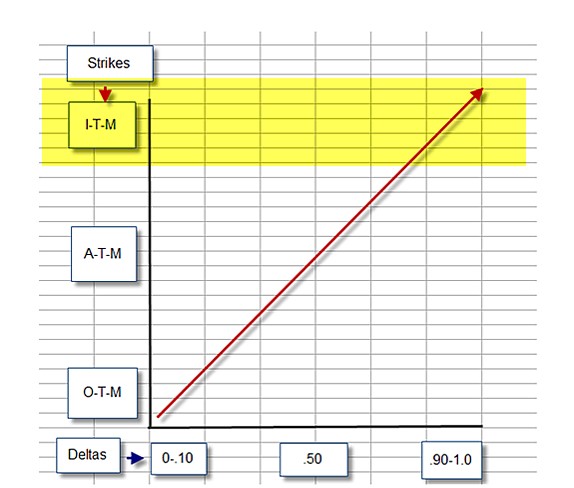

ITM strikes have the highest Deltas as shown in the screenshot below (yellow

A Delta approaching “1” means that the options will change in value nearly dollar-for-dollar with the underlying security. If the option holder is anticipating a significant share appreciation by contract expiration, it could result in an impressive percentage return because of the much lower cost basis of the option compared to the underlying asset.

Portfolio hedging

Frequently money managers will seek a Delta-neutral portfolio to mitigate against market risk. This where positive and negative Deltas neutralize each other. For example, if stocks were shorted resulting in negative Deltas, buying ITM options to mitigate with positive Deltas may be appropriate.

The in-the-money strike may have been an OTM strike previously

The moneyness of an option changes based on the price of the underlying security. If an option buyer purchased a $50.00 call when share price was $48.00, that option was out-of-the-money at time of trade execution. If shared price then moved to $52.00, that same strike is now in-the-money. The Options Clearing Corporation matches up buyers and sellers of options and those trade executions were probably not executed at the same time.

Discussion

The use of in-the-money strikes has its advantages and uses for both option buyers and sellers. There will always be a market for liquid stocks and exchange-traded funds (ETFs) for out-of-the-money and in-the-money or near-the-money strikes. Understanding when and how to use in-the-money strikes is one of the skills that will definitely put additional cash in our pockets.

Market tone

Global stocks were flat for the week. An increase in volatility was a result of concerns that White House turmoil could impact President Trump’s pro-growth agenda. Adding to volatility was a terrorist attack in Barcelona that killed 14. These events moved the Chicago Board Options Exchange Volatility Index (VIX) back up to 14.26. The price of West Texas Intermediate crude oil dropped to $47.20 a barrel from $48.20 last week. This week’s economic and international news of importance:

- Both the Fed and the ECB sent more dovish signals than the markets were expecting regarding monetary policy normalization

- There is concern that inflation is not moving toward the central bank’s 2% targets These concerns call into question the pace of future Fed hikes and the timing of an expected taper in ECB asset purchases

- After several high-profile defections of corporate CEOs from two business advisory councils, President Trump this week dissolved the councils

- North Korea regime announced this week that it will not target the area around Guam, a US island territory in the Pacific Ocean

- President Trump signed an order this week directing the Office of the United States Trade Representative to conduct an investigation into China’s trade practices with regard to intellectual property theft and the forced transfer of technology in order to be granted access to Chinese markets

- The British government published several position papers this week, laying out detailed viewpoints on border issues between Northern Ireland and the Republic of Ireland as well as on the need for a transitional customs union following Brexit

- Japan’s economy expanded at a 4% annualized rate in the second quarter, far exceeding expectations of a 2.5% rise

- With 92% of the members of the S&P 500 Index reporting, Q2 earnings are expected to increase 12% compared with Q2 2016. Excluding the energy sector, earnings are expected to advance 9.3%

- Revenues are seen growing 5.1% overall and 4.2% when excluding energy companies

THE WEEK AHEAD

Tue, August 22nd

- Eurozone: Economic sentiment survey

- Canada: Retail sales

Wed, August 23rd

- Global: Preliminary purchasing managers’ indices

- United States: New home sales

Thu, August 24th

- US: Jackson Hole Fed symposium begins

Fri, August 25th

For the week, the S&P 500 moved down by 0.65% for a year-to-date return of 8.34%

Summary

IBD: Uptrend under pressure

GMI: 1/6- Sell signal since market close of August 11, 2017

BCI: I am currently favoring in-the-money strikes 2-to-1. The stock market has been incredibly resilient given the global and domestic political concerns. It is not clear how much longer this durability will last.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The 6-month charts point to a mildly bearish outlook. In the past six months, the S&P 500 was up 2.5% while the VIX (14.26) moved up by 23%.

Much success to all,

Alan and the BCI team