Value investing can be rewarding, but growth investing can be much more enjoyable as it often presents the opportunity for much larger returns.

Picking growth stocks can be serious fun because they can lead to massive returns, and there is always an outside chance you grab the next Apple (NASDAQ:AAPL) . Yet, growth-focused investors cannot just pick any stock at random because it was in the news or has gone up recently. They must search for a company that presents a real chance for major gains based on current growth opportunities within the business.

With this standard in mind, growth investors could consider looking at KB Home (NYSE:KBH) .

The home construction giant has built homes since the late 1950s. KB Home specializes in modern, energy-efficient attached and single-family homes, where buyers are given an array of design options to choose from.

KB Home is currently a Zacks Rank #2 (Buy). On top of that, the company sports a “B” grade for Growth and an overall VGM grade of an “A.”

Last month, KB Home’s revenues jumped 25% to $1.1 billion. The company’s third-quarter net income rose 28% and hit $50.2 million. These gains were helped, in part, by a 12% increase in average selling prices.

KB Home revenues are expected to pop over 14% next quarter. Based on our current consensus estimates, the company’s full-year revenues are projected to climb over 20% to hit an upward estimate of $4.35 billion.

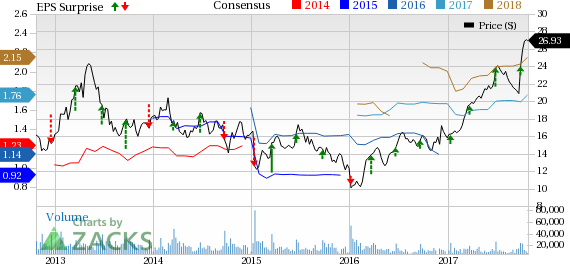

In the last 60 days, KB Home received eight upward earnings estimate revisions for its full-year along with no downward revisions. KB Home earnings are projected to skyrocket almost 90% in its fourth-quarter. For the full-year, the home building giant’s earnings are set to soar over 55% to touch as high as $1.80 per share.

KB Home has beat or matched earnings estimates in 10 out of the last 11 quarters, including the trailing seven quarters.

Shares of KB Home have already surged 83% over the last 52weeks, which more than doubles its industry’s average and crushes the S&P 500. Within the last four weeks alone, KB Home has seen its stock price rise almost 25%.

KB Home’s strong third-quarter helped send its shares to their 52-week high, which it reached this week.

It seems clear that growth investors should think about KB Home based on its earnings and revenue estimates alone. Coupled with its high Zacks Rank and VGM score, KB Home becomes even more enticing.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

KB Home (KBH): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research