From what I can see, this year is setting up to be another 2016—and that’s likely to hand us a buying opportunity in our favorite high-yield investments: closed-end funds (CEFs).

Here’s what I mean: after the market’s fast run higher in January, things have stalled out a bit. After the year we put in last year, this means we’re still left with some decent discounts to net asset value (NAV) on CEFs, as well as high yields (as CEF veterans know, payouts of 7% and up are common in the space, and most CEFs pay dividends monthly, too).

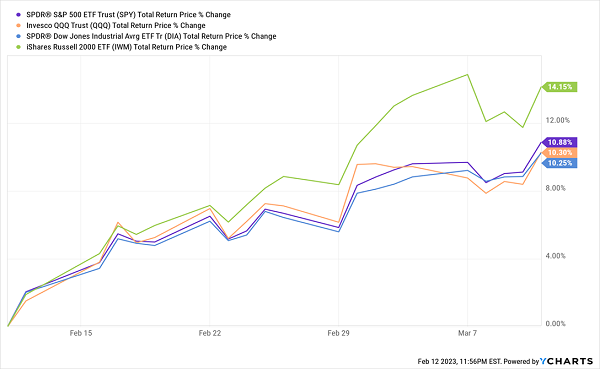

Here’s why I say that a “return to 2016” could mean big gains (and dividends) for us this year. As you can see below, back in 2016, the benchmark ETFs for the S&P 500 (in purple), the NASDAQ Composite (in orange), the Dow Jones Industrial Average (in blue), and the small cap-dominated Russell 2000 (in green) notched strong gains early in the year, despite fears about the Fed raising rates, rising inflationary pressures and a possible recession. Sound familiar?

2016’s Gains Had Investors Worried About a Pullback

Back then, these worries faded as economic data proved the economy could handle some rate hikes, and stocks really started soaring in mid-February—a bit later than this year, when they started grinding higher in early January. But as you can see from the angle of the upward lines back then, the gains were very similar in terms of sheer momentum.

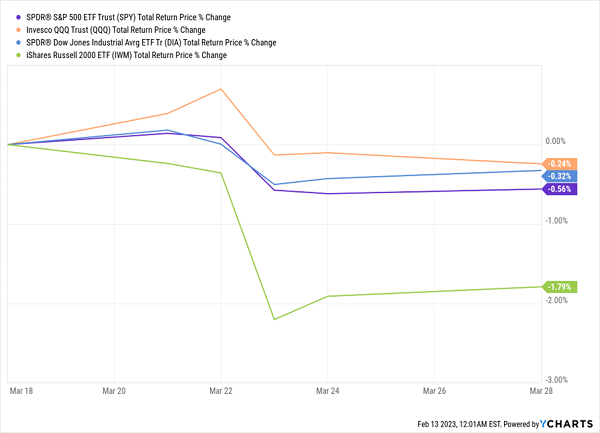

Of course, all bull markets take a breather, so stocks’ hot start this year couldn’t last forever, especially with the Fed aggressively raising rates. Similarly, the bull market in ’16, too, couldn’t last forever, and about a month after it began, it suddenly stopped, stoking fear of a pullback.

And the Resulting Stall Was a Buying Opportunity

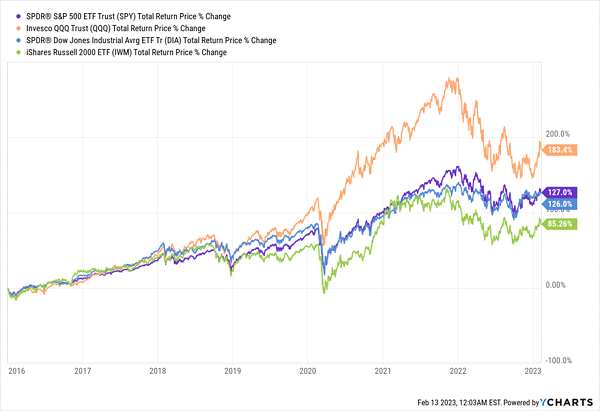

Investors who bought at this time notched considerable gains: the S&P 500 ended the year up 12%, and small caps soared over 21%. Then there are the huge gains stocks have handed out since then, with all four of the above indexes returning over 100% on average.

Long-Term Holders Win Out

So what does this mean for today? Simply put, this latest “stall” is a buying opportunity. But what kind of CEFs should we focus on?

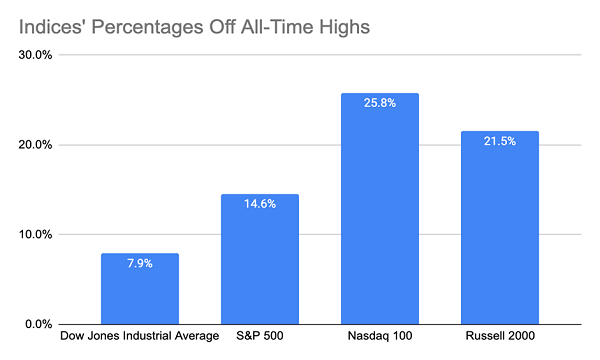

A quick look at the chart below tells us that the tech-dominated NASDAQ has the most room to recover, but if you want to stick with the safety of large caps, you’re in luck: the S&P 500 also has quite a bit of room to rise, even with the gains it’s posted so far this year:

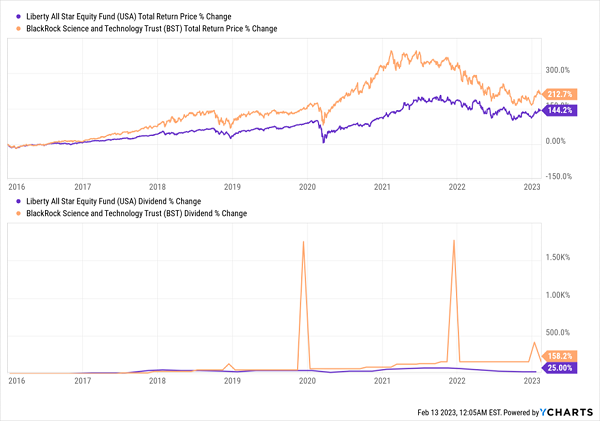

A good “2-CEF” strategy here, then, would be to start with, say, the Liberty All-Star Equity Closed Fund (NYSE:USA), which yields 9.5% today and holds S&P 500 mainstays like Visa (NYSE:V), Dollar General (NYSE:DG), and UnitedHealth Group (NYSE:UNH).

Then you could add the BlackRock (NYSE:BLK) Science & Technology (NYSE:BST), a 9.3%-yielding pick that focuses exclusively on large-cap tech names like Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT). Both of these funds have beaten the S&P 500 since 2016, and both have substantially raised their payouts, and booked big total returns, despite bear markets in 2018, 2020, and 2022.

USA and BST Dish Big Dividends and Total Returns

Note that the USA pledges to pay out 10% of its NAV per year as dividends, which is why its payout fluctuates slightly more than that of BST. And BST, for its part, is known for special payouts—the orange lines in the second chart above.

The key takeaway here is that over the coming months, each of these funds is likely to see its market price get close to the all-time highs they hit back in 2021, making now a good time to buy.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI