In 2013, the S&P 500 closed at a record high at the same time that the 10-year U.S. Treasury bond yield closed at a record low. The reason? The Federal Reserve had been buying hundreds of millions of government bonds as part of its quantitative easing (QE) program. Indeed, back in 2013, Fed leaders determined that the country still required emergency-level economic stimulus.

Here in 2016, the S&P 500 may close at a record high above 2130 at the same time that the 10-year yield closes at a record low beneath 1.36%. The difference between three years ago and the present? While the Fed is still maintaining an effective overnight lending rate near zero percent, the central bank has not been acquiring Treasuries with additional electronic dollars to stimulate the U.S. economy. In other words, the Fed is not as stimulus-crazy as it used to be.

How rare is it for the S&P 500 to register a record high-water mark as the 10-year yield is logging a never-before-seen low point? According to Jones, if it happens again, it will be the second occurrence in 40 years.

U.S. stocks and investment grade bonds have both performed remarkably well since the February stock correction. On the flip side, an astute observer should be quick to note that iShares 7-10 U.S. Treasury Bond ETF (NYSE:IEF) has outhustled the S&P 500 SPDR Trust (NYSE:SPY) since the Fed’s final bond purchase back on December 18, 2014. (And with a whole lot less volatility.)

Analysts continue to wonder, “Can stocks and investment grade bonds keep it up?” History suggests that something is likely to break; that is, either the bond bubble will burst or the stock balloon will pop. (Heaven help participants if both asset classes get cremated simultaneously.)

Some optimists have been suggesting that the unusually strong correlation between stocks and investment grade bonds since February may persist for many months into the future. The thinking? Foreign money – institutions, pensions, sovereign wealth funds, money managers, retail – will continue to grab the remaining A-rated debt with a positive yield. Positive-yielding debt is increasingly scarce with $12 trillion in negative-yielding global debt. Meanwhile, the optimists contend, negligible bond yields make U.S. stocks all the more attractive.

Other market watchers, myself included, see the “risk off” element as the more powerful force in the months ahead. Economic fragility in China, the recession in Japan, the U.K. exit from the European Union and “too big to fail” European banks create an environment of unprecedented global uncertainty. None of the issues alone is likely to serve as a death blow to U.S. equities. In aggregate, however, the headwinds may be severe.

Is it really the case that the U.S. is immune to the world’s headaches? Vanguard All-World (NYSE:VEU) has dropped approximately 20% over the last two years. European banks in iShares MSCI European Financials (NASDAQ:EUFN)? 40%. When one considers the reality that U.S. corporations generate half of their profits from abroad, one recognizes that overseas troubles can exert significant pressures on the earnings outlook ahead.

Granted, one may choose to explain record lows for U.S. Treasury yields as a function of foreign investor demand. Yet “risk-off” assets like SPDR Gold Trust (NYSE:GLD) and CurrencyShares Yen Trust (NYSE:FXY) are also beating U.S. stocks in 2016. It is a bit more of a stretch to suggest that the demand for Japan’s currency and/or the yellow metal emanates from overseas interests.

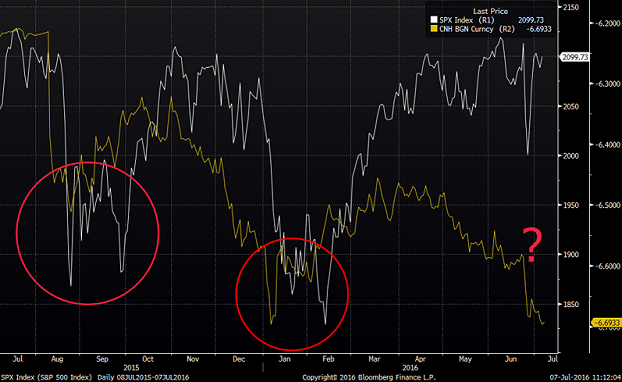

There’s more. Over the last 12 months, whenever China’s yuan (renminbi) tumbled, U.S. stocks corrected by 10% or more. And yet, the S&P 500 appears to be dismissing Chinese credit concerns. (Can that really last?)

China’s credit mess. Disrepair of the EU banking sector. Persistent deterioration in gross world product (GWP). Central banks around the world are likely to continue pushing unconventional policies that will keep the bond bubble blowing.

Conversely, the tiniest of unanticipated pin pricks is likely to poke a hole in the U.S. stock balloon. When it happens, investors with 25% or more in cash and cash equivalents will be well-positioned to acquire shares at genuinely favorable prices.