The cryptomarkets have stepped up over the past 48 hours. ripple had an amazing day yesterday with a rise of more than 10% and bitcoin is up more than 5% over the past 24 hours.

European regulators have been cracking down on all things crypto lately and are considering introducing more regulatory framework that could hamper the growth of blockchain based assets.

On the other hand, Brazil's biggest financial firm is has announced that they plan to add bitcoin trading for their clients.

In Japan, where bitcoin has been fully legalized as of April, a large energy supplier called Remix point has now added the option for their clients to pay in Bitcoin. This move is actually very strategic, not as much for retail customers as for corporations.

These companies pay very large bills which carry significant transaction fees. By paying in bitcoin they'll be able to save a lot of money every month by cutting out the payments middlemen.

Today's Highlights

The House & Taxes

When will the bubble pop?

NFP Today!

Please note: All data, figures & graphs are valid as of October 6th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

Wall Street rejoiced yesterday as the US House of Representatives passed their 2018 budget clearing the way for Donald Trump's widely anticipated tax reforms.

The politics are exhausting and there are a thousand hurdles before it actually happens but this first step in the right direction was enough to send stocks flying. The Dow Jones and the SPX500 both put up massive gains as they traveled ever further into record high territory.

Stocks were also comforted by the fact that the Catalan government has yet to take any drastic steps towards independence. The Spanish stock market has managed to completely recover Wednesday's losses and is now awaiting further updates.

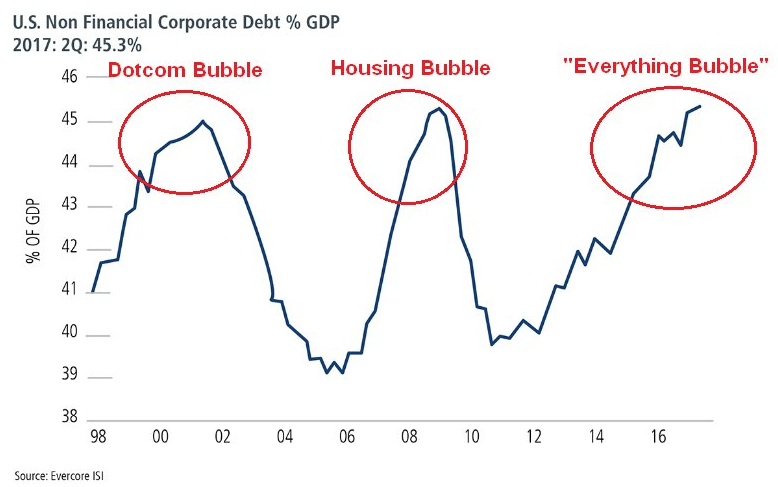

There's no doubt that the stock markets are currently in a bubble. The following chart shows a key indicator that's currently reaching eerily familiar levels.

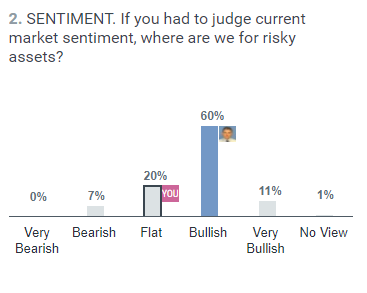

On the other hand, there are many who believe that this bubble is yet to reach max potential. A survey of investment managers performed by Goldman Sachs (NYSE:GS) reveals that 71% of those surveyed are currently bullish on the stocks.

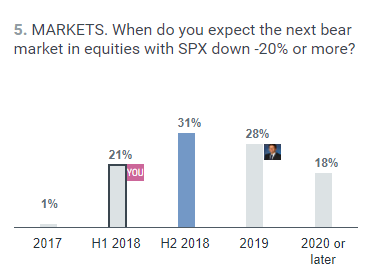

And that only 22% believe there will be a major pullback before July of 2018.

One more thing that's worth noting today is the decline in the British Pound over the last week. The GBP/USD has dropped 2.4% since the beginning of the month.

In large part, the decline is due to a stronger US dollar as well as some weak economic data that has lowered investor expectations of a rate hike from the Bank of England.

Prime Minister Theresa May's position has also suddenly been called into question. At this stage of the Brexit negotiations, political uncertainty is the last thing the UK needs.

"She's been on death row since the election. Boris attacked her recently and the conservatives are falling apart. My feeling is they were happy for her to stay in power after the election to take the criticism."

NFP Data Today

Yup, it's that time of the month again. The US jobs report is usually the biggest event that moves the markets on a monthly basis. With the Dollar fighting hard since the lows of September 8, this particular piece of data could prove critical.

Analysts are currently forecasting that a very weak number of jobs were added to the US economy in the month of September with most estimates ranging between 80 to 90 Thousand, well below the average level of growth for the past few years.

The announcement will come at precisely 12:30 PM GMT and we should get some nice movements at that time.

Wishing you an amazing weekend!

@MatiGreenspan

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.