My post of late January on the Dow 30 Index mentioned that price had reached 20,000, in spite of negative rhetoric from media pundits and some investors about an imminent implosion of markets under President Trump's economic agenda in the months leading up to the presidential election and to that date.

Yesterday, the Dow 30 broke and closed above 22,000 for the first time, setting another all-time record high. As you can see from the monthly chart below, price has now hit the top of a long-term uptrending channel from the 2009 lows. So far, markets seem unfazed by the ongoing political gridlock and machinations in Washington.

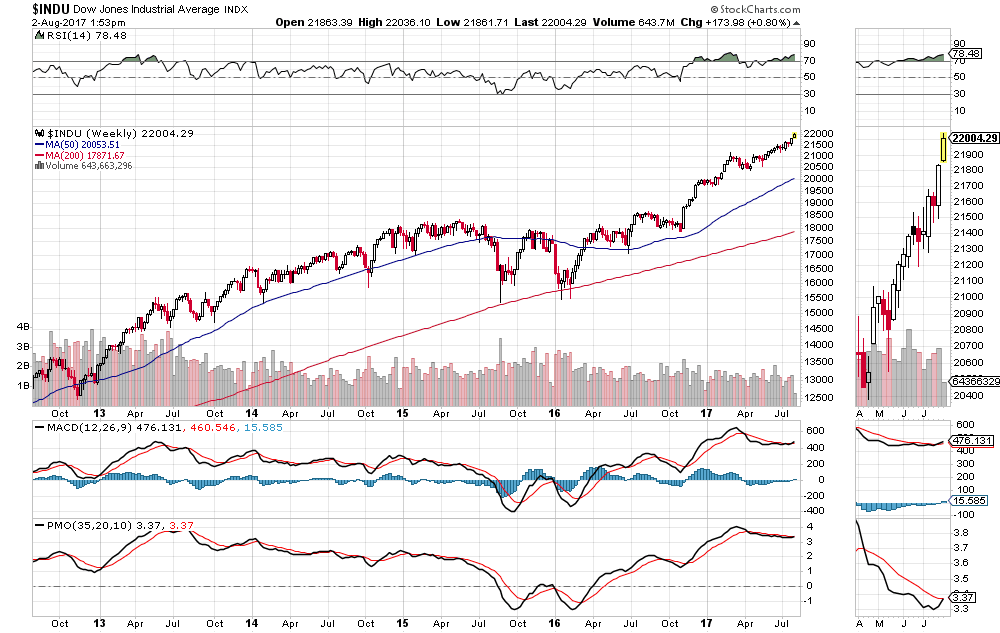

Looking at a shorter-term weekly timeframe (see chart below), we see that the RSI continues its uptrend, a bullish cross-over has formed on the MACD, and a bullish cross-over is about to form on the PMO...all of which signal that the bulls are still in charge.

The fact that price has touched the upper channel on the monthly timeframe does not automatically mean that a pullback is imminent...rather, that price could very well continue to climb along this upper edge for some time, as it did in 2013 and 2014, albeit with possibly a bit more volatility than we've seen of late.