Hope you had an excellent weekend. Our inspiring technological achievement for today comes from Singapore.

The country has just recently issued their first few Singapore dollars on the ethereum blockchain. Project Ubin is running a private version of ethereum so unfortunately, they've not opted for total transparency.

This news is a huge leap forward for blockchain technology, but unfortunately two steps backwards for fairness and income equality.

Unless I misunderstood the project, which is entirely possible, this new money being developed in Singapore will be exclusively traceable by the banks and government, leaving private citizens in the dark.

Today's Highlights

- UK's Future Gov

- Questionable Fed

- Bitcoin 3000; ethereum 300

Please note: All data, figures & graphs are valid as of June 12th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

The damage done by Theresa May seems to be quite contained at this point, almost like a nuclear weapon that may or may not be deployed.

The Tories unlikely alliance with the Northern Irish DUP did manage to put the markets at some level of ease. Let's hope that they are able to strike a solid deal soon.

For now, May is still in charge but after gambling with the fate of the nation and losing, there are many who would like to see her replaced asap.

The largest reaction can be seen in the British pound, which fell more than 300 pips on the night of the election (blue circle). Since the Brexit referendum one year ago, there have been two surges upward. One was Theresa Mays "Strong Brexit speech on January 17th (yellow circle) and the second was when May called the snap elections and the markets perceived that she will strengthen her hand (orange circle).

Arguably, a strong May has been responsible for saving the pound from falling below 1.2000. So further uncertainty could certainly bring it back to that point.

Other markets

... don't seem the least bit concerned about what happened in the UK. At this point, Brexit seems a foregone conclusion so the only real question is what kind of deal will the UK get with Europe.

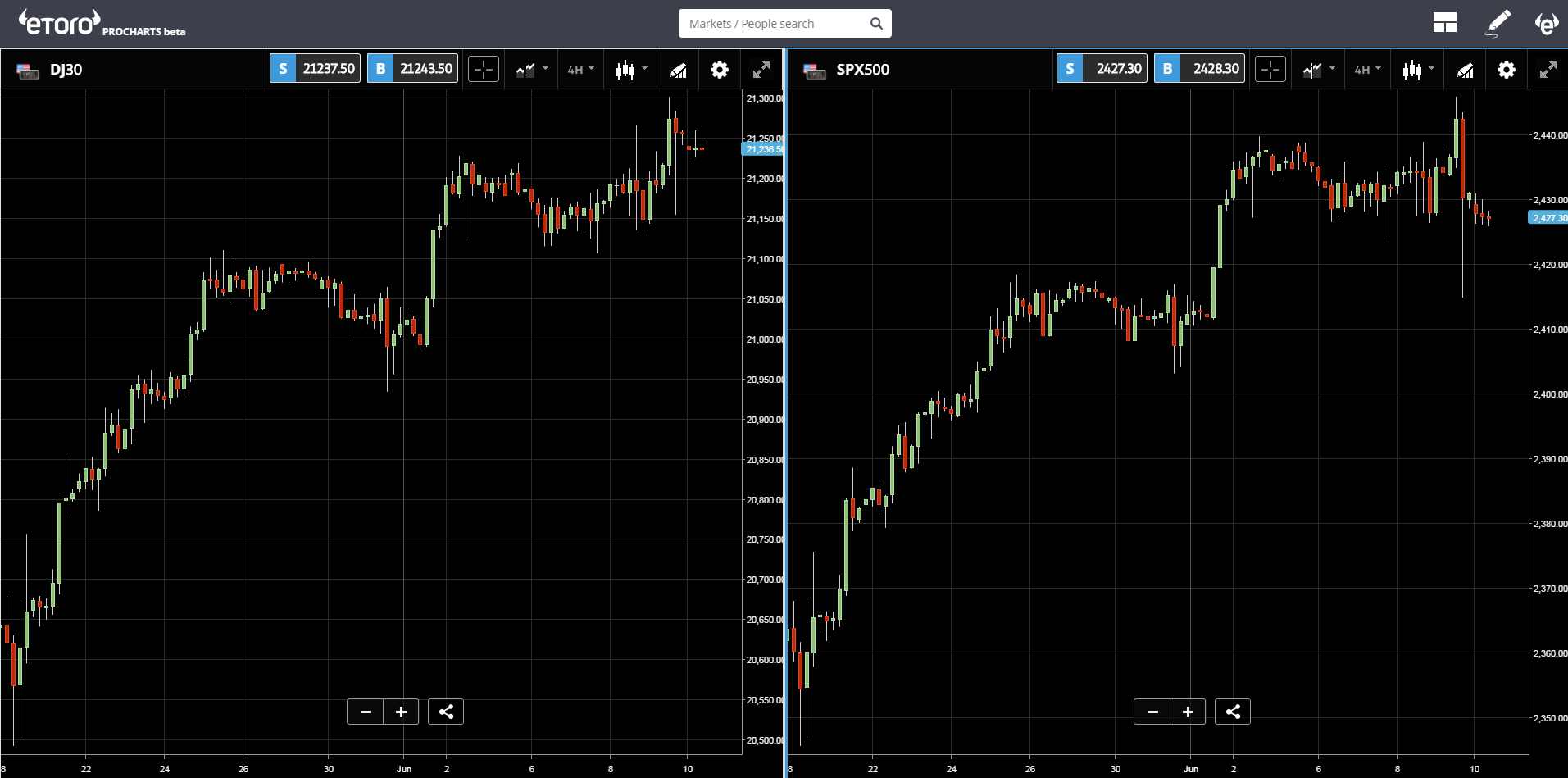

Wall Street continued to venture into record high territories on Friday but the Dow Jones and S&P 500 did experience some minor pullbacks before the weekend.

Gold continued on downwards and is now seriously testing its short term support level (dotted yellow line). A stumble below that line could easily lead it to the bottom of the blue channel so watch out for any large sell orders.

Oil is also testing the lows and for the last three sessions has been holding at $46 a barrel. The blue box represents a large area of support between $42.5 and $45 a barrel. However, if the oversupply pushed it below that it could spell trouble.

Aside from the Trump-related drama in the USA, the markets are now waiting for the Federal Reserve meeting on Wednesday. For now, analysts continue to argue what the Fed will do and coming so close to the meeting with uncertainty still prevalent is not a good situation.

Cryptos Blast Off!!

The surge towards crypto assets continued this weekend. With ethereum passing $300 for the first time and bitcoin now trading above $3000 in Japan and China. The West is still a tad lower but if the trend continues we should catch up shortly.

Ethereum didn't take any time to rest at this milestone and is already trading above $360 a coin. A new ICO called Bancor is coming online today could attract some fresh money into the ether network.

This project is right at the heart of blockchain as the future of the internet and may one day completely replace CFDs as the main way people trade stocks, commodities and other financial assets online.

We're still in the early stages of blockchain technology but the thought that Bitcoin and Ethereum could one day replace money and the internet is certainly gaining traction.

The total market cap of all digital assets, as reported by coinmarketcap.com is now just shy of $115 Billion and rising fast

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.