It’s common knowledge now that Big Tech dominates the broad stock market like never before.

As Bianco Research recently demonstrated, if FAAMG were its own sector it would comprise a larger share of the S&P 500 Index than any sector has in the past and by a wide margin.

Certainly, the structural nature of passive indexes contributes to this effect of the big growing ever bigger, especially at a time when inflows have surged in an entirely unprecedented way (and even if they appear to now be decelerating).

But there is also a fundamental factor at work in addition to the structural. These stocks have grown revenues over time, and especially over the past year, at rates that not long ago would have been very difficult to imagine for such large companies.

As a result, investors have extrapolated those growth rates indefinitely into the future and once again to an entirely unprecedented degree. But what if Big Tech’s growth were to disappoint going forward?

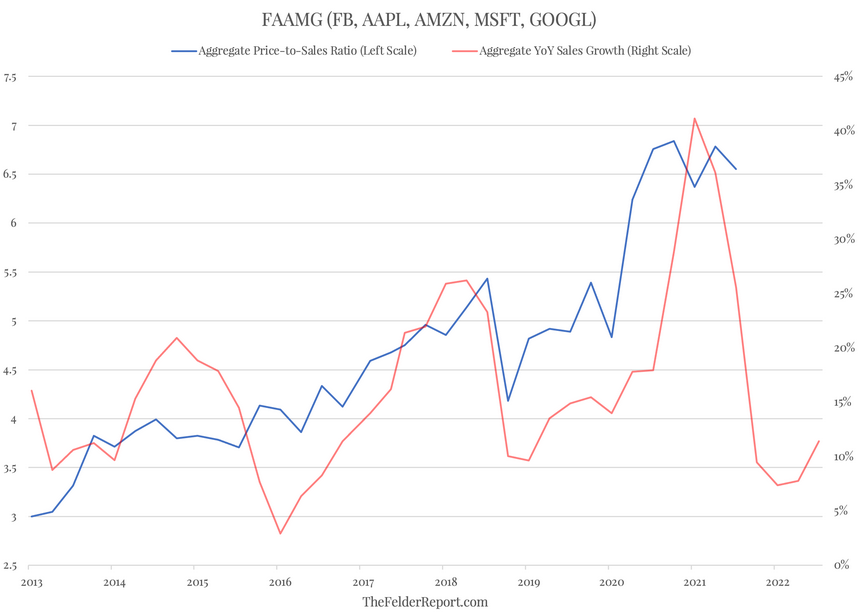

The chart below plots the aggregate price-to-sales ratio for FAAMG: Facebook (NASDAQ:FB)—now Meta, Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google, i.e., Alphabet (NASDAQ:GOOGL), along with the year-over-year growth of aggregate sales.

Clearly, there is some relationship here between sales growth and valuations; when the former rises the latter follows and vice versa. And over the past year, sales growth has soared leading to record valuations.

However, according to analyst estimates, sales growth for this group is set to decline in a dramatic way over the next few quarters which could pressure these extreme valuations.

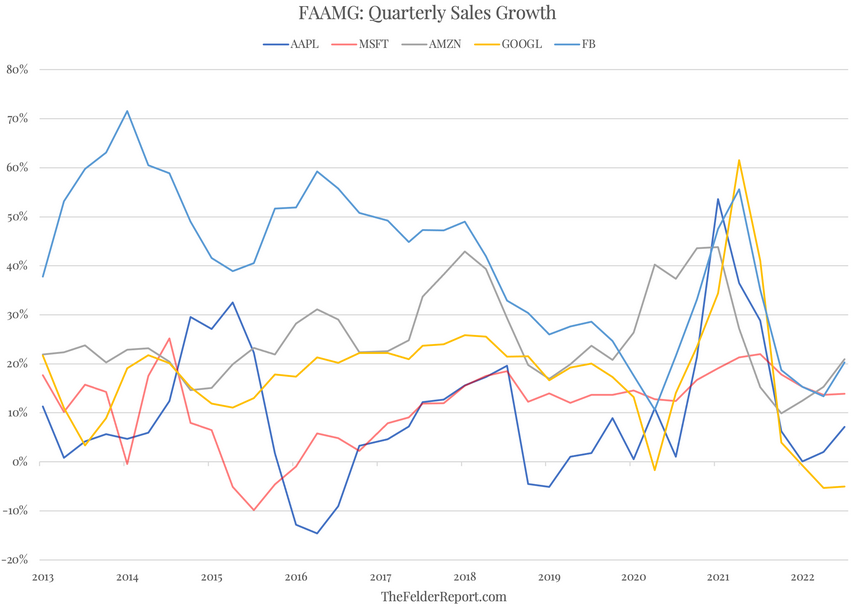

What’s more, while Amazon and Apple dominate this group by the sheer size of their revenues, the decline in sales growth is not, by any means, relegated to these two.

Every company in this group is expected to see its sales growth drop by well more than half over the next few quarters; some may even see sales declines.

And when looking at the past decade, the recent degree of correlation in the sales growth of these companies is yet another aspect of this phenomenon that appears entirely unprecedented. The chart below makes a fairly compelling case that the onset of the pandemic represented a significant catalyst for sales growth for FAAMG that will soon prove temporary.

So the big question then becomes: Given the fact that valuations now discount record sales growth, what level of growth is actually sustainable going forward?

Because if that number is something significantly less than the record highs we have just seen, then the aggregate valuation of FAAMG may need to adjust downward to reflect that reality.

Perhaps an even more important question is: What level of passive inflows are sustainable going forward? Because if the current record pace continues to decelerate, that, too could become a headwind for prices.

Due to the fact that these stocks essentially are the stock market today, these questions could hardly be more pertinent.