Here are a few charts that I focus and plan to trade upon them over the coming weeks. Overall, expect markets to get rough near the end of December and the start of January.

1. S&P 500: A possible fractal replay to the Brexit price action.

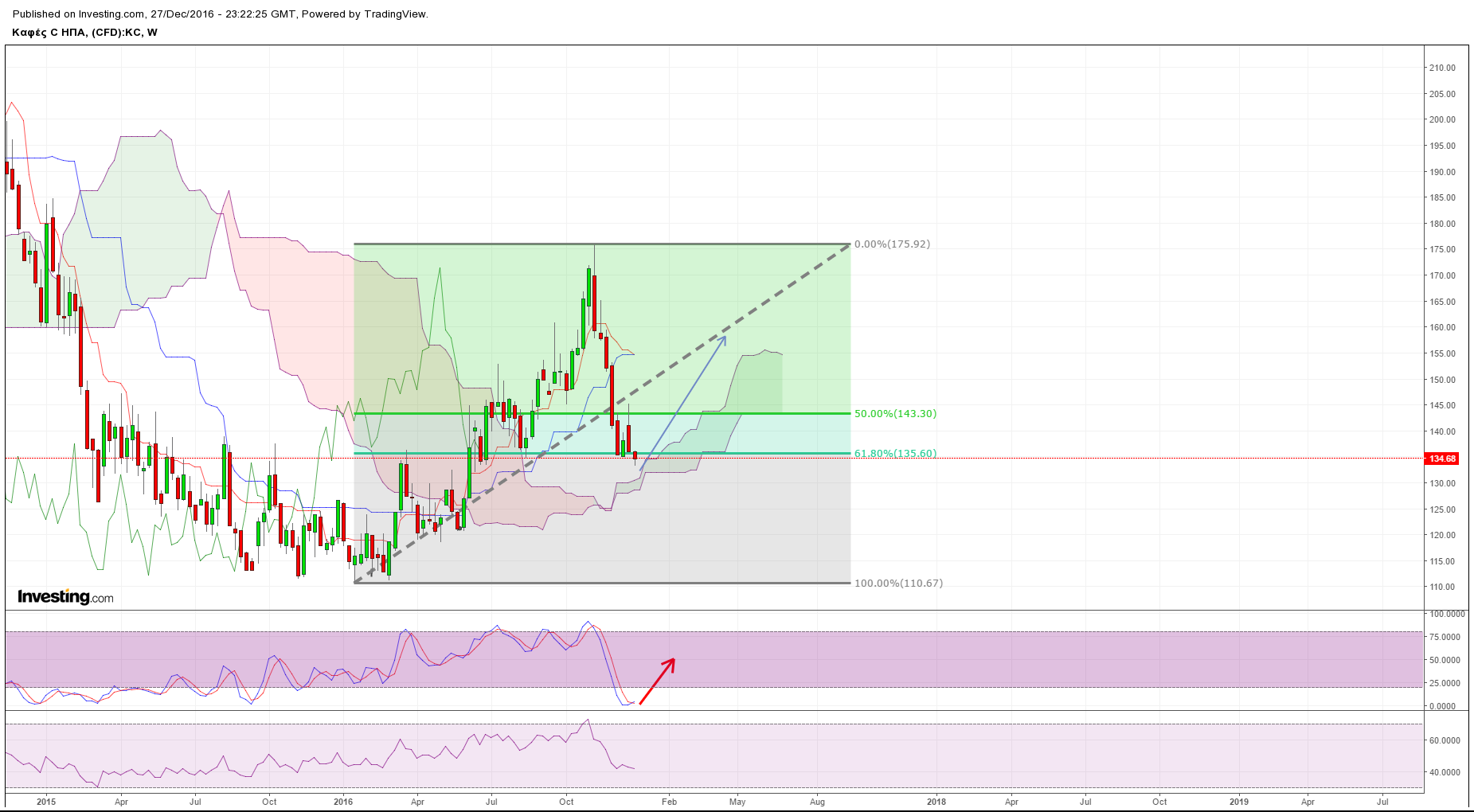

2. Coffee: Testing weekly cloud. Oversold. Expecting strong upward reversal.

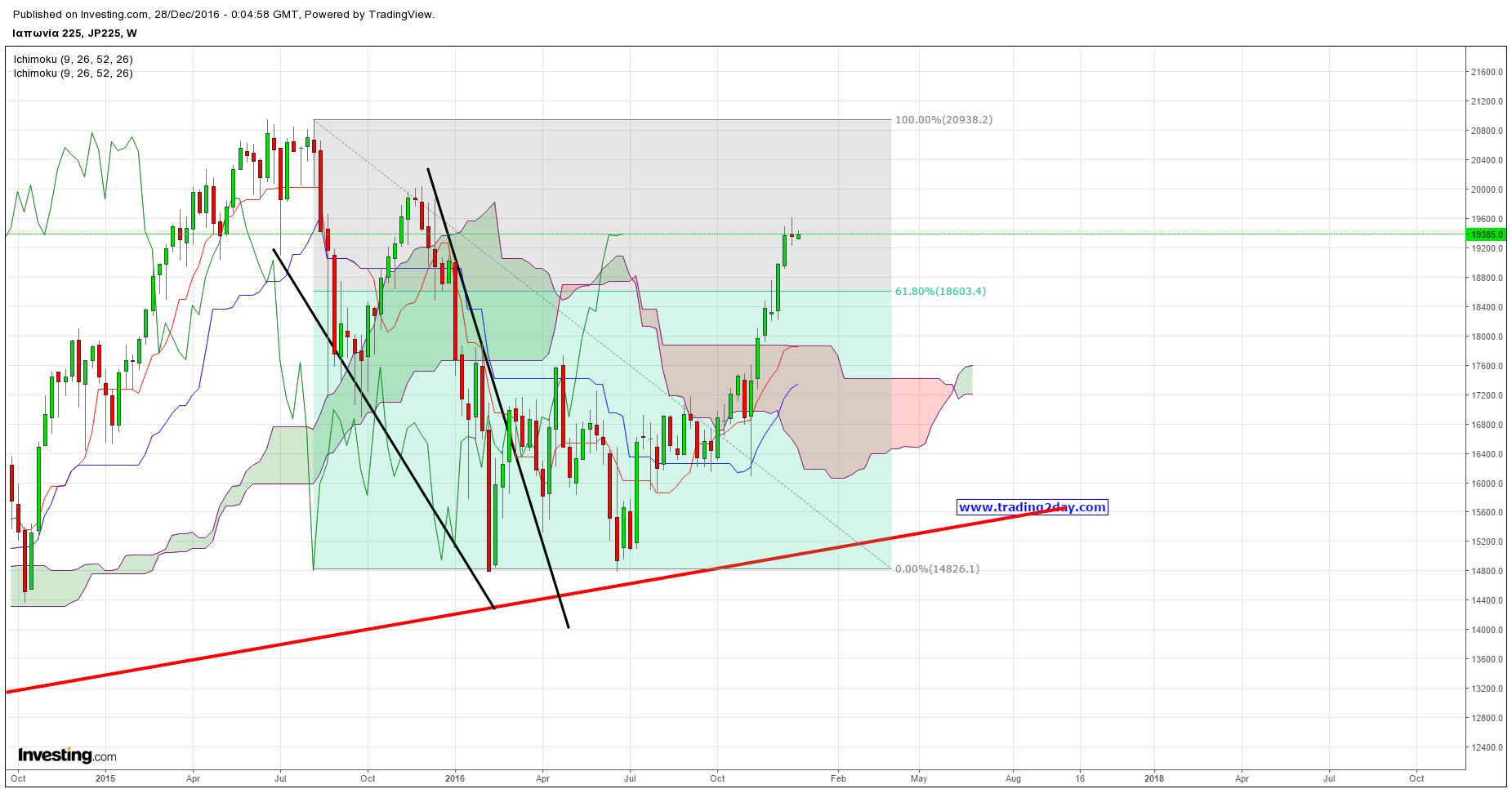

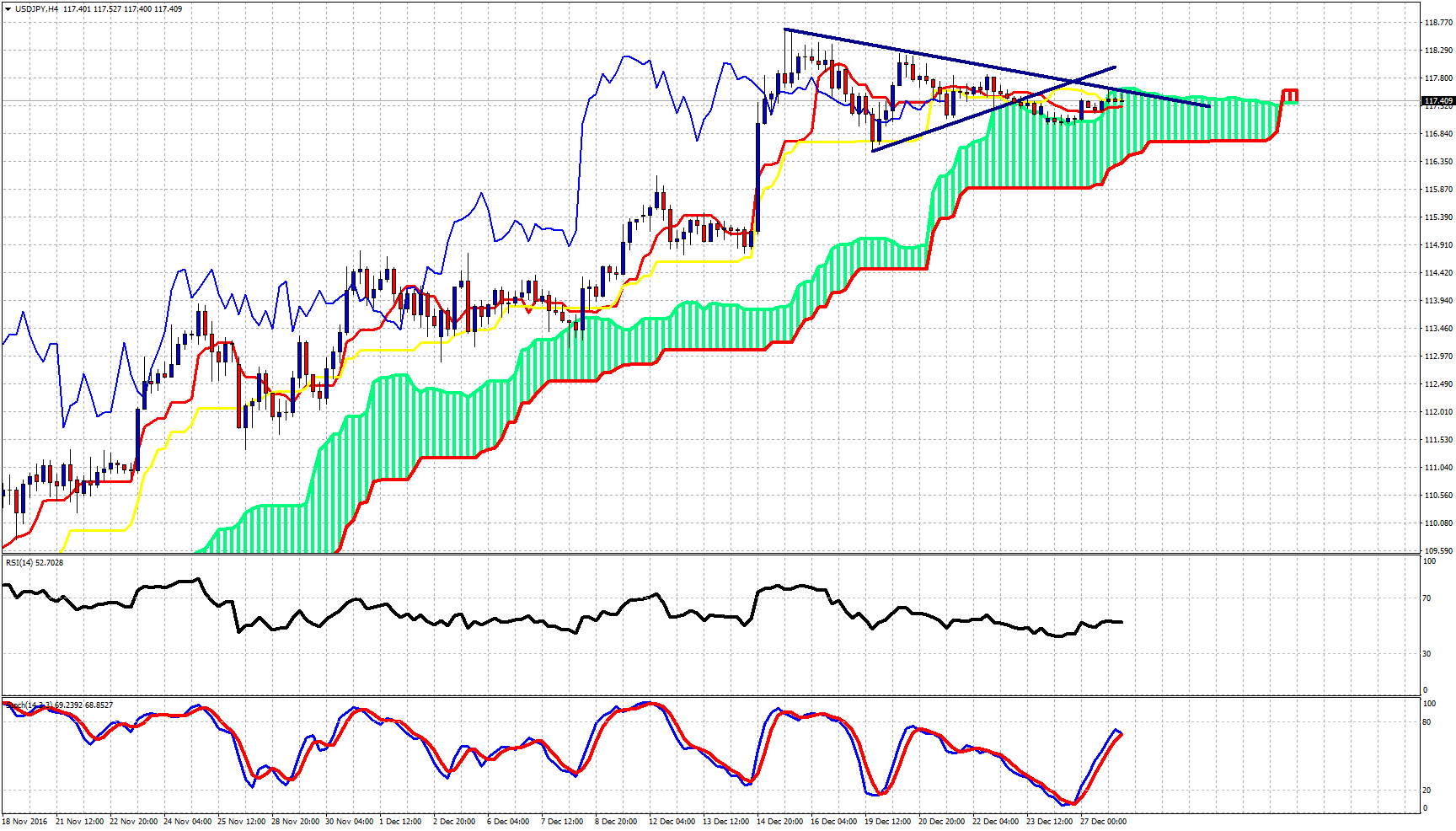

3. - 4. USDJPY and Nikkei: Ready for a reversal?

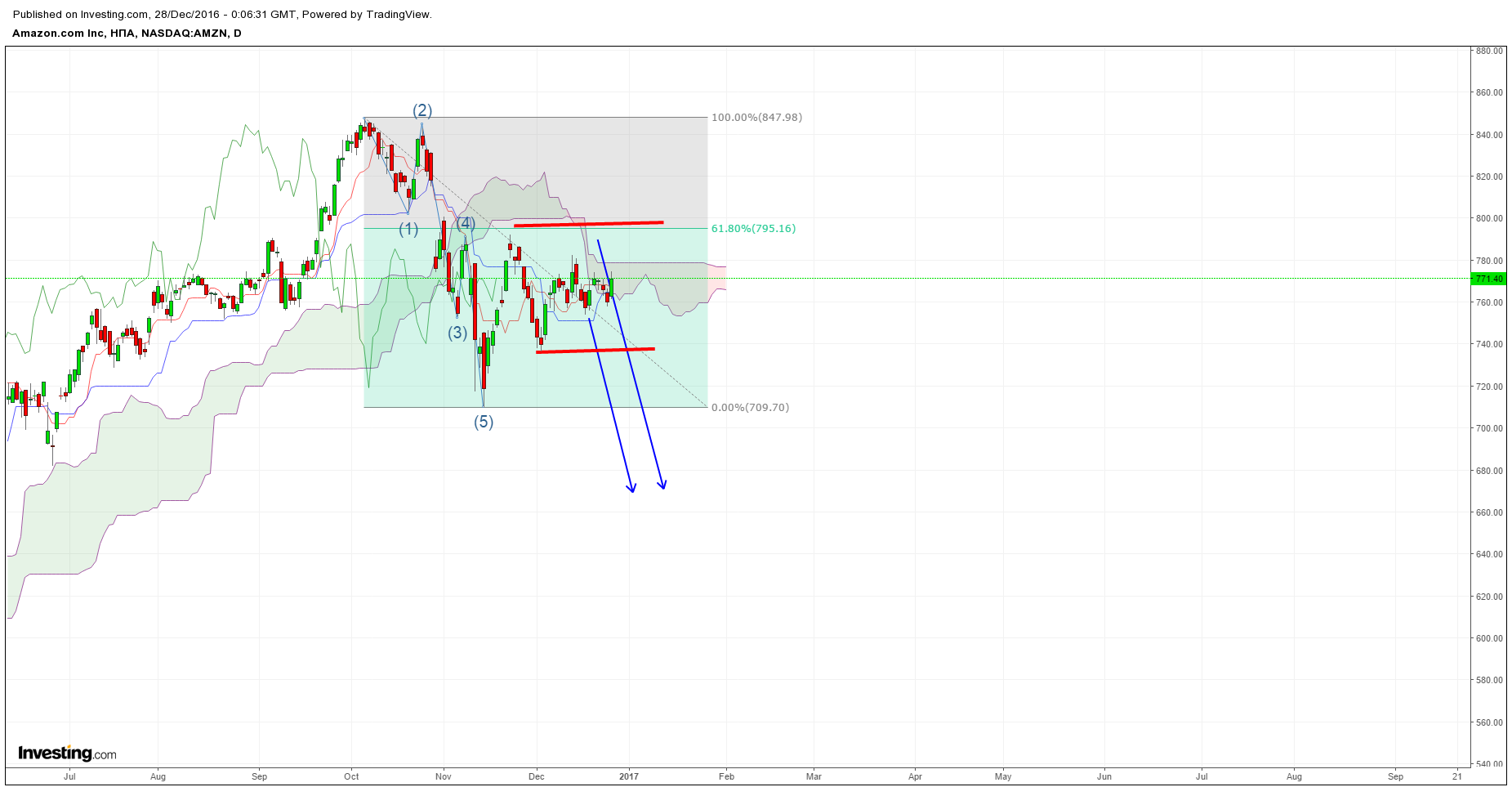

5. Amazon.com (NASDAQ:AMZN): $795 key level to short, #735 key support level. Big downside potential.

6. Sugar: The next big bullish move? Maybe we will taste its sweetness.

7. Gold: Preparing for its next leg up towards $1,500

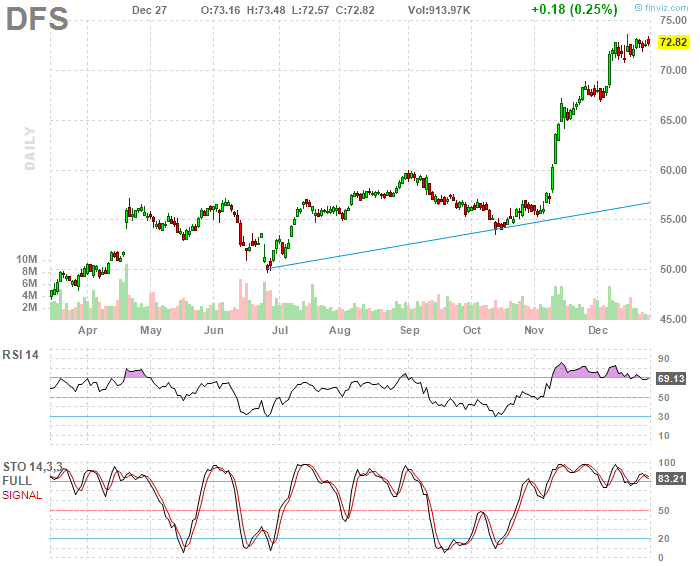

8. - 13.: On my watch list to short are stocks like Alaska Air (NYSE:ALK), American Express (NYSE:AXP), Discover Financial (NYSE:DFS), Goldman Sachs (NYSE:GS), US Bancorp (NYSE:USB) and Prudential Financial (NYSE:PRU).

Overbought divergence signs (triple most common), many bearish wedges. Get ready to sell sell sell these if support (recent lows) breaks down.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.