While I didn't post on Wednesday I had thought market gains held promise with volume rising in confirmed accumulation. However, yesterday's sharp reversal put paid to those gains. It's not a total disaster, as December swing lows remain intact for the NASDAQ, S&P and Russell 2000 - but the probability of these lows breaking is now significantly higher.

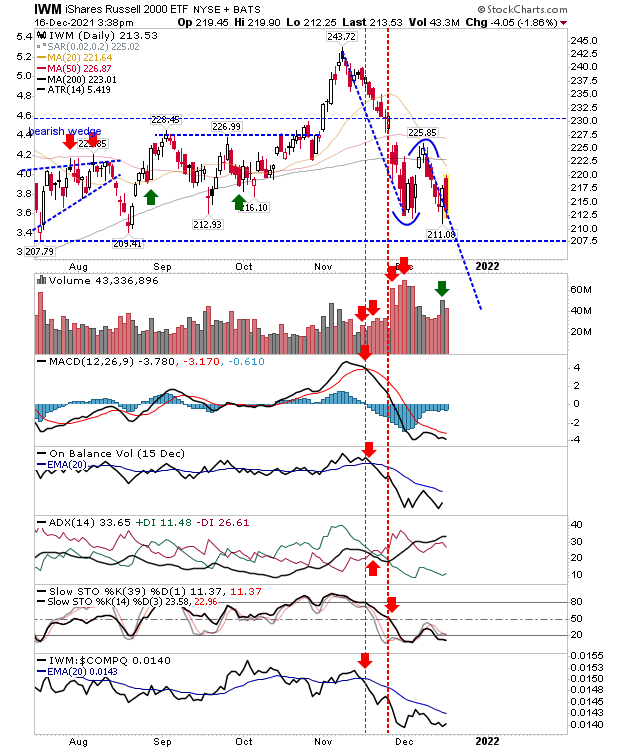

In the case of the Russell 2000 we had a "bearish engufling pattern", but note, this pattern only carries weight as a reversal in an overbought market and we don't have this scenario here (stochastics/momentum is oversold). It does look like the measured move target down is still in play. Once the December swing low is taken out I would be looking for selling to accelerate.

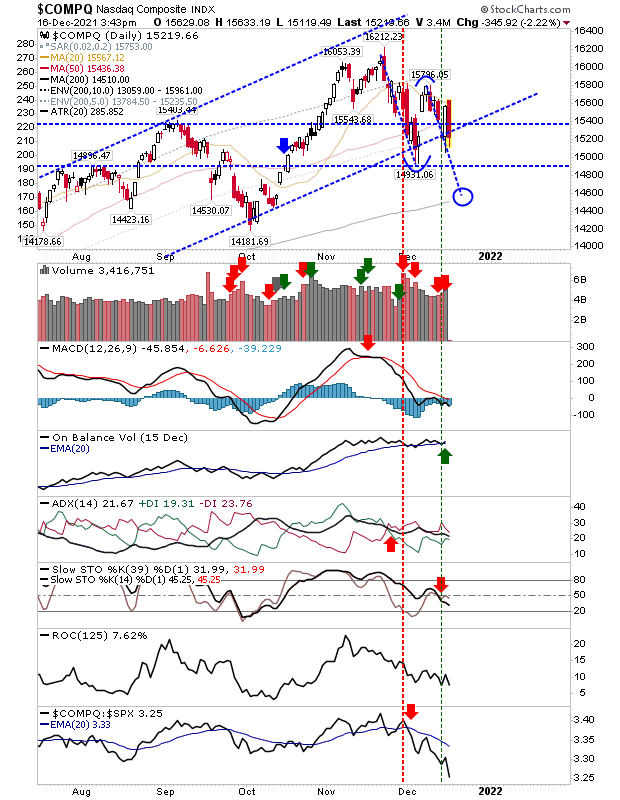

The NASDAQ is trading within a rising channel as opposed to a sideways consolidation like the Russell 2000. Yesterday's losses place the index at support of this rising channel. I still like the idea of a test of the 200-day MA - which would mark a breakdown from this channel. Technicals are mostly negative, with only On-Balance-Volume holding to a 'buy'.

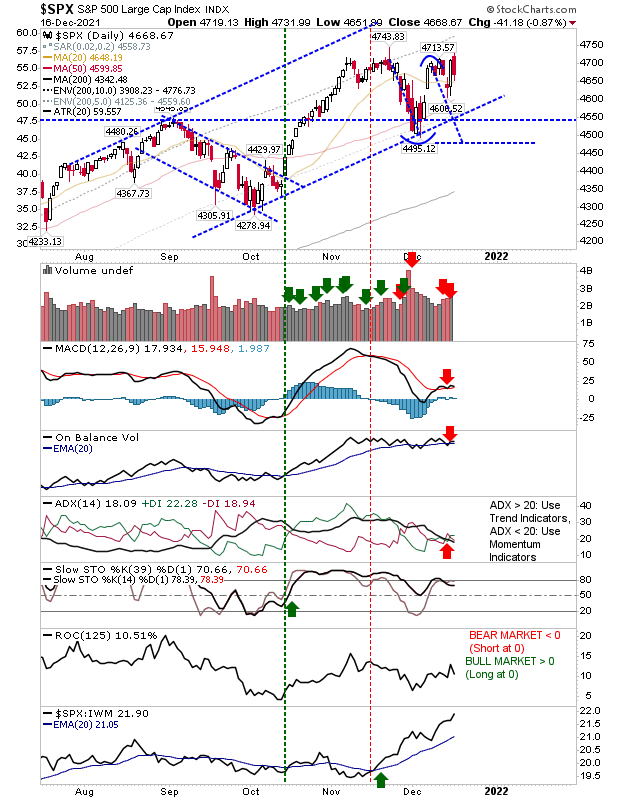

The S&P held up the best of the indices as it's losses didn't entirely engulfing Wednesday's buying, plus, it's an index knocking on the door of resistance rather than support. The S&P should survive Christmas, but might struggle in the New Year if the Russell 2000 and NASDAQ continue to sell off.

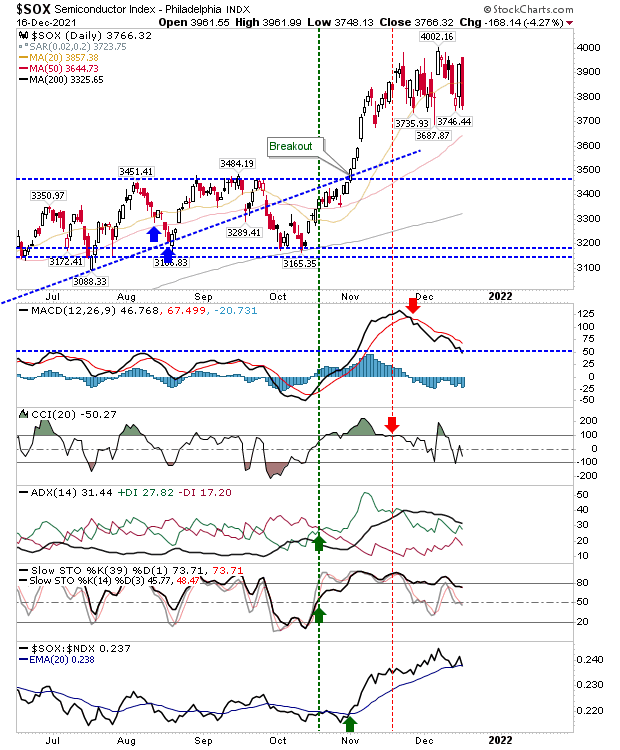

After a series of narrow candlesticks in Semiconductors during October, things have been started to broaden out, although technicals are shifting negative. While this sector is doing better than most, how it impacts on the NASDAQ remains to be seen.

For many, holidays start next week, so things will slow down. How indices react to support (or resistance) will unlikely be marked by higher volume - so confirming breaks will be harder.