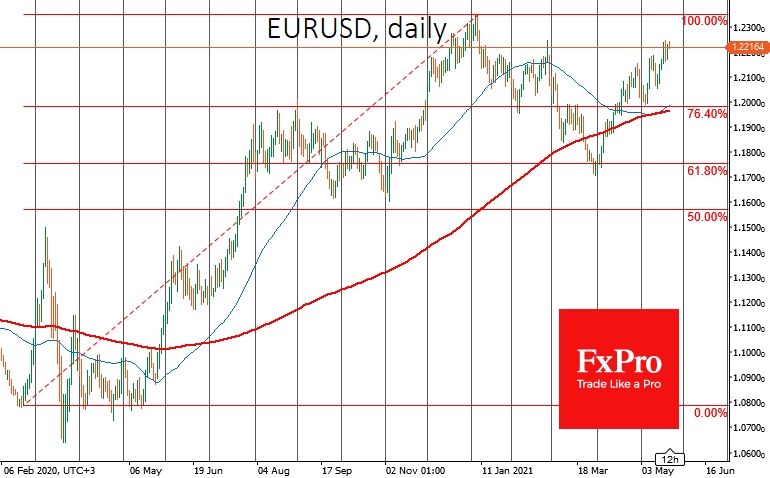

The idea of temporary inflation seems to be creeping into the minds of the financial community, helping to calm interest in commodities. Furthermore, we see politicians in different parts of the world engaging in their ways to combat the inflation threat.

China announced measures earlier in the week to curb metal prices, quickly cooling the recent overheating.

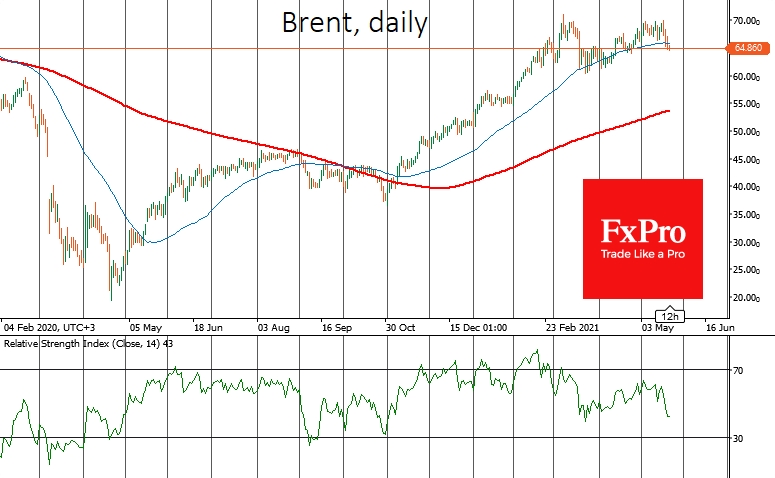

Oil's growth trend is again in question. Top policymakers say that nuclear talks with Iran are productive, so they could lift sanctions prohibiting Iranian oil export. This may increase the oil supply, putting pressure on the price.

Brent fell below its 50-day moving average, an important uptrend support line since November last year. This is more good news for Iran (and the rest of the world) but bad news for oil prices.

Falling out of the uptrend channel risks creating an additional snowball effect with inflationary bulls shorting long positions. Possibly, the bulls are waiting for a small pullback to level the purchases, so it is worth paying attention to the dynamics of oil near the area of the previous lows at $60-61. A solid decline below $60 will open the way to a deeper correction, potentially $55.

Bloomberg also says that pro-inflationary trends are pausing, noting a drop in demand for lumber and house building amid multiple price hikes. At the same time, sawmills are not increasing their production, suggesting the recent boom is temporary.

Moreover, the Philadelphia Fed business activity index fell from a record 50.2 in April to 31.5, much stronger than forecast. At the same time, US 10-year government bond yields went down, and inflation expectations from the markets cooled, indicating a decline of interest in inflation-tolerant bonds.

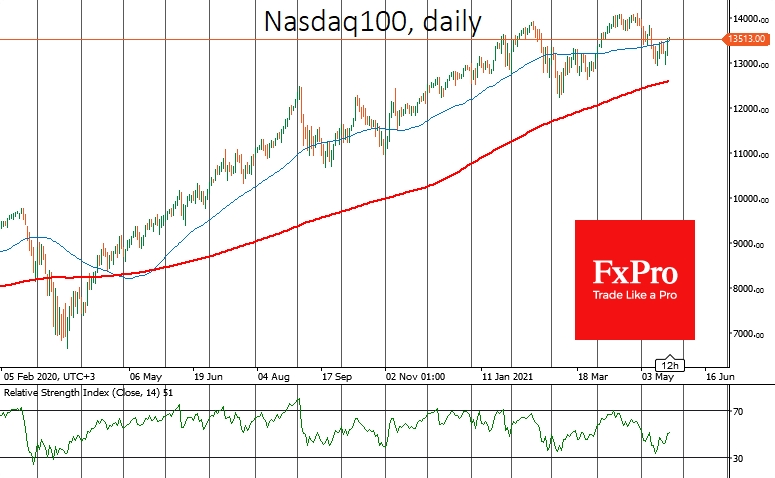

Lower inflation fears potentially mean stronger support for growth versus value stocks, providing an advantage for the NASDAQ over the Dow Jones.

In confirmation of market participants' optimism, from the side of tech analysis, we now see a test of the 50-day average by the NASDAQ 100 and a bounce out of the oversold RSI area, which also indicates that the sell-off is over and buying recovery is underway.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

What Does Waning Inflation Panic Mean For Techs And The Dollar?

Published 05/21/2021, 07:45 AM

What Does Waning Inflation Panic Mean For Techs And The Dollar?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.