When the term 'Bull Market' is mentioned, it's often the Wall Street statue that comes to mind. The statue looks strong, aggressive and focused. And that's not a bad definition of a bull market: strong, aggressive and focused. But sometimes it can be hard to see that through all the day-to-day noise. How can this be a bull market if the Dow Jones Industrial Average can’t manage to break 20,000? Or if valuations are stretched? Or famous managers are ‘going to cash’?

It is the noise that kills your portfolio. All of these examples are just opinions of the state of the market and where it will go. The one and only piece of information that matter though is what the indexes are actually doing. In a bull market they are going up. We could argue how high the markets need to go to be considered a bull market but let’s keep it simple for now. Up = bull.

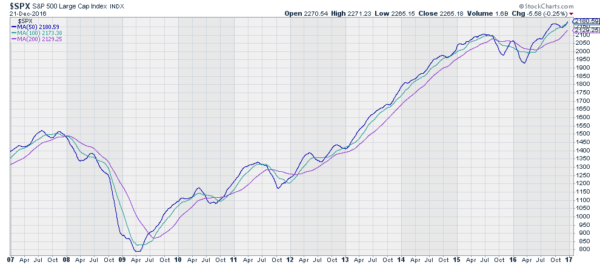

But even that definition can yield confusion. To borrow from President Bill Clinton’s testimony, with some leeway, it depends on what your definition of ‘up’ is. Prices move up and down all the time and can change day to day and intraday. So what is up? We can simplify that, too, by looking at smoothed price data, like in the chart above. The 3 lines in the chart show the 50-, 100- and 200-day simple moving averages for the S&P 500. By averaging price over 50, 100 or 200 trading days, the noise gets washed out.

What, then, does this chart say about the market? Since 2009, there has been a strong, bullish trend higher, interrupted by 3 periods of pause or downward action. The first was in mid 2010, the second in mid 2011 and the third was the longest from mid 2015 to the 2nd Quarter of 2016. Since then, the moving averages have all been running higher. That's a Bull market. So push aside the noise and ride it higher.