Western Digital Corporation (NASDAQ:WDC) recently announced that it has completed the acquisition of the assets of Upthere, an app-based cloud-storage startup. The company will integrate Upthere into its Client Solutions business unit. However, financial details of the transaction were not disclosed.

Moreover, acting Chief Executive Officer (CEO), Chris Bourdon, will join the Western Digital team as a strategic leader. The company also announced that Barbara Nelson, an executive who joined recently, will lead Western Digital’s cloud services business.

Upthere’s Storage Approach: It’s Different

Redwood City, CA-based Upthere offers cloud storage services which is almost similar to other well-known providers like Dropbox, Apple (NASDAQ:AAPL) iCloud, Box (NYSE:BOX) and Google (NASDAQ:GOOGL) Drive. The app is available on most platforms including iPhone, iPad and Android devices, as well as Mac operating system (OS) and Windows PCs.

Upthere’s “streaming” approach is different as compared to its cloud-storage peers. Per TechCrunch , the service bypasses (almost) local storage and directly “writes”/”reads” into the cloud, which updates documents, files and music on a real-time basis. This feature also makes the app significantly faster during uploading/downloading files.

However, Upthere doesn’t sync with a users local file system. So, a user cannot see through Finder or Windows explorer.

The acquisition will definitely boost Western Digital’s footprint in the cloud-storage market, which is projected to grow from $23.76 billion in 2016 to $74.94 billion by 2021. However, we believe that the consumer cloud-storage market is already quite oversaturated. Hence, room for further growth may not be significant in our view.

Acquisitions: Key Catalyst for Western Digital

Over the years, Western Digital has focused on acquisitions to expand total addressable market (TAM) and solidify footprint in growth markets. The acquisition of SanDisk has opened new avenues of growth for the company, particularly in the NAND and SSD markets.

The acquisitions of Amplidata, sTec, Velobit, Inc., Arkeia Software Solutions and Virident Systems have not only strengthened Western Digital’s small-to-medium sized business solutions but also expanded its SSD product portfolio.

Reportedly, Western Digital is on the verge of acquiring Toshiba’s (OTC:TOSYY) chip unit, which will significantly improve its competitive position in the NAND flash market.

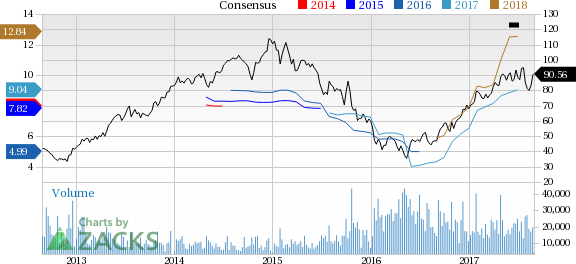

Currently, Western Digital carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong buy) Rank stocks here.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Western Digital Corporation (WDC): Free Stock Analysis Report

Box, Inc. (BOX): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research