In the absence of real data it is easy and tempting to speculate. Unlike last week, the week ahead featured an avalanche of data – more in both quantity and importance than we have seen in a month. With some recent significant reports showing economic improvement we expect a change of focus:

It is time for an economic spring thaw?

Prior Theme Recap

In my last WTWA I predicted a weeklong quest for new market worries. I even named a few candidates. Helped by early-week selling, this forecast proved to be very accurate. Veteran CNBC anchors who had obviously not read my primer on volatility made silly statements like “the Dow was down triple digits earlier but now is in the green. Oh, it is now down three points.” A worried viewer is a loyal viewer. Don’t touch that dial! A quick review of Fast Money topics shows Yemen, Fed commentary, biotechs, semis, energy, transports, and others too numerous to mention.

And a surprise: a fresh omen. “Three Black Crows” could spell doom for the market.

Doug Short’s pictures are always worth a thousand words. Read his full weekly “snapshot” post for informative long-term charts, and an analysis of drawdowns.

Feel free to join in my exercise in thinking about the upcoming theme. We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

This Week’s Theme

The upcoming week has interesting calendar effects.

- It combines end-of-month and start-of-month data – a combination of important reports.

- It is holiday-shortened, but with a twist. The market rarely is on holiday while the government is in action, but this week is an exception. The employment situation report will be released, as usual, on Friday. There also will be Fed conference presentations.

I expect position-squaring in front of Friday’s news.

Significant reports from last week – home sales, retail sales, and initial jobless claims – all showed an economic uptick. This combination of factors may create a more positive focus for market pundits. I expect many to be asking:

Will there be an economic spring thaw?

The Viewpoints

- No excuses! Winter occurs every year. The economic weakness continues.

- This winter was exceptional. Seasonally adjusted data have not done justice to the cold-weather effects.

- The most important data – employment and retail sales – have shown strength.

As always, I have some additional ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

There was some good news last week:

- Compromise in the House. Party leaders Boehner and Pelosi huddled up and forged an agreement on Medicare reforms. It is good to see a solution for an issue that has required an annual “doc fix” in Medicare payments. It is even more important that there is some ability for leaders to compromise when action is needed.

- Michigan sentiment strengthened and beat expectations. No one captures the whole picture as well as Doug Short.

- Earnings expectations seem to have bottomed. Brian Gilmartin tracks this closely for the S&P 500 and still expects an improved result for 2015. He also reports on Q1 pre-announcements, which have been better than usual.

- Overall corporate profits remain strong. Scott Grannis has emphasized this for several years. He writes as follows:

To fully understand this argument, I recommend reading a series of many similar posts over the past 5-6 years. I’m using the same charts over and over, and making the same basic argument, which is that corporate profits have been extraordinarily strong for years, but the market has been (and is still) unwilling to assign an unusually high multiple to those profits. This tells me that equities could be fairly valued at current levels, and at the very least they do not appear to be “overvalued.”

- Hotel occupancy is strong. Calculated Risk has the story about a possible new record. This confirms my anecdotal experience in New Orleans, where hotels and restaurants were busy and lively.

- Initial jobless claims improved – back below the three-handle.

- New home sales solidly beat expectations, an annualized growth of 539K. Calculated Risk notes the good start to the year, helped by the reduced number of distressed sales.

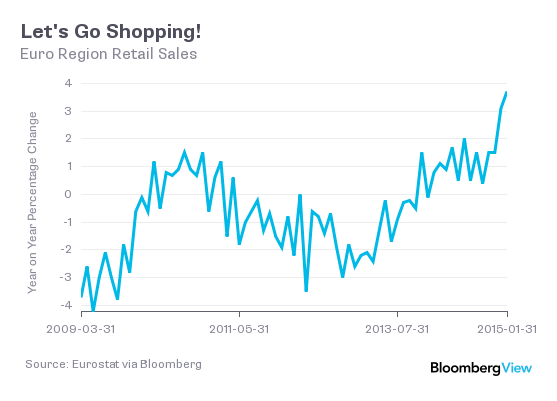

- European economies are improving. Here is one of the five charts from BloombergView:

The Bad

There was also a little discouraging economic news, although less than market results would suggest.

- FedSpeak tilted hawkish. Bullard and Fischer signaled the possibility of a faster path for rate increases. Even Yellen provided some support.

- Durable goods fell 1.4% while a small gain was expected. Doug Short takes a close look, adjusting for both population and inflation.

- Q414 GDP disappointed some observers who expected a positive revision to the 2.2% increase. Some thought it was better than it looked (WSJ). Most were more skeptical (Doug Short and Steven Hansen at GEI).

- High frequency indicators were mixed, but leaning negative according to New Deal Democrat’s excellent weekly update.

- The trucking index declined in February. (Calculated Risk). Some are concerned about Dow Theory readings from the transport sector.

The Ugly

Yemen. The initial impact has been a spike in oil prices, which has hurt consumers without really helping energy companies. The threat is even greater now that Saudi Arabia and other Gulf Cooperation Council states have joined in the air strikes. Kenneth M. Pollack of Brookings has an interesting analysis. (More Brookings background).

Quant Corner

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (three years after their recession call), you should be reading this carefully. Doug has the latest interviews as well as discussion. Also see Doug’s Big Four summary of key indicators.

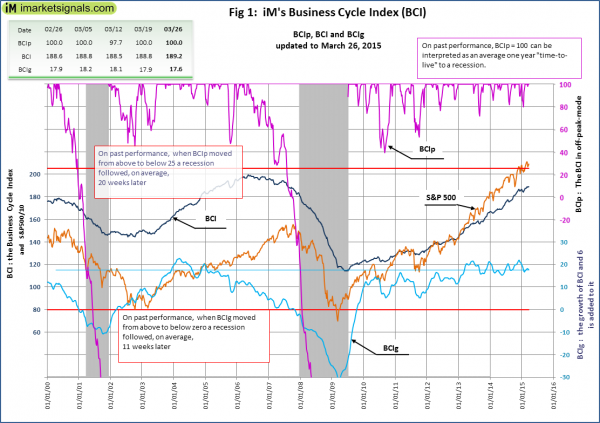

Georg Vrba: has developed an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. He gets a similar result from the Business Cycle Indicator (chart below). Georg continues to develop new tools for market analysis and timing, including a combination of models to do gradual shifting to and from the S&P 500. I am following his results and methods with great interest. You should, too.

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting market indicators. He recently noted an increase in his combined measure of economic stress, although the levels are still not yet worrisome. Recently Dwaine introduced a valuation model that is much more sophisticated than the popular Shiller CAPE method. It also provides a much less worrisome conclusion, 13.7% returns through the end of 2016.

Jeff Hirsch at Almanac Trader points out that April has been the best month for the DJIA since 1950. Those following seasonal trading methods will spend the month getting ready to “sell in May.” Jeff is one of the few who actually does this honestly. My observation is that a Venn diagram of the “sell in May” and “buy in October” disciples has almost no overlap!

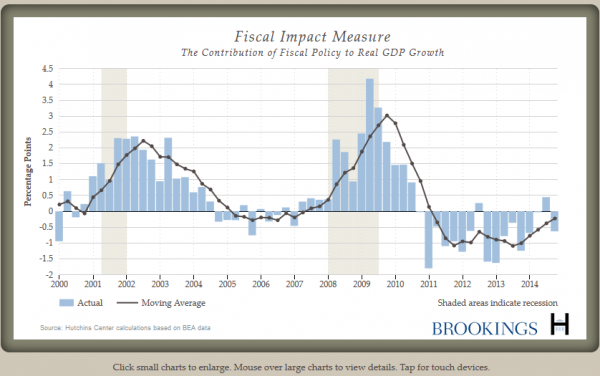

Brookings has an interesting interactive chart (snapshot below) showing the effect of government spending, combining all levels, on GDP. When state and local effects are included, it has been a significant drag.

The Week Ahead

It will be a huge week for economic data.

The “A List” includes the following:

- Employment report (F). The biggest news of the week, but no trading until Monday.

- ISM index (W). Interesting combination of concurrent and leading indicators.

- Initial jobless claims (Th). The best concurrent news on employment trends, with emphasis on job losses.

- Personal income and spending (M). February data, but important.

- ADP employment (W). Good independent read on private employment.

- Auto sales (W). New highs? (See Calculated Risk’s preview).

- Consumer confidence (T). The Conference Board version reflects employment and consumer spending.

The “B List” includes the following:

- Pending home sales (M) Less important than new home sales, but everything about housing remains important.

- Construction spending (W). February data, but important.

- Factory orders (Th). February data and a volatile series.

- Crude oil inventories (W). Maintains recent interest and importance.

- Trade balance (Th). Feb data will be part of Q1 GDP calculation.

A daily dose of FedSpeak is on tap, including Chair Yellen on Thursday and also two presentations on Friday.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

Felix switched to bullish from neutral for the three-week market forecast. There is still extremely high uncertainty, reflected by the percentage of sectors in the penalty box. Our current position is still fully invested in three leading sectors, mostly because there have been good opportunities in spite of the volatility. For more information, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com.

Felix did not enter the hedge fund manager contest at Scutify.com ($20,000 in cash and prizes), but he is making a daily appearance to mention a top sector.

Our best trader article this week comes from The Trading Coach. Mike Bellafiore has a list of lessons that includes some familiar ideas. He adds value with a link to a strong article for each lesson. Traders can profitable spend a few hours reviewing these links.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a new page summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking.

One of my recurrent themes for investors is to turn the page whenever the see a story about the “aging bull” or a prediction that the market is “due” for a major correction.

Bull markets do not die of old age! This economic cycle, the basis for the stock market cycle, features a sharp decline and a very gradual recovery. It could continue for years. Dr. Ed joins in on this theme:

A long expansion is a persuasive argument for buying stocks even though forward P/Es are historically high. Investors are likely to be willing to pay more for stocks if they perceive that the economic expansion could last, let’s say, another four years rather than another two years. The more time we have before the next recession, the more time that earnings can grow to justify currently high valuations.

If a recession is imminent, stocks should obviously be sold immediately, especially if they have historically high P/Es based on the erroneous assumption that the expansion’s longevity will be well above average. Bull markets don’t die of old age. They are killed by recessions.

Other Advice

Here is our collection of great investor advice for this week:

Featured Commentary

If I were to recommend a single source this week, it would be the CNBC interview with Legg Mason’s Bill Miller. Watching the entire piece will be six minutes well spent. Miller (no relation) is a value investor who famously beat the market for ten consecutive years. He has a great process to underscore the excellent long-term results. Here are three points you should get from the interview:

- There are plenty of cheap stocks. He mentions several and features four (of which we own two).

- He likes biotech and homebuilders.

- Investors should not worry about the initial Fed moves. Worry when policy switches from neutral to tightening, not from accommodative to neutral. Miller says that this first step might take several years. If there is a tantrum, it will be a temporary move and a buying opportunity.

- Some great investment opportunities have no current earnings, or low earnings with great growth potential (biotech). This is an interesting perspective from a value investor.

- And a humorous note – CNBC puts up the wrong stock symbol and chart, causing a 1% pop in the “mistake.” A bit later they post the correct information. Those doing the interview did not know, of course, and no correction was made. Trying to trade these TV interviews is a losing proposition, especially

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor, even if busy, should join with a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition.

Stock Ideas

Chuck Carnevale continues his series on retirement ideas taking a deep look at Cisco (NASDAQ:CSCO). He uses the analysis to illustrate some of the new features of his indispensable FastGraphs tool. It is a standard part of our analysis of stock candidates, and this is an easy way for you to see the features.

Your stock picks are probably biased by familiarity with certain companies and products. A great company is not necessarily a great investment. If you have a March Madness bracket, you might appreciate this lesson about the most popular picks. FiveThirtyEight explains why popular may not have “edge” in your pool. Enjoy the interactive chart and remember for next year!

Methods

This post, from Adam Grimes, is about trading, but it is equally true for investors. You can always find a justification for whatever action you want to take. You need to ask what could prove you wrong.

Karl Popper was one of the greatest thinkers of the 20th century–scientist, philosopher, and philosopher of science. At the risk of oversimplifying, one of his most important ideas provides the foundation for modern scientific thought: ideas can never be proved, only disproved. We need to focus not on finding things that support our ideas, but we should look for pieces of information that contradict. An idea is only meaningful insomuch as it can be disproved.

Energy Stocks

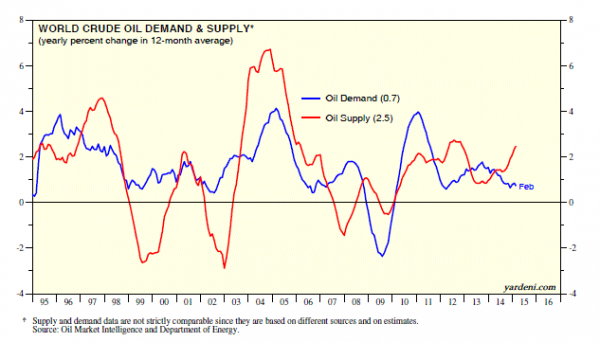

Ed Yardeni does not see a real bottom in prices until there is better balance in supply and demand.

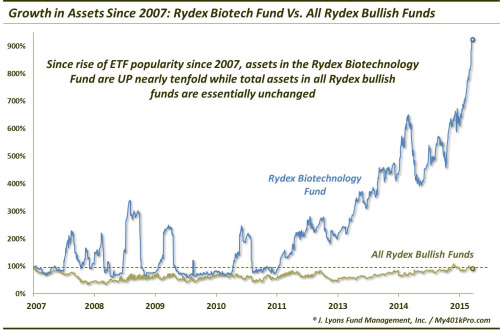

Biotech Stocks

Frothy (Dana Lyons).

Contrast will Bill Miller (above) who cites biotech names as possibly the best stocks ever. No chart can capture the scientific or market potential. Short-term trading often depends upon psychology.

Economic Worries

First Trust explains why concerns are exaggerated when it comes to the magnitude of student debt.

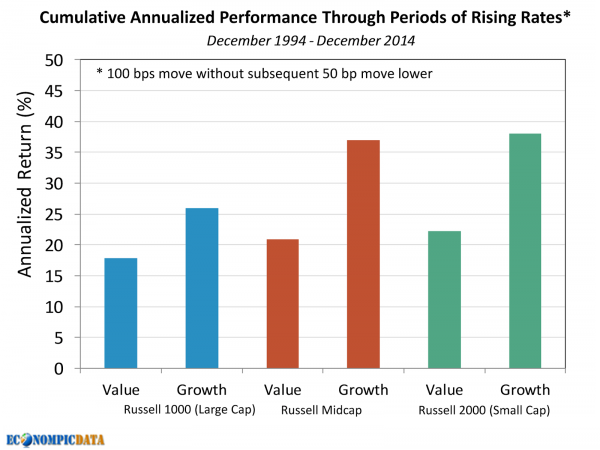

Rising rates – at least in early stages – do not impede stock gains.

Bond Funds

Josh Brown warns about the stretch for yield in unconstrained bond funds – many traps.

I’m from the government…

…and I’m here to help you. Dodd Frank’s watchdogs have a summary of the bearish case about stocks. The MarketWatch author warns to look out below.

The report shows no balance or awareness about the debate over valuation methods. Your tax dollars at work!

Final Thought

Watching for the spring thaw involves separating data from noise.

Last week I explained why “the popular market worries are not very convincing”. The Bill Miller interview (cited above) included his statement that there have been 16 “corrections” of 3% or more during the current bull market. In each of these his fund experienced redemptions! Whenever we have a spate of selling, even if the underlying fundamentals have not changed, some people have been primed to sell.

- Some are playing the “due theory” while ignoring actual data (see discussion above on old age and bull markets);

- Some are using “trailing stops” which confuses their investing with trading;

- Some are convinced by the every-changing wall of worry;

- Some believe the “bubble” talk, and sell at the first sign of a dip.

Investors who have been out of the market have similar concerns, keeping them in cash, bonds, or dangerous bond proxies.

It is not that complicated if you stick with the fundamentals:

- There is little chance of recession in the next year. Recessions occur at business cycle peaks and are associated with the big market declines.

- Earnings expectations have been hit by the energy sector and the strong dollar, but remain OK. Some of these effects have probably peaked.

- An improving US economy is fundamentally good for stocks. The Fed is on track to remain accommodative for years.

- Foreign central banks are on a mission to stimulate, probably now including the Chinese.

- There is a long list of well-documented worries providing plenty of fear.

Investors must use fundamental methods that recognize both opportunity and danger. It is not simply a matter of time. And especially, you cannot treat every market blip as the start of “the big one.”