In my last WTWA (two weeks ago, since I am allegedly on vacation. I resumed work on Fed day to watch and to meet with readers and potential investors near New Orleans. Next week I’ll be back on my normal schedule). I asked whether good news was now bad for investors. The continuing Fed focus was once again a successful theme, despite the increasing irrelevance of Fed policy.

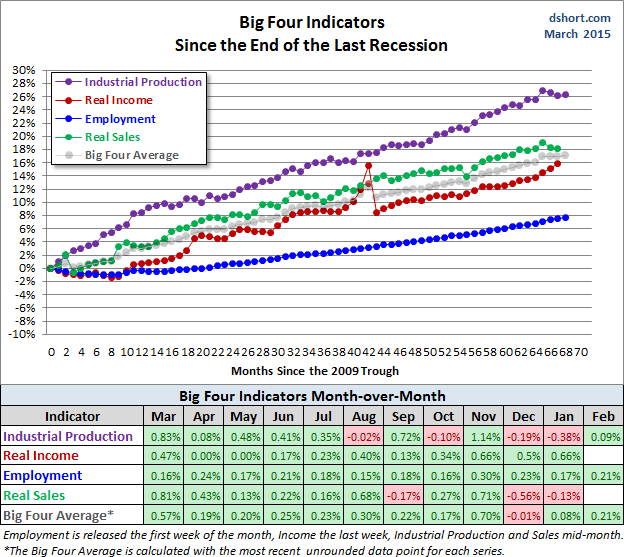

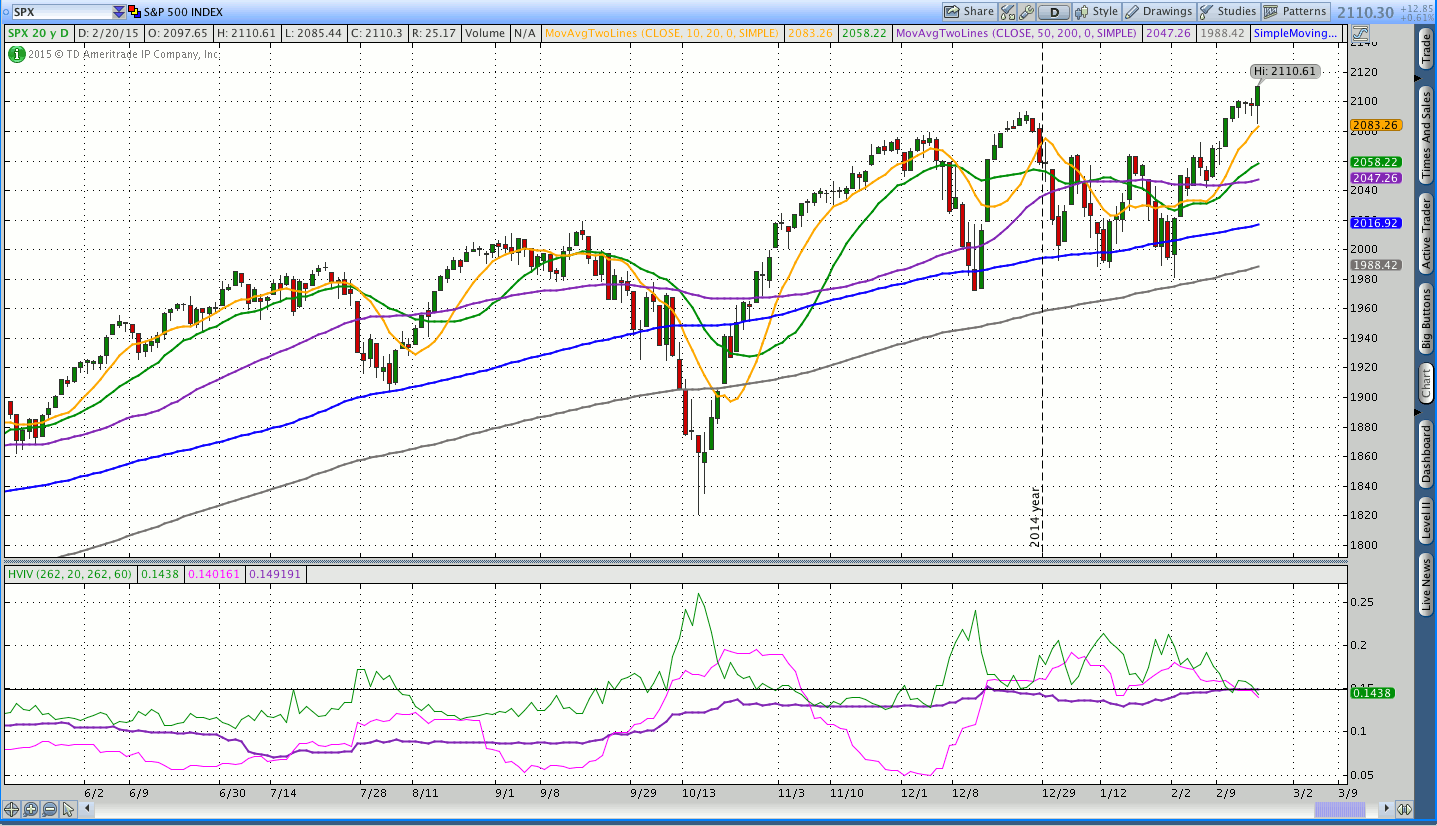

Doug Short’s pictures are always worth a thousand words.

Feel free to join in my exercise in thinking about the upcoming theme. We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead.

This Week’s Theme

The upcoming week has an emphasis on housing data, but that probably will not be the theme. I expect a search for new worries. These might include falling earnings estimates, the strong US dollar, falling commodity prices, mistaken Fed policies, and increased volatility. Since airtime and news space must be filled with “explanations” of any market move, there is a job to be done! With the Fed decision behind us,

What should investors worry about next?

The Candidates

- The ever-popular Fed failures remain the leading candidate. The Fed is “in a box” or “painted in a corner” so unable to take appropriate action.

- It has been too slow to raise rates. Steven Hansen at GEI states this position quite aggressively. Gene Epstein (Barron’s) agrees. Those who attribute stock gains simply to central bank policy now prefer Europe to the US. (Bloomberg).

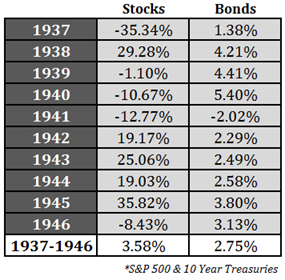

- It might raise rates too quickly. Ray Dalio got a lot of buzz last week with his “1937 scenario.” (via Ben Carlson)

- Falling earnings expectations might be serious. Factset now sees Q1 '15 declining 4.8% year-over-year. The biggest declines are in the energy sector, but the stronger dollar has affected other stocks as well.

- Increased volatility is the newest “wise comment” from the punditry. Even those who are relatively sanguine about the markets warn of the “wild ride” we should expect. The implication is that volatility is bad.

- Overvalued markets will generate poor long-term returns. Since the repetitive bubble warnings have not proven prescient, investors are now urged to worry about long-term returns. Ten years is the suggested horizon. (Barron’s).

As always, I have some additional ideas in today’s conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasions something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

There was some good news last week:

- Building permits rose 3%. Calculated Risk also notes the Campbell survey which projects action from first-time buyers. I agree with his “we will see soon” conclusion.

- Fed policy attracted market support. There are some observers who have been consistently right on analyzing the Fed. Their conclusions often disappear sharply with those of traders, assorted non-economist skeptics, and especially the most dangerous group, those “self-taught” in Austrian economics. (I have noted that some claiming that credential have recently promoted themselves to “leading experts” in Austrian economics). Here are the conclusions from two favorite sources, obviously in tune with the market.

- Tim Duy is the leading expert on Fed policy. If you only watch TV you are missing out. He writes as follows:

"Bottom Line: Yellen does it again – she moves the Fed both closer to and further from the first rate hike of this cycle. By moving toward the markets on the path of rate hikes, the Fed acknowledges that they are eager to let this recovery run on. Moreover, they proved that they are in fact data dependent by moving policy in the direction of the data. Overall, Yellen has managed the transition away from what the Fed came to see as excessive forward guidance just about as well as could be expected."

- Diane Swonk is the level-headed analyst from Mesirow Financial. She writes as follows:

"Bottom Line: The FOMC remains clearly focused on hedging downside risk; members would rather wait and raise rates too slowly, than risk stamping out growth and having to reverse course and lower rates soon after the first increase. They also want to make sure the recovery is truly self-sustaining before removing the proverbial punch bowl. Since the party has hit a lull, the Fed wants to make sure that more of us get to the punch bowl before watering down the mix; they have also paid the band and the waitstaff to work a little longer. Our forecast for a modest increase in rates in September holds. The fed funds rate is expected to end 2015 at 0.50% but only if we see a sharp reacceleration in growth in the second and third quarters.

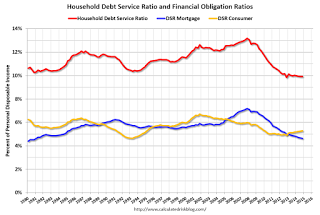

- Household debt service hits a new low. Calculated Risk has the full story and this helpful chart:

- Tim Duy is the leading expert on Fed policy. If you only watch TV you are missing out. He writes as follows:

The Bad

There was also some discouraging economic news.

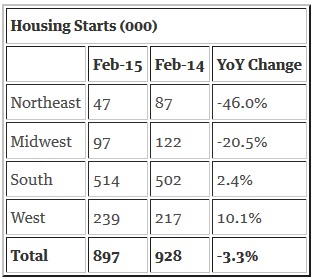

- Housing starts plunged 17% and 3.3% YoY. With weather exceptionally bad – worse than normal seasonal adjustments – it is tempting for some to use that as an excuse. Calculated Risk shows the dramatic weather effect in the table below, but Bill concludes that it is still a weak report.

- Industrial production missed expectations, rising only 0.1%. (WSJ).

The Ugly

IRS scams. These are back again. Beware of fake calls wanting payment by credit card. ({{0|Yahoo (NASDAQ:YHOO) Finance}}.

Quant Corner

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

Doug Short: An update of the regular ECRI analysis with a good history, commentary, detailed analysis and charts. If you are still listening to the ECRI (three years after their recession call), you should be reading this carefully. Doug has the latest interviews as well as discussion. Also see Doug’s Big Four summary of key indicators.

Georg Vrba: has developed an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. He gets a similar result from the Business Cycle Indicator (chart below). Georg continues to develop new tools for market analysis and timing, including a combination of models to do gradual shifting to and from the S&P 500. I am following his results and methods with great interest. You should, too.

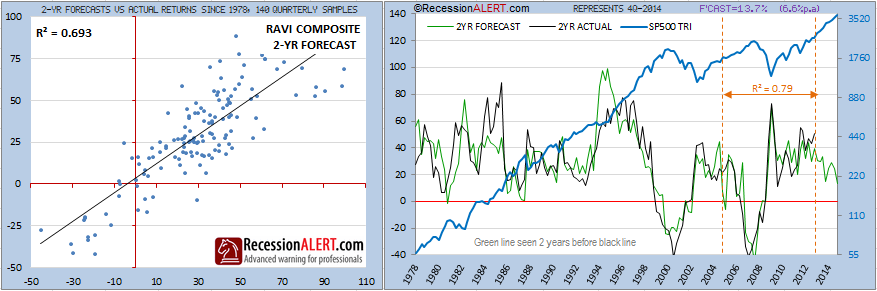

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting market indicators. He recently noted an increase in his combined measure of economic stress, although the levels are still not yet worrisome. This week Dwaine has a valuation model that is much more sophisticated than the popular Shiller CAPE method. It also provides a much less worrisome conclusion, 13.7% returns through the end of 2016.

The Week Ahead

It will be a light week for economic data.

The “A List” includes the following:

- Initial jobless claims (Th). The best concurrent news on employment trends, with emphasis on job losses.

- New home sales (T). Still mired in February weather.

- Michigan sentiment (F). A good concurrent read on employment and spending, with some leading qualities.

The “B List” includes the following:

- Existing home sales (M) Less important than new home sales, but everything about housing remains important.

- Durable goods (W). Volatile February data, but significant.

- CPI (T). Inflation data is of lesser significance until we see several months at higher levels.

- Crude oil inventories (W). Maintains recent interest and importance.

- Q4 GDP final estimate (F). Old news.

A resumption of FedSpeak.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

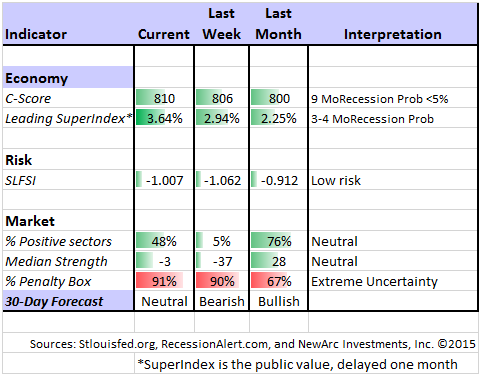

Insight for Traders

Felix switched to bearish mode and then back to neutral for the three-week market forecast. There is high uncertainty, reflected by the percentage of sectors in the penalty box. Our current position is still fully invested in three leading sectors, mostly because there have been good opportunities in spite of the volatility. For more information, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix’s weekly ratings updates via email to etf at newarc dot com.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a new page summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking.

My bold and contrarian prediction for 2015 – that the leading sectors would lose and the laggards would win – lagged a bit last week as utilities rebounded and interest rates fell. I also see plenty of time left in this economic and stock cycle.

Other Advice

Here is our collection of great investor advice for this week:

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor, even if busy, should join with a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition.

Stock Ideas

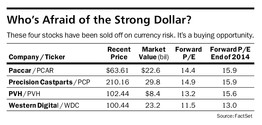

Have some stocks declined more than warranted due to the rising dollar? Barron’s mentions a number of ideas including the WisdomTree International Hedged Equity Fund (NYSE:HEDJ) (recently favored by Felix) and the stocks in the table below. Read Jack Hough’s full article for full explanations and more ideas.

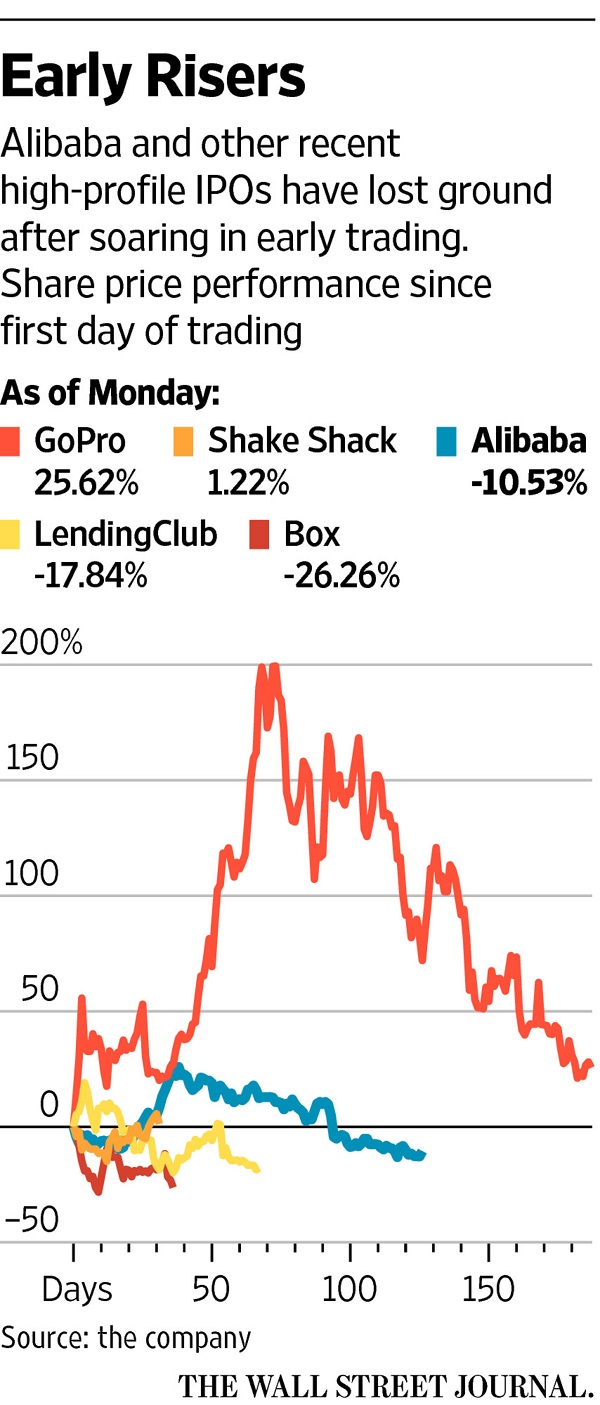

The Alibaba (NYSE:BABA) lockup expires Wednesday, permitting sales from some of the buyers of the IPO. It is anyone’s guess how much buying interest there is for these shares and how much of the expected selling pressure is already reflected in the market. We did not buy the IPO because the valuation seemed too rich. After the stock ran up and then receded, we bought on the decline for those in our “high octane” program. The WSJ has a nice summary and comparisons to other recent IPOs.

Economic Cycle

- The bull market is getting old. Jim Stack, a top newsletter writer, is cautious, cutting stocks from 80% to 76%. (MarketWatch).

- The bull market is younger than you think. (MarketWatch).

Final Thought

The popular market worries are not very convincing.

Let’s start with the Fed. Most of the current critics have been consistently wrong for many years. The predictions of Fed failure have now been moved years into the future. It is all speculation, mostly from those who did not agree with policies that have (so far) been pretty successful.

The increased volatility argument ignores history. The long-term historical volatility of the S&P 500 is 15. That corresponds to a daily change of nearly 0.9%. The frequent TV emphasis on a “triple digit move in the Dow – stay with us” means a volatility of 12. And remember that volatility is not just a measure of downside moves. A market that goes down 1% every day, up 1% every day, or alternates between the two has the same volatility – about 16.

See It Market has a good short course on volatility with explanations and good charts. Here is one example:

While every minor twist and turn is getting the “Fed treatment,” it really makes no sense. The market rallied on news that the Fed remains patient, whether explicitly stated or not. Investors should get ready for an extended period of time with continuing low short-term rates. This means a longer than normal business cycle.

I continue to see daily effects from the “new” carry trade, the one where the dollar is not the funding currency. I mentioned this in my 2015 preview, but it may be time for a more complete discussion.