This week’s calendar includes a little data, a lot of politics, slow summer trading, and the last of the earnings reports. I expect financial media to focus on an earnings season post-mortem by asking:

Has the Earnings Recession Reached a Turning Point?

Last Week

The important economic news was excellent, and the market reaction was positive.

Theme Recap

In my last WTWA (two weeks ago), I predicted a focus on what the U.S. elections might mean for stocks. With major conventions in both parties and saturation coverage of anything said, that was a pretty easy forecast. My own final thoughts included the idea that there were not yet any clear implications. Since the major averages are about where they were in my prior post, the market seems to agree.

The business of figuring out what a President will do is pretty tricky. Morgan Housel uses historical data to rank past presidents on various criteria – stock market, profit growth, GDP, and inflation. Even knowing your history, the results will surprise you. The “best” presidents on these measure often started at a time when things were pretty bad.

The politics digested, the market turned to the biggest data of the last two weeks, the monthly employment report. The news relieved some continuing concern about the economy.

The Story in One Chart

I always start my personal review of the week by looking at this great chart of the S&P 500 from Doug Short. While the range is pretty narrow, you can clearly see the early weakness and Friday’s rally to a new all-time high. Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis and several other charts providing long-term perspective.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something really good. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The Good

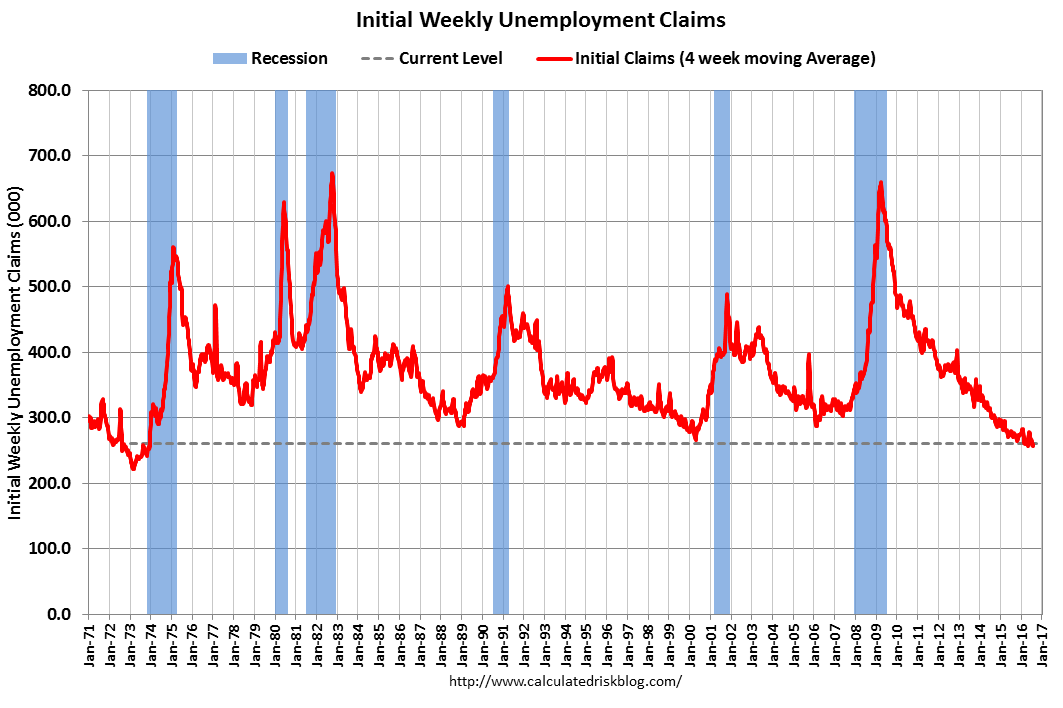

- Initial jobless claims remain low. There was a slight miss of expectations this week, but Calculated Risk provides the overall perspective.

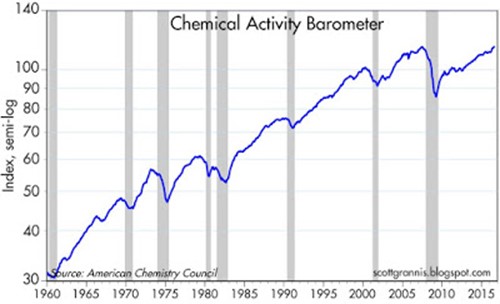

- Chemical activity hits a new high. Scott Grannis continues to follow solid indicators that most others miss. This one has a good record and “points to stronger growth than is widely perceived to be the case.”

- Vehicle sales beat expectations, but some complained that higher incentives were required.

- Employment increased solidly and more significantly than expected with a net gain of 255K payroll jobs and even more strength in the individual survey. While some are, as usual, seeking nits to pick, these data were an encouraging signal about economic strength. Expect the dialog to shift back to Fed policy. Bloomberg has good coverage.

The Bad

- Rail traffic declined again. Steven Hansen covers the story including non-seasonally adjusted data in several time frames.

- ISM services Index dropped slightly to 55.5, a little below estimates.

- GDP growth was only 1.2% in Q2, significantly lower than expectations. Prof. James Hamilton has an objective analysis of what is going on. Hint: Inventories are crucial, and difficult to gauge. See also Bloomberg on the inventory story.

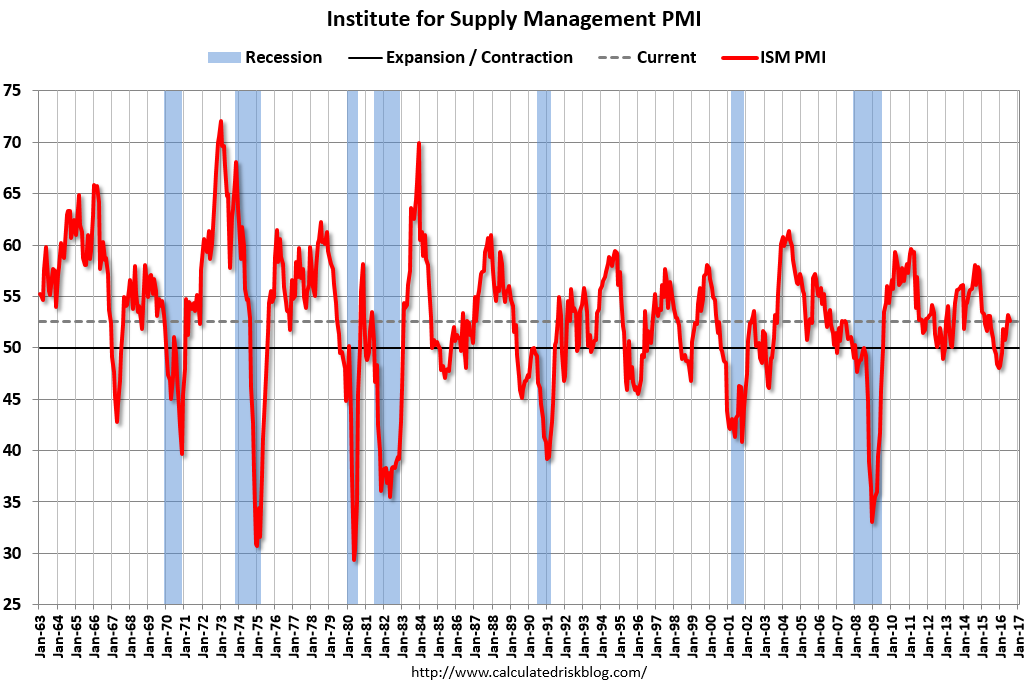

- ISM Index dipped slightly but remained in expansion territory. Calculated Risk has the analysis and this chart:

The Ugly

Printed firearms on airplanes? The TSA caught this example, but there is a technology war going on. If you read the TSA Blog, you will see how many loaded weapons discovered at checkpoints.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. No award this week. Nominations are always welcome. There is plenty of misinformation to refute!

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a moderate week for economic data, as earnings season winds down. While I watch everything, I highlight only the most important items in WTWA. It is important to focus.

The “A” List

- Michigan sentiment (F). Good read on jobs and spending.

- Retail sales (F). Consumer spending remains as a key factor for economic growth.

- Initial claims (Th). The best concurrent indicator for employment trends.

The “B” List

- Wholesale inventories (T). Volatile June data, but an important part of gauging GDP.

- Business inventories (F). More June data with implications for GDP adjustments.

- JOLTS report (W). Important to understand labor market structure – not job growth.

- PPI (F). This will become important after a few hot months – but not yet.

- Crude inventories (W). Often has a significant impact on oil markets, a focal point for traders of everything.

The big story will still be corporate earnings. We have a little FedSpeak. Expect questions to focus on whether a policy change is more likely after the employment report. Don’t expect much new information before Yellen’s Jackson Hole speech. More politics, of course, but without a clear implication for markets.

Next Week’s Theme

Markets seem to have digested the Brexit story, and surprisingly shrugged off the terrorist violence. The economic data have quieted recession worries, and even turned positive. In the slow summer trading I expect more attention to analyzing earnings. Everyone will be asking:

Has the Earnings Recession Reached a Turning Point?

- Brian Gilmartin continues his strong analysis on this topic with a review of recent reports and emphasis on outlook and future earnings. He is also a “nervous energy bull.”

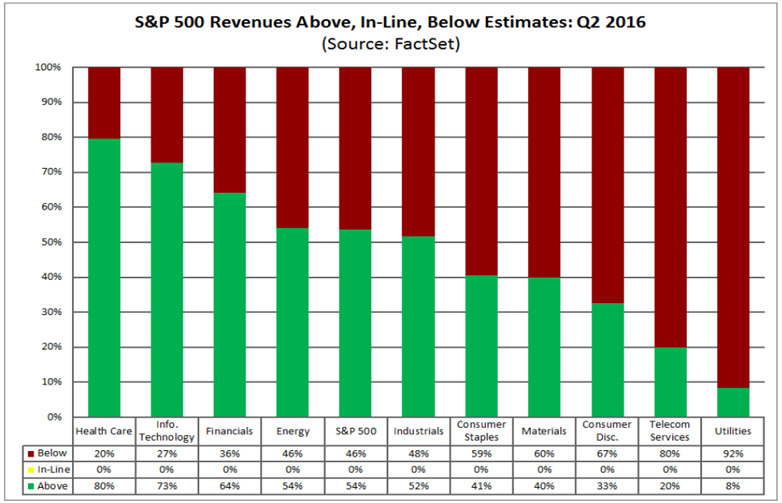

- FactSet reports a generally positive earnings season, with an interesting revenue spread across sectors.

- The bearish side will emphasize multiple points;

- The streak of losses continues

- Profit margins remain high, and (theoretically) vulnerable

- Earnings results reflect stock buybacks and other financial engineering

- And other points about how earnings are calculated.

In many ways, this debate will hinge upon forward expectations for the economy, business investment, and future profits.

As always, I’ll have a few ideas to add in the conclusion.

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

Whether you are a trader or an investor, you need to understand risk. Risk first, rewards second. I monitor many quantitative reports and highlight the best methods in this weekly update.

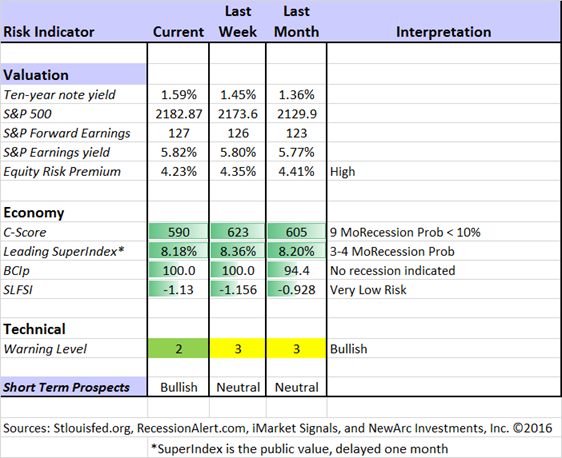

The Indicator Snapshot

The Featured Sources:

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies. This week he expresses more confidence about growth in earnings.

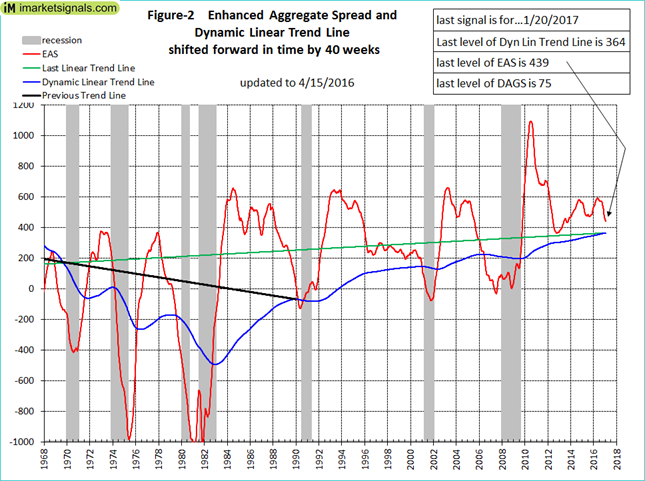

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

The recession odds (in nine months) have nudged closer to 10%. This does not completely reflect Brexit effects, so we may get a further revision.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

The ECRI has been dropped from our weekly update. It was not so much because of the bad call in 2011, but the stubborn adherence to this position despite plenty of evidence to the contrary. Those interested can still follow them via Doug Short and Jill Mislinski. The ECRI commentary remains relentlessly bearish despite the upturn in their own index.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has a number of interesting approaches to asset allocation.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his site for an array of interesting methods. Georg regularly analyzes Bob Dieli’s enhanced aggregate spread, considering when it might first give a recession signal. Georg thinks it is still a year away. It is interesting to watch this approach along with our weekly monitoring of the C-Score.

How to Use WTWA

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. For most readers, they can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk – what we all should know.

- Income investing – better yield than the standard dividend portfolio, and also less risk.

- Holmes – the top artificial intelligence techniques in action.

- Why 2016 could be the Year for Value Stocks – finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions or suggestions for new topics.)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We have moved to a bullish market forecast. Felix is fully invested, including some more aggressive sectors. The more cautious Holmes is still about 80% invested. The recent strength has moved Holmes into the bullish camp, and we expect an increase in the number of candidates.

Top Trading Advice

Are you worried about “missing” a trade? Do you switch your system a lot? Do you make “boredom trades?” If your answer to any of these is “yes” you should read this post from Adam H. Grimes.

Is your trading affected by high-frequency models? Do you need to change your methods? Josh Brown has some answers and what you should be thinking about.

Brett Steenbarger distinguishes between successful discretionary traders and successful quantitative traders. Which are you?

Successful discretionary traders I’ve known and worked with have been distinguished by their level of market understanding. Successful quantitative traders I’ve encountered have excelled at analysis and prediction. Sometimes the successful discretionary trader makes use of predictive models as inputs to decisions; the successful quantitative trader will ground models in sound market understanding. At the end of the day, however, quants trade their predictions and discretionary participants trade their understanding. One trades universal patterns; another trades insights specific to what is observed here and now in a particular market.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility! Mixing insurance and investments is a terrific way to kill two birds with one stone.

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Tony Isola’s discussion of widely believed lies. He includes a great list. I like so many entries that it is tough to pick a favorite. I’ll go with “Mixing insurance and investments is a terrific way to kill two birds with one stone”. What is yours?

Stock Ideas

The Zika virus is prominent in the news. While we all sympathize with the victims, we can also invest in companies working on a cure. Angus Nicholson of IG has some interesting suggestions for biotechs set to win big.

Chuck Carnevale turns his focus to dividend growth stocks in healthcare. This is an attractive sector, and he provides nine timely ideas in Part 1 of 3. This entry was excellent and we look forward to the future installments.

Holmes will begin contributing an idea each week, a stock we bought for clients a few days ago. I will mention it here and Holmes will also post it each Friday in a Scuttle at Scutify.com. While we cannot verify the suitability of specific stocks for everyone who is a reader, the ideas may be a starting point for your own research. Holmes may exit a position at any time, and I am not going to do a special post on each occasion. If you want this information, just sign up via holmes at newarc dot com and you will get email updates about exits. This week’s Holmes pick is Enbridge (NYSE:ENB).

Market Overview and Outlook

Josh Brown explains (Rules-based tactical vs wizardry and witchcraft) why you should not attempt to imitate big-firm pronouncements by following their calls.

Eddy Elfenbein also weighs in on market timing, reporting the dramatic difference in a Fidelity study.

Avondale’s weekly Company Notes Digest is especially useful during earnings season. You do not have time to listen to all of the conference calls and you certainly cannot count on the media coverage. This is a good way to find important themes. (terrorism more important than Brexit). Also why Aetna (NYSE:AET) is leaving the health insurance exchanges. And much more.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are several great choices worth reading, but my favorite is Jason Zweig’s important warning about the risks of too much stock in your 401-K account. He writes:

Since June, four dozen companies whose stock fell by at least half in 2015 have filed disclosure forms to the Securities and Exchange Commission on their 401(k) and other savings plans. By my estimate, workers at these companies lost $1 billion in 2015 by over-investing in the stock of their own employer.

This is very important. I frequently see such risks in the accounts of potential clients. It is one of the first things we fix.

Value Stocks

Since value stocks have lagged, many strong voices have suggested that the market message is that the economic cycle is over. I covered this subject last week. If you missed it, please take a look. I provide discussion of several stocks recently dissed in the media.

Watch out for….

For those at or nearing retirement, here are eleven common Medicare mistakes.

Final Thoughts

Over the past several weeks we have gotten quite a bit of new evidence to guide our investing. I see four major themes:

- Most investors seem to be looking beyond concerns about uncertainty and matters without quantifiable market impacts – Brexit, the election, terrorism.

- The economic data looks better than it did in the second quarter.

- Earnings expectations seem to have made a trough.

- Some sectors are much more promising than others both because of potential earnings growth and current valuation.

The biggest concerns relate to improving earnings, the need for more business confidence, and a resulting increase in corporate investment.

We are entering a period where we can expect a showdown on the economy and earnings – probably in Q3, despite the upcoming election. Fasten your seatbelts!