This week’s calendar includes a big serving of data, an FOMC meeting, the Democratic convention, and plenty of earnings news. The financial media will be asking: What does the election mean for stocks?

Last Week

The economic news was excellent, and the market reaction was positive. It was a light week for data, but the important news was positive—especially housing.

Theme Recap

In my last WTWA, I predicted that we should expect some challenge to the post-Brexit rally. People would be focused (even more than we usually see) on what could go wrong. It was a big week for earnings and politics as well. The market’s answer to the question reflected some optimism about the second half of the year.

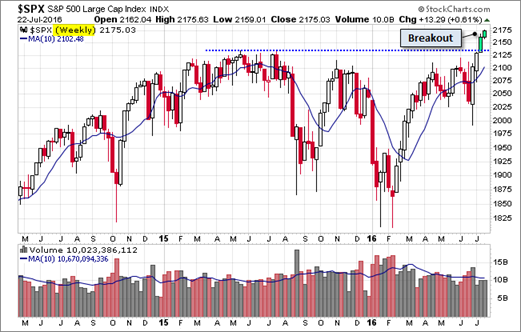

The Story in One Chart

I always start my personal review of the week by looking at this great chart of the S&P 500 from Doug Short. You can clearly see the successive highs and the final breakout on Friday. Doug has a special knack for pulling together all of the relevant information. His charts save more than a thousand words! Read his entire post where he adds analysis and several other charts providing long-term perspective.

The News

Each week I break down events into good and bad. Often there is an “ugly” and on rare occasion something really good. My working definition of “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The Good

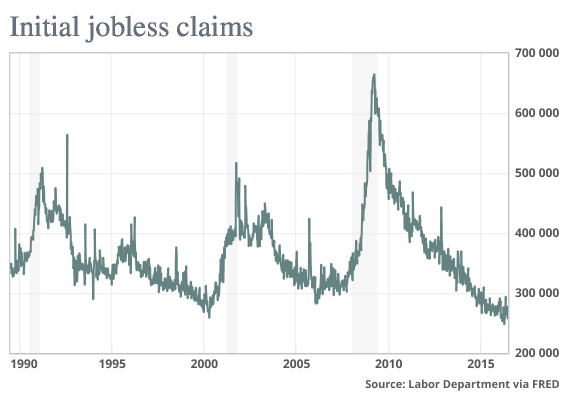

- Initial jobless claims are at a 43-year low. (Jeffry Bartash, MarketWatch).

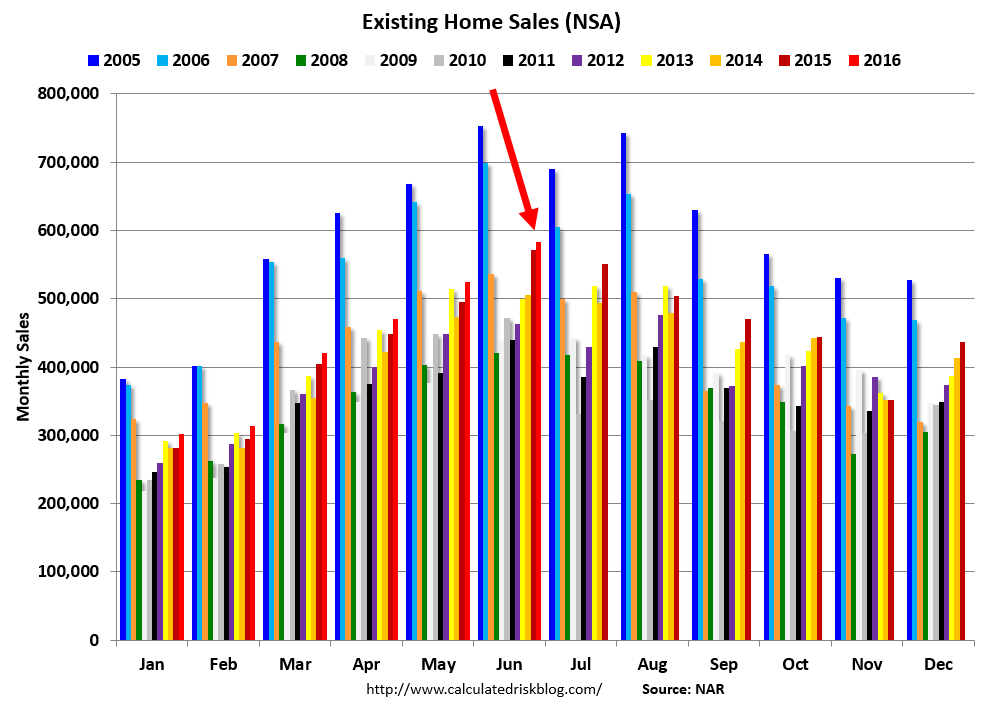

- Housing

- Existing home sales are strong and would be even stronger with more inventory. Calculated Risk explains the reduction in distressed and foreclosure sales. June sales were the best in ten years.

- Housing starts and building permits. Growth is solid and prices are higher, but this is not another housing bubble. Patrick Clark (BloombergMarkets) does a good job of explaining the difference in the current growth phase. He writes as follows:

But residential real estate isn’t in a speculative bubble, industry observers contend. Instead, a low inventory of available homes is driving prices higher—prices, however, will eventually recede as buyers throw up their hands, or as more new homes come on line. The structural issues that led to the housing collapse last decade aren’t present.

The largest price appreciation is coming in places where population is growing, but zoning laws have restricted the pace of new construction.

The Bad

- Trucking weakens again. Steven Hansen takes a comprehensive look.

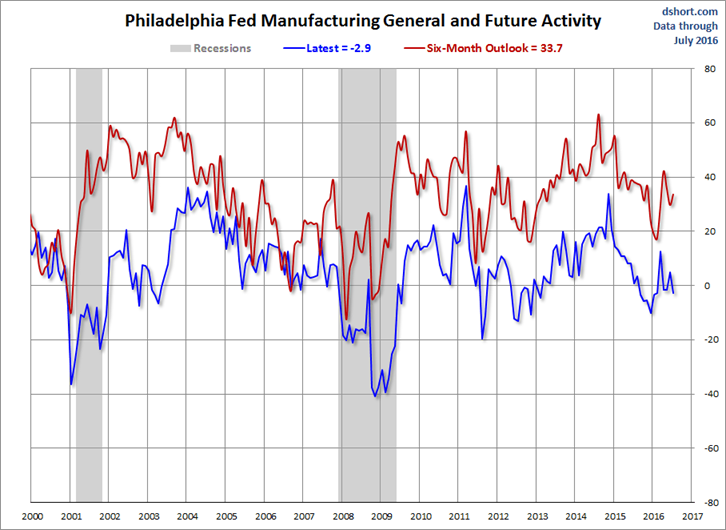

- The Philly Fed index was negative (-2.9) and missed expectations. Doug Short has a comprehensive analysis with many useful charts, including this one:

The Ugly

Another week, a new terrorist event. I continue to hope for a week where the ugly award once again goes to a financial problem.

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. No award this week. Nominations are always welcome. There is plenty of misinformation to refute!

To help in spotting ideas, here is a handy guide from The Guardian’s Science observer, David Spiegelhalter, Our Nine-Point Guide to Spotting a Dodgy Statistic. (Thanks to reader AR for this suggestion). Most of the examples are British, but with universal application. I especially like the “indicator switching,” a favorite ploy of market pundits.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

The Calendar

We have a pretty big week for economic data, featuring the FOMC decision. While I watch everything, I highlight only the most important items in WTWA. It is important to focus.

The “A” List

- FOMC rate decision (W). A rate increase is not expected; the statement will get close attention.

- Consumer confidence (T). Conference board version is an indicator for jobs and spending.

- Michigan sentiment (F). Unlike conference board, has a panel component.

- GDP (F). First read on Q2 – big rebound expected.

- New home sales (T). Important economic sector. Can the growth continue?

- Initial claims (Th). The best concurrent indicator for employment trends.

The “B” List

- Pending home sales (W). Less important for the economy than new construction, but a good read on the overall market.

- Chicago PMI (F). An early read on next week’s ISM number.

- Durable goods (W). Volatile June data, but the trend is important.

- Employment cost index (F). Q2 data. Wage growth confirmed?

- Crude inventories (W). Often has a significant impact on oil markets, a focal point for traders of everything.

The big story will still be corporate earnings. The Democratic Convention will grab plenty of news. FedSpeak is on hold for the FOMC meeting, but there are some Friday appearances.

Next Week’s Theme

Markets seem to have digested the Brexit story, and surprisingly shrugged off the terrorist violence. The economic data have quieted recession worries, and even turned positive. We have competing potential themes this week.

The economic news and earnings reports are important. So far the earnings news has been solid. Brian Gilmartin was early and accurate in calling for an earnings trough. His latest post highlights the importance of Apple (NASDAQ:AAPL) earnings and previews the other upcoming big reports. FactSet notes that both bottom and top-line results so far are exceeding the average “beat rate” from the last several years. Alliance Bernstein observes that headwinds to earnings growth has abated. Avondale has plenty of color about earnings calls, with a surprisingly positive take on the economy, Brexit, and earnings outlook.

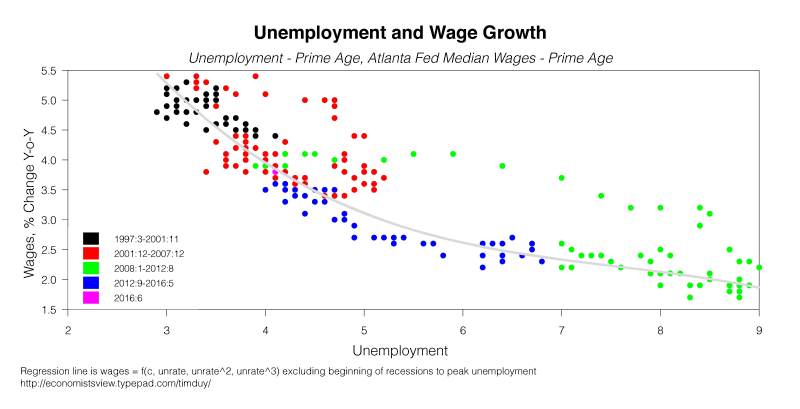

A competing issue will be the FOMC meeting. While no policy change is expected, circumstances have improved enough to put one or two rate hikes back on the table this year. Tim Duy has a chart-packed analysis of what the Fed is seeing. The look at labor market tightness is especially important.

Instead of these key issues, everyone will be asking:

What will the election mean for stocks?

I rather hope that I am wrong, and that the important economic and earnings news will take center stage.

Quant Corner

We follow some regular great sources and also the best insights from each week.

Risk Analysis

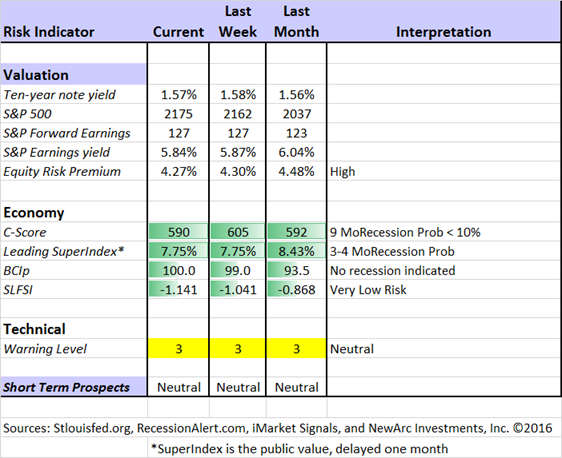

Whether you are a trader or an investor, you need to understand risk. Risk first, rewards second. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

The Featured Sources:

Brian Gilmartin: Analysis of expected earnings for the overall market as well as coverage of many individual companies. This week he expresses more confidence about growth in earnings.

Bob Dieli: The “C Score” which is a weekly estimate of his Enhanced Aggregate Spread (the most accurate real-time recession forecasting method over the last few decades). His subscribers get Monthly reports including both an economic overview of the economy and employment.

The recession odds (in nine months) have nudged closer to 10%. This does not completely reflect Brexit effects, so we may get a further revision.

Holmes: Our cautious and clever watchdog, who sniffs out opportunity like a great detective, but emphasizes guarding assets.

Doug Short: The Big Four Update, the World Markets Weekend Update (and much more).

The ECRI has been dropped from our weekly update. It was not so much because of the bad call in 2011, but the stubborn adherence to this position despite plenty of evidence to the contrary. Those interested can still follow them via Doug Short and Jill Mislinski. The ECRI commentary remains relentlessly bearish despite the upturn in their own index.

RecessionAlert: Many strong quantitative indicators for both economic and market analysis. While we feature his recession analysis, Dwaine also has a number of interesting approaches to asset allocation.

Georg Vrba: The Business Cycle Indicator, and much more. Check out his site for an array of interesting methods. His latest update describes the elements of the indicator we cite every week.

How to Use WTWA

In this series I share my preparation for the coming week. I write each post as if I were speaking directly to one of my clients. For most readers, they can just “listen in.” If you are unhappy with your current investment approach, we will be happy to talk with you. I start with a specific assessment of your personal situation. There is no rush. Each client is different, so I have six different programs ranging from very conservative bond ladders to very aggressive trading programs. A key question:

Are you preserving wealth, or like most of us, do you need to create more wealth?

My objective is to help all readers, so I provide a number of free resources. Just write to info at newarc dot com. We will send whatever you request. We never share your email address with others, and send only what you seek. (Like you, we hate spam!) Free reports include the following:

- Understanding Risk – what we all should know.

- Income investing – better yield than the standard dividend portfolio, and also less risk.

- Holmes – the top artificial intelligence techniques in action.

- Why 2016 could be the Year for Value Stocks – finding cheap stocks based on long-term earnings.

You can also check out my website for Tips for Individual Investors, and a discussion of the biggest market fears. (I welcome questions or suggestions for new topics.)

Best Advice for the Week Ahead

The right move often depends on your time horizon. Are you a trader or an investor?

Insight for Traders

We consider both our models and also the best advice from sources we follow.

Felix and Holmes

We continue our neutral market forecast. Felix is once again fully invested, including some more aggressive sectors. That continues to work well during the rally. The more cautious Holmes is now about 80% invested, taking some profits last week. Even when the overall market is neutral, there will often be some strong candidates. That is what we see now. It is not a resounding endorsement of the overall market, but a vote for opportunistic trading. I am curious about what it will take for Holmes to turn “mildly bullish.”

Top Trading Advice

Are stocks coiled for an upside move? Dana Lyons, using the mid-cap 400 to illustrate, writes as follows:

Specifically, the 7-day range in the index spans less than 1 percent for just the 8th time ever. And, at precisely 1.00%, the 8-day range is the narrowest in more than 20 years. In fact, all of the historically tighter ranges occurred in the low-volatility early to mid-1990′s period.

He sees a good setup for an upside breakout – tradable if it fits your time frame.

Brett Steenbarger explores the creative aspects of trading, revisiting a recent post that proved to be his most popular ever. Traders will benefit from both.

Insight for Investors

Investors have a longer time horizon. The best moves frequently involve taking advantage of trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be the insightful market outlook provided by “Davidson” via Todd Sullivan.

…(E)conomic fundamentals are reliable in forecasting economic activity 12mos-18mos ahead. Fundamentals provide guidance to markets well before and often in contradiction to consensus market psychology. Fundamentals provide a long-term rate of return (Natural Rate) that can be used to compare returns from markets and individual securities. Having fundamentals which can do this for us make them a good tool to separate the investments which carry value from those which reflect more hope than substance. Many forecasters have called for a ‘Market Top’ every year since 2010 (SPDR S&P 500 (NYSE:SPY)). In counter-point, fundamentals have continuously forecasted higher equity prices since late 2008. Over the long-term, history shows that fundamentals have always driven market psychology which in turn drives market prices. A market top is not near. A top is not even close. Markets are a ‘Human System’. We should worry most when most are not worried.

Good advice.

Stock Ideas

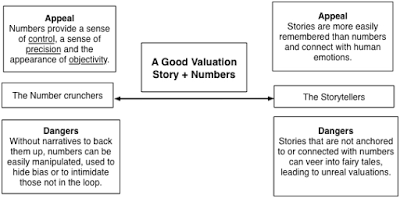

I always like articles that illustrate good analysis while discussing a potential stock. Valuation expert Aswath Damodaran discusses “story stocks” using Tesla (NASDAQ:TSLA) as an example. (He also mentions Amazon (NASDAQ:AMZN)). Here is a chart of the basic thesis:

Can distressed energy company bonds be a better choice than the stock? Some traders are buying bonds and selling short the stock. Investors who own the stock might find it preferable to replaced it with bonds. (The FT).

Barron’s warns about pharmacy benefit managers (on the cover) and utilities. IBM (NYSE:IBM) and Cisco (NASDAQ:CSCO) get friendlier treatment.

Market Overview and Outlook

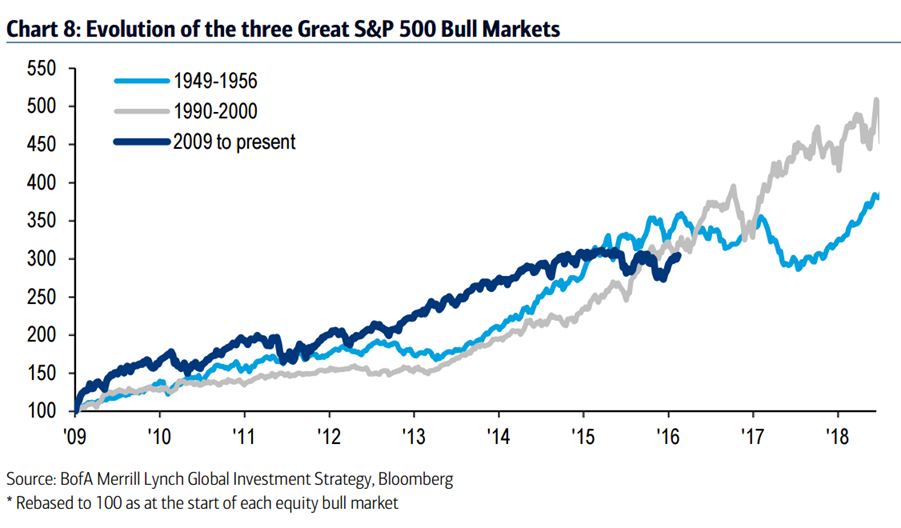

Providing a contrast to the oft-cited, infamous 1929 chart, Shawn Langlois (MarketWatch), reviews evidence about whether the current bull market might be just getting going.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read AR every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in his weekly special edition. There are several great choices worth reading, but my favorite is Michael Batnick’s advice on how long-term investors should focus. Read the whole piece, but the essence is this Carl Richards sketch.

Value Stocks

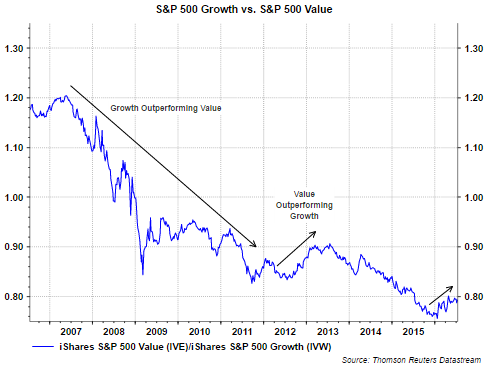

It is important to remember the length of stock market cycles. Even the best approaches can be out of favor for several years. HORAN Capital Advisors notes the encouraging rebound in value stocks, emphasizing the remaining upside potential.

Watch out for….

Target date funds. Check out five reasons to think twice. The “set it and forget it” approach might not work for you. (MarketWatch).

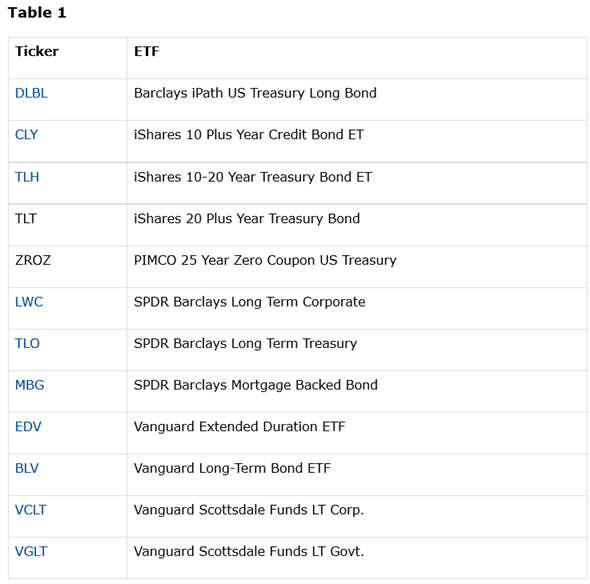

Long-term fixed income. Marc Gerstein says, “Owning long-term bonds are like using your jaw to punch Mr. Market in the fist.” Here is his “hate list.”

Final Thoughts

I have not written much about the election, because there is no clear implication for stocks – at least not yet. Many supposed impacts (drug prices?) are over-estimates of effects. Since we are concerned with investments, we look at political issues only through the prism of those effects.

More important is a mistaken viewpoint that stocks reaching a new high means that investor sentiment is euphoric. Not so.

BofA opines this week that it is time to buy stocks. Rupert Hargreaves (BI) reports:

Hartnett’s simple bullish message is based on the pessimistic attitude of investors in the market following Brexit and amid the general global economic malaise. Indeed, according to Bank of America’s research, investors ended June with the highest cash allocation on record at 5.7% on average and reported the lowest equity allocations in four years. Moreover, it looks as if investors are capitulating into bonds with annualised year-to-date return from global government bonds in 2016 at 25%, the highest return in 30 years. These three bearish indicators combined with the fact that inflows into precious metal funds hit a record during the first week of July, all point to the fact that investors are very bearish on the outlook for global equities. Bank of America, Merrill Lynch’s Bull & Bear Indicator, fell to an “extreme bear” reading of 1.6 on June 28.

There is plenty of room for stocks to advance, depending upon three factors:

- The economy – reasonable growth and no recession;

- Corporate earnings – getting out of the energy funk and inducing some business investment; and finally

- Attracting (even more) investors from alternative allocations.

At the mid-point of 2016, the key for investors is to understand the remaining market potential, and avoid obsession with scary headlines.

Economic cycles very rarely “stall out.” Recessions begin at a business cycle peak, something that is still at least a year away.