Stocks managed a mid-day rebound from a 566-point decline in the DJIA. Among the suggested reasons was more help from central bankers. With a light economic calendar, I expect Fed speculation to compete with earnings in the week ahead. Everyone will be wondering:

Will the Fed signal a dovish tilt?

Prior Theme Recap

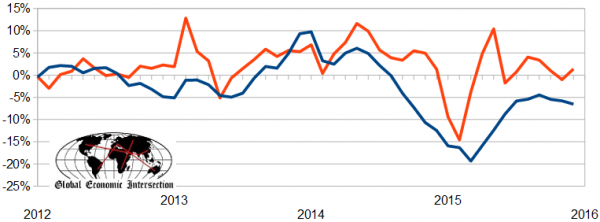

In my last WTWA I predicted that everyone would be watching earnings reports carefully, wondering if they could provide a floor for stocks. There was indeed a lot of attention to earnings, but that news did not seem to support the stock market. The stock rebound coincided with a mysterious rally in oil. (Could some really have been confused by the shift from the expiring front month contract? Really??) You can see the mixed story for stocks from Doug Short’s weekly S&P 500 chart. (With the ever-increasing effects from foreign markets, you should also add Doug’s World Markets Weekend Update to your reading list).

Doug’s update also provides multi-year context. See his full post for more excellent charts and analysis.

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react. That is the purpose of considering possible themes for the week ahead. You can make your own predictions in the comments.

This Week’s Theme

There is a fairly light economic calendar this week, featuring the FOMC decision on Wednesday. Despite the continuing flow of earnings reports, speculation about the Fed will dominate market discussion until after the meeting. Everyone will be wondering –

Will the Fed signal a dovish tilt?

No one expects a change in rates at this Fed meeting, but the language in the statement will be carefully parsed for signs that the path of future increases will be less aggressive. Here are the key viewpoints:

- The Fed is out of touch with the economy, increasing rates at the wrong time. What is needed is more QE.

- The Fed must reduce the implied four rate hikes to one or two, in line with market expectations.

- Higher U.S. interest rates, just as other countries are reducing theirs, will strengthen the dollar. This will hurt the U.S. economy as well as provide more pressure on commodities.

- Fed policy matters little right now. It is all about oil prices.

- The Fed sees a stronger economy than do market participants. There will be no hint of a more dovish policy.

You will see vigorous proponents for each of these viewpoints.

As always, I have my own opinion in the conclusion. But first, let us do our regular update of the last week’s news and data. Readers, especially those new to this series, will benefit from reading the background information.

Last Week’s Data

Each week I break down events into good and bad. Often there is “ugly” and on rare occasion something really good. My working definition of “good” has two components:

- The news is market-friendly. Our personal policy preferences are not relevant for this test. And especially – no politics.

- It is better than expectations.

The Good

On balance the news was pretty good last week.

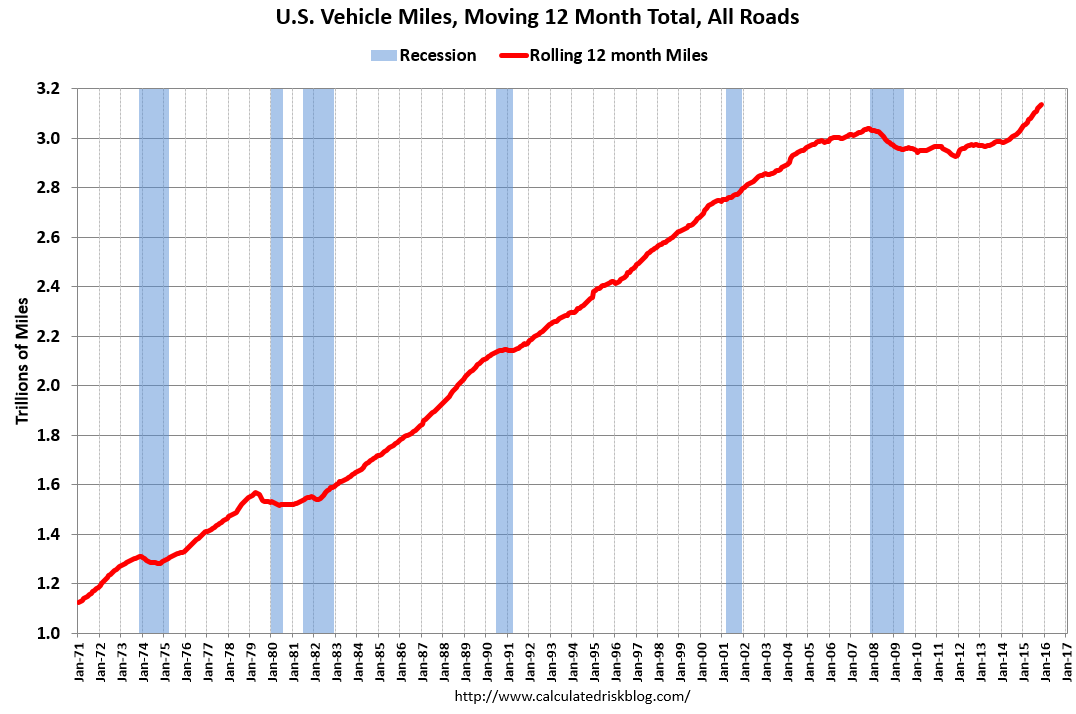

- People are driving more. This is good news since it provides more satisfaction without additional cost. Calculated Risk notes that gas prices are down about seventy-four cents per gallon while miles are up 4.3%.

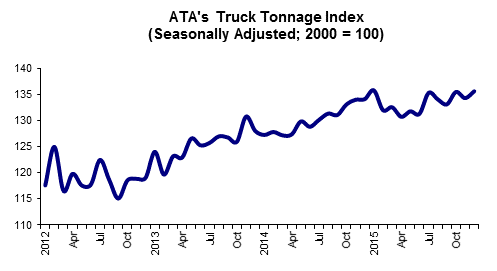

- ATA truck tonnage improved by 1% over last year. The organization’s chief economist, Bob Costello, cautioned that the overall results for the year were not that strong. He cited high inventories in the supply chain.

- Existing home sales were very strong. Calculated Risk explains the positive effect of changes in regulations, as well as the needed and likely increase in inventory.

- High frequency indicators have improved. New Deal Democrat has an excellent weekly report that includes many items you might otherwise miss. I always read it, and you should, too.

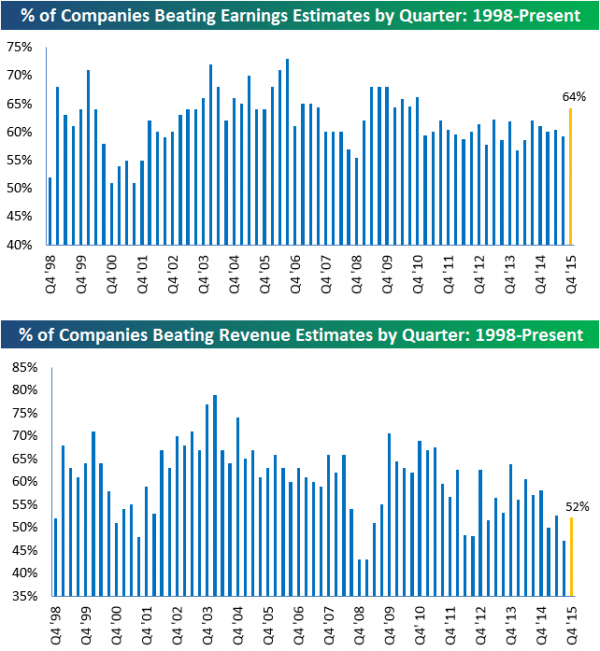

- The earnings news has been pretty good. Bespoke reports the data. Long-time earnings expert Brian Gilmartin notes that reports often improve as the season continues.

The Bad

Some of the economic data was disappointing.

- Initial jobless claims increased again, this time to 293K. The less volatile four-week moving average also moved higher. I watch this closely. It remains at encouraging levels, but the move bears watching.

- Housing starts and building permits declined. Calculated Risk, our go-to source on all things housing has the full story, great charts and analysis. Bill McBride believes that next year will see a reduction in the ratio of multi-family starts. New Deal Democrat was a bit more positive.

- Sea container counts remain weaker than last year. Steven Hansen (GEI) reports.

The Ugly

A weakened European Union. Just as the economic issues were looking better, there is a new issue – immigration and open borders. (News from Davos).

The Silver Bullet

I occasionally give the Silver Bullet award to someone who takes up an unpopular or thankless cause, doing the real work to demonstrate the facts. Think of The Lone Ranger. No award this week, but perhaps someone will identify the errors in this post, which was widely-publicized early in the week.

Please take a look at our review of last year’s winners. I think you will find the summary fun to read, and the lessons still quite timely.

A Little Fun?

I hope that our annual Hot and Not Hot post will bring a smile to your face. It also might stimulate a few investing ideas, as you recognize how much trends have changed in the last year.

Quant Corner

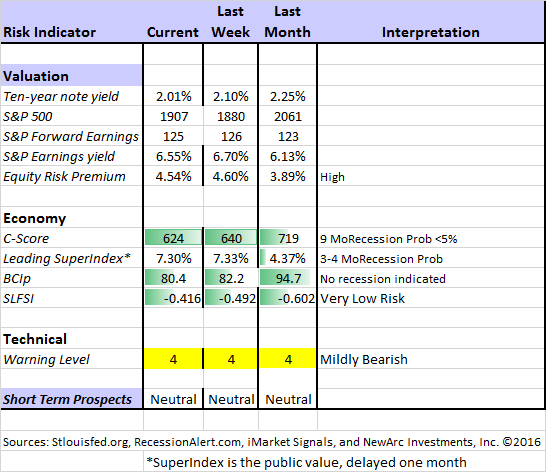

Whether a trader or an investor, you need to understand risk. I monitor many quantitative reports and highlight the best methods in this weekly update. Beginning last week I made some changes in our regular table, separating three different ways of considering risk. For valuation I report the equity risk premium. This is the difference between what we expect stocks to earn in the next twelve months and the return from the ten-year Treasury note. I have found this approach to be an effective method for measuring market perception of stock risk. This is now easier to monitor because of the excellent work of Brian Gilmartin, whose analysis of the Thomson-Reuters data is our principal source for forward earnings.

Our economic risk indicators have not changed.

In our monitoring of market technical risk, I am using our new model. While it is in the same tradition as Oscar and Felix it has a stronger emphasis on asset protection. We have found that the overall market indication is very helpful for those investing or trading individual stocks. The score ranges from 1 to 5, with 5 representing a high warning level. The 2-4 range is acceptable for stock trading, with various levels of caution.

The new approach improves trading results by taking some profits during good times and getting out of the market when technical risk is high. This is not market timing as we normally think of it. It is not an effort to pick tops and bottoms and it does not go short. We have decided that “Oscar” does not fit the new approach, so my marketing department is working on a different name – perhaps a dog breed, a symbol, or a famous fictional character.

The new method is intelligent and careful about new opportunities and quick to exit when there is danger. What fits these characteristics? Suggestions welcome.

Interested readers can get the program description as part of our new package of free reports, including information on risk control and value investing. (Email requests to main at newarc dot com).

In my continuing effort to provide an effective investor summary of the most important economic data I have added Georg Vrba’s Business Cycle Index, which we have frequently cited in this space. In contrast to the ECRI “black box” approach, Georg provides a full description of the model and the components.

For more information on each source, check here.

Recent Expert Commentary on Recession Odds and Market Trends

Bob Dieli does a monthly update (subscription required) after the employment report and also a monthly overview analysis. He follows many concurrent indicators to supplement our featured “C Score.”

Georg Vrba: provides an array of interesting systems. Check out his site for the full story. We especially like his unemployment rate recession indicator, confirming that there is no recession signal. He gets a similar result with the twenty-week forward look from the Business Cycle Indicator, updated weekly and now part of our featured indicators.

Doug Short: Provides an array of important economic updates including the best charts around. One of these is monitoring the ECRI’s business cycle analysis, as his associate Jill Mislinski does in this week’s update. His Big Four update is the single best visual update of the indicators used in official recession dating. You can see each element and the aggregate, along with a table of the data. The full article is loaded with charts and analysis.

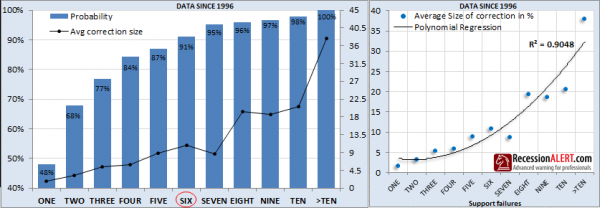

RecessionAlert: A variety of strong quantitative indicators for both economic and market analysis. While we feature the recession analysis, Dwaine also has a number of interesting systems. These include approaches helpful in both economic and market timing. He has been very accurate in helping people to stay on the right side of the market.

This week Dwaine published a research note helping to identify the probability of future new lows by using the number of times the market broke support. There was a further decline after publication, but history still suggests about a 90% chance that we have seen the worst of it. Dwaine carefully notes that we are moving into the part of history where we have fewer past cases.

The pseudo-experts are at it again, with plenty of ill-informed recession forecasts. I explain how to find real experts in this post.

I am delighted to note that Bill McBride of Calculated Risk also joins in this myth-busting. He cites his own (very accurate) history on the economy. He has a modest and carefully-reasoned argument with a conclusion I strongly endorse:

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future – and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn – and I don’t expect a recession for a few years.

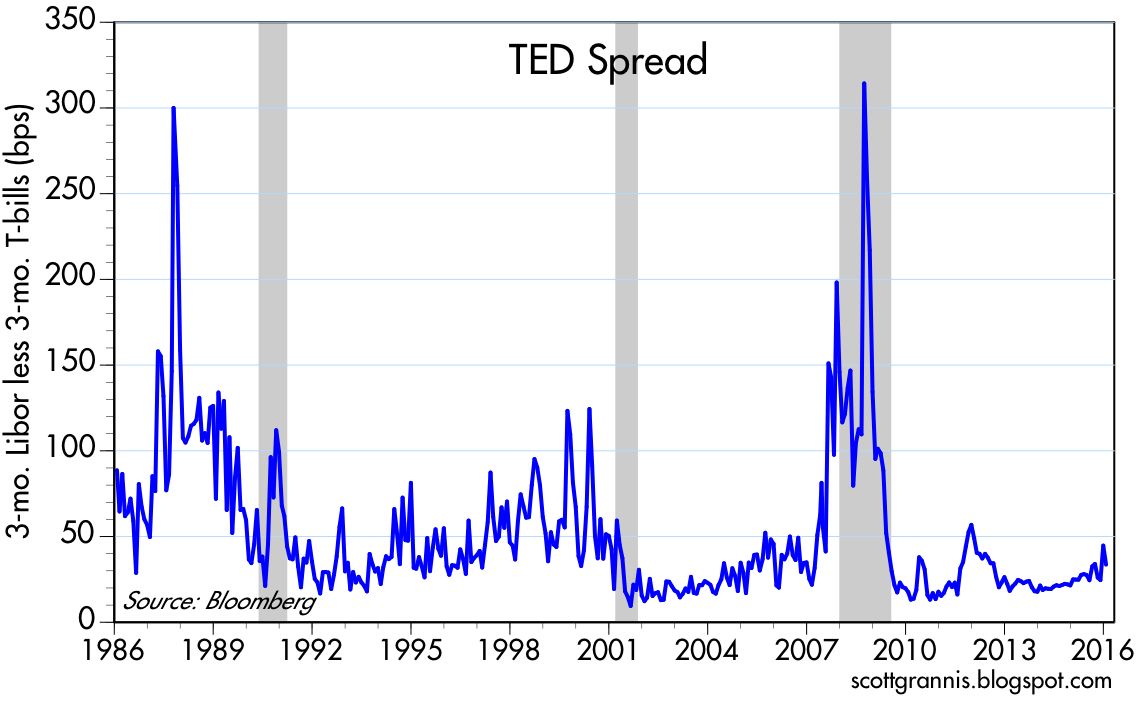

Scott Grannis refutes those worrying about economic weakness like 2008. Here is a key quote and an interesting chart:

Bottom line, the underpinnings of financial markets look reasonably solid, and that offers the promise that the turmoil in the oil patch will be resolved without plunging the world into another 2008-style crisis.

The Week Ahead

We have a relatively quiet week for economic data. While I highlight the most important items, you can get an excellent comprehensive listing at Investing.com. You can filter for country, type of report, and other factors.

The “A List” includes the following:

- FOMC rate decision (W). No policy changes or a press conference so the focus will be on language.

- Q4 GDP (F). Will it have a “one-handle”?

- New home sales (W). Important read on construction and the economy.

- Consumer confidence (T). The Conference Board version has been strong.

- Michigan sentiment (F). Will the final read for January maintain the preliminary strength?

- Initial Claims (Th). The best concurrent news on employment trends, with emphasis on job losses.

The “B List” includes the following:

- Chicago PMI (F). More widely followed when it comes a weekend before the national ISM report. Recent weakness worrisome for many.

- Pending home sales (Th). Not as important as new construction, but still a good overall read on the housing market.

- Crude oil inventories (W). Attracting a lot more attention these days.

- Durable goods orders (Th). Volatile December data, but still important.

No FedSpeak until after the meeting, and then not much. Corporate earnings reports will remain in the spotlight. News from around the world is a continuing wild card, with U.S. stock futures often showing big moves in pre-market trading.

How to Use the Weekly Data Updates

In the WTWA series I try to share what I am thinking as I prepare for the coming week. I write each post as if I were speaking directly to one of my clients. Each client is different, so I have five different programs ranging from very conservative bond ladders to very aggressive trading programs. It is not a “one size fits all” approach.

To get the maximum benefit from my updates you need to have a self-assessment of your objectives. Are you most interested in preserving wealth? Or like most of us, do you still need to create wealth? How much risk is right for your temperament and circumstances?

My weekly insights often suggest a different course of action depending upon your objectives and time frames. They also accurately describe what I am doing in the programs I manage.

Insight for Traders

We continue both the neutral market forecast, and the bearish lean. We stepped up to about 50% invested in trading programs on Wednesday – not catching the bounce perfectly, but close. There are often plenty of good investments, even in an expected flat market, but the cash has provided a nice cushion for both Oscar and Felix in the last few weeks. For more information, I have posted a further description — Meet Felix and Oscar. You can sign up for Felix and Oscar’s weekly ratings updates via email to etf at newarc dot com. They appear almost every day at Scutify (follow here).

Do you think you need a trading coach? You probably do! Dr. Brett gives some ideas about being your own coach, including a daily review of your best and worst trades.

Insight for Investors

I review the themes here each week and refresh when needed. For investors, as we would expect, the key ideas may stay on the list longer than the updates for traders. Major market declines occur after business cycle peaks, sparked by severely declining earnings. Our methods are focused on limiting this risk. Start with our Tips for Individual Investors and follow the links.

We also have a page (recently updated) summarizing many of the current investor fears. If you read something scary, this is a good place to do some fact checking. Pick a topic and give it a try.

Other Advice

Here is our collection of great investor advice for this week.

If I had to pick a single most important source, it would be Chuck Carnevale’s advice on how to avoid “value traps.” As he notes, this term is often used quite carelessly, applied to any stock that is cheap on a P/E basis but is currently out of favor. Here is a key quote:

The value opportunity occurs when price drops farther than temporary or cyclical fundamental deterioration warrants. In other words, the market overacts to normal cyclicality. This is where focusing on the dividend can identify a value opportunity rather than a value trap. If the dividend continues to rise in spite of cyclicality in earnings, attractive value is created representing opportunity, not a trap.

As always, Chuck provides some great examples.

On the theme of price movement versus fundamental analysis, you might enjoy the contrast from Josh Brown about “closet technicians.”

Stock and Fund Ideas

What about airline stocks? Shouldn’t they be enjoying lower fuel prices? The Trading Goddess explains that some misguessed on hedging plans. She provides some ideas about which airlines.

International Paper (N:IP) – cheap and recession-resistant. (Barron’s)

Barron’s Roundtable issues (this week and last week) have quite a few stock ideas from their well-known participants. Even if you are not a regular subscriber, you might enjoy this issue. While I make my own decisions, I usually get some ideas that I have not seen elsewhere.

Energy

Leading oil economist Prof. James Hamilton looks at production from various countries, concluding that the current imbalance will not be easily corrected. He expects cuts in U.S. production as well as continuing low prices.

Personal Finance

Professional investors and traders have been making Abnormal Returns a daily stop for over ten years. The average investor should make time (even if not able to read every day as I do) for a weekly trip on Wednesday. Tadas always has first-rate links for investors in this special edition. There are several great posts, but I especially liked this advice from Susan Dziubinski of Morningstar – five financial habits to break in 2016. The top item? Checking on your portfolio too often.

Market Psychology, Timing, and Outlook

Investors pull $24 billion in equity funds in January. (MarketWatch).

Scott Rothbort identifies the market bottom with the help of some interesting anecdotal evidence. You will enjoy the stories. (My Gut Feeling)

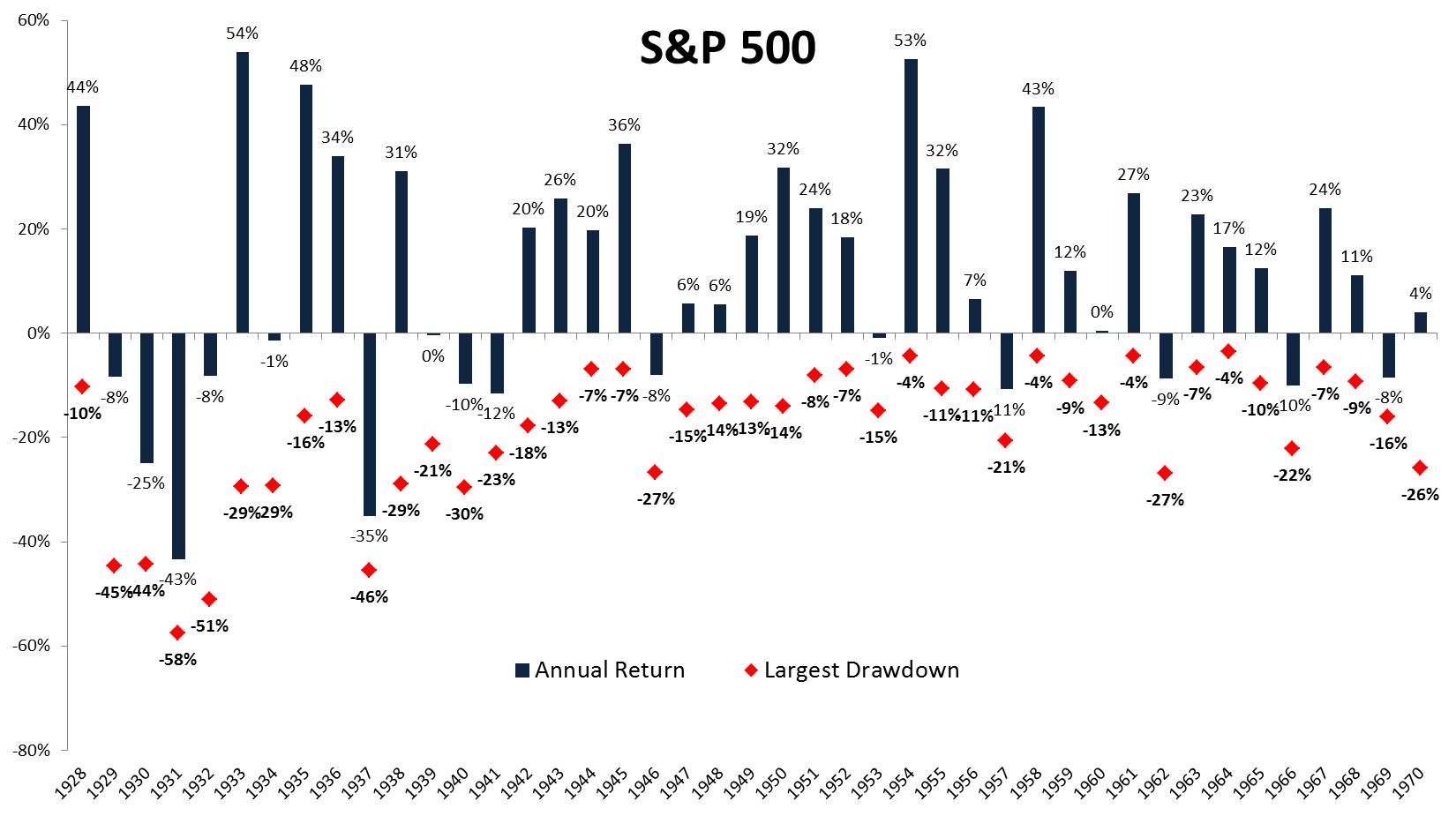

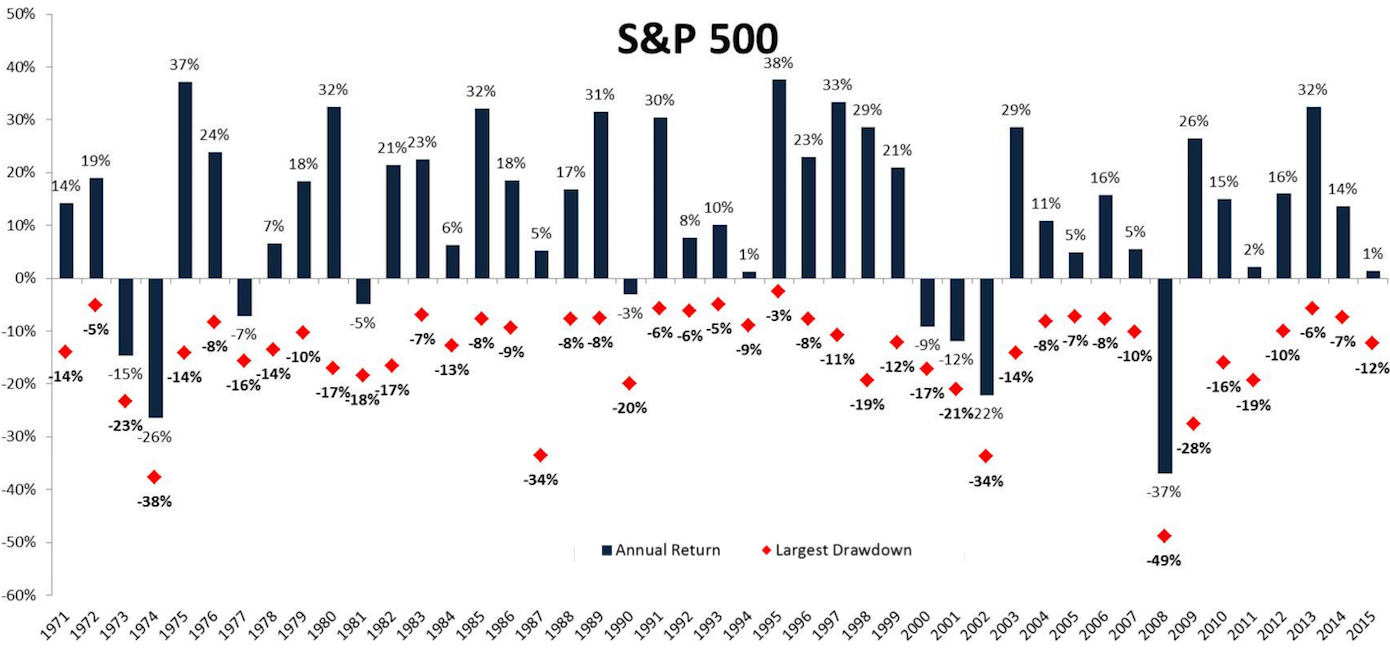

Michael Batnick provides helpful data showing that drawdowns are quite normal, even in good years.

George Soros is bearish. He doubts that the Fed will raise rates and has concerns about China.

Watch out for…

Dividend stocks with payout ratios that are too high. (Barron’s)

Those selling hot IPOs. (Josh Brown)

Final Thoughts

Last week I said, “Traders may still need some fancy footwork in the next few weeks”. That was an understatement! Our trading models were all more aggressive at mid-week, but with reduced size. That caution seems reasonable.

Stock traders are taking cues from oil prices. Oil traders are watching stocks. There is plenty of guesswork involved!

Turning to investors, I want to modify last week’s two questions:

- Is this the start of something big, as so many are warning? The reason for our quant corner is to evaluate the risk of stock declines beyond the “normal” correction of 15-20%. We look at fundamental valuation, recession odds, financial risk, and technical concerns. When something is threatening but does not fit these categories, I provide a human element (as I did at the time of the threatened “fiscal cliff”).

None of our risk indicators signal danger.

- Can we expect mid-week help from the Fed?

I doubt it. The Fed world view is quite different from that of most market participants:

- More confidence in actual economic data as opposed to market prices.

- Much less emphasis on “supporting markets” than most believe.

- Little concern about a recession and more concern about tightening labor markets.

- Less perceived responsibility for worldwide events. Two mandates are enough.