Once again, the calendar includes most of the important economic news in a single week. Competing with the data will be the ongoing discussion of important policy issues. Most significant are the debt ceiling and tax policy. Congress will start a five-week recess. I expect pundits to be wondering:

Is this really the time for a Congressional vacation?

Last Week Recap

The Fed announcement, according to leading observer Tim Duy, was a “snoozefest.” He sees an early move toward reducing the balance sheet.

The Story in One Chart

I always start my personal review of the week by looking at this great chart from Doug Short via Jill Mislinski.

Doug has a special knack for pulling together all the relevant information. His charts save more than a thousand words! Read the entire post for several more charts providing long-term perspective, including the size and frequency of drawdowns.

Personal Note

I’ll be back from vacation tomorrow. It was a refreshing trip, and I have some interesting new ideas for posts. Toronto is a great city with a vibrant community.

The News

The economic news has continued in the mildly positive trend. New home sales and consumer confidence showed strength last week. Most important has been the earnings news.

Earnings season has continued strong with energy living up to its great expectations for the most part, while the three largest S&P sectors by market capitalization, Technology (~20%), Financials (~16%), and Healthcare (~15.00%) are reporting strong earnings growth.

As Brian Gilmartin at Fundamentalis explains in his article last week, Market Cap Matters!, the largest sectors reporting the best earnings growth often makes for bull markets. Over half of S&P 500 constituents (57%) have reported actual results for Q2 so far, and of those about three quarters are reporting EPS above estimates compared to a five-year average. Actual sales reports show similar above estimate results for about three quarters of companies reporting.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

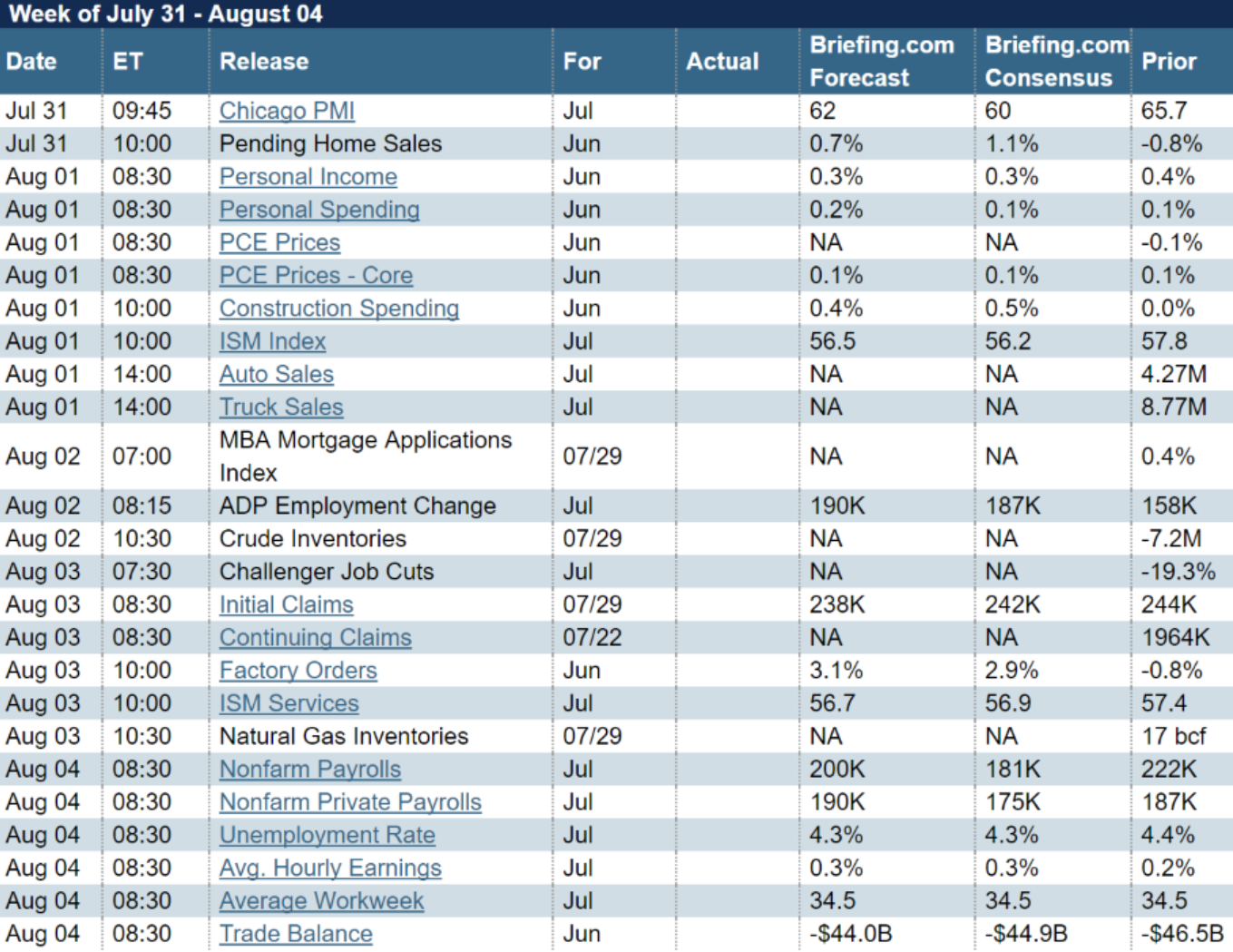

The Calendar

The calendar is a busy one this week, with numerous important data points coming in such as Employment, ISM Manufacturing and Non-Manufacturing PMI, as well as Auto Sales reporting.

Briefing.com has a good U.S. economic calendar for the week. Here are the main US releases.

Next Week’s Theme

There is plenty to talk about, with employment taking center stage. The big economic weeks have not led to much volatility this year, and this will probably not be different.

There is an interesting counter theme: The Congressional recess. There is plenty of work undone, most urgently the debt limit. Treasury Secretary Mnuchin asked Congress to deal with the debt limit before the recess. While he has found extraordinary measures to keep the government going through September, it comes with a cost.

I expect this subject and stories about meetings with constituents will raise the question:

Is this really an appropriate time for a Congressional vacation?

As usual, I’ll have more in my Final Thought.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

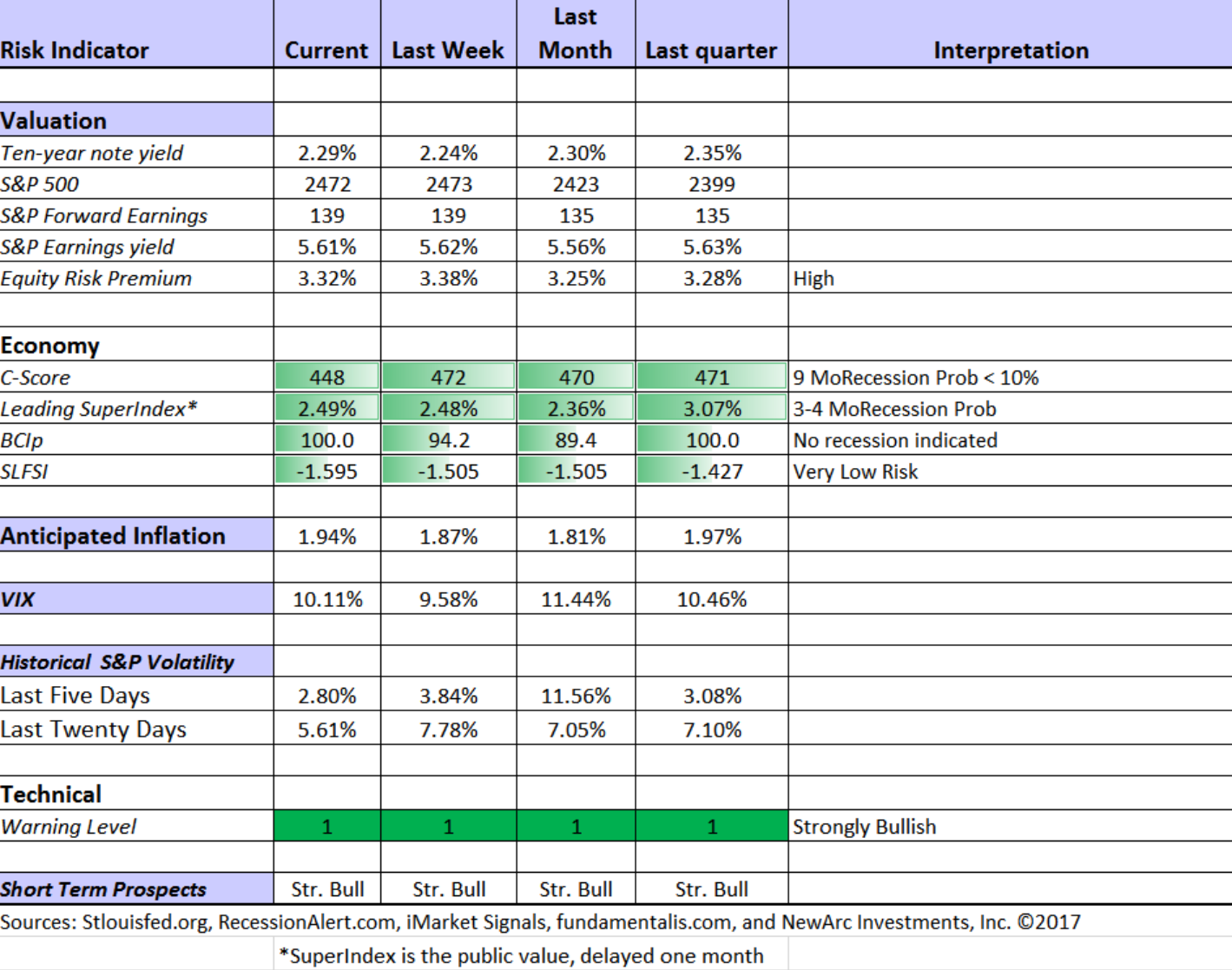

Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

Watch Out

Mark Gaffney reports on two vastly different views of Universal Display (NASDAQ:OLED) are examined. Heavily endorsed by Jim Cramer as the company which will dominate the organic light emitting diode space for year to come, UDC’s recent success stems both from such promotion, as well as from OLEDs having become the new ‘it’ material for electronic displays.

As notable short seller Manuel Asensio mentions, however, UDC’s key patents expire in December 2017, and their OLEDs based on the rare-earth iridium can’t display blue light nearly as efficiently as the potential touted for OLED technology. According to Sensio UDC faces stiff competition for this lucrative market, and is likely to lose its dominant position by the end of 2018 as large industry players like Merck (NYSE:MRK), Panasonic, and LG bring new OLED technology to bear as well as compete in UDC’s iridium home field. To say Cramer and Asensio have differing opinions on UDC’s management would be an understatement.

Final Thoughts

What worries me…

- China, Russia, and North Korea. Even more given the latest missile test. There has been no progress on this dangerous matter.

…and what doesn’t

- Continuing political turmoil. Beyond specific policies, cooperation and compromise will result in better outcomes for investors. This will only happen when the necessity becomes obvious to all.