There are not many top tier data releases on this week’s agenda, but we do have the US employment report for August, with market participants on the edge of their seats as they try to adjust their bets with regards to the Fed’s plans on QE tapering. Another interesting release may be Eurozone’s preliminary inflation data for August. We also have Australia’s and Canada’s GDP for Q2.

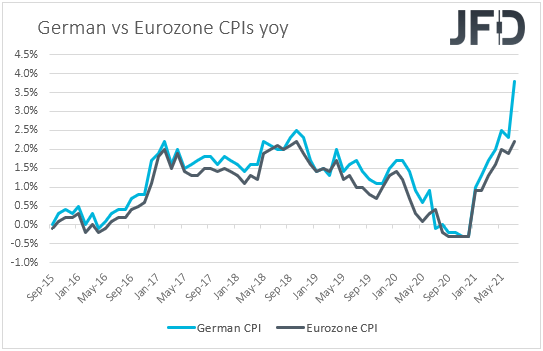

On Monday, during the European afternoon, we get Germany’s preliminary inflation data for August. The headline CPI rate is forecast to have ticked up to +3.9% yoy from +3.8%, while the HICP one is anticipated to have edged up to +3.4% yoy from +3.1%. This is likely to raise speculation that Eurozone’s headline CPI, due out on Tuesday, could also accelerate.

However, we don’t expect any major recovery from the euro, and we will explain why in a while. A couple of hours later, the US pending home sales for July are expected to have rebounded +0.4% mom, after sliding 1.9% in June.

On Tuesday, Asian time, Japan’s employment report for July is due to be released, with the unemployment rate expected to have held steady at 2.9% and the jobs-to-applications ratio forecast to have ticked down to 1.12 from 1.13. The nation’s industrial production is expected to have contracted 2.5% mom in July after expanding 6.5% in June.

China’s official PMIs for August are also coming out, but there is forecast only for the manufacturing index, which is expected to have slid fractionally, to 50.2 from 50.4.

Later in the day, we have Eurozone’s CPIs for August. The headline rate is expected to have moved further above the 2% mark. Specifically, it is expected to have risen to +2.8% yoy from +2.2%. The HICP excluding energy and food rate is also expected to have risen, but to have stayed below 2%. The forecast is for a rise to +1.4% yoy from +0.9%.

At its latest gathering, the ECB kept all of its settings untouched, but changed its forward guidance, saying that it will keep interest rates at present or lower levels until it sees inflation reaching 2% well ahead of the end of its projection horizon, which may also imply a period during which inflation moderately overshoots that objective.

In our view, this translates into willingness to hold rates low for much longer than the previous guidance suggested. Yes, accelerating inflation could bring forth the hike timing, but bearing in mind that the preliminary euro area PMIs for August slid by more than anticipated, and also that underlying inflation is still expected to stay decently below 2%, we don’t expect ECB officials to change their minds with regards to their future policy plans.

On the contrary, with the ECB pledged to stay accommodative for long, we see the case for the euro to stay under pressure against currencies the central banks of which are expected to start normalizing their respective policies soon, the likes of NZD and, perhaps, USD. Germany’s unemployment rate for August is also coming out and the forecast points to a downtick to 5.6% from 5.7%.

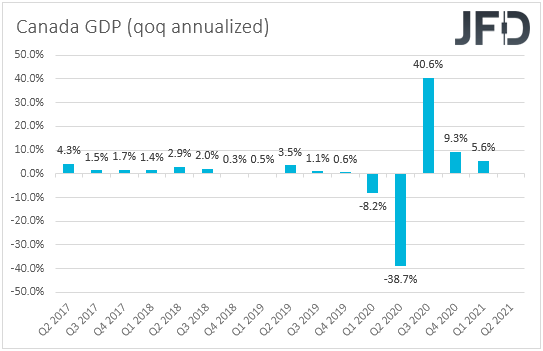

Later in the day, we have Canada’s GDP for Q2 and June. The qoq annualized rate is expected to have slid to +2.5% from +5.6%, but the monthly rate for June is expected to have risen to +0.7% from -0.3%.

At its prior gathering, the BoC appeared less hawkish than expected, saying that they continue to see the output gap closing in H2 2022, which suggests that their expectations over when they may start raising interest rates have not come forth.

What’s more, both headline and core Canadian inflation rates for July declined, while the employment report for the month fell short of its own forecasts, which may have added credence to that view. However, the Canadian dollar enjoyed decent gains in the last 10 days, perhaps driven by the rebound in oil prices. Therefore, we believe that the currency is likely to stay linked mainly to that instead of data releases.

From the US, we get the Conference Board consumer sentiment index for August, which is forecast to have slid to 124.0 from 129.1.

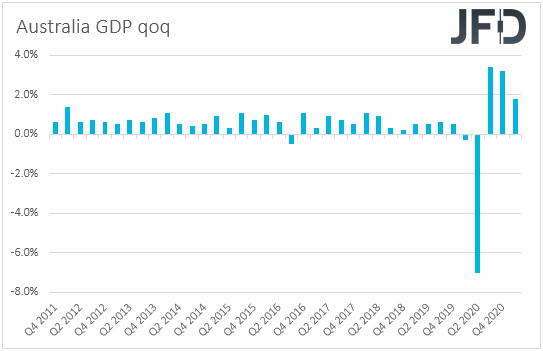

On Wednesday, during the Asian session, the main item on the agenda may be the Australian GDP for Q2, with the forecast pointing to a slowdown to +0.5% qoq from +1.8%.

Even after that quarter, the nation is under lockdown and with the government saying that in order to ease the adopted measures, vaccinations should hit around 70-80%, the restrictions are likely to stay in place for a while more. Thus, this will add more credence to the RBA’s view that interest rates are unlikely to be lifted before 2024 and is likely to keep the Aussie under selling interest.

Later in the day, the US ADP employment report for August is expected to have accelerated to 638k from 330k, but the ISM manufacturing PMI for the month is anticipated to have slid to 58.5 from 59.5. In any case, accelerating jobs growth in the private sector could raise some speculation that the NFPs, due out on Friday, may accelerate as well. However, we will not rely much on the ADP print, as it is far from a reliable predictor for the NFPs. Even last month, when the ADP number fell to 330k from 680k, the NFPs held more or less steady around 940k.

On Thursday, the only releases worth mentioning are Switzerland’s CPI and GDP for August and Q2 respectively. The CPI is forecast to have ticked up to +0.8% yoy from +0.7%, while economic growth is anticipated to have rebounded +1.9% qoq, after contracting 0.5% in the first three months of the year.

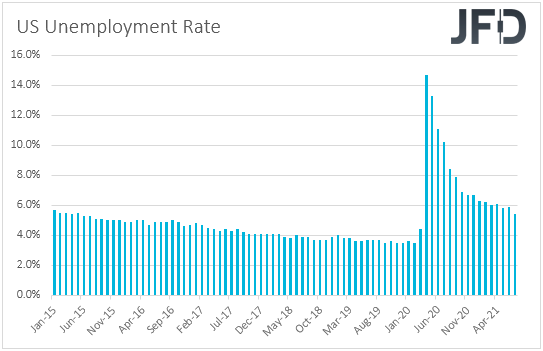

Finally, on Friday, the spotlight is likely to turn to the US employment report for August. Nonfarm payrolls are expected to have slowed to 728k from 943k, but the unemployment rate is expected to have slid to 5.2% from 5.4%. Average hourly earnings are expected to have grown another 0.4% mom, the same pace as in July, something that is likely to keep the yoy rate unchanged at +4.0%.

Despite the hawkish views by several of his colleagues, Fed Chair Powell maintained a cautious stance in his Jackson Hole speech. He acknowledged the progress of the US economy towards the Fed’s objectives but refrained from providing clear signals with regards to when they may begin tapering their QE purchases. He added that he wants to avoid chasing “transitory” inflation and potentially discouraging job growth in the process.

Having said all that though, another round of strong employment data may raise the volume of the hawkish voices among the committee, something that may result in a majority vote for tapering sooner than Powell thinks. Therefore, a decent employment report on Friday may be the catalyst for a rebound in the US dollar, which slid following Powell’s Jackson Hole remarks.

As for the rest of Friday’s events, we do get the final services and composite PMIs from the Eurozone, the UK services and composite, and the US services and composite, but as it is always the case, they are expected to confirm their preliminary estimates. The ISM non-manufacturing PMI for August is also coming out and it is expected to have slid to 61.8 from 64.1.