Following the RBA last week, we have three more central banks deciding on monetary policy this week: the RBNZ, the BoC and the BoJ. We expect the RBNZ and the BoC to be dressed in hawkish colors, with the latter perhaps tapering its bond purchase further, even as soon as this week. That said, with both the Japanese headline and core inflation rates near zero, the BoJ is likely to maintain a dovish approach. The US CPIs are also on this week’s agenda, and they may well shape expectations around the Fed’s future course of action.

Monday appears to be a relatively light day with no major economic releases and events on the agenda.

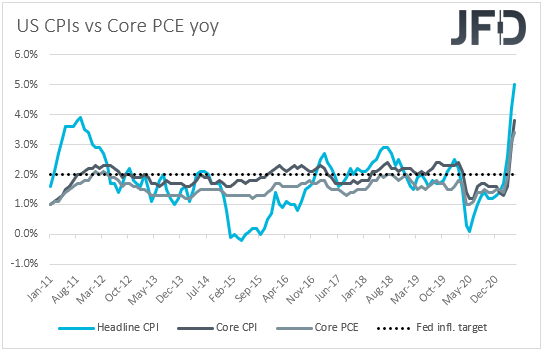

On Tuesday, the highlight is likely to be the US CPIs for June. The headline rate is forecast to have ticked down to +4.9% yoy from +5.0%, while the core one is anticipated to have inched up to +4.0% yoy from +3.8%.

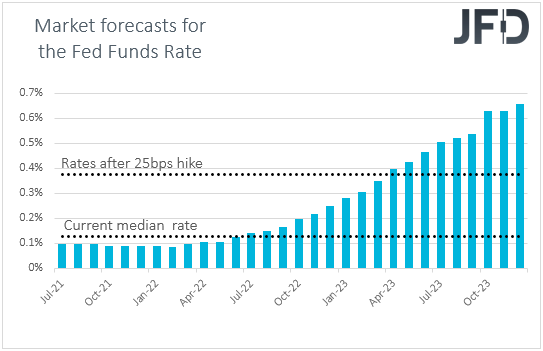

At its latest meeting, the FOMC kept its policy unchanged, but signaled that interest rates are likely to start rising in 2023. Since then, we’ve heard the individual views of several policymakers, with some of them supporting that interest rates should even start rising during 2022, and others arguing against withdrawing monetary policy support too soon. The divided Fed was also reflected in the minutes of the gathering, with various participants feeling that the conditions for reducing their asset purchases would be “met somewhat earlier than they had anticipated”, while others saw a less clear signal from incoming data and suggested a “patient” approach to any policy change. Overall though, they generally agreed that it is important to be well positioned to reduce the pace of asset purchases in case there is faster-than-anticipated progress towards the Committee’s goals.

In our view, a rising core CPI rate could add more credence to the view that the surge in inflation may eventually not be due to transitory factors and could increase expectations that the Fed may indeed start normalizing its monetary policy sooner than previously thought. According to the Fed fund futures, market participants expect the first rate hike to be delivered in April 2023, but a rising core CPI rate may bring that timing forth and thereby support the US dollar. At the same time, equities are likely to correct lower, but we believe that the main focus for equity investors is likely to be second-quarter earnings, with big banks reporting this week. Expectations are for a growth of 65.8% for companies in the S&P 500, up from a previous forecast of 54% at the start of the period. Solid earnings are likely to encourage more equity buying, and thus, we don’t expect a major pullback in stock indices in case data show that underlying inflation continued to accelerate in the US. We believe that expectations around the Fed’s future course of action may be reflected more in the FX sphere.

As for the rest of Tuesday’s data, during the Asian session, we have Australia’s NAB business confidence index for June and China’s trade balance for the same month. Later in the day, ahead of the US CPIs, we get Germany’s final inflation numbers for June, but as it is always the case, they are expected to confirm their preliminary estimates.

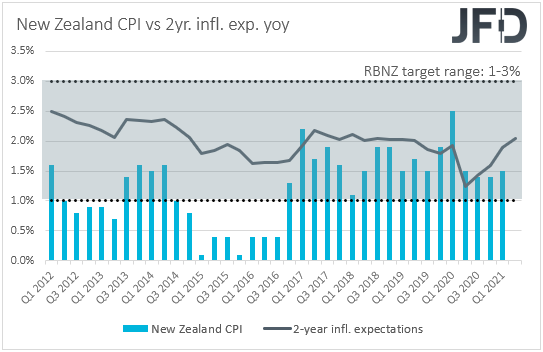

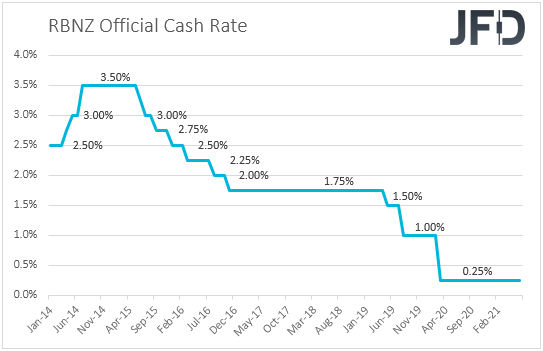

On Wednesday, we have two major central banks deciding on monetary policy, the RBNZ and the BoC. The RBNZ gets the ball rolling during the Asian morning, and although no policy action is expected, the tone of the accompanying statement may play a major role in shaping expectations over the Bank’s policy plans. Last week, market participants brought forth their bets over when this Bank will push the hike button, with 60% of New Zealand’s financial-sector firms expecting interest rates to rise over the coming year. This happened after a closely watched business confidence index jumped to its highest in four years.

With all that in mind, investors may dig into the statement for clues and hints on how optimistic policymakers are, and when they may be thinking to start raising rates. Although inflation remains below the midpoint of the Bank’s 1-3% target range, New Zealand has so far avoided a major outbreak of Covid’s Delta mutation, which may allow officials to be more optimistic than previously. This could support the Kiwi at the time of the announcement, but bearing in mind that FX traders’ sentiment may also be affected by expectations surrounding a potential Fed tightening, we don’t believe an upbeat RBNZ could prove the catalyst for a major trend reversal in NZD/USD. It could just allow the latest corrective recovery to continue for a while more.

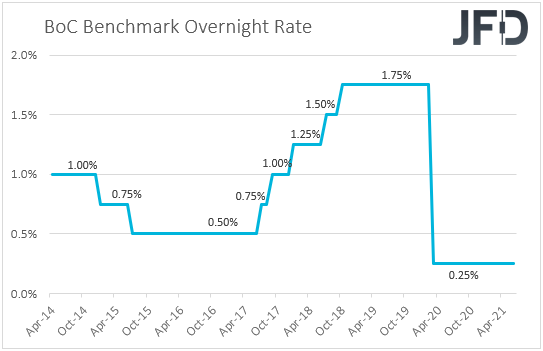

Later in the day, the BoC takes its turn. When they last met, policymakers of this Bank kept their monetary policy settings unchanged, but noted that any adjustments to the pace of their QE purchases will be guided by the ongoing assessment of the strength and durability of the economic recovery. In our view, the absence of strong hints with regards to further tapering in the upcoming months may have disappointed some Loonie traders, and that’s why the currency traded lower after the decision.

However, since then, both the headline and core CPIs accelerated by more than anticipated, while the employment data showed that the Canadian economy added more jobs than expected in June. What’s more important though is that the Bank’s latest Business Outlook Survey indicator rose to a record high, due to a fast vaccination pace and the easing of some covid-related restrictions. In our view, this may allow the Bank to scale back its QE further at this gathering, which, combined with upbeat signals that more tapering is in the works for the months to come, could support the Canadian dollar.

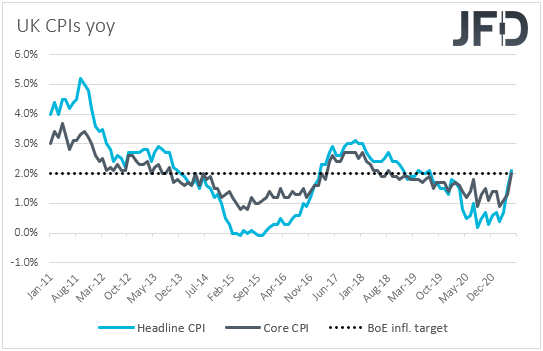

As for Wednesday’s data, during the early European session, the UK CPIs for June are due to be released. The headline rate is forecast to have ticked up to +2.2% yoy from +2.1%, while the core one is anticipated to have held steady at +2.0% yoy. At its latest gathering, the BoE kept its policy unchanged, with only one member voting in favor of QE tapering. That member was Chief Economist Andy Haldane, for whom that was the last meeting. The Bank repeated that the surge in inflation is expected to be transitory, and added that they do not want to undermine the recovery by premature tightening. With that in mind, we don’t expect inflation staying around the Bank’s 2% objective to be a reason for officials to alter their own view. We believe that the actual prints have to overshoot their forecasts decently in order for speculation over policy tightening to resurface. If both CPI rates stay around 2%, the pound is unlikely to react much.

A few hours later, we have Eurozone’s industrial production for May, while during the US session, the US PPIs for June are coming out. Eurozone’s industrial production is expected to have weakened 0.1% mom after improving 0.8% in April, while both the headline and core US PPI rates are expected to have risen further.

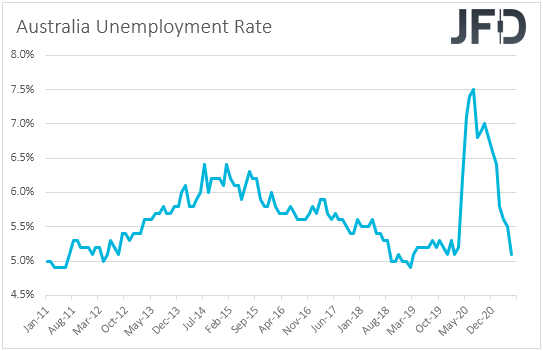

On Thursday, during the Asian session, the main items on the agenda may be Australia’s employment report for June, as well as China’s GDP for Q2, which will be accompanied by the fixed asset investment, industrial production, and retail sales, all for June. In Australia, the unemployment rate is forecast to have ticked down to 5.0% from 5.1%, but the net change in employment is expected to show that the economy has gained less jobs than in May. Specifically, it is expected to show a 30.0k jobs gain following 115.2k new jobs in May.

At last week’s gathering, the RBA announced that it will proceed with more bond purchases, beyond September, adding that they will reevaluate things in November. With the RBA still wearing its dovish dress, we don’t believe that the anticipated slide in the unemployment rate will be enough to spark speculation that Australian policymakers will turn in the direction of the more hawkish Fed, RBNZ and BoC in the months to come, especially with the employment growth slowing down. Having that in mind, whatever the direction of the broader market sentiment is, we believe that the Australian dollar will underperform the other risk-linked currencies, the likes of Kiwi and Loonie, in the foreseeable future. In other words, we would expect AUD/NZD and AUD/CAD to drift south for a while more.

As for the Chinese data, the GDP is expected to have accelerated to +1.3% qoq from +0.6%, while fixed asset investment is anticipated to have slowed to +12.5% yoy from 15.4%. Industrial production and retail sales are expected to have slowed as well, to +7.9% yoy and +11.0% yoy from +8.8% and +12.4% respectively. In our view, despite expectations of some slowdown during the last month of the quarter, it seems that the world’s second largest economy has performed very well during the whole period and thus, we don’t expect this data series to have a major impact on investors’ morale.

Later in the day, we have the UK employment report for May and the US industrial production for June. The UK unemployment rate is expected to have held steady at 4.7%, with the employment change slowing to 90k from 113k in April. That said, average weekly earnings, both including and excluding bonuses, are expected to have accelerated notably in yoy terms, something that could raise concerns over UK inflation eventually overshooting the BoE’s target of 2%, which could in turn tempt central bank officials to start thinking whether it would be better to start normalizing policy sooner than previously anticipated.

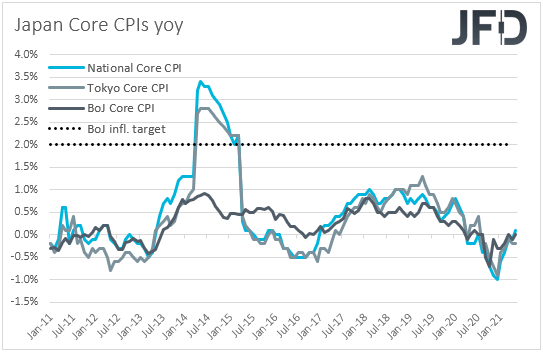

Finally, on Friday, the central bank torch will be passed to the BoJ. Its latest meeting resulted in no fireworks, with officials maintaining their policy unchanged and extending the deadline for pandemic-related programs by six months, as was mainly expected to happen at that gathering, or the one scheduled for this week. With both Japan’s headline and core inflation rates around the zero mark, we don’t expect this Bank to adopt a similar stance to other major central banks and start sending signals with regards to whether and when it could start normalizing its policy. We expect policymakers to keep their foot on the extra-loose pedal and perhaps signal that they are willing to leave it there for long. Although, under normal circumstances, a dovish language may have been proven negative for the Japanese yen, we don’t expect the yen to suffer much this week, especially if FX traders start pricing an earlier tightening move by the Fed. Worries over the Delta coronavirus variant could also keep this safe-haven currency supported.

As for Friday’s economic indicators, Asian time, New Zealand’s CPIs for Q2 are coming out, but bearing in mind that they will be released a couple of days after the RBNZ’s monetary policy decision, we don’t believe that they will attract the appropriate attention. Conditional upon the RBNZ appearing optimistic on Wednesday, it would need a notable disappointment in the CPIs for rate-hike expectations to fade. Eurozone’s final CPIs for June are also released, but, as it is always the case, they are expected to confirm their preliminary estimates. Later in the day, we have the US retail sales for June, which are expected to have declined again, but at a slower pace than in May, as well as the preliminary UoM consumer sentiment index for July, which is forecast to have risen to 86.5 from 85.5.