After hitting new all-time highs in the days after Christmas, US equities have now fallen two weeks in a row, an auspicious way to start the new year.

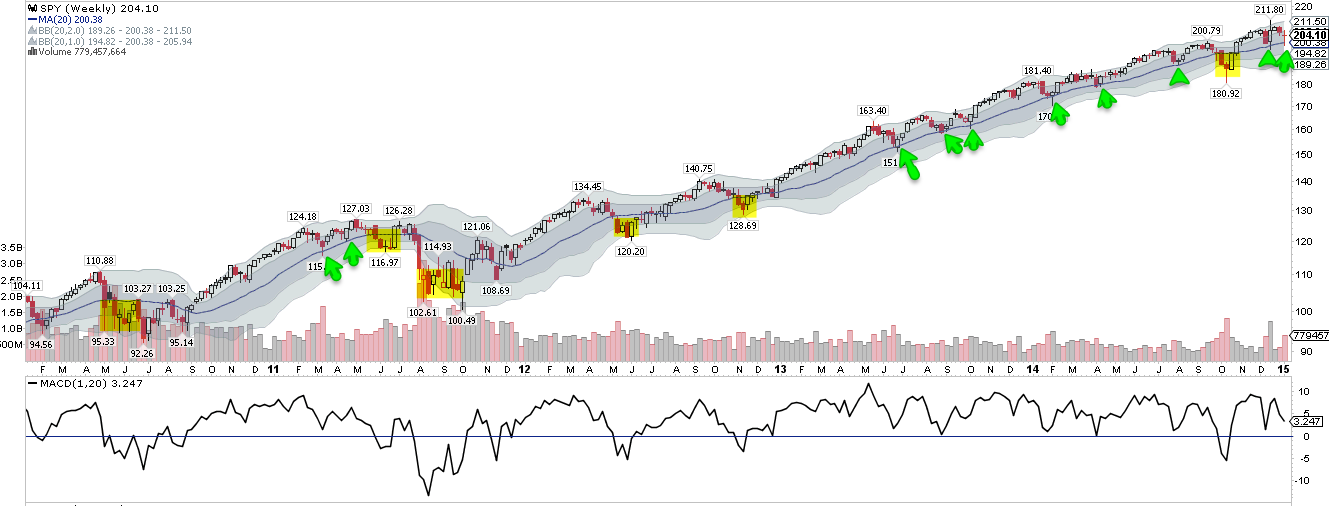

The lows this past week pierced the 20-weekly MA. Strong uptrends remain above this line (arrows). A quick return to this level in the weeks ahead likely leads much lower. In the past, a close below the 20-WMA has often led to a touch of the weekly Bollinger® band bottom, currently at 189 (yellow).

The most worrying development in the US markets is the NASDAQ. Among cyclical sectors, technology shares were the top performer in 2014, but there appears to be a potential loss in leadership taking place. SPX, DJIA and RUT all made higher highs in December; NDX did not. NDX also was the only index to retest its December low this past week; the others all made higher lows. Finally, NDX is the only US index to close below its 50-DMA again on Friday.

NDX must exceed 4320 to avoid forming a third lower high. The pattern is beginning to resemble a bearish descending triangle.

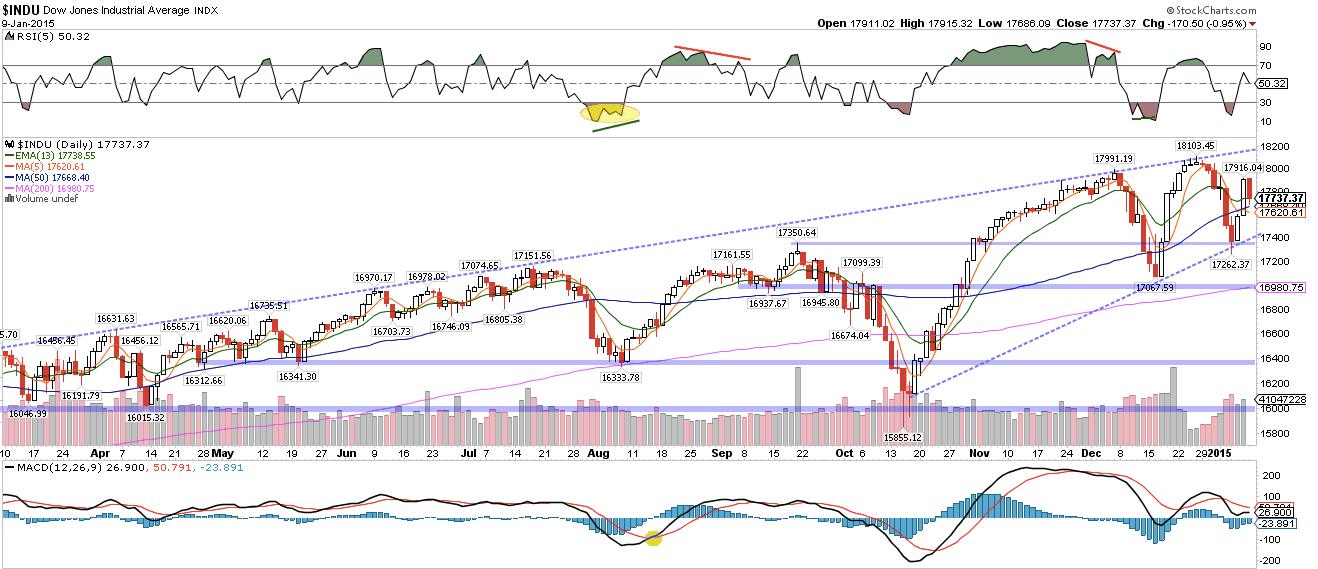

SPX, RUT and DJIA all made clear higher highs in December and the lows this past week were distinctly above the December lows. This is the definition of an uptrend.

That's not to say that these indices are in the clear. SPX and DJIA (large caps) are once again close to their 2014 uptrend lines. These indices are possibly forming a rising wedge, which can often be bearish.

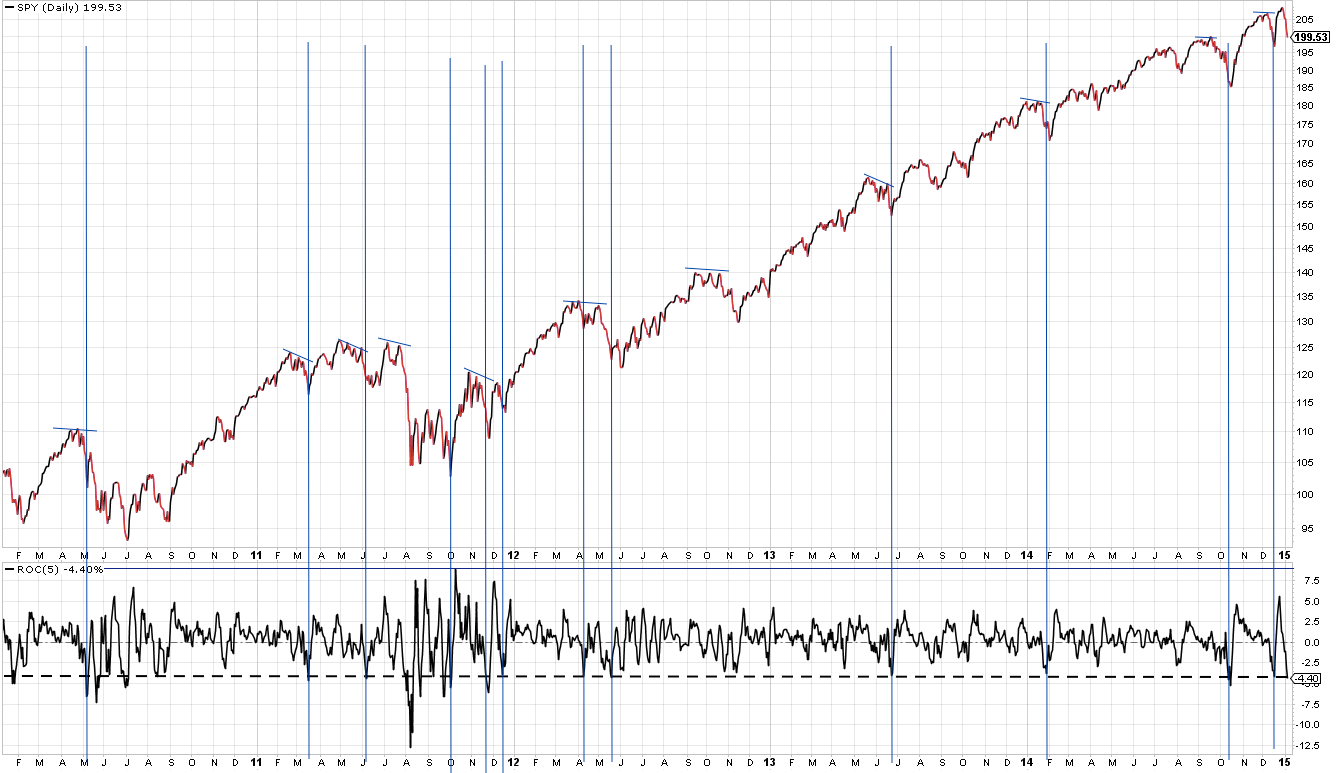

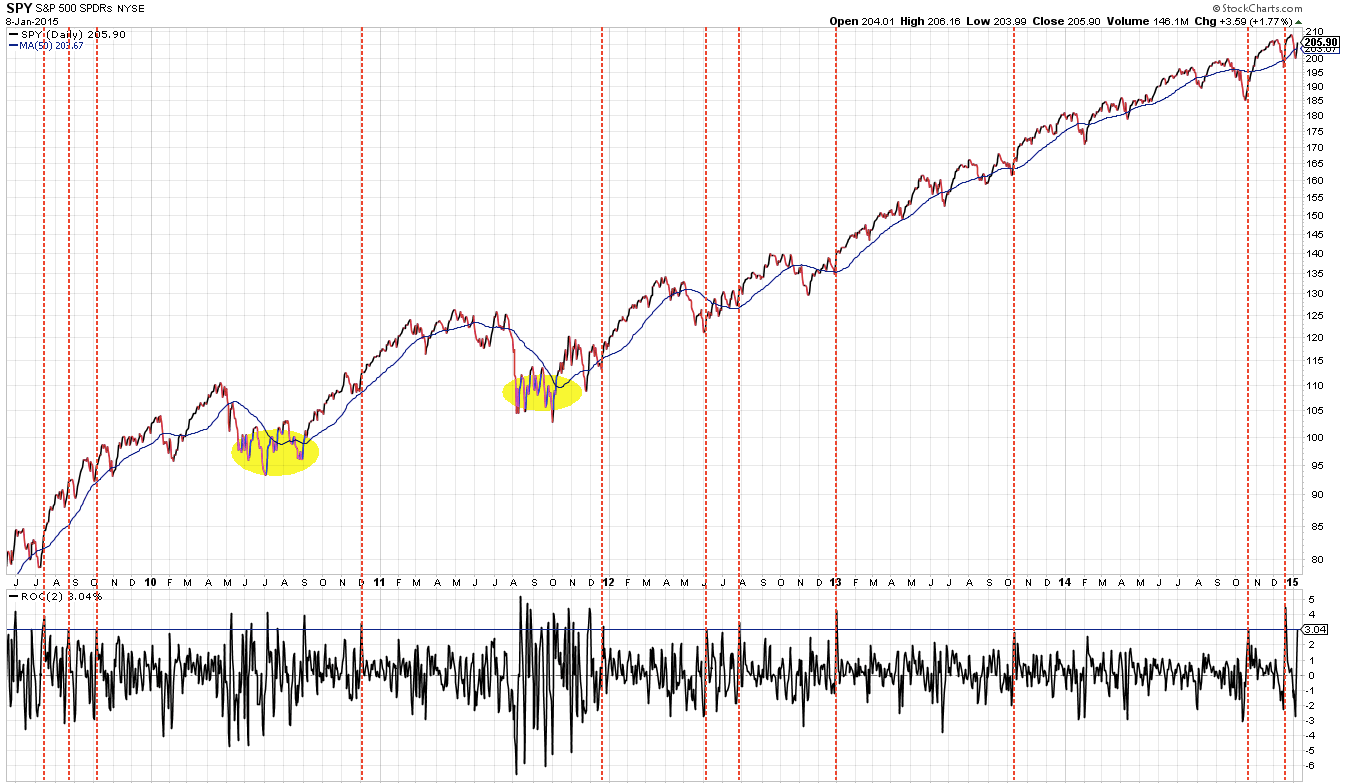

Another worrying development in the US market is a notable increase in volatility. From its December high, SPDR S&P 500 (ARCA:SPY) lost 4.5% in 5 days. This happened two other times recently: the October and December lows. Before February, it happened only once in the prior 18 months.

Then, from this past week's low, SPY rallied 3% in 2 days. This is the third time SPY has rallied this hard in the last 3 months. To put that in perspective, it didn't have a single similar rally in the 4 years from May 2003 to May 2007.

The bearish upshot is this: volatility like this happens when price is potentially changing directions. This sawtooth pattern has previously marked highs and lows in the market (yellow).

Note in particular the crisscrossing of the 50-DAM in the chart above (blue line).

To be clear, the trend remains higher: the 20, 50 and 200-DMA are all ascending. But another break below the 50-DMA in the next week would likely usher in a sharp move lower. That level is now 203.8. Until then, we assume that the selloff on Friday was a backtest of the 50-DMA, which is not unusual after a low (blue arrows).

The recent weakness in US equities is coming on the heels of a bullish spike in investor sentiment. At the end of December, inflows into US equity mutual funds and ETFs was an astounding $38bn over two consecutive weeks. This was the largest increase since Lipper began tracking this data.

As a result, individual investors now have the lowest portion of their assets in cash since 2000. Their equity allocations are conversely at their highest in 7 years (article).

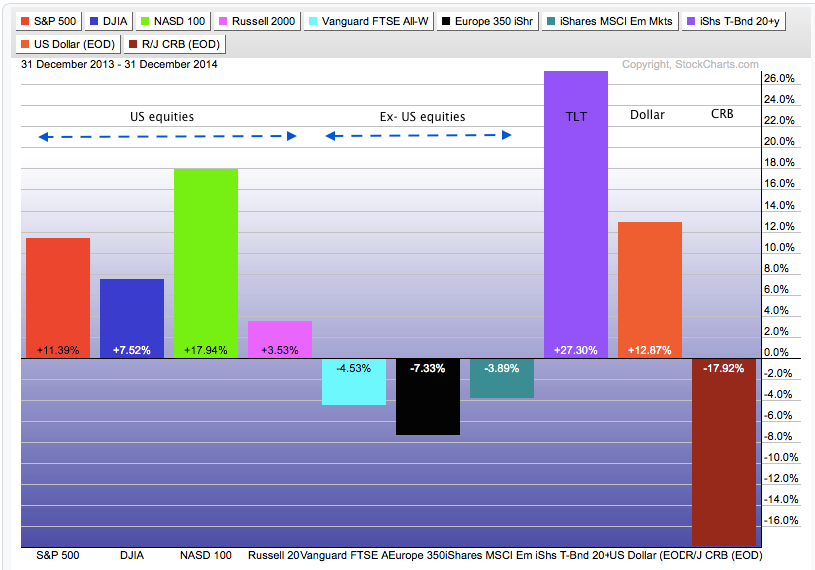

Like professional investors (article), individuals are bearish on bonds, where they hold a relatively small portion of their assets. This is surprising; in 2014, iShares Barclays 20+ Year Treasury (ARCA:TLT) handily outperformed foreign and domestic equities, including tech shares.

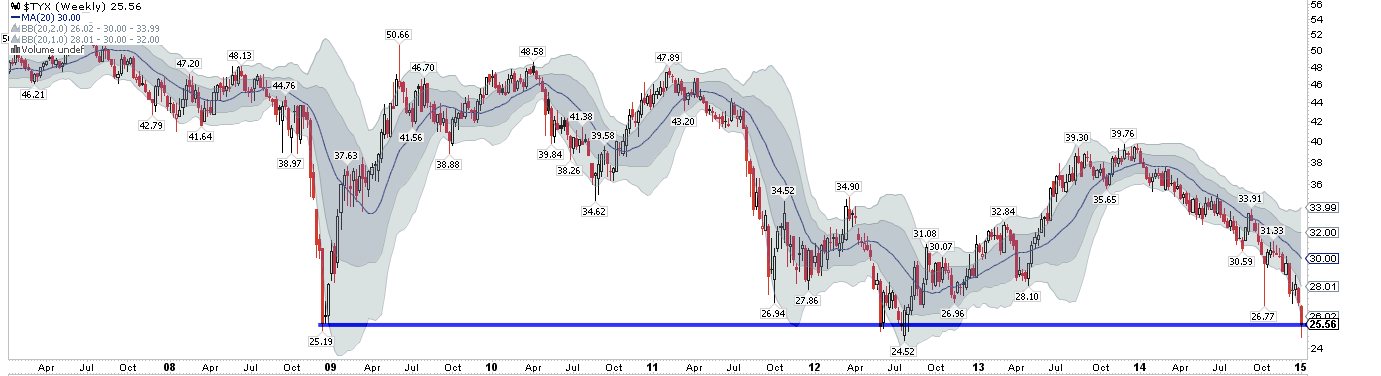

TLT made a new ATH this past week. U.S. 30-Year yields touched 2.47%, lower than at the depths of the 2008 financial crisis and equal to the low in July 2012.

The drop in Treasury yields probably does not reflect waning domestic growth prospects so much as it does continued weak inflation and significantly lower yields in Europe and Japan (post).

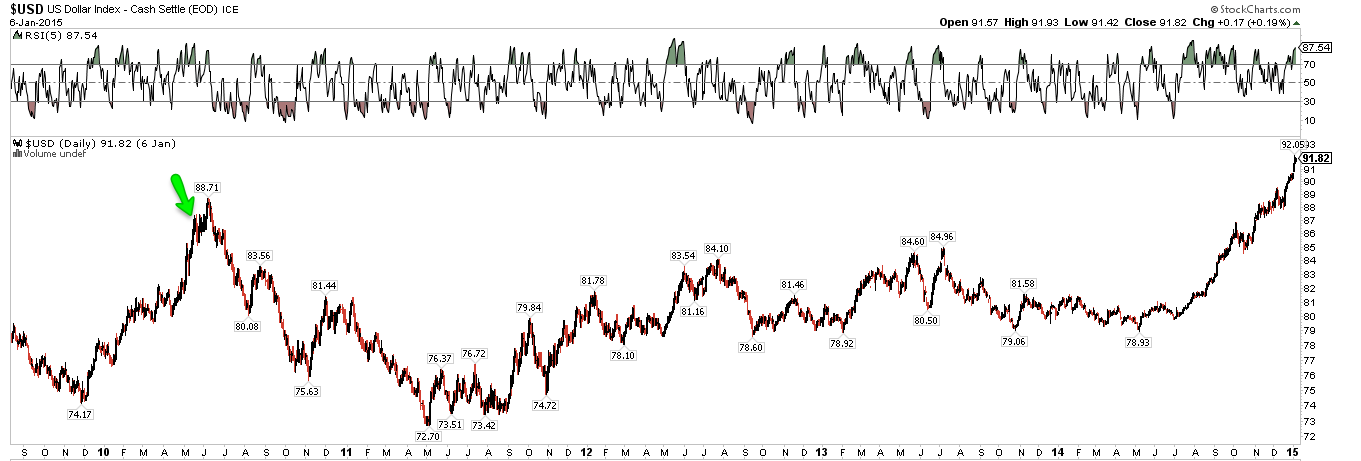

The dollar is a net beneficiary of the concerns surrounding ex-US growth. Sentiment towards the dollar is now reaching a bullish extreme; DSI is 98%, the highest since May 2010 (arrow). The dollar moved somewhat higher but the bigger move was lower over the next year (data from Sentrade).

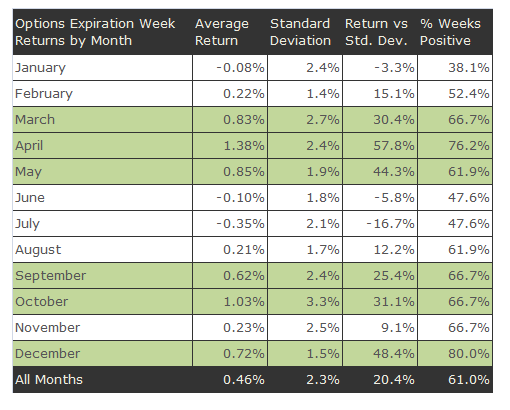

This coming week is options expiration (OpX). January has traditionally had the weakest OpX week of the year.

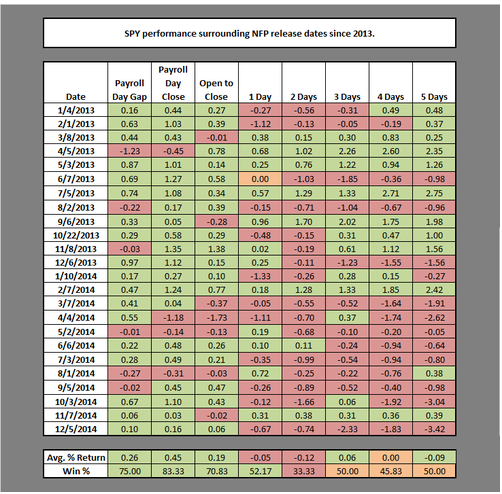

The week after the release of NFP (Friday) was also weak. The sample is too small but its conceivable that Friday's sell off may have removed some of that downward bias (data from Chad Gassaway).

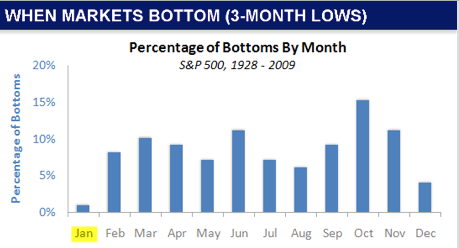

Of bigger seasonal concern is that 3-month lows almost never occur in January; meaning, the weakness that began after Christmas could well continue into February. That, recall, was also the pattern in 2014 (data from Sentimentrader).

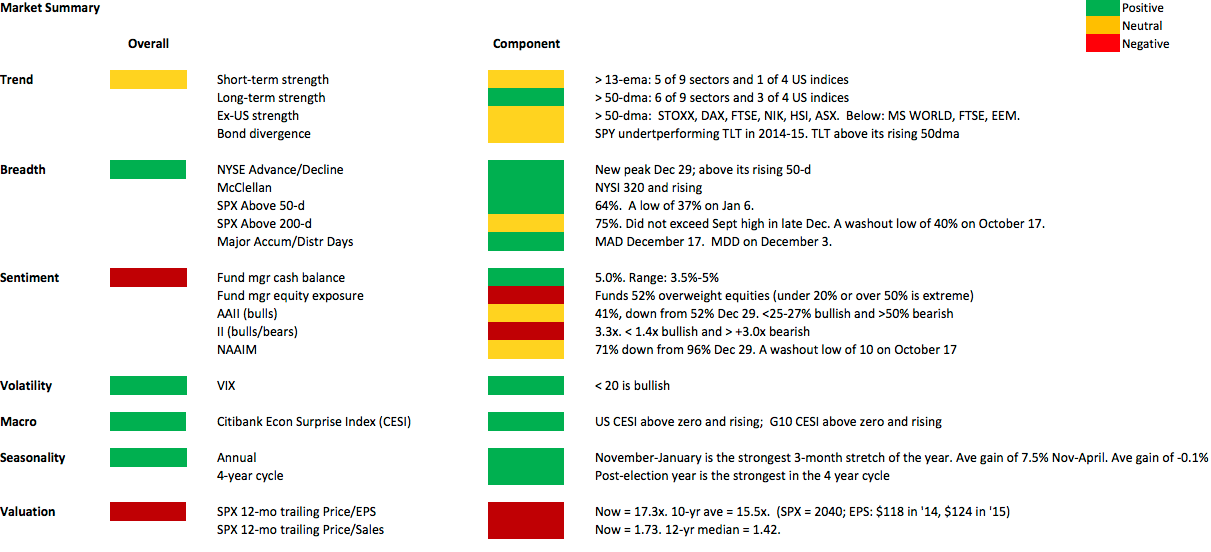

Our weekly summary table follows.