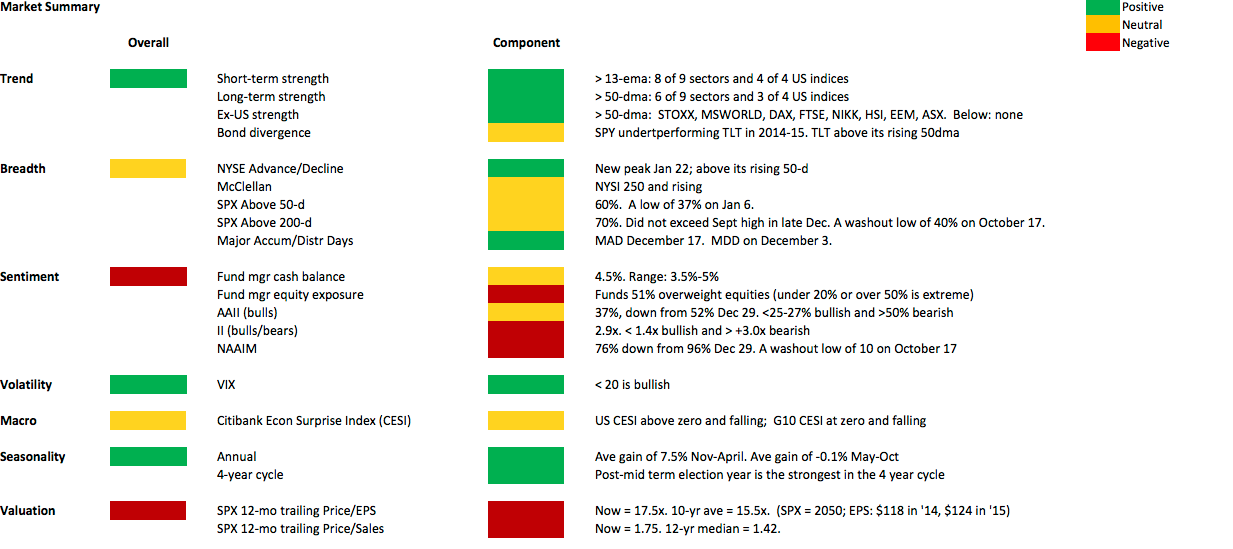

After falling three weeks in a row for only the third time since June 2012, US equities bounced strongly this past week. The NDX led, rising by 3.3%. The SPX rose by 1.6%.

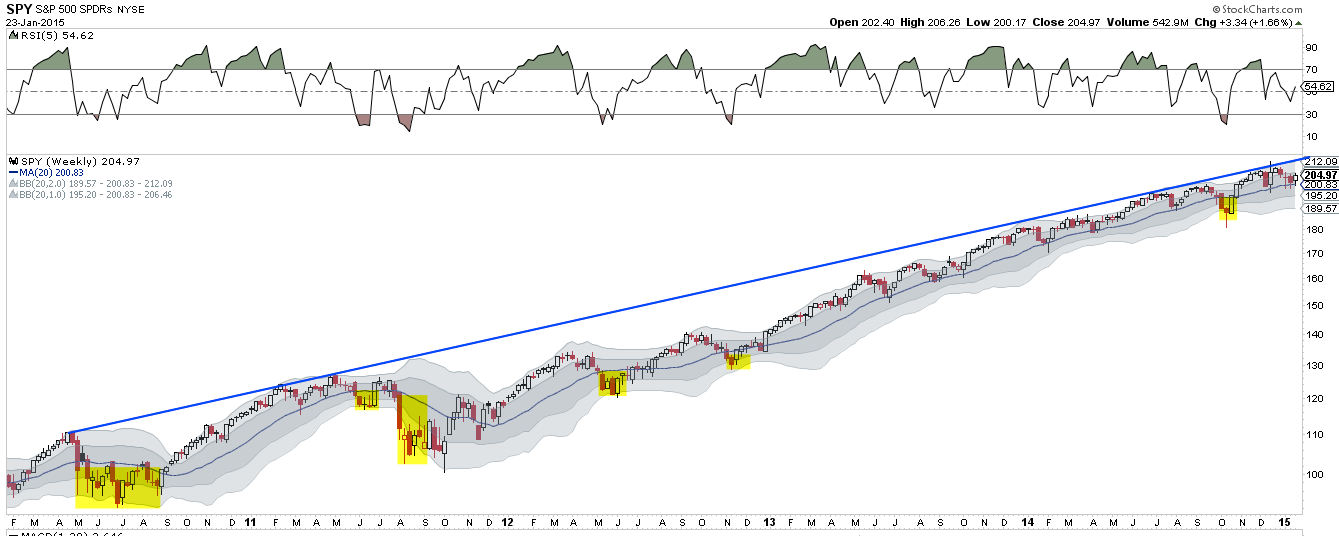

SPX started the week by again piercing its weekly 20-ma. This was the third week in a row it has done so. As we have said, a close below likely leads to the 190 area in SPDR S&P 500 (ARCA:SPY). That is the prior pattern (yellow). The 20-wma (200.5) remains an important line in the sand going forward.

The blue trend line has been resistance for the past 4 years. A return to that line now implies upside of 3-4% (to 212).

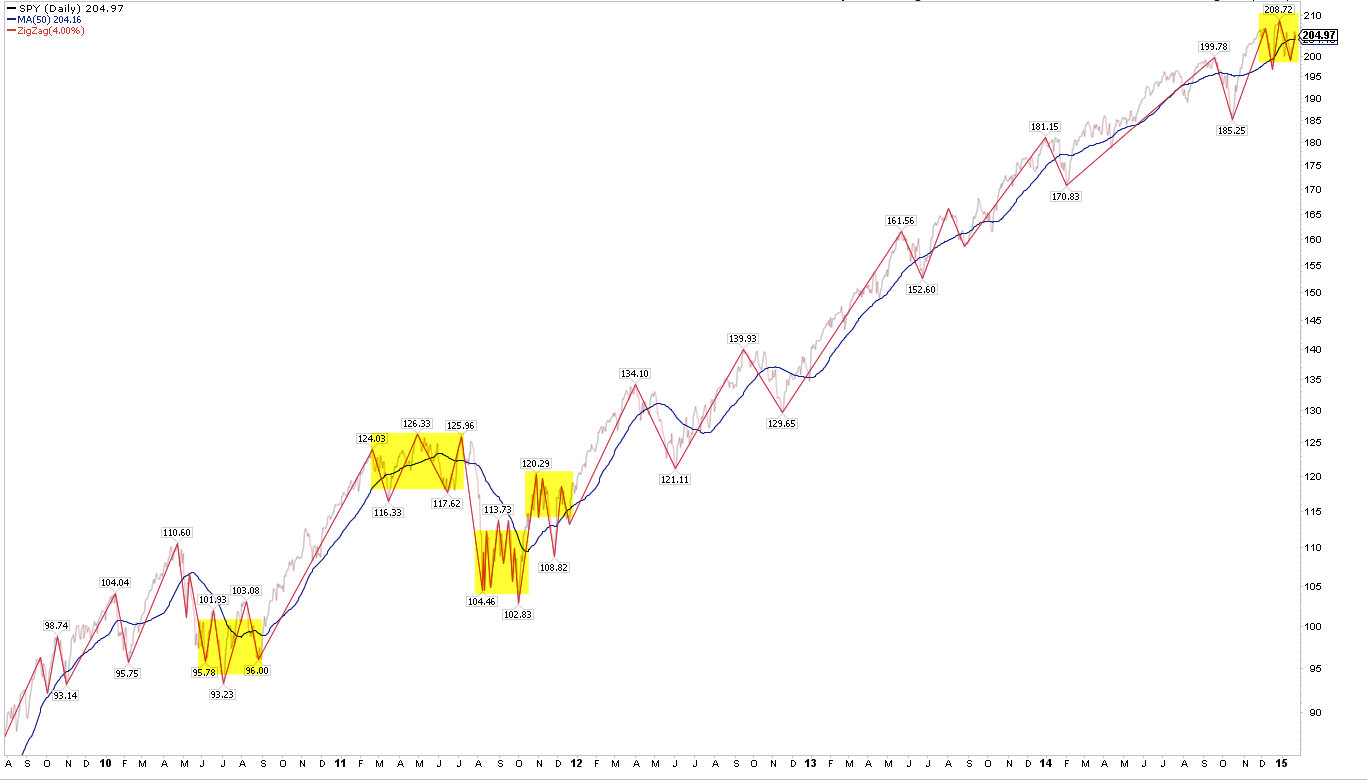

It's safe to say that US indices have been acting very differently over the past two months than they have at any other time in the past 3 years. This oscillating pattern of sharp falls and rebounds suggests equities are searching for direction. In the past 5 years, this has been a prelude to a change in trend.

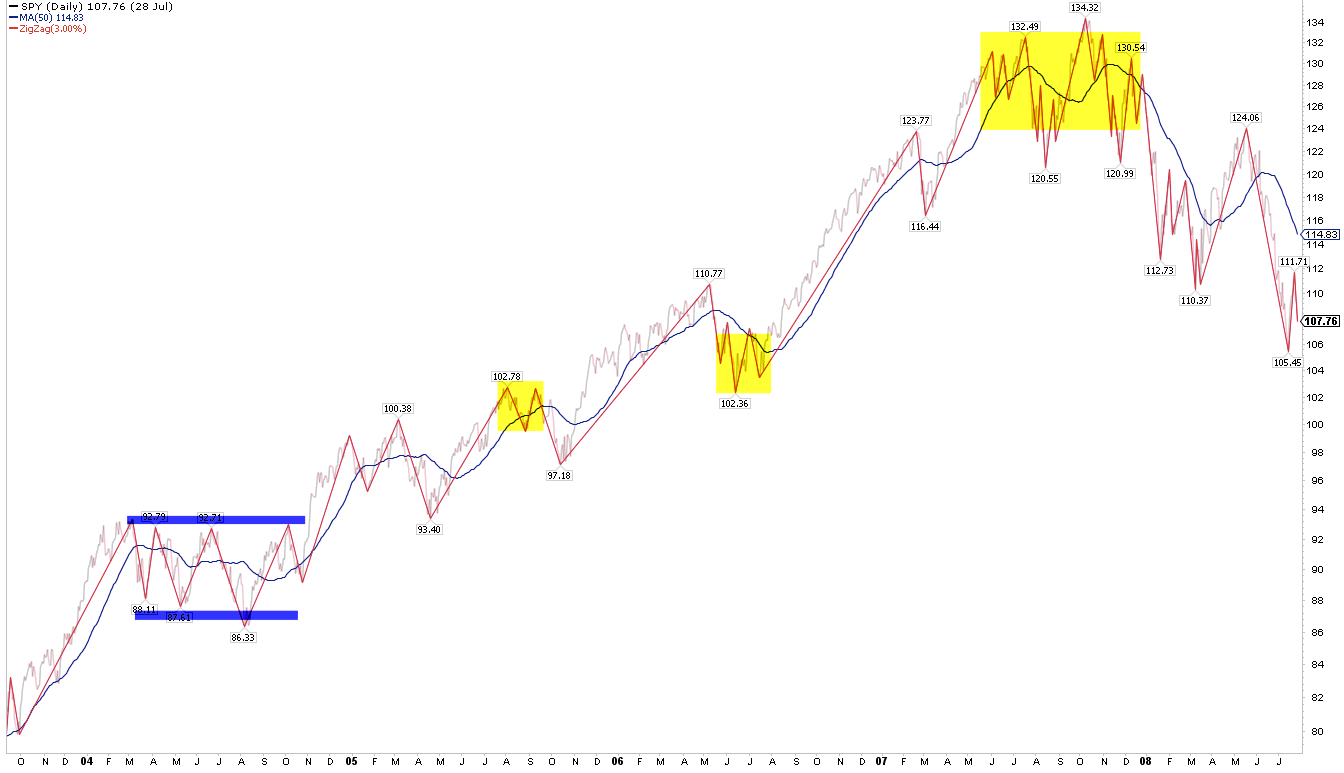

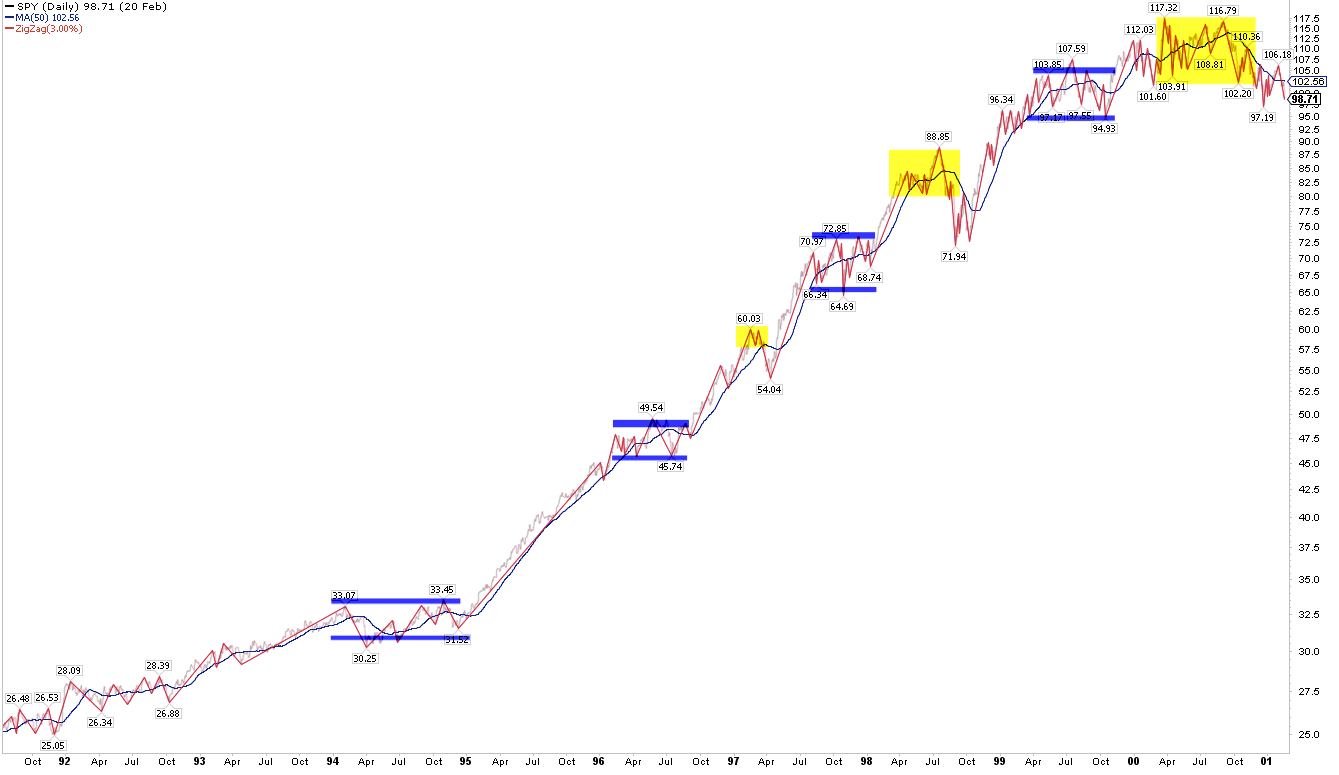

The pattern during the 2003-07 bull market was largely the same: the sawtooth pattern indicated a change in trend, most notably at the end of the bull market (yellow).

There's an alternative outcome: the sawtooth pattern in 2004 was part of a year long consolidation (blue lines, above). The range, from top to bottom, was less than 10%.

That was also a common pattern during the 1990s bull market. For long periods in 1994, 1996, 1997 and 1999, SPY chopped in a range of 10% (blue lines). The pattern in 1998 led to a 20% drop. The pattern in 2000 ended the bull market.

So which is it now: a sideways pattern or a prelude to a more significant top?

Unfortunately, technicals can't say which is more likely. Good corporate profitability and improving US macro argue against this being a top. On the other hand, the deteriorating macro situation in Europe, high valuations in the US and longer-term measures of sentiment (like allocations to equities and margin debt) are consistent with a top.

What we can assume is that 2015 is unlikely to be a one-way market higher like 2013 and 2014. The pattern is changing, and probably the best case scenario is a sideways market that frustrates and confuses many who have grown accustomed to a trending market. The net gain months from now may be very slight.

Let's turn the focus to the shorter-term.

That the bounce higher this week was led by NDX is a positive. Recall, NDX peaked a month before the other US indices and had made a series of lower highs and lower lows since then. The bounce this week exceeded the early January high: it was the only US index to do so. NDX needs to exceed the late December high (4320) and then the late November high (4350) to reestablish an uptrend. Overall, NDX has really lacked any trend in the past two months.

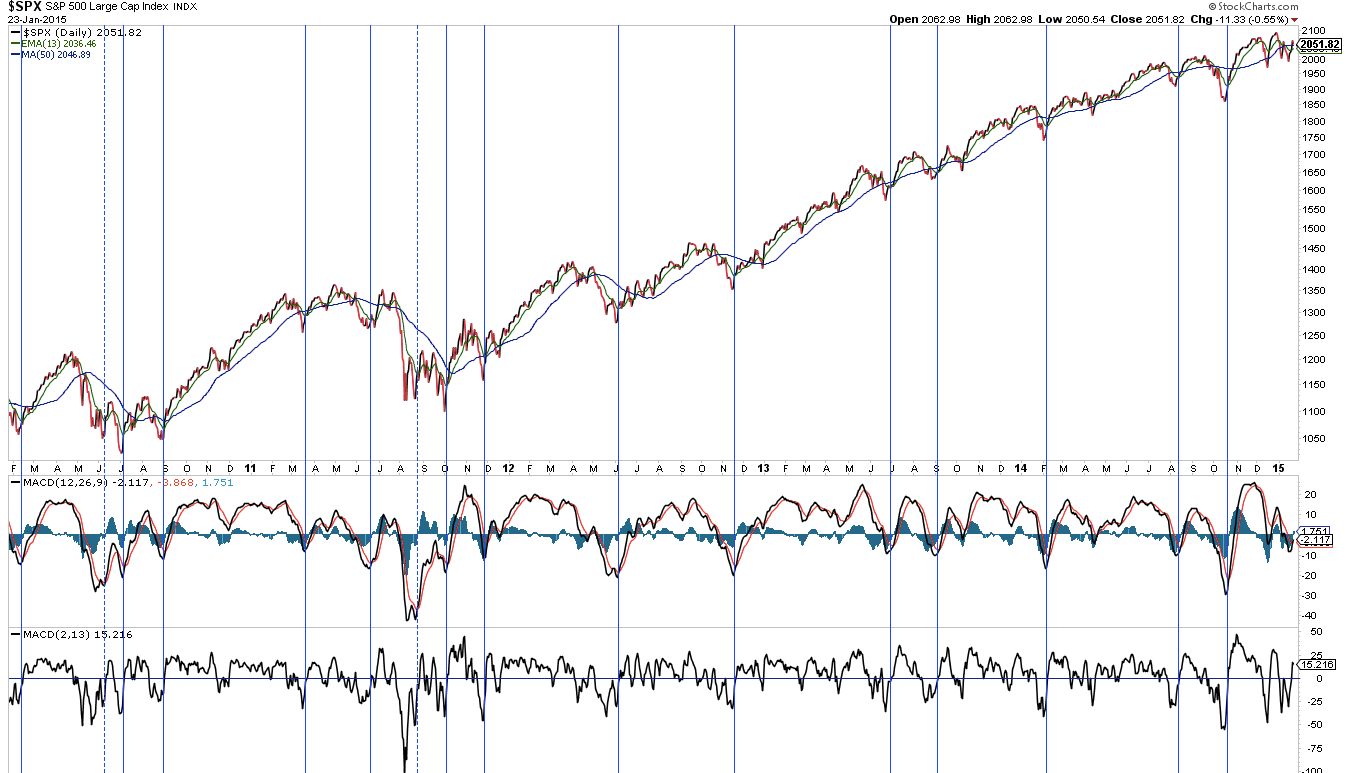

Note the red trend line right above Friday's close. This is the first level of resistance for next week. The yellow vertical lines denote recent instances where the MACD has crossed positive (from below zero). More on that in a minute.

SPY met resistance right at its early January high of 206.5. While there's no higher high yet, the balance of evidence points to a resumption of the uptrend. Price is back above all of its key moving averages and all of these (except the 20-d) are ascending. That's a good indication of an uptrend. But, like NDX, there really hasn't been any trend in the past two months.

It would not be unusual for SPY to backtest its 50-dma in the next week. SPY rose 4 days in a row this week. Often, after two weeks below, SPY will pause right below its 50-dma before going higher (like in August and October last year). When it rips right through (like it did this week), it will often backtest it. As an example in the chart above, look at the February 2014 low: 4 days higher through the 50-dma followed by a backtest (arrow).

A close below the 50-dma (now at 204) next week would be the first warning of trouble. That also happens to be the weekly pivot point.

Perhaps most importantly, the MACD crossed positive (from below zero) for SPY, NDX and DJIA on Thursday. The last time it did so was in October. For SPY, this has been a reliable long signal, especially when the 13-ema is also rising (vertical lines). This is how uptrends usually start. It would be unusual for this to quickly fail while the 50-dma is still ascending.

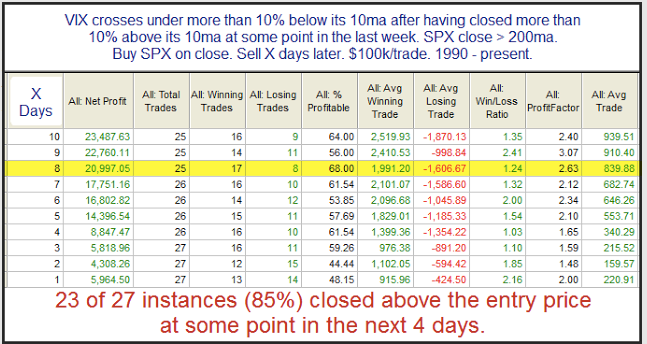

The technical narrative for the rise this week was that short-term sentiment had turned very bearish after the three week fall (post). Recall that the VIX term structure had inverted (meaning investors were paying more for 1-month than for 3-month protection). This has previously marked many lows (chart). In the event, VIX was elevated; when it falls hard, as it did this past week, returns for SPY are positive. The study below is from Rob Hanna and indicates a very high probability of SPY exceeding Thursday's close (206.10) this past week.

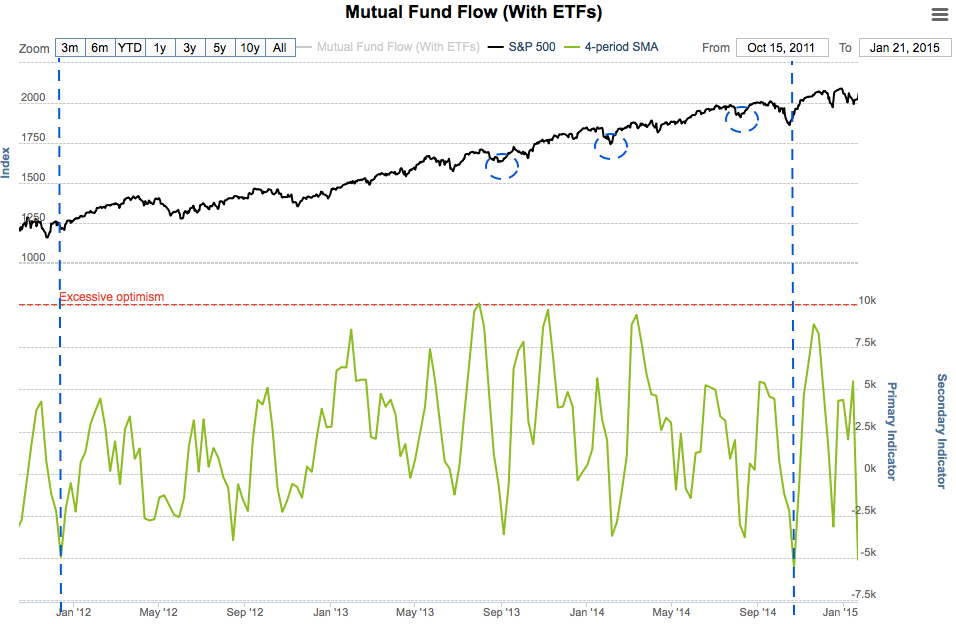

Likewise, recall that daily sentiment (DSI) a week ago was the second lowest since 2012. In fact, outflows from equity mutual funds and ETFs have totaled over $22b during the past three weeks. That is about 60% of the enormous inflow that took place at the late December equity peak. The last 4 week's average outflow is now equal to those at the October 2014 and the December 2011 lows. It looks extreme. Certainly, SPX has formed a low after smaller outflows in the past 3 years (circled are September 2013, February and August 2014).

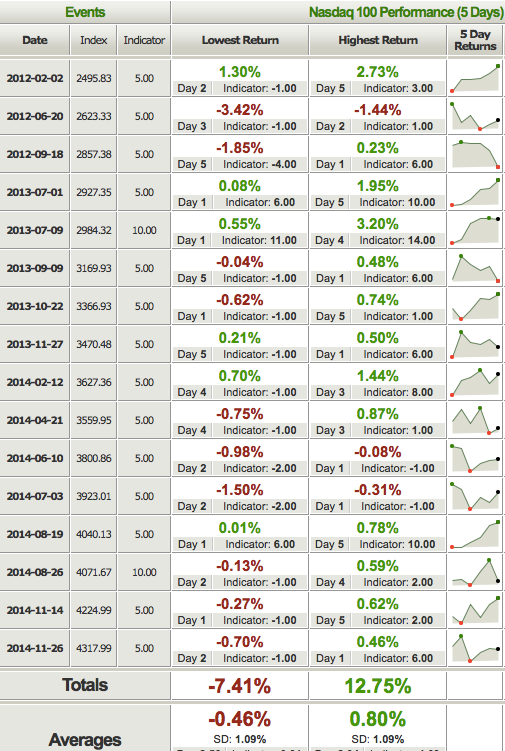

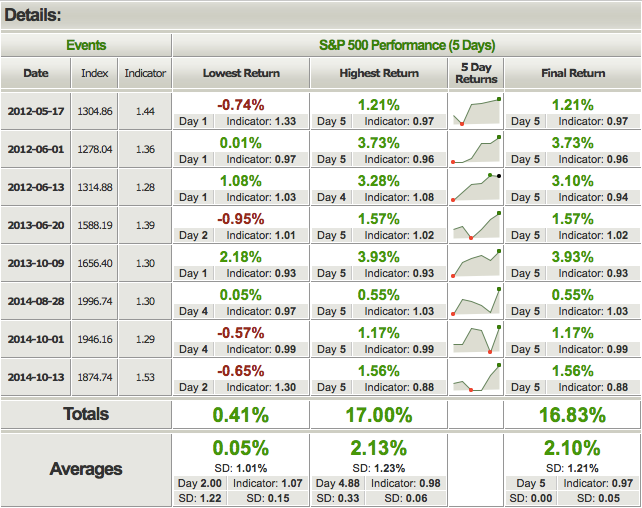

Another consideration for this coming week is momentum. SPY rose 4 days in row before falling on Friday. SPY has risen 4 days in a row 36 times in the past 3 years. 75% of these closed higher within the next 5 days (far right column); again, this implies a close above 206.1 this week. The average draw-down is about 0.6%, which was the size of the fall on Friday (middle column).

The same is true for NDX. It rose the last 5 days in a row. This has occurred 16 times in the past 3 years; 80% closed higher, by an average of 0.8%, within 5 days. Draw-downs are half the size of gains.

There are numerous signs of fear in the market (chart). On Friday, perhaps due to the weekend's Greek elections, total put/call spiked to nearly 1.3. This has happened 8 other times in the past 3 years: SPY gained an average of 2% over the next 5 days. It's a small sample, but the bias is clearly positive.

The fundamental narrative for this past week was the initiation of quantitative easing in Europe. Largely as expected, on Thursday the ECB announced that it would buy 60 billion euros worth of bonds every month through September 2016, or until inflation returns to its 2% target. In that sense, the program is like the Fed's QE3; it's open-ended. Assuming a late 2016 end, the ECB program amounts to 1.1 trillion euros ($1.3 trillion) in new money being injected into the European financial system.

Equities responded positively to this news. The DAX made a new all-time high; FTSE 100 and STOXX came close to doing so.

Whether the ECB program will restore growth, and thus inflation, is anyone's guess. Unlike the US, the EU faces a stagnant population. Also unlike the Fed, the ECB is addressing weak demand 7 years after the start of the financial crisis. Slow growth, high unemployment and weak pricing have already become embedded. In this sense, the EU has greater similarities to Japan which was very late to vigorously battle a crisis which began 25 years ago.

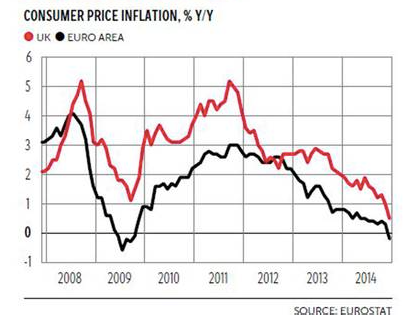

Price growth in Europe is now negative and the region risks falling into a liquidity trap. This occurs when the following vicious cycle takes hold: weak demand causes prices to fall, causing the real cost of money (as well as the value of debt) to rise, further reducing demand. And so on. This is the reason behind the valid fear of deflation and also the reason why Swiss yields are now negative. If you are looking for a reason why a top is being put in in the equity markets, here's your leading argument.

About 40% of the sales of SPX companies comes from overseas, much of that from Europe, so what happens elsewhere is germane to US equities.

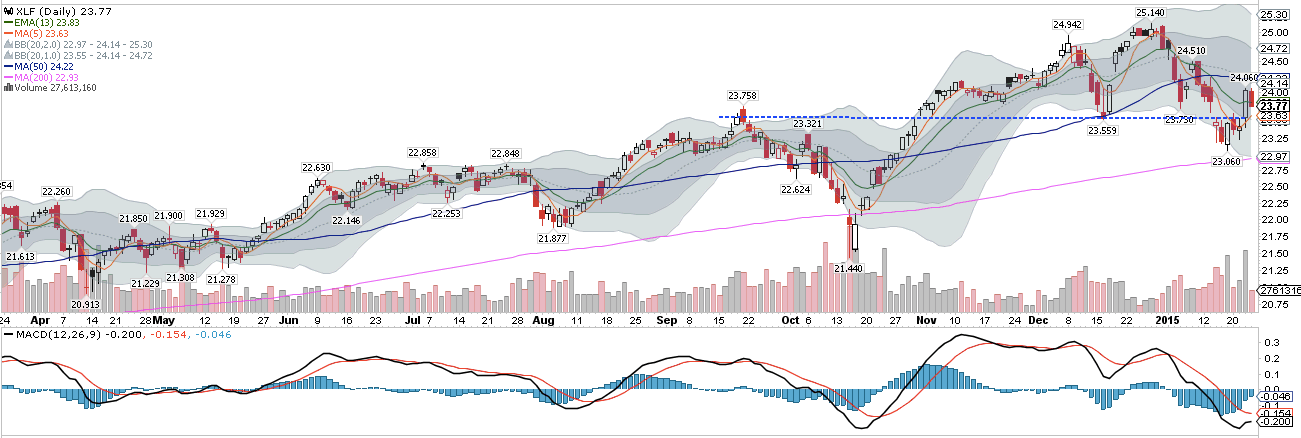

On weakness, the financial sector should be watched most closely. Aside from transports, they were the only sector to break their December low last week. They have recovered, but only just. A close below 23.5 in the Financial Select Sector SPDR Fund (ARCA:XLF) would indicate a false recovery.

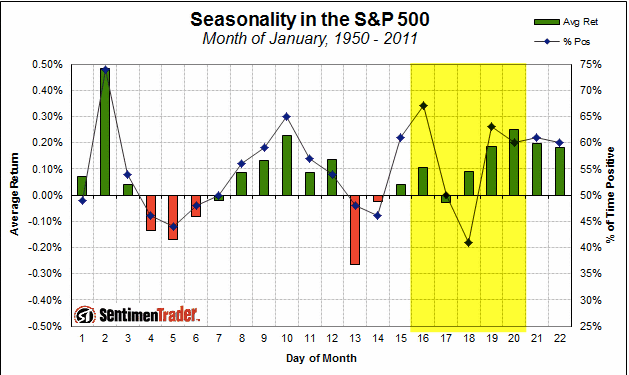

January trading ends the coming week. The last week of the month is seasonally positive.

Our weekly summary table follows.