Summary:

The selling on Friday was extreme; there is typically some follow through downward momentum in the day(s) ahead.

N:SPY and NDX are near support and breadth is either washed out or close to being so. Volatility experienced an extreme spike; mean reversion usually follows. Seasonality, especially with December OpEx up next, is very bullish. All things being equal, risk/reward should be skewed higher.

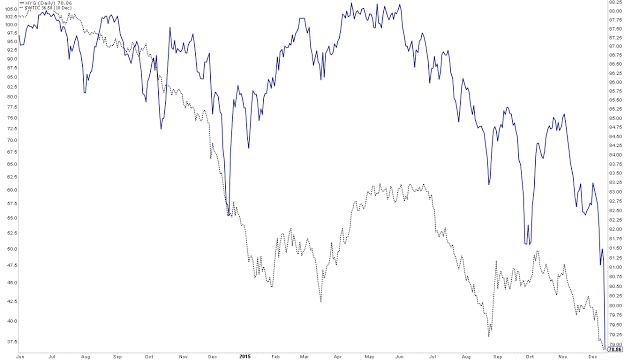

The wild card is oil: equity markets are being driven lower by falling oil prices and their impact on high-yield. That could pressure markets further. Adding to the drama is the Fed is expected to initiate the first rate hike since 2006 this week.

For the week, N:SPY and NDX lost 3.6%, about the same as the high-yield ETF, N:HYG. Oil was the biggest loser, dropping 11%.

The week's biggest move belongs to VIX, which gained an astounding 63%.

What's going on?

First, recall that SPX has seen an average drawdown in December of 3.7% since 1928. Since the December 1 close, SPY is now down 4.2%. So what has happened is, in some ways, not so unusual.

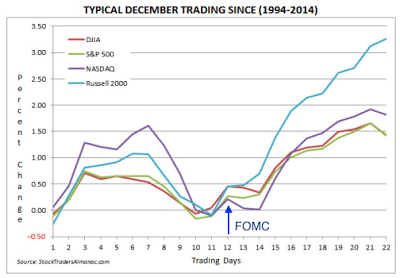

Second, while December is typically very strong, the beginning of the month is not. The positive performance in December typically starts in the second half (meaning the week that's upcoming). Again, so far nothing extraordinarily unusual.

Third, and most importantly, the market is being driven by the collapse in oil. About 15% of the high-yield market is exposed to energy; so, falling oil (gray line) is pushing high-yield prices lower (blue line). And lower high-yield price (wider spreads) is creating concern that a larger credit crisis is unfolding, foreshadowing a recession.

Most of the drama is taking place overnight: SPY fell $7.70 this week, of which an astounding $5.20 (68%) was a result of overnight gap downs.

The drop this week put SPY near the bottom of its 2015 range. This comes just one week after closing about 1% from a new all-time high. While jarring, the index did the exact same move in the beginning of November. Aside from a month this summer, SPY has been trading between 202 and 212 since February.

This area should be good initial support, as it has been in the past. If there is follow through weakness next week, the next level to watch is 199.3; this is WS1 (green line) and also an open gap from October 15 (arrow). That level represents risk of 1.5% from Friday's close.

Recall that the leader, NDX, made a new ATH last week. It's in the middle of its range and about 1% above the mid-November pivot at 4500 (risk). This is the first backtest of the rising 50-dma in two months. Note that the market pierced this same moving average last December before a strong rally (arrow).

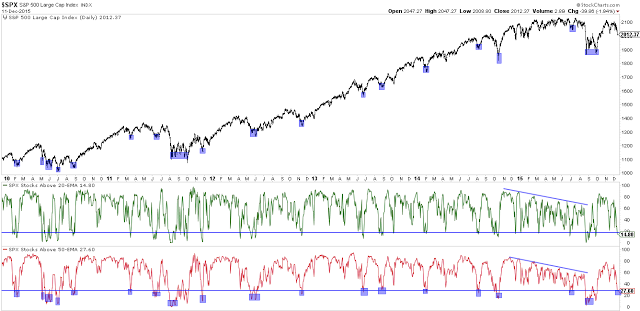

It was a horrible week for breadth. All nine of the SPX sectors closed below their 50-dma. Less than 30% of SPX companies are now above their 50-ema (lowest panel). This hasn't always marked the exact low in the index, but it has usually been very close to a washout where a low begins to form (blue shading).

That Friday may not be the exact low is also brought out by two other statistics.

First, when Friday closes down more 1.5%, the following Monday has had a "lower low" 95% of the time (86 of 90 instances since 1990; data from James DePorre).

Second, Friday was a major distribution day (MDD), meaning more than 90% of the volume on the NYSE was negative. That represents strong selling pressure and that momentum normally carries over into the days ahead.

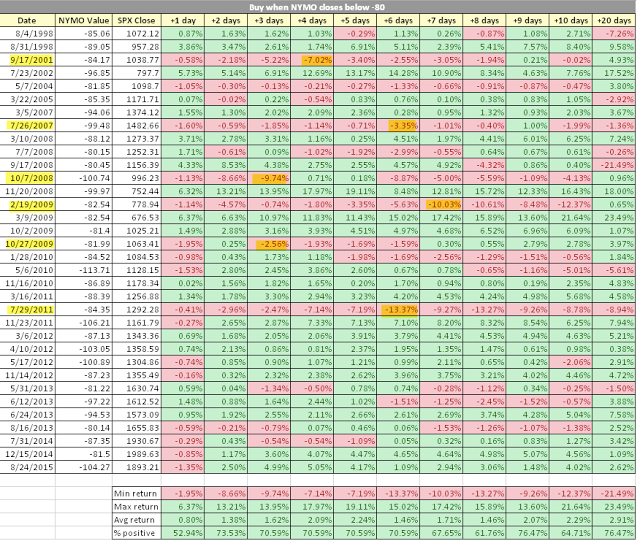

Notably, the McClellan Oscillator (NYMO) closed at minus 82 on Friday. 85% of the time (28 of 34 instances since 1998) SPY has had some bounce before losing too much more. Half of the cases where it fell further right away were in bear markets, arguably not the case now (data from @RickyRoma0).

In the chart above, it is also notable that 2014 was the only other year where NYMO closed this low in December. The market rallied strongly from that point forward.

That is not entirely surprising since seasonality is strong in December. The period for positive performance in SPY begins next week (Monday is Day 10; data from Stock Almanac).

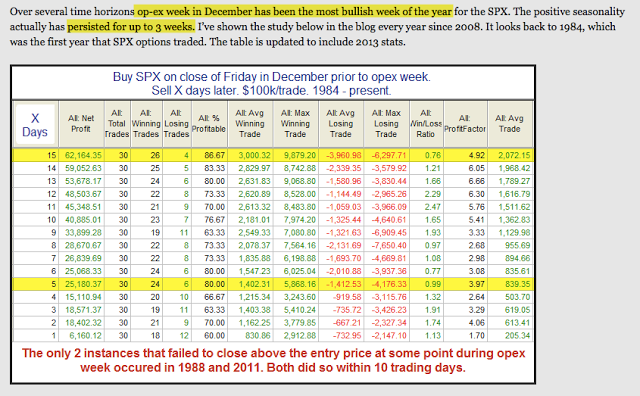

Next week is also December OpEx. This is one of the most bullish weeks of the year. SPY has closed higher from the prior week close within 10 days every time in the past 30 years (data from Rob Hanna).

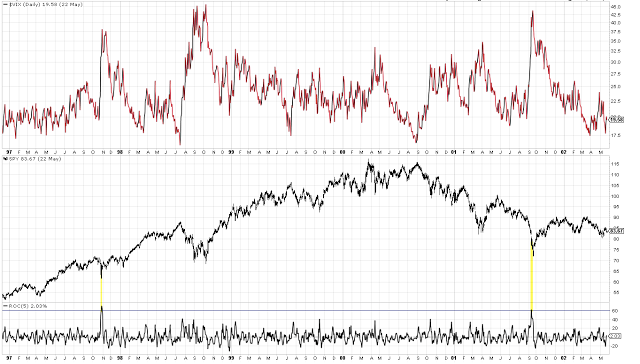

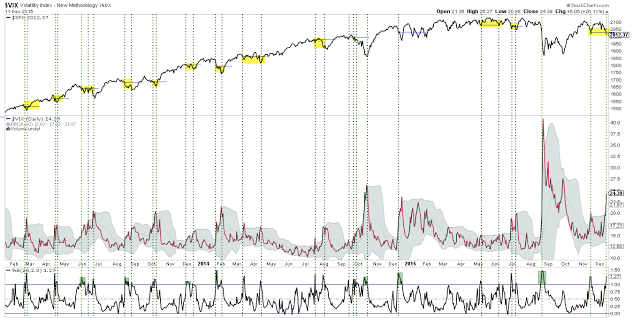

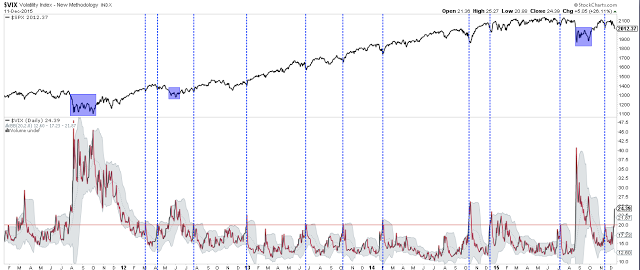

Also notable this week is that VIX gained 63%. This is quite rare and has normally been at or near a low in SPY. Shown first are two cases in 1998 and 2001.

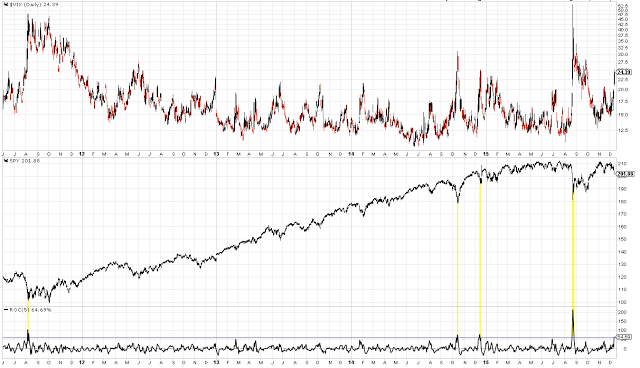

Next are cases in 2011, 2014 and 2015. Again, each was at or near a low in SPY.

Friday also marked the second spike in VIX above its Bollinger Band® (BB) in the past month. We've noted many times in the past that VIX spikes tend to come in pairs within a month, with SPY making a lower low with the second spike (as it did today). SPY then normally rises; the safe play is to wait for VIX to close back under its upper BB.

VIX also closed well over 20. This has most often been very close a low in SPY (exceptions highlighted in blue).

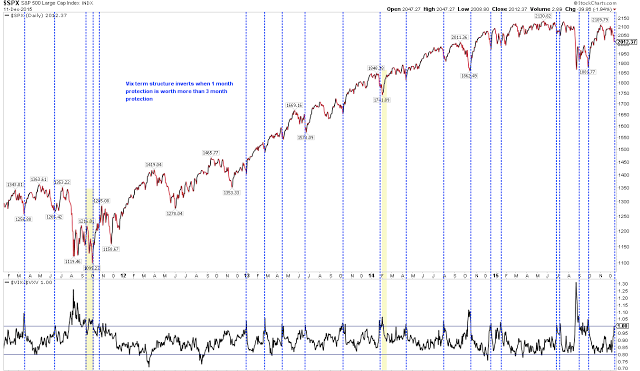

The VIX term structure also inverted on Friday. Again, this most often occurs very near a low in SPY (exceptions highlighted in yellow).

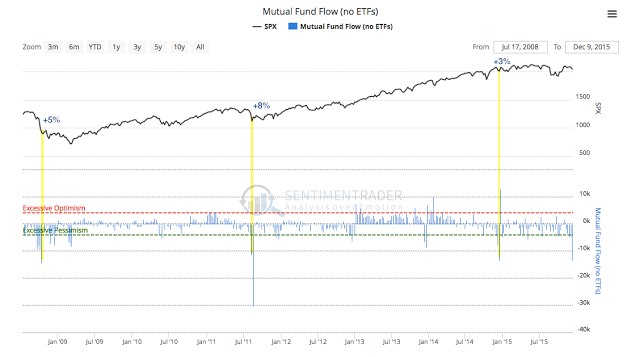

Sentiment has turned very sour. Last week, $13.5b was taken out of equity mutual funds, the most in a single week since 2011. There are only 3 other similar instances since 2008 and in each case, SPY jumped at least 3% the following week(s). It's true that money can flow out of mutual funds in mid-December, but this was an extreme (data from Lipper and Sentimentrader).

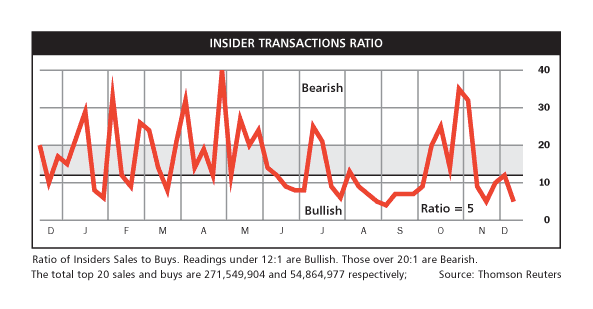

Insiders, who are often but not always right, are as bullish now as they were in mid-November before a 3% rally in SPX (data from Barron's).

In summary, SPY and NDX are near support and breadth is either washed out or close to being so. The spike in volatility was extreme and mean reversion usually follows. Seasonality, especially with December OpEx up next, is very bullish. All things being equal, risk/reward should be strongly skewed higher.

There are two big wild cards this week.

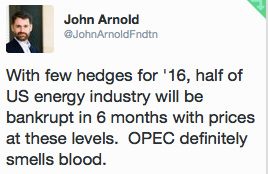

The first, as mentioned earlier, is the drop in oil prices that is weighing on high-yield and, in turn, equities. Lower oil pressures ISIS, which now controls 40% of Iraqi oil and is funding itself by selling oil through Turkey. Lower oil also allows OPEC to force out uncompetitive supply. There are a lot of political and economic crosscurrents and exactly what oil does next is anyone's guess. The price is making lower lows each day; there's no bottom forming. If this continues, expect weakness in equities to persist.

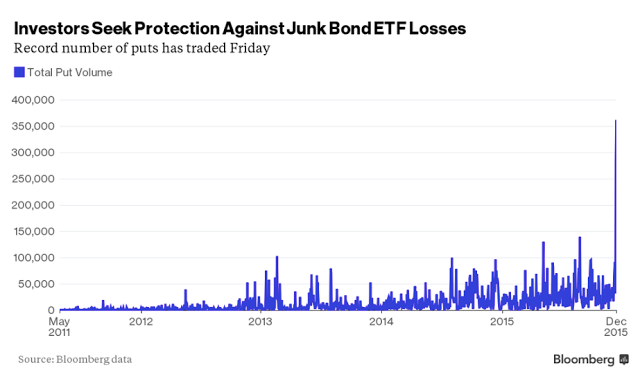

This vicious cycle has created an epic panic in the high-yield market. A record high number of puts traded on Friday. Put spikes in December 2014 and in August and September 2015 marked short-term reversal points in high-yield.

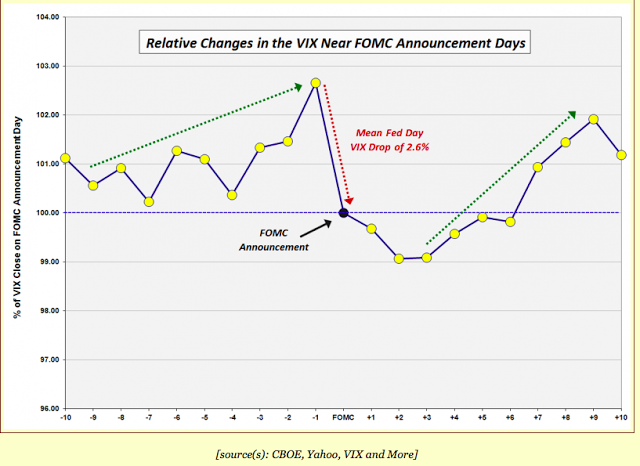

The second, of course, is that the Fed is expected to initiate raising rates this Wednesday. Further volatility before then might reduce the expected rise in rates. This event, given turbulence this week, has become a black box. Of note is that VIX typically rises ahead of the Fed and then falls after; if it does so again now, it will be a positive for equities after mid-week (data from Vix and More).

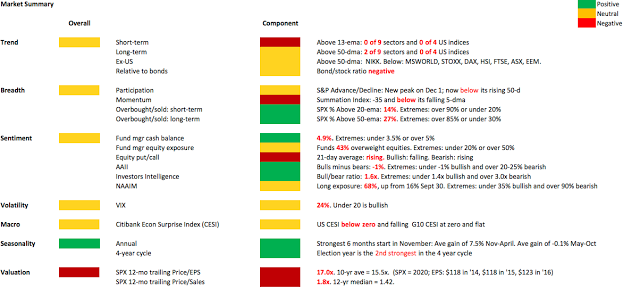

Our summary table follows: