Summary: Aside from the upcoming FOMC meeting, there do not appear to be many strong impediments to further gains by year-end for US equities. Three scenarios seem possible:

- A breakout higher now is likely to be a failed move, especially if it occurs prior to the December 16 FOMC meeting. This would the best scenario for bears.

- If seasonality drops the market ahead of the FOMC, there is likely to be attractive upside into year-end. This would be the best scenario for bulls.

- The most frustrating scenario would be if stocks chop up and down both into and following the FOMC meeting; unfortunately, that has most often been the case at other times the Fed was initiating rate hikes.

For the week, equities made small gains, led by NDX. Oil lost 4% to close at its lowest level in 7 years. Gold rose nearly 3%, reversing the prior 3 weeks of loses.

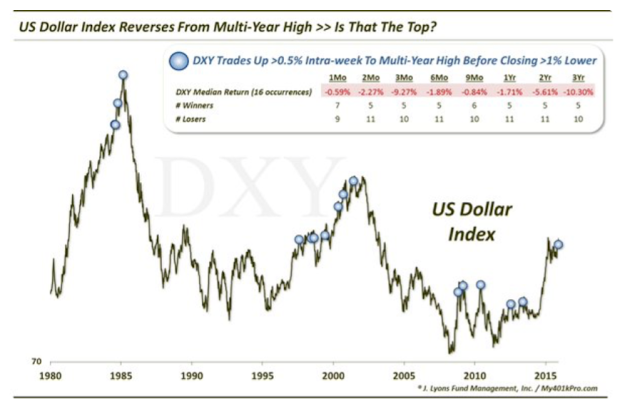

Perhaps most importantly, the dollar fell 2% this week, retracing the past several week's gains. We have recently discussed how fund managers view the dollar as overvalued and that this has most often corresponded with a dollar decline.

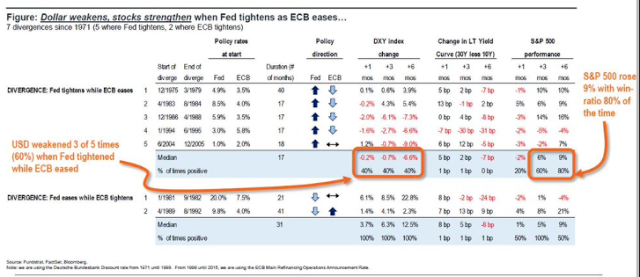

A weaker dollar has also been the pattern following the initiation of rate hikes in the US, even if other central banks are loosening (small sample; data from Thomas Lee).

The dollar's fall came after closing at a multi-year high last week. This reversal pattern has most often led to further loses in the dollar in the months ahead (data from Dana Lyons).

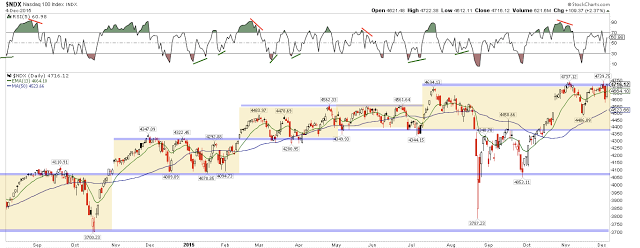

Turning to equities, NDX made a new 15-year intraday high on Wednesday, then fell almost 3.5% within two days. On Friday it rallied all the way back to a new 15-year weekly closing high.

This index has been leading the others. It is now back at the top of its range for the 4th time. This area has been strong resistance, but with repeated hits, odds are skewing to a break higher. Note the pattern of "higher lows" and the rising 50-dma.

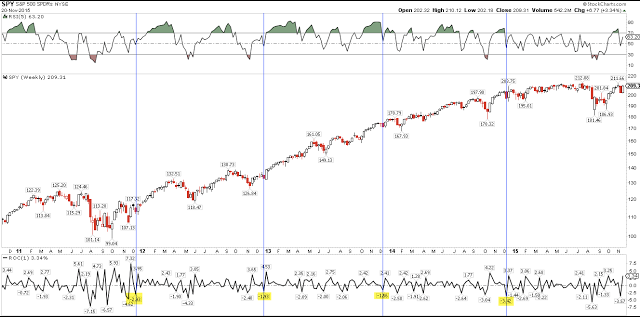

For all the noise this week, N:SPY is also back within 1% of the top of its range ($212). It has failed to move higher the 5 prior times. Again, with repeated hits, the odds skew to a break higher. Like NDX, the pattern is supported by "higher lows" and a rising 50-dma.

It is certainly fair to say that the index has not moved above the range established more than half a year ago. But the fall in August and September resulted in a significant drop in sentiment. It was a reset and these normally precede a range break. This again supports a move higher.

The first positive sign that a breakout is imminent will be when SPX can break the pattern of "lower highs" established since May with a close over 2116 (top blue line). Similarly, on weakness, the November low at 2020 is key to maintaining "higher lows" (dashed line).

It's hard to say that breadth is a significant roadblock. For one, the cumulative advance-decline line for the SPX made a new all-time high on Tuesday. That hasn't always been a positive sign for equities, but it does represent a broadening of participation.

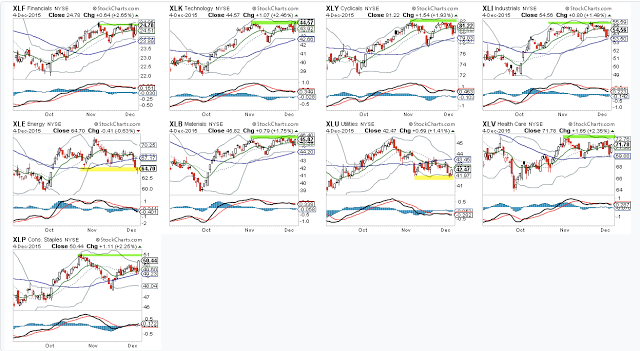

Moreover, a majority of the 9 SPX sectors are challenging their 3-month highs, supported by "higher lows" and rising 50-dmas (green shading). Only two sectors (energy and utilities) are diverging lower.

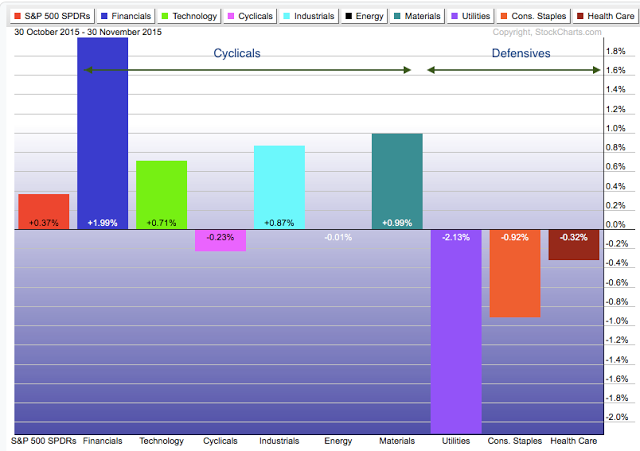

The month of November, which was flat for the indices, was supported by outperformance from pro-growth cyclical sectors. Cyclical leadership is a positive characteristic in uptrending markets. That the indices didn't move higher is mostly attributable to lagging defensives, especially utilities.

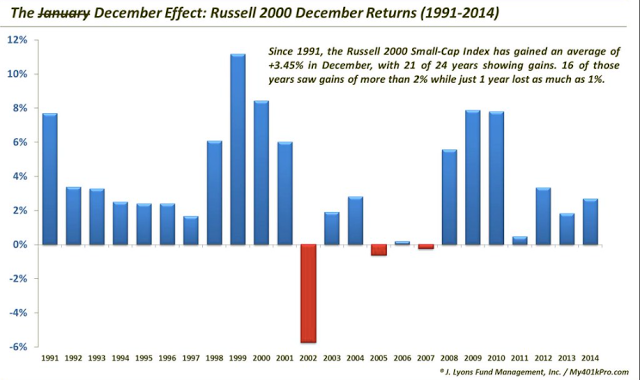

Small cap stocks tend to outperform in December and January. RUT made a 3-month high this week, but then closed lower. The index is still struggling. A sustained break above 1210 will be further confirmation that the equity rally is broadening. Note the "higher lows" and rising 50-dma here, too.

Better breadth as small caps catch up seems likely. The index is down more than 1% so far in December, but usually gains an average of more than 3% into year end (data from Dana Lyons).

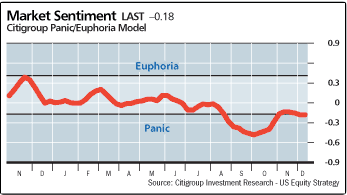

Investor sentiment continues to be very subdued. Equity fund inflows on positive weeks have been modest since the August low. In fact, funds faced redemptions of $1b in the past week. AAII and NAAIM surveys are neutral and the Investors Intelligence bull/bear ratio is just 1.5x, a decline over the past two weeks (data from Citigroup (N:C)).

If anything, more bulls are needed; it takes bulls to push a market higher and investors have been tentative. The 21-dma equity-only put/call ratio has been rising the past 3 weeks; a falling ratio supports a move higher in price. Bulls want to see this turn lower into year-end.

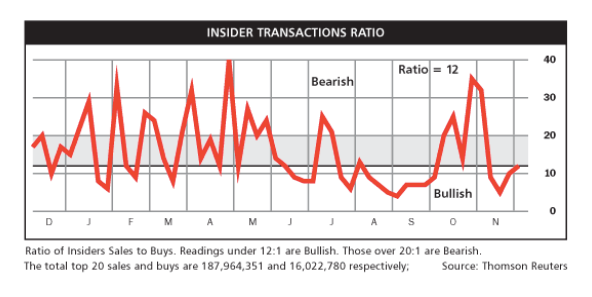

Corporate insiders, who aren't perfect but tend to be good at knowing when to buy, are still accumulating shares. This continues to be a positive (data from Barron's).

Macro remains supportive of higher equity prices. Friday's employment report showed growth of 2% with more than 2% growth in wages. Both employment and wages are in solid uptrends. That creates a self-reinforcing cycle, where better incomes support greater consumption which in turn leads to improvements in income.

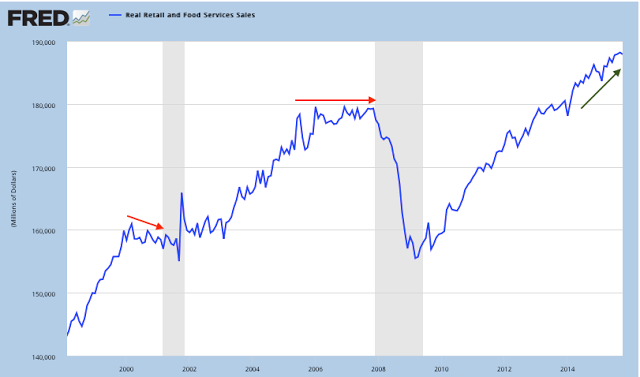

The consumption data has been positive. There is normally a deterioration in consumption prior to the onset of a recession. There is no such deterioration at present (arrows).

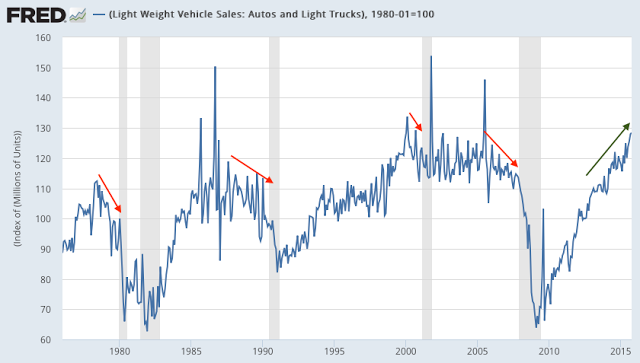

Auto sales, for example, are hitting new 10 year highs. Yes, financing is supporting sales but household debt servicing is near 4 decade lows. Incomes can easily support more leverage.

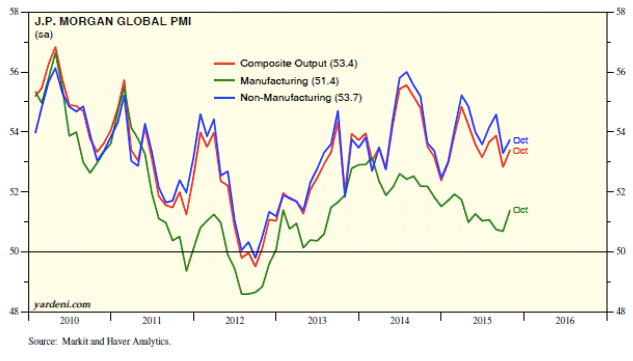

Positive consumption patterns are seen in many services, like hotel occupancy and restaurant sales. It's true that manufacturing data has been weak, but economic growth is overwhelming driven by services (data from Yardeni).

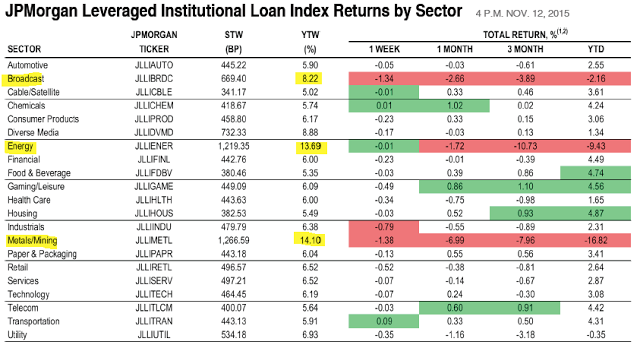

With the economy improving, albeit slowly, would problems in the credit market be expected? Probably not. Widening spreads in the credit market are due primarily to weak pricing in the energy and material markets; most other sectors are fine (data from Guillermo Roditi Dominguez).

So trend and macro support higher prices while breadth and sentiment are at worst neutral. On balance, equities should have further gains into year-end. That is our bias.

Our view coming into December was that a swoon was high odds and would provide an attractive entry point for a year-end rally. As we said then: There have been drops of 2-4% each year in December the last 4 years. All of the drops put SPX below the close from the week prior to Thanksgiving. This week's drop did as well. Our chart is reproduced below.

This fits the historical pattern where a typical December sees a fall. Since 1928, the average December drawdown has been 3.7%; since 2000 it has been 3.6%. This week it was 3% (data from Walter Murphy).

The big question now is whether this week's steep, but brief, drop was it.

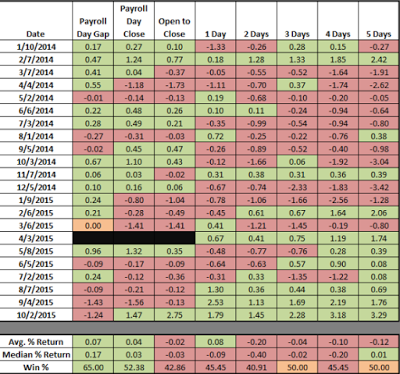

The week after the release of NFP data has tendency to give back some gains. In the past 2 years, 75% have seen at least one lower close (November closed lower, not included in table; data from Chad Gassaway).

Moreover, when SPX gains more than 2% on NFP day, it has closed lower within the next week 9 of 11 times since 1998 (data from Sentimentrader).

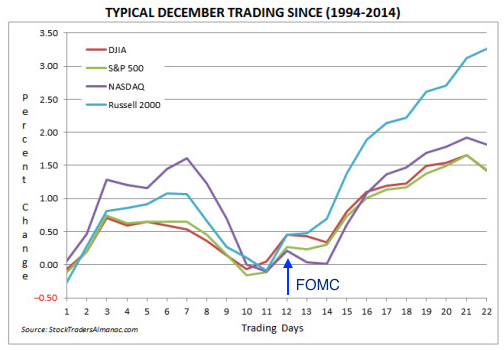

Weakness after NFP would fit with the seasonal pattern for December: the second week of the month is typically weak (next week is Days 5-9). Whether that is still valid, with the swoon this past week, is certainly open to question (data from Stock Almanac).

As you can see in the chart above, the pivotal FOMC meeting on December 16 (Day 12) is ahead. At that meeting, the Fed is considered very likely to raise rates for the first time since 2006. The chart above indicates weakness ahead of the meeting and then the traditional "Santa rally" into year-end. Given that the rate increase is likely to be minor and has been very well telegraphed, that might still be the case this year.

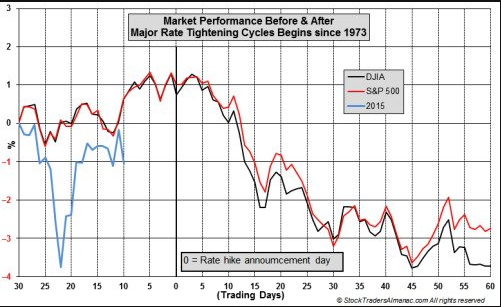

It's worth noting, however, that the opposite has been true prior to past "first rate increases": stocks move sideways in the final 7 days prior to the meeting and then sell off a week or so afterwards. In other words, the pattern would be for stocks to chop back and forth for the next two weeks and then decline in the days after Christmas and then into January (data from Stock Almanac).

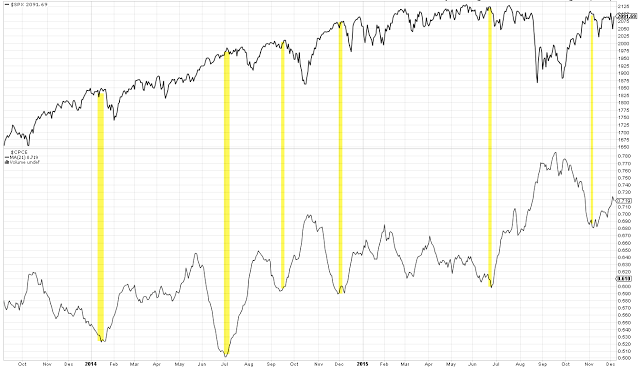

We can add one more data point. Let's assume that NDX breaks out higher before year end and N:SPY follows; will the breakout last? The recent evidence says probably not.

The next chart looks at all the breakouts in the past 15 months. The yellow shading shows the breakouts and each one has gone about 1-2% before giving the gains back. Perhaps this one could be more significant; after all, there has been a big dip and a half year has passed since the last one.

In summary, the balance of evidence points to further upside by year-end. SPY is up about 0.5% so far in December. A typical December rises 1.5-2%. Aside from the upcoming FOMC meeting, there do not appear to be many strong impediments to further gains by year-end.

Three scenarios seem possible:

- A breakout higher now is likely to be a failed move, especially if it occurs prior to the December 16 FOMC meeting. This would the best scenario for bears.

- If seasonality drops the market ahead of the FOMC, there is likely to be attractive upside into year-end. This would be the best scenario for bulls.

- The most frustrating scenario would be if stocks chop up and down both into and following the FOMC meeting; unfortunately, that has most often been the case at other times the Fed was initiating rate hikes.

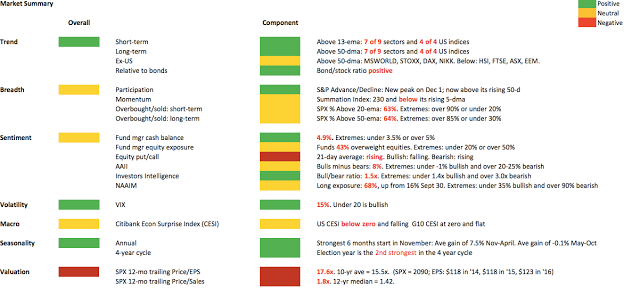

Our weekly summary table follows: