Summary: The major US indices traded at new all-time highs (ATH) again this past week, led by surging small cap stocks. SPX is now higher 6 months in a row and 10 of the past 11 months; that level of momentum has never marked a bull market high.

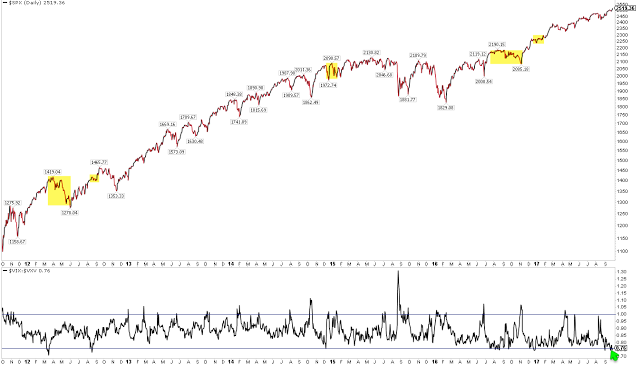

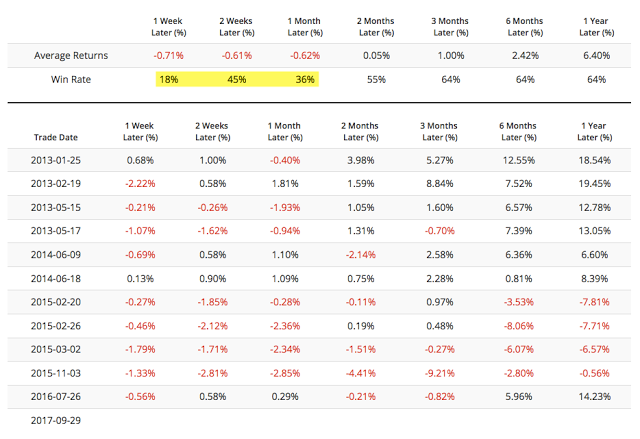

Short-term optimism has reached an extreme that has resulted in a lower weekly close within the next 6 weeks every time over the past 5 years.

The fundamental narrative for the current rally is that the Trump administration's tax plan will boost earnings by an estimated 6%. If investors expect the tax plan to also cause economic growth to accelerate, they are very likely to be disappointed.

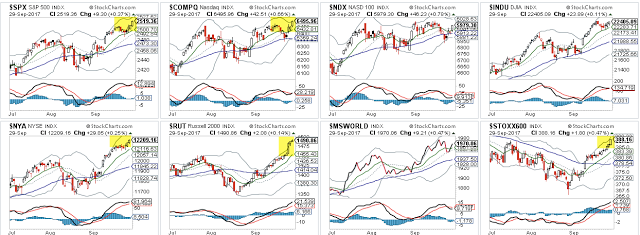

SPX, COMPQ, RUT and NYSE made new all-time highs (ATH) again this past week. SPX has been up 5 of the last 6 weeks. The dominant trend remains higher.

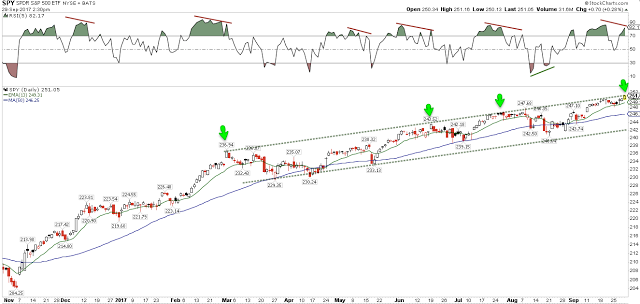

The set up for this week was for a bounce off the 13-ema (on its first touch in 3 weeks; green line) and then a higher high in price (momentum highs are followed by price highs; slanted line in the top panel). That post is here. SPDR S&P 500 (NYSE:SPY) ended the week at the top of 7-month price channel that has marked stiff resistance since winter (arrows).

The long-term outlook for US equities is positive.

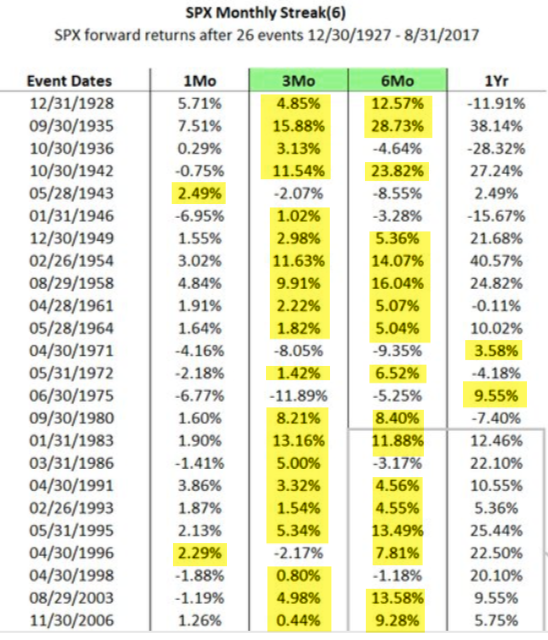

September became the sixth month in a row that SPX has risen. In the past 90 years, this has happened 26 other times, with SPX closing higher either 1 or 3 months later in 92% of instances. In the two instances that it failed, stocks closed higher by 1 year later. A bear market did not start within 3 months of any of these instances; there was always a higher high ahead (from Nautilus Research).

Moreover, since 1928, when SPX has risen in every month from May through September, as it has this year, it has risen in the 4th quarter every time (from Ryan Detrick).

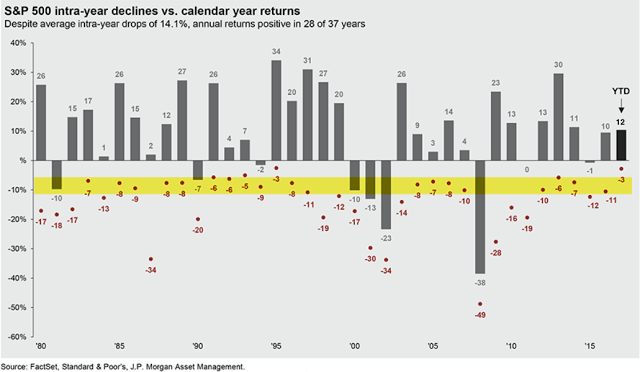

The most salient feature of the US equity market this year has been the persistence of the uptrend. SPX is up more than 12% YTD but the maximum drawdown has been just 3%, tied for the lowest of the past 37 years. The median annual drawdown is about 8% (from JPM).

That is significant, as the studies presented above and in prior weeks demonstrate that persistent uptrends do not quickly reverse direction. If past is prologue then SPX is likely to see a series of 3-5% swings (higher and lower) - creating a sawtooth pattern as the uptrend weakens - before a more significant drop takes place. This process has not yet started.

The persistent uptrend has kept one-month volatility at significant discount to three-month volatility for nearly 3 weeks, the longest streak in at least 10 years (lower panel). After similar instances, SPX has moved sideways or lower over the next 1-3 weeks; if SPX moved higher, those gains were given back (upper panel).

Similarly, the persistent uptrend pushed the CNN Fear & Greed index over 90 on Friday. Using the backtest engine from Sentimentrader, prior instances in the past 5 years have preceded a lower close in SPX within the next month 91% of the time and within six weeks 100% of the time.

The gains this week were particularly strong for small cap stocks (RUT) on the hope that they may disproportionately benefit from any reduction in corporate taxation. Over the past 7 weeks, RUT has significantly outperformed large cap stocks. This is not at all unusual.

The bottom panel in the next chart compares the performance of small and large cap indices: when the line rises, small caps are outperforming and when the line falls, large cap are outperforming. Through both bull and bear markets, investors will regularly rotate their exposure between small and large cap stocks, but over the past 11 years, the net difference in performance is nearly zero.

Importantly, there is no way to use the relative performance of small cap stocks to anticipate turns in the main indices like SPX: sometimes RUT declines ahead of SPX, sometimes it outperforms into a top, as explained in more detail here.

Likewise, the belief that weakness in transportation stocks (which surged to a new ATH this week) is useful for anticipating turns in the broad indices (part of what is known as the "Dow Theory") is misplaced. In the past 37 years, notable declines in SPX (black line) have been equally preceded by declines, rises or coincident tops in transports (blue line). There is no consistent pattern.

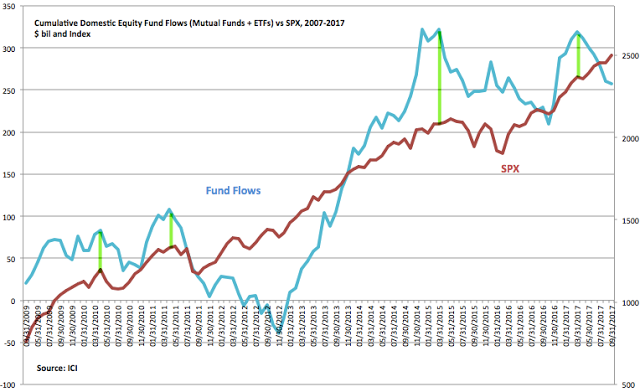

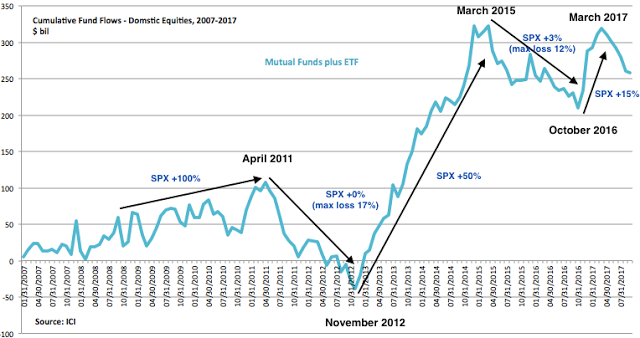

Despite the persistent rise in US equities, money has been consistently flowing out of equity mutual funds and ETFs since peaking in March. In fact, net outflows are well over $60b during this period and were a further $10b in the past week alone. What is unusual is that index peaks (red line) have previously been largely coincident with fund flow peaks (blue line). Residual investor pessimism will often cause fund flows to remain negative even after the index has again begun to rise. This time has been different and while there is no history to rely upon, the most likely interpretation is that investors are skeptical of the continuing bull market (from ICI).

Overall, sentiment data is split. Surveys by Investors Intelligence and NAAIM together with put/call and volatility data indicate that investors are currently bullish, while fund flows, fund manager allocations and the AAII survey indicate that investors are bearish. This inconsistency might account for the persistence of the uptrend this year; there has been, in other words, no clear euphoria that can often mark a noteworthy top.

The best index returns have taken place while fund flows are positive. It's possible a year-end flood of inflows would power the index much higher.

Part of the recent fundamental narrative for higher equity prices is tax reductions proposed by the Trump administration. According to S&P analyst Howard Silverblatt, a reduction in corporate taxation to 20% would result in a 6% increase in SPX earnings. According to this narrative, the price indices are now in the process of discounting this prospect.

However, if the indices are also discounting higher economic growth as a result of tax reductions, they are very likely to be disappointed. The following discussion is not about politics, it's about economics.

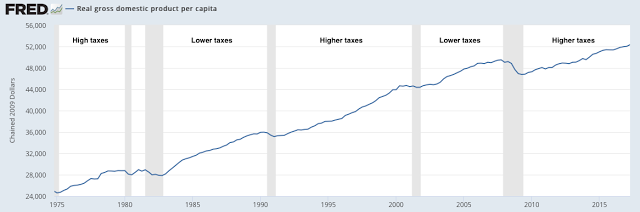

Disentangling macro growth due to concurrent changes in taxes, interest rates (monetary policy), government spending (fiscal policy) and population is a challenge. But, as Bruce Bartlett, domestic policy adviser to President Reagan, points out, macro growth was at least as good during periods when taxes rose as when taxes were reduced (article).

Real per capita income growth was as high or higher during high tax periods than during periods when taxes were low/lowered.

These views are also endorsed by the non-partisan think tank, the Brookings Institute, and by conservative economist Martin Feldstein (link).

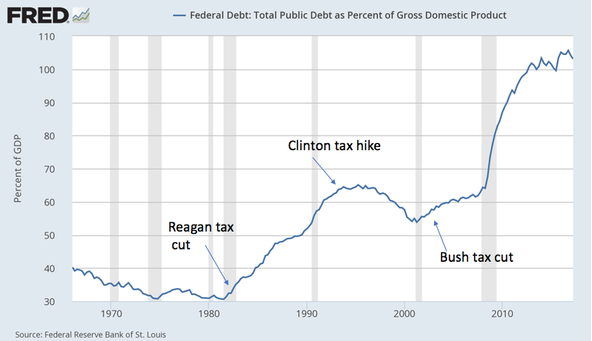

One likely affect is an increase in federal debt as tax revenue declines. Tax reductions have never "paid for themselves," they have been financed by higher debt relative to income. The only period in recent history when federal debt declined was at the tail end of the Clinton administration, following a tax increase (from the NYT).

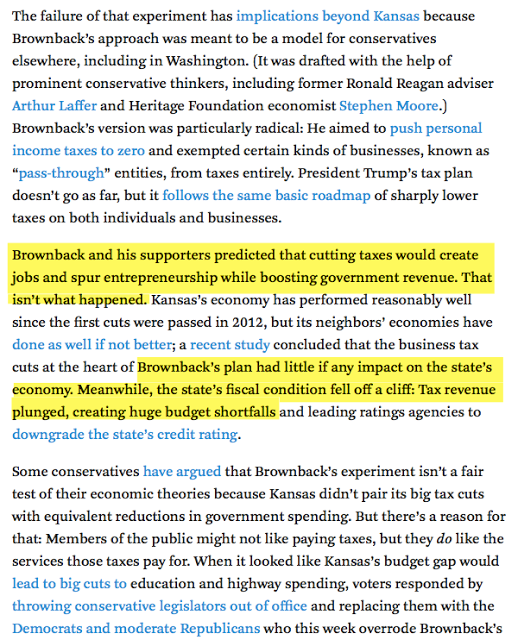

The state of Kansas has provided one of the best studies on the specific affect of tax reductions on economic growth and debt. The state instituted tax reductions that were promised to pay for themselves through higher growth. Instead, growth in Kansas lagged that of neighboring states and the reduction in tax revenue forced a credit downgrade. A bi-partisan legislature has now reversed those tax cuts, acknowledging the failed experiment (from FiveThirtyEight).

Whether higher debt will lead to higher interest rates and slower growth, however, is far from certain: the US has no difficulty servicing current debt and has assets many multiples higher than its liabilities. A recent post on this is here. Federal debt has been steadily rising since the beginning of the 1980s during which time Treasury yields have continually fallen.

Net, US equities continue to make new ATHs and the outlook into year-end is favorable. Short-term studies like the Fear and Greed index and the volatility term structure suggest a lower close in the next month is ahead.

The macro calendar this week is dominated by NFP employment data to be released on Friday. Auto sales data is released on Tuesday.