Summary: Equities fell for the first time in six weeks. The intermediate-term uptrend remains healthy, but some minor short-term weakness has crept in. The SPDR S&P 500 Fund (NYSE:SPY) could be setting up within a trading range between 200 and 206: fading extremes at these levels is probably the set-up going forward.

Equities are entering a buyback blackout period, but these have had no consistent bias (positive or negative) in the past. April starts Friday: over the past 10 and 20 years, April has been one of the most consistently positive months of the year for stocks.

Equities fell this past week for the first time since the February low. They had risen each of the prior 5 weeks. SPY lost 0.6% and the NASDAQ 100 (NDX) lost a scant 0.1%. Leading the downside were small caps, with the Russell 2000 (RUT) losing 2% for the week. Emerging markets also lost 2%.

Safe havens - Treasuries and gold - which had been in high demand during the sell-off in equities, were mixed. Treasuries gained 0.4% this past week but gold dropped 3%.

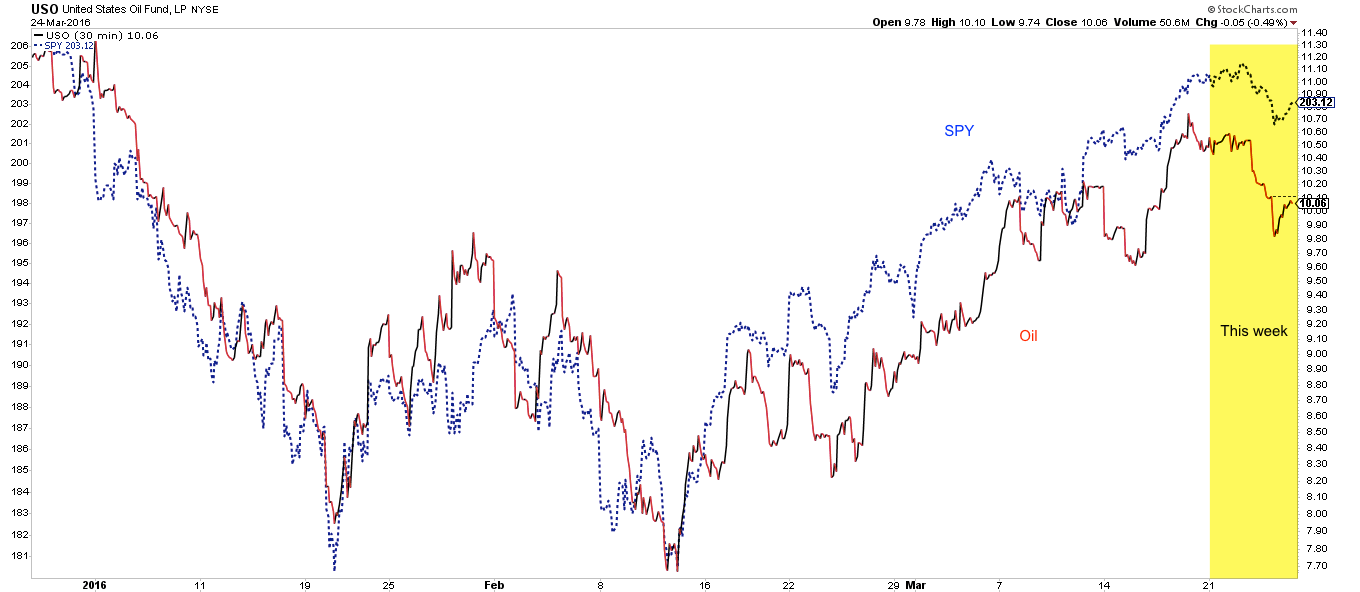

Oil and equities had risen together the prior 5 weeks. Not surprisingly, oil also fell this past week, by nearly 4%. What happens next for equities is largely contingent on oil: if the rally in oil (via United States Oil ETF (NYSE:USO) in chart below) is over, it is very likely equities will sell off more.

Crude failed near $43: its 200-dma and also an important pivot level September-November. Momentum dropped below neutral (top panel). $37-38 is the prior support zone; dropping below here would be a bigger concern. A strong trend will stay overbought; therefore, we'll look to see whether crude can regain momentum this coming week (top panel).

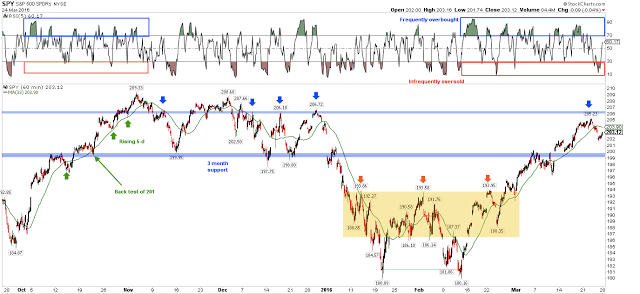

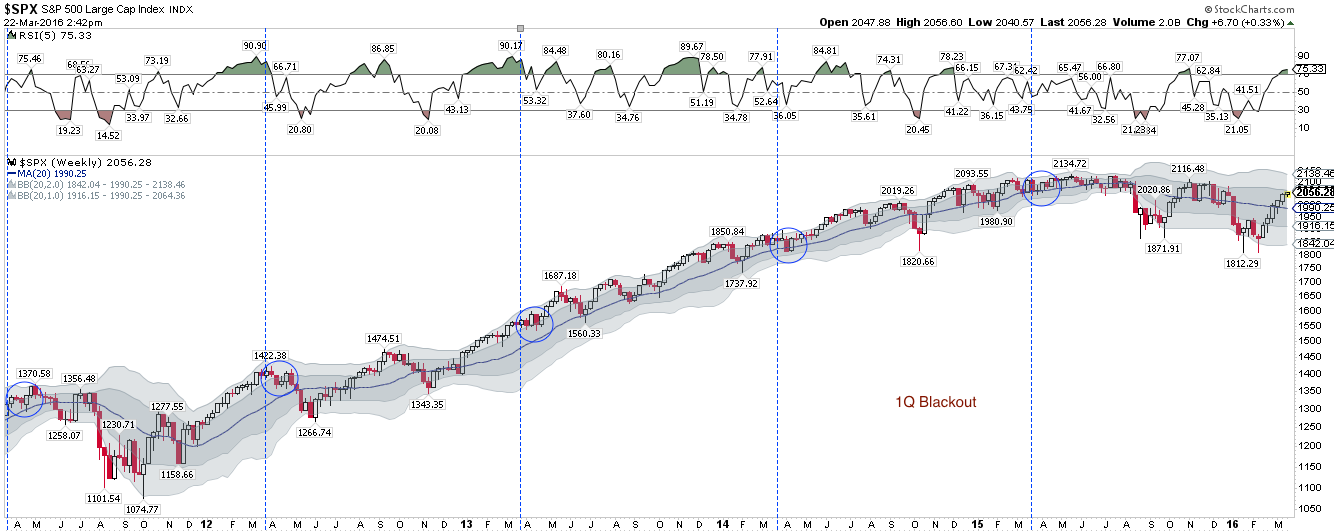

SPY closed at a new uptrend high last Monday and made a new intraday high on Tuesday, but then sold off the rest of the week, its first 3 day losing streak since January 8. There is no foul yet: momentum remained above neutral on the sell off (top panel) and the rising 13-ema marked the low (green line). The 50-dma is rising and the 200-dma is now set to rise as well. If this past week's low (201.8) is breached, it's a fair guess that SPY is headed back to the 200 "breakout" level which has often been support during the past year.

On the chart above, note the MACD has now pinched close (bottom panel). When this has recently happened, SPY has next broken its 13-ema and gone on to test its 50-dma (blue line) through time and price. In other words, SPY could be entering into a weak, choppy, sideways period over the next several weeks.

That wouldn't be surprising. We showed several studies last week that indicated that this would likely take place: SPY had gained 10% in 5 weeks; its spread to the 50-dma was extreme; strong gains leading into an FOMC meeting are normally followed by a retracement. That post is here.

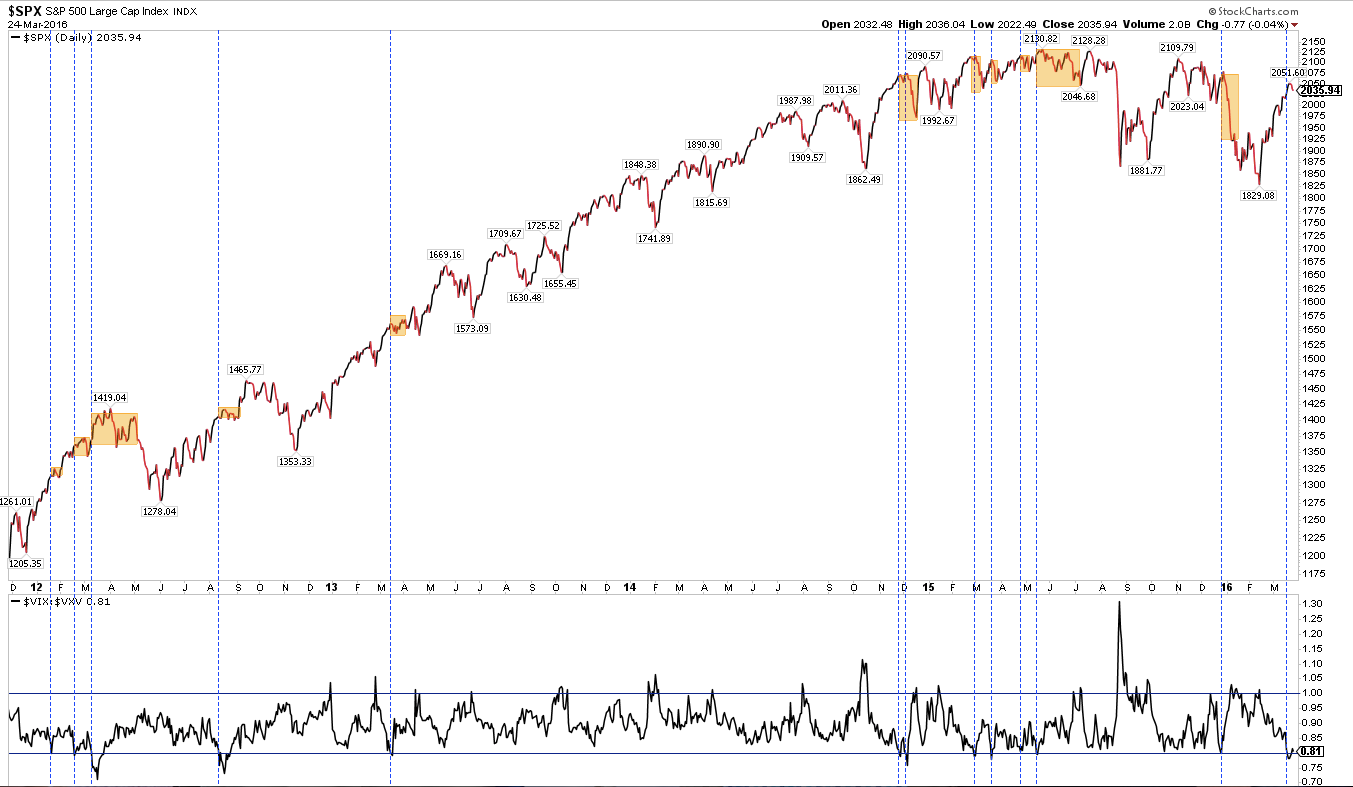

Recall as well that the volatility index (VIX) had fallen by more than half since February 11. When VIX (1-month volatility) is less than 80% of VXV (3-month volatility), SPY normally struggles to make any gains, and most often retraces in the week(s) ahead. Even the shortest period of weakness in this chart was 2 weeks.

On a shorter time frame (hourly), SPY has remained mostly "overbought" (top panel). In fact, Thursday was the first day that SPY was "oversold" since February 29. This has been an unusually strong uptrend. While there's no major foul so far, there was a minor foul: on Thursday, SPY's 5-dma curled lower for the first time this month (green line). It will take a quick rise back over 204 to move the 5-dma back to positive.

In the chart above, it is easy to imagine the index sliding into a 200-206 trading range once again (blue lines). Fading extremes at these levels is probably the set up going forward.

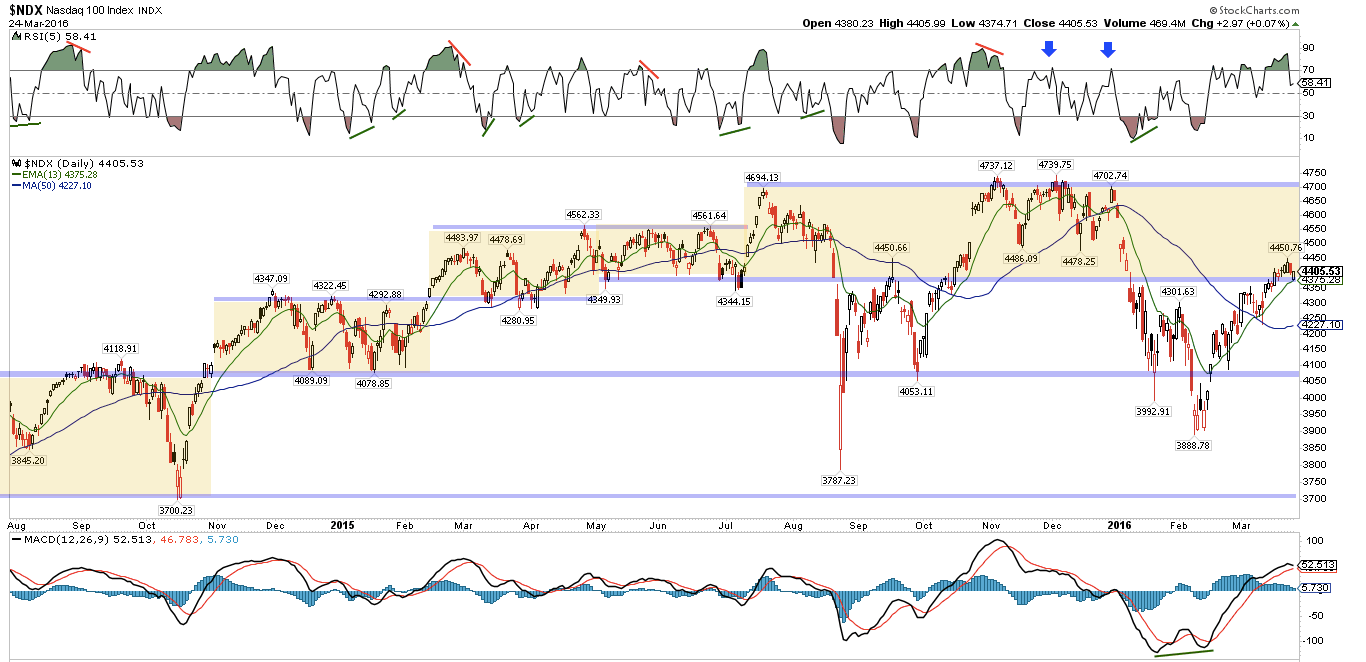

NDX made a new uptrend closing high on Tuesday. Like SPY, momentum remains above neutral but the MACD has pinched closed. If NDX breaks Thursday's low, the index will likely move through time and price to its rising 50-dma.

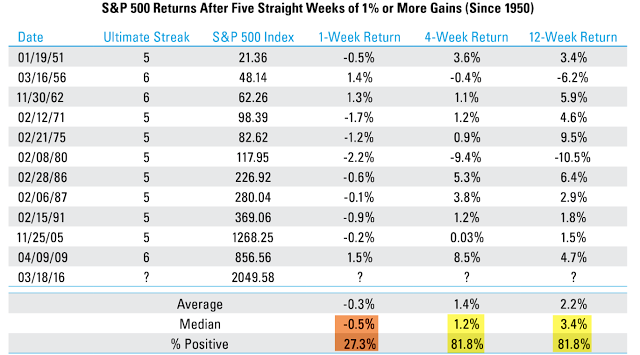

The intermediate-term evidence is against the current rally failing and the indices returning to their February lows. As reviewed last week, strength in breadth and momentum are unlike those of a bear market rally. In addition to those studies, add this: SPX gained more than 1% for 5 weeks in a row. It was flat or higher 1 and 3 months later in 81% of the cases where this has previously happened. At a minimum, this suggests a trading range and that any strong sell off would likely be bought (from Ryan Detrick).

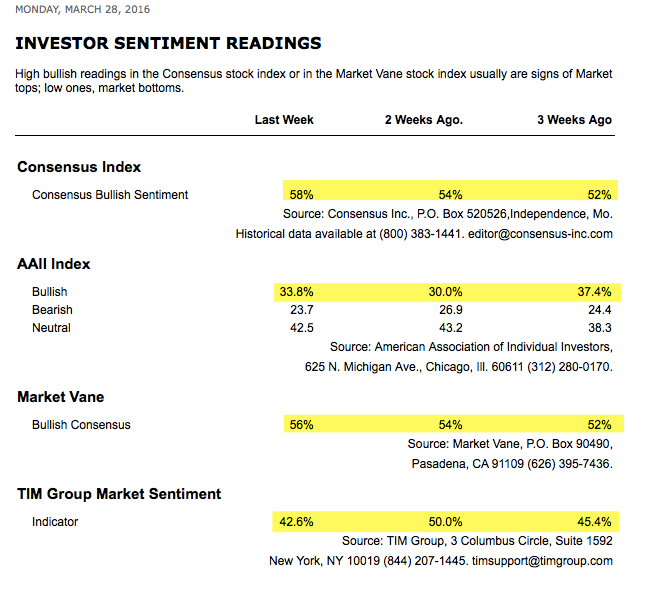

By most measures, investors remain skeptical of equities. In the summary table below, bullish sentiment declined in two surveys. In none of these surveys are investors leaning bullish (from Barron's).

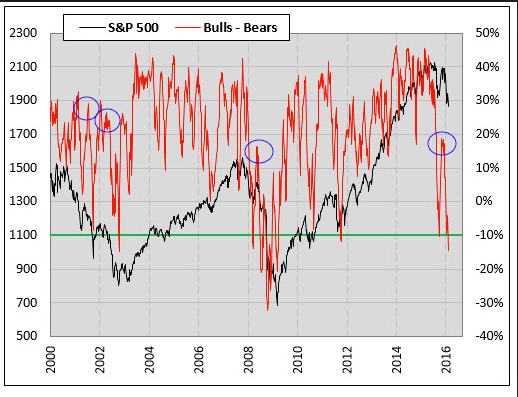

The most optimistic survey is from Investors Intelligence: the bull/bear ratio is back to where it was last November and also in May 2008 (20%). Both times, equities rolled over. But bear market rallies in 2000-02 did not end until the ratio moved higher (to 25-30%). In a bull market, the ratio is not at an extreme until it reaches 35-40%. This measure is now neutral.

Only $2B flowed into equity funds this past week. This is a paltry amount given the strength of this rally, especially considering that equity flows have been negative 10 of the past 12 weeks, longer than any time during the 2007-09 bear market. Meanwhile, investors have added to the safe haven of bonds 15 weeks in a row. It would be remarkable if investor sentiment did not become more bullish before this rally ends. The bear market rally in March-May 2008 included several positive weeks of equity inflows, including one that was more than $20B in one week.

1Q ends this coming week. Among other things, that means that companies are now in a buyback blackout until they have reported their financial results. For the bulk of companies, that means until the 3rd week in April. How significant is this blackout on equity performance?

Not very. Performance over the next few weeks is mixed: sometimes higher, sometimes lower. That is true during the blackout period for 1Q, 2Q and 3Q. There's no strong bias.

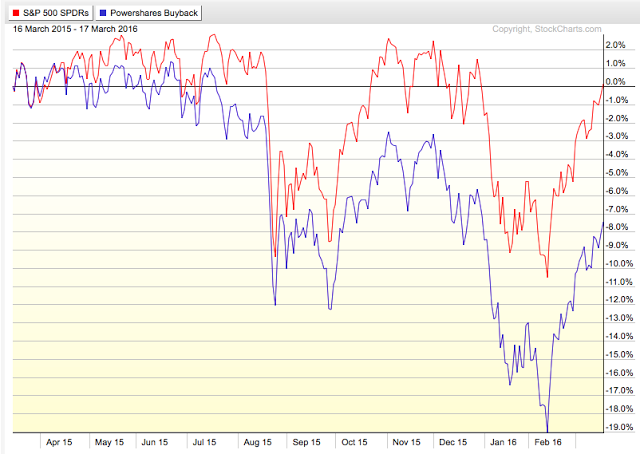

That should not be too surprising. Companies that are doing buybacks (blue line) have been underperforming the S&P index (red). In the past year, buybacks have underperformed by 800 bp.

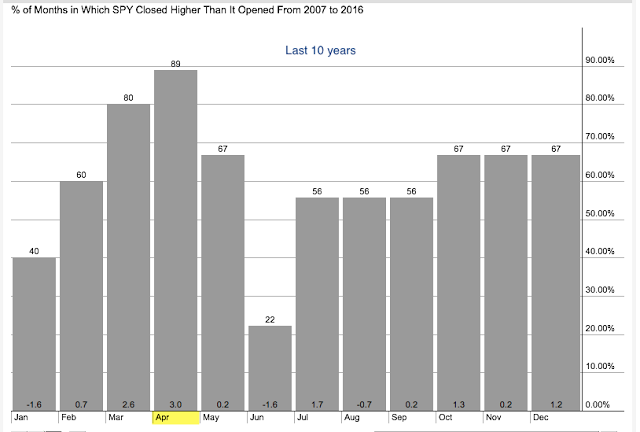

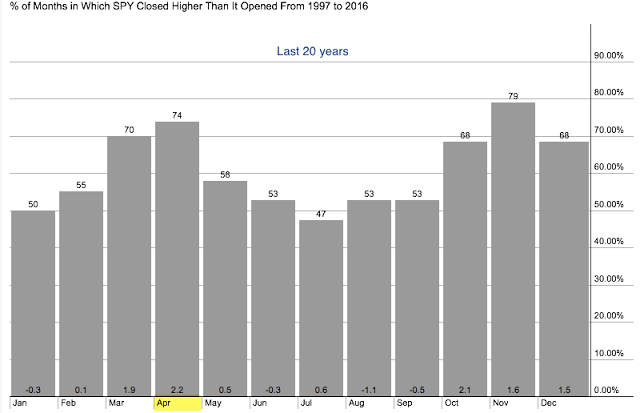

Moreover, if the buyback blackout was a significant driver of performance, then April would be a weak month. Instead, it is is one of the best months of the year for the S&P over the past 10 years and 20 years.

On the economic calendar, personal consumption is reported on Monday and employment on Friday.

In summary, the intermediate-term uptrend remains healthy, but some minor short-term weakness has crept in. SPY could be setting up a trading range between 200 and 206: fading extremes at these levels is probably the set up going forward. Equities are entering a buyback blackout period, but these have had no consistent positive or negative bias in the past. Over the past 10 and 20 years, April (which starts Friday) has been one of the most consistently positive months of the year for stocks.