Market Summary

Asia

Asian markets kicked off last week on strong footing, gaining in response to gains from Wall Street, and on investor optimism over the U.S. tax reform legislation. The exception to that was South Korea’s Kospi, which remained depressed throughout most of the week. By Wednesday the optimism over tax reform had faded, in a case of buy the rumor and sell the news. The passage of the tax act through both the House and Senate in the U.S. had little positive impact on Asian markets. They did end the week on a high note however, with broad based gains across the region Friday. Overall Hong Kong’s Hang Seng was the strongest performer, gaining 2.5% on the week. Japan’s Nikkei also posted a 1.6% gain, but most of that was from Monday. In Australia the S&P/ASX 200 was 1.2% higher, again with the bulk of gains coming at the beginning of the week. The worst performance came from South Korea’s Kospi, which ended with a 1.7% weekly loss. Markets in Hong Kong and Australia will be closed Monday for Christmas and Tuesday for Boxing Day.

Next week is expected to be fairly quiet across the Asian region, and although most markets in Asia don’t close for Christmas, the lack of trade volume from Europe and the U.S. is almost certain to keep results muted. We will hear from Bank of Japan governor Haruhiko Kuroda on Tuesday, and this could impact the Japanese markets. Australia and Hong Kong are likely to remain quiet due to the three day trading week, followed by another long holiday weekend, which will likely have many traders away from the markets all week.

Europe

Europe had a very short trading week, with markets closed on Monday and Tuesday, and most markets closing early on Friday. Still, the two-and-a-half days were enough for some strong moves as Germany’s DAX fell 1.2% and the CAC 40 in France lost 1.0%. The pan-European Stoxx Europe 600 fared a bit better as it was only lower by 0.3% for the week. London investors took full advantage of their time in the markets however, with the FTSE ending the week at a new record high as it gained 1.2% for the week, with 0.85% coming in the half-day session Friday alone.

European markets will remain closed on Monday for the New Year holiday, but should get off to a strong start on Tuesday, at least in London. Even though there remain questions and uncertainties surrounding the Brexit, U.K. investor sentiment remains high, and we could see additional record coming from the FTSE. European markets could struggle however, as the Euro continues rising against the U.S. dollar, which makes European export companies less profitable and competitive. The Euro gained 14% on the U.S. dollar in 2017 and if that trend continues we could see a bad year for European equities in general.

.

US

U.S. markets remained muted with small gains and losses in thin trade for most of the week. That looked as if it would hold true through the end of the last trading session of the year, but a steep sell-off in the final lhours of trade left the major indices with weekly losses. The S&P 500 fell 0.4% for the week, the Dow was 0.1% lower, and the Nasdaq lost 0.8% on a weekly basis. Still, all three of the major benchmark indices were higher for the month of December, and they all put in very respectable performances for 2017, with the S&P 500 up 19.4%, the Dow adding 25.1% and the Nasdaq 28.3% higher in 2017.

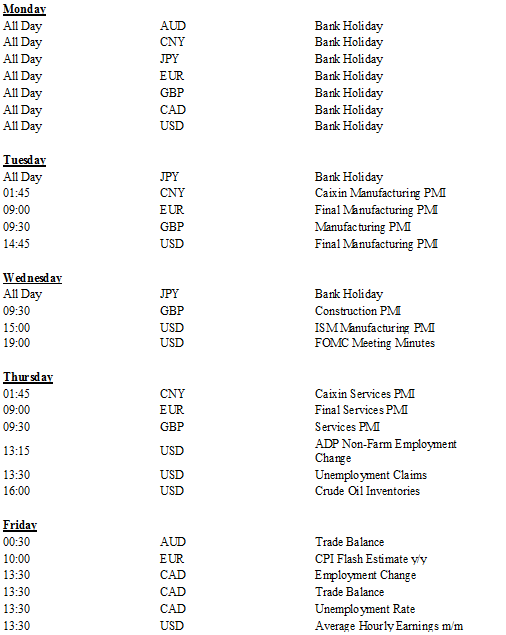

U.S. markets will be closed on Monday for the New Year holiday, but will resume trading on Tuesday, with normal volumes returning then or by Wednesday at the latest. There remains enthusiasm among investors for the tax reform changes, and this could give markets a boost to begin 2018. The weaker U.S. dollar will also provide a tailwind, but investors might remain cautious at the beginning of the year as they await the release of U.S. employment data due on Thursday and Friday.

Cryptocurrencies

Bitcoin began the week on strong footing, gaining 20% Tuesday and looking as if it was ready to make a run at the $20,000 level. The rally fizzled out however, and over the following two sessions Bitcoin pulled back, nearly to the $14,000 level. It recovered some on Friday, retaking the $15,000 handle. Most other cryptocurrencies followed the moves in Bitcoin, although there was one standout coin. Ripple continued soaring all week, and by Friday it overtook Ethereum to score the second position in market capitalization for cryptocurrencies. It is up roughly 800% since December 10th.

The coming week could see Bitcoin return to its winning ways. The Christmas holidays certainly seemed to take their toll on the cryptocurrencies, but with traders returning full time to the markets we could get another leg higher from Bitcoin and other coins. Ripple bears watching given it rapid rise in the second half of December as a dump could occur as traders decide to take profits.