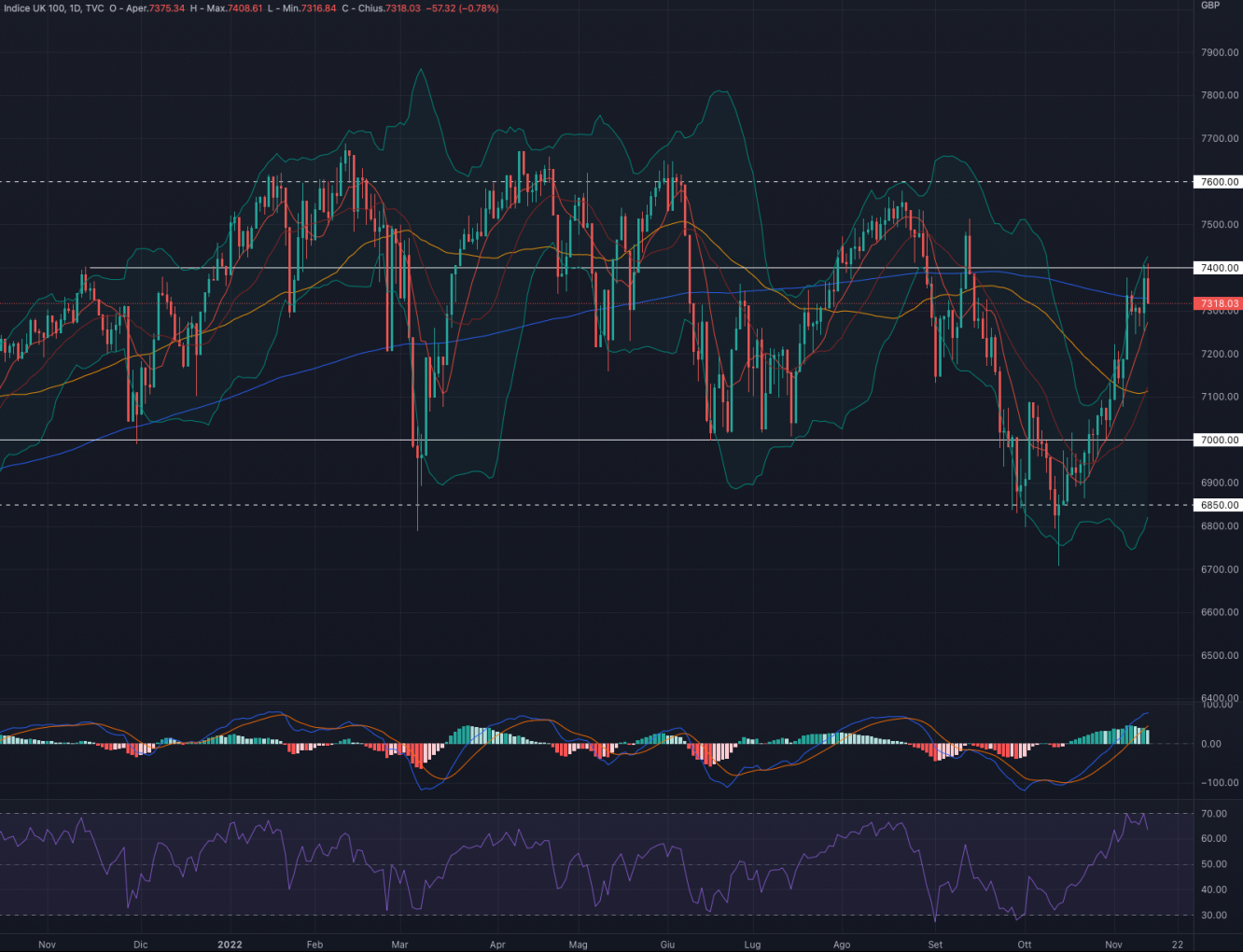

FTSE 100 (UKX)

The FTSE 100 index had a week down by -0.23%. For the coming week, we are in favor of a retracement in the area of 7,200-7,250

Indicators

Very positive week for the British index, which brings back the price close to the strong resistance at 7,400.

We can see that the price ended the week just below the 200-day moving average (blue line), and we don't believe there is the strength and conditions needed to move further up.

MACD and RSI are now very extended to the upside: the former is reporting a slowdown in the histograms, and the RSI is in overbought territory and negative divergence with the price action.

The exit from the Bollinger Bands is a further element of caution and a sign of a price that is now very extended to the upside and with high downside potential.

We are bearish on the FTSE 100 and await substantial declines before considering long setups.

- Support at 7,000

- Resistance at 7,400

FTSEMIB (FTSEMIB)

The FTSE MIB Futures index had a week up by + 5.04%. For the coming week, we are in favor of a retracement in the area of 23,300

Indicators

Very positive week for the FTSE MIB, bringing the Italian index back above the 200-day moving average (blue line) and strong resistance at 23,600.

If in the medium to long term, these latest upward moves are undoubtedly positive, in the short term, we believe that now the price is very extended to the upside and that it may need significant retracements before proceeding to the upside.

MACD and RSI are now very extended to the upside, particularly in overbought territory (a scenario that has not happened since November 2021).

We are bearish on the FTSEMIB as we believe that price swing and internal indicators are now very extended to the upside, shifting the risk in favor of retracements rather than repeated upside moves.

The index is far from all the leading moving averages, making the current scenario unstable and subject to significant reversals.

- Support at 22,500

- Resistance at 24,850

DAX 40 (DAX)

The DAX index had a week up by + 5.68%. For the week ahead, we favor a progressive retracement to 13,600.

Indicators

A positive week for the German index brings the price well above the 200-day moving average (blue line), and we believe the conditions are not there to continue rising, at least in the short term.

MACD and RSI are now very extended to the upside, with the latter in overbought areas: this aspect radically shifts the risk /reward in favor of possible short-term declines.

The extensive trading range of 12,200-13,600 has been temporarily broken and we could assume 13,600 is a back-test area. We are bearish on the DAX and in favor of possible short-term weakness.

- Support at 13,100

- Resistance at 14,350

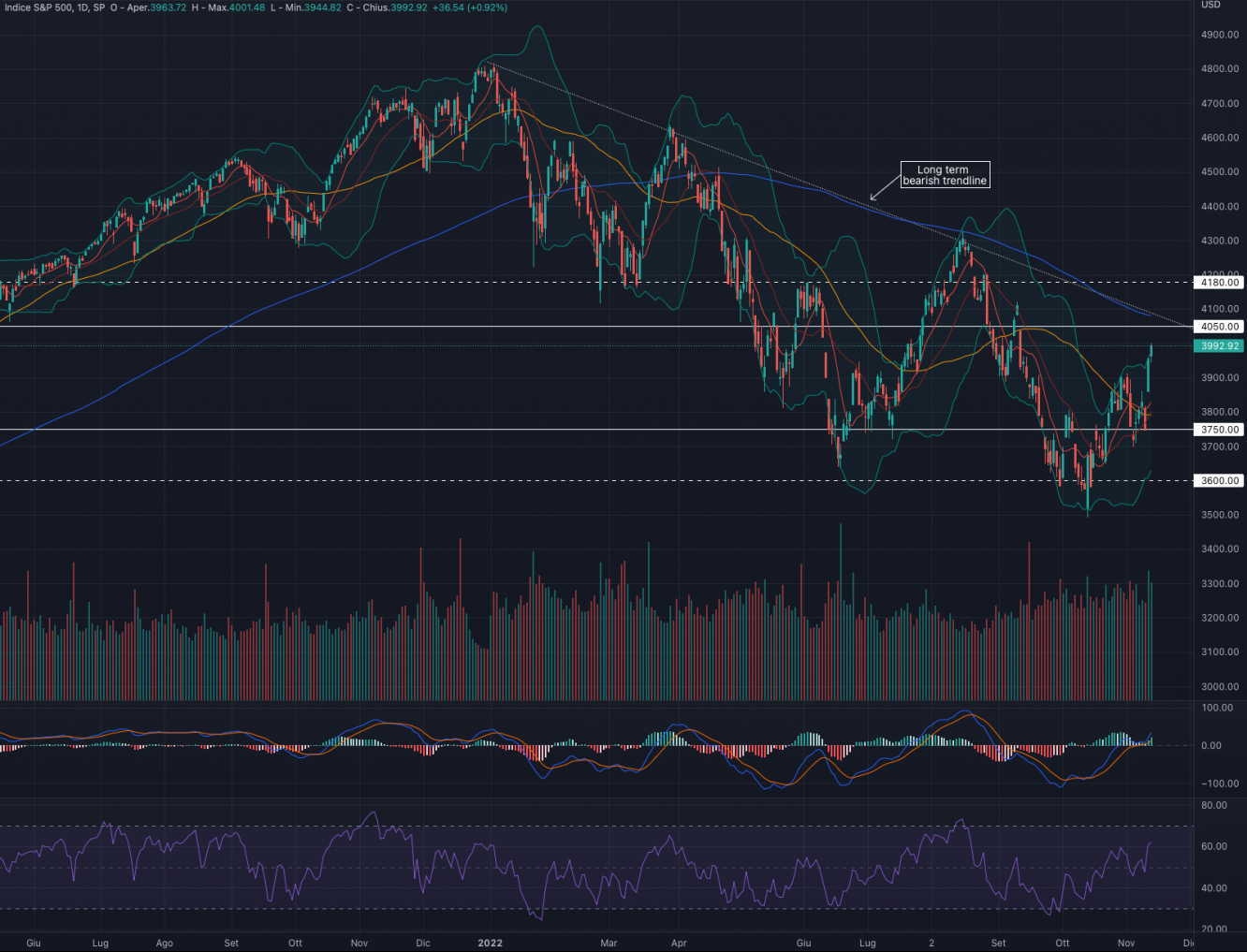

S&P 500 (SPX)

The S&P 500 index had a week up by +5.90%. For the coming week we are in favor of a possible consolidation in the area of 3,800 - 3,900.

Indicators

Positive week for the American index, which gained strength after a long period of consolidation.

Given the strong candles at the end of the week it is desirable to expect a consolidation rather than a bullish continuation: the short-medium term target remains the long bearish trendline at 4,000-4,100, and we believe that this can be reached after the occurrence of a possible reversal /backtest.

We are positive on the S&P 500, and we believe there is room for further upside moves; at the same time, we believe it is appropriate to wait for a consolidation in price before considering long setups.

- Support at 3,550

- Resistance at 3,900

NASDAQ 100 (NDX)

The Nasdaq 100 index had a week up by +8.84%. For the coming week, we favor consolidation in 11,200 - 11,600.

Indicators

A positive week for the Tech index brings the price back to the top of the narrow trading range of 11,800-11,600.

The break of the 50-day moving average (yellow line) indicates a possible short-medium-term bullish continuation. Added to this are the MACD and RSI internal indicators that seem to support the index's recovery in strength: the former is marking higher lows, and the RSI is now back above 50.

We are positive on the NASDAQ 100 and looking forward to a consolidation above 11,600: once that is exceeded, we see 12,000 and 12,700 as short to medium-term targets.

- Support at 10,400

- Resistance at 12,000

DOW JONES (DJI)

The Dow Jones Industrial Average index had a week up by +4.15%. For the coming week, we favor an initial retracement of 32,800.

Indicators

The positive week brings the index back to the levels of August 2022 and above the 200-day moving average.

At the same time, the substantial distance from the 50 (yellow) and 9 (red line) day moving averages make us remain cautious about the latest strong upward extensions.

MACD and RSI are now very extended to the upside, with the latter in overbought territory.

In addition, we believe it is interesting to point out how the recent swing in October is very similar to the ones recorded in August: we are not alluding to upcoming new lows in the DJI but we believe there is a fair chance of a retracement at least close to the 50MA, or around 31,000 - 31,500.

However, a retracement of this magnitude would present an overall encouraging scenario in favor of a medium-term bullish case.

We are bearish on the DOW JONES given the strong upward extension; other stretches would make the situation even more fragile and less sustainable.

We look forward to a retracement in both price and internal indicators and a possible reconciliation with the major moving averages.

- Support at 31,200

- Resistance at 34,150