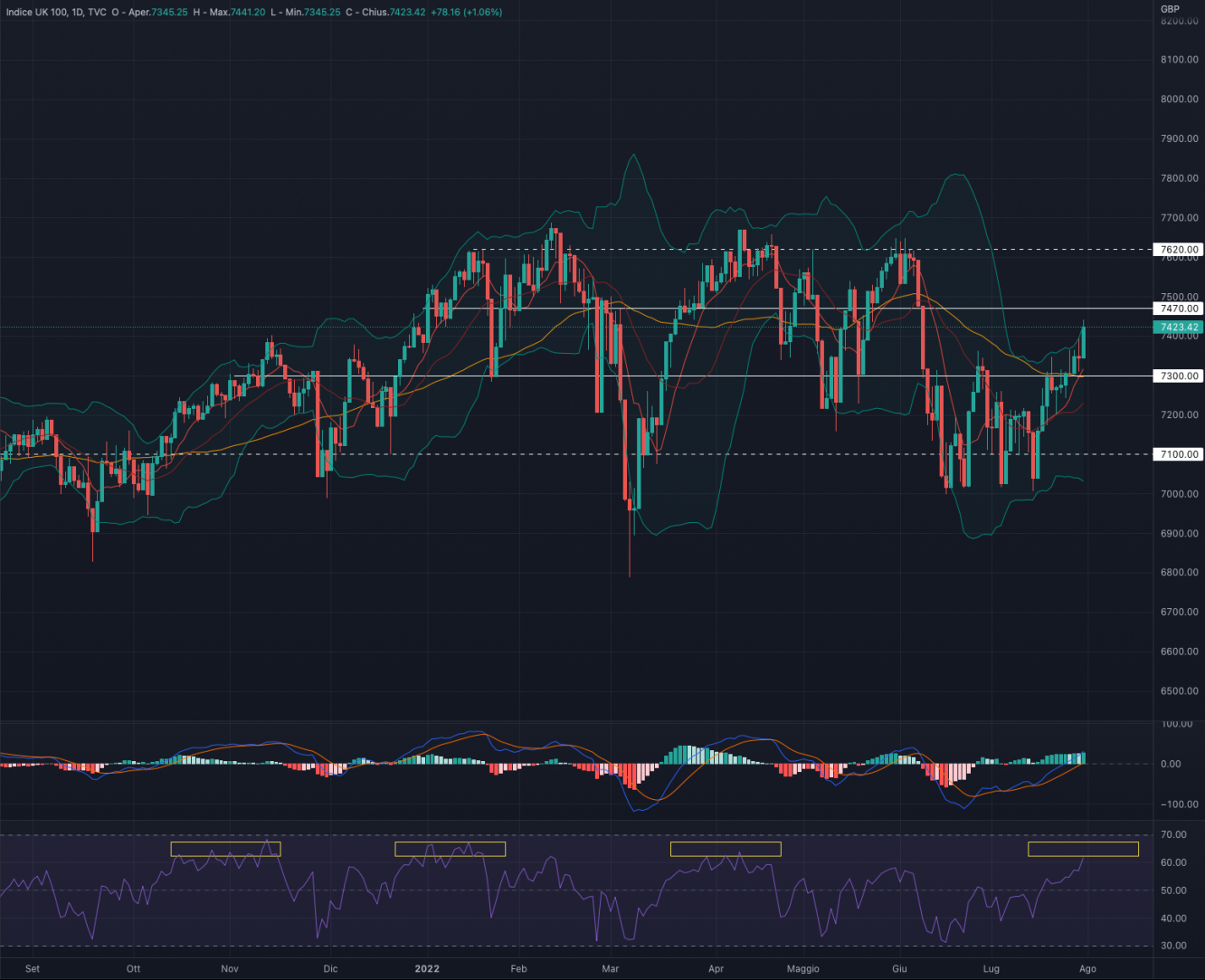

FTSE 100

The FTSE 100 ended the week up by + 2.02%. For the coming week, we could see a consolidation in the area between 7,300 - 7,400.

Indicators

Positive week for the British index, which managed to break above the 50MA (yellow line): we consider this a positive bullish sign for the short-medium term.

At the same time, the strong push brought the price outside the Bollinger bands, which now makes us lean towards a slight retracement for the week ahead. The break of the 7.300 level was a significant signal, and to avoid overbought scenarios, we believe there may be a slight retracement and back-test before continuing to rise.

MACD and RSI support the push of the UKX: the former has broken out of the 0 line (positive momentum), and the latter is now in a strong resistance area.

We remain positive on the FTSE 100 and look forward to retracements.

- Support at 7,300

- Resistance at 7.470

DAX 40

The DAX ended the week up by +1.74%. For the coming week, we could see a consolidation in the area of 13,300-13,400.

Indicators

The upsides continue on the German index, which is now on the 50MA (yellow line) and the upper part of the Bollinger band. Given the strong upward extension, we believe the price may retrace slightly to avoid overbought situations and an unsustainable bullish move to the upside.

MACD and RSI support the push, finding the first near the 0 line (positive momentum) and the second at 60, a strong resistance area tested several times.

We remain positive on the DAX and see a bullish push supported by increased volumes.

- Support at 12,600

- Resistance at 14,050

S&P 500

The S&P 500 had a week up by + 4.26%. For the coming week, we favor consolidation in the area of 4,000 - 4,050.

Indicators

A strong week of rises brought the SPX close to the resistance of May - June 2022. The decisive moves to the upside that have just occurred make us exclude a break-up of this area and lean more towards a retracement to avoid situations of overbought and unsustainable growth.

MACD and RSI reflect the index positivity, with the first above the 0 thresholds (positive momentum) and the second very close to the overbought area.

We remain positive on the S&P 500, but an almost overbought RSI coupled with strong resistance at 4,150 keeps us cautious and in favor of a retracement.

- Support at 3,950

- Resistance at 4,175

NASDAQ 100

The NASDAQ ended the week up by + 4.45%. For the week ahead, we believe there may be a retracement to the area of 12,500.

Indicators

The week just ended saw the reaching of the intermediate resistance at 13,000. Given the strong stretches and the near exit from the Bollinger band, we exclude a bullish continuation up to 13.500 without first seeing a price retracement.

We believe a possible target for this retracement can be identified at 12,500.

MACD and RSI support the push of the index and are both very extended upwards: the first is well above 0, and the second has almost reached the overbought area. Still, on the RSI, we see a tight uptrend channel that almost seems to suggest a possible short-term downside.

We remain positive on the NASDAQ 100 despite expecting a possible retracement.

- Support at 12,400

- Resistance at 13,500

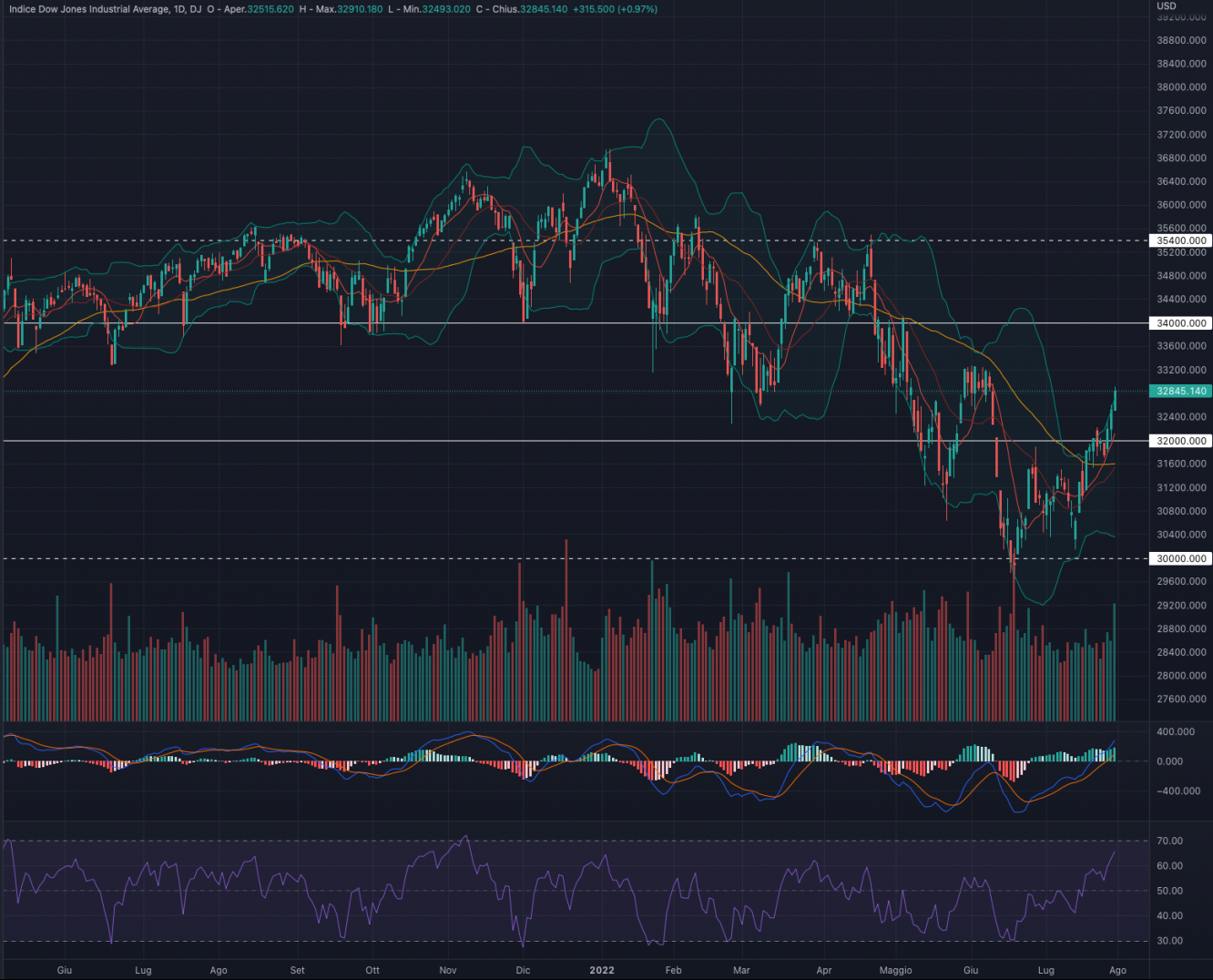

DOW JONES

Dow Jones Industrial Average had a week up by +2.97%. For the coming week, we could see a possible retracement to the area of 32,400.

Indicators

The index is now close to the intermediate resistance seen in May-June 2022. Given the bullish upsides of the week just ended, we exclude a strong continuation to the upside while we favor a possible retracement. This price action could avoid an overbought situation and unstable push.

It is important to note that the price is now outside the Bollinger band and a bearish swing is very likely.

MACD and RSI support the index's upside, with the former well above the 0 thresholds (positive momentum) and the RSI very close to the overbought area.

We remain positive on the DOW JONES but look forward to its retracement.

- Support at 32,000

- Resistance 34,000