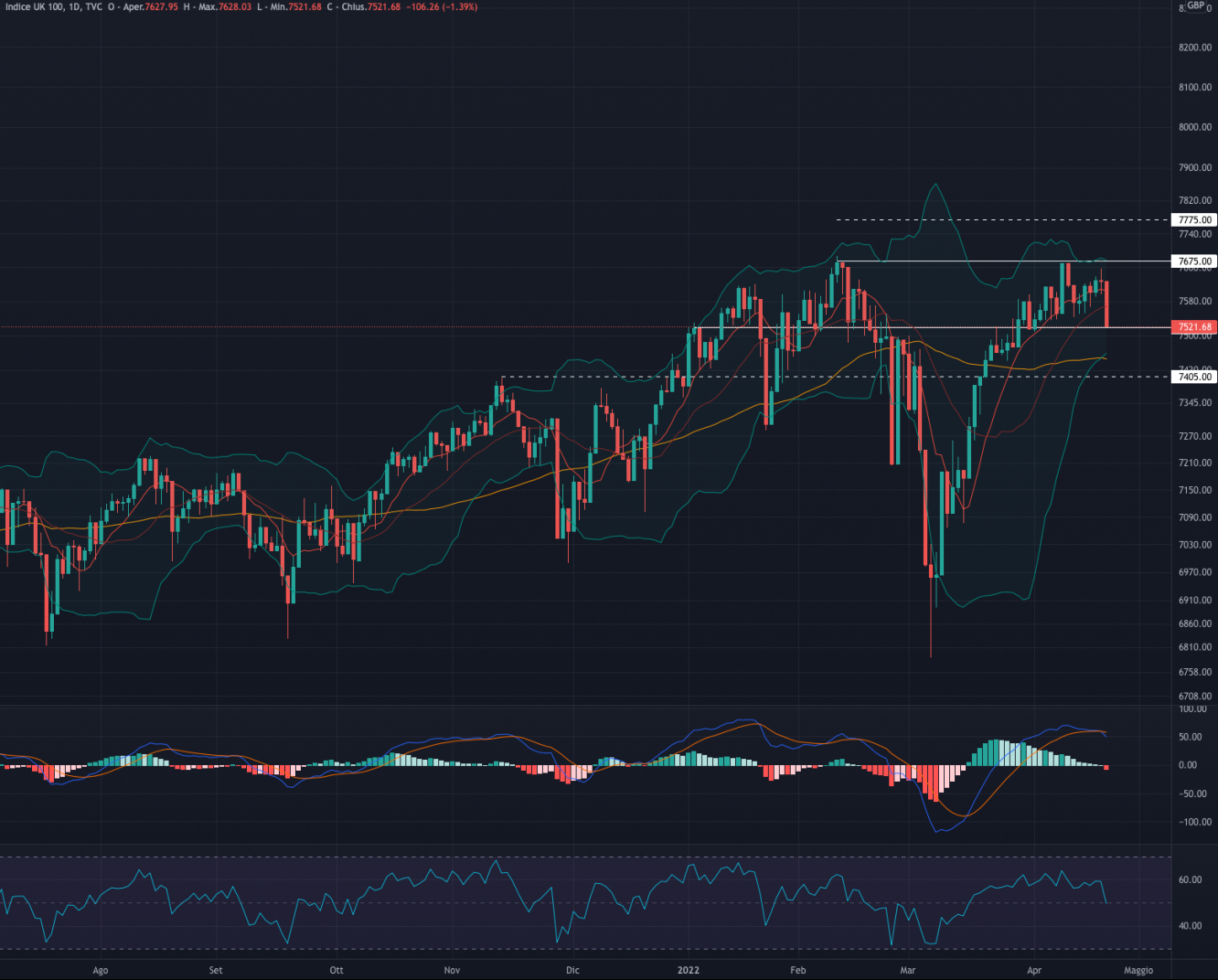

FTSE 100

The FTSE FT100 TR (UKX) ended the week down by -0.52%. For the week ahead, we could see a consolidation between 7,450-7,500.

Indicators

The sharp drop on Friday could be an anticipatory sign of the strong volatility that we believe will be the protagonist in the final week of April and the whole month of May.

The first strong level of support to monitor is, in our opinion, the 50MA (yellow line) which could act as a reversal area to the upside.

MACD and RSI confirm the bearish period of the index, with the former crossed to the downside and the RSI is now on the 50 line.

We remain positive on the index, but we await 7,450 before evaluating long positions.

Support at 7,520

Resistance at 7.675

FTSEMIB

The FTSE MIB Net Total Return (Lux) fell by -2.08%. The coming week could see consolidation between 24,000-24,500.

Indicators

Interestingly, FTSEMIB has remained substantially in the wide range between 24,000 and 24,960 since mid-April. We believe that such price action can also be perpetuated in the following weeks.

That said, however, the narrowing of the Bollinger® Bands suggests high volatility in the short term. The 50MA (yellow line) continues to play the role of dynamic resistance while the MACD and RSI reflect the bearish moment of the index.

MACD looks close to a cross below the 0 line (bearish momentum) and the RSI continues to stay below the 50 line (bearish). So, for the short term, we remain neutral on the FTSEMIB and wait for a breakout of one of the support or resistance levels.

Support at 24,000

Resistance at 24.960

DAX 40

The DAX ended the week up by + 0.27%. For the week ahead, we favor consolidation of between 14,000 -14,400.

Indicators

The attempt to exceed the 50MA (yellow line) is a positive sign in the medium-term scenario in which we consider the price action from mid-March until today—long consolidation before proceeding to the upside.

Despite a positive view on the index, at the moment MACD and RSI are both negative. The former continues to remain below 0 (bearish momentum) and the RSI fluctuates on the 50 line.

If the index manages to stay above the 50MA, at around 14,400, we could see a bullish recovery in the DAX.

Support at 14,150

Resistance at 14.815

S&P 500

The S&P 500 had a week down by -2.89%. For the week ahead, we see consolidation between 4.300 and 4.375.

Indicators

The sudden change of course of the last two trading days brought the SPX back to a strong buying area (yellow rectangle). Looking at past price action, we can in fact see how the area between 4,200-4,300 has often led to accumulations and subsequent rises.

Although it is too early, given the strong bearish candles, we believe that a similar scenario can repeat itself. This hypothesis is supported by the movement of the RSI which seems close to reaching the oversold area.

MACD, below the 0 line (bearish momentum) continues to respect the bearish trend line.

Support at 4,240

Resistance at 4.375

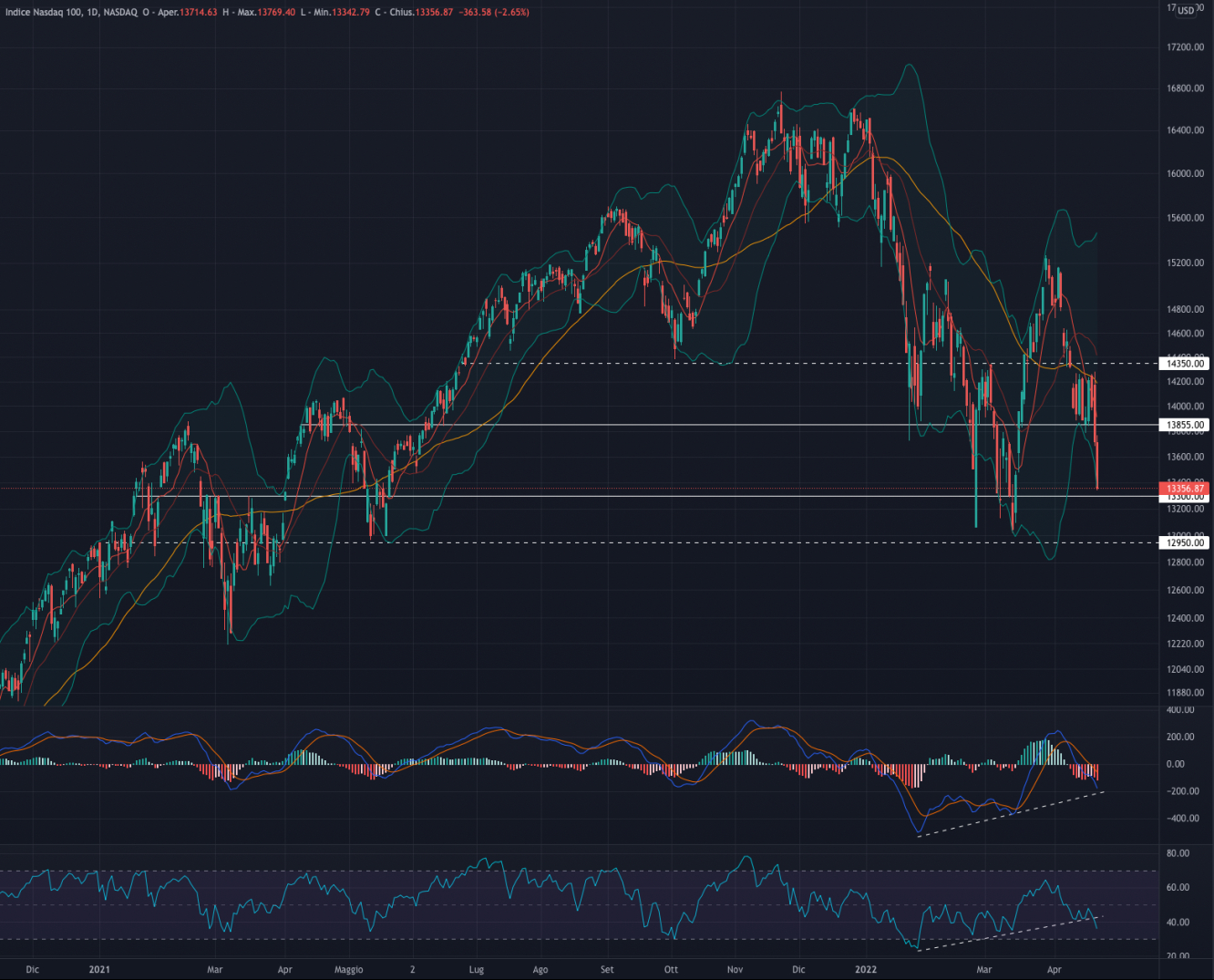

NASDAQ 100

The NASDAQ 100 ended the week down by -4.03%. For the week ahead, we are in favor of a consolidation between 13,400 and 13,800.

Indicators

Despite a bearish week, we believe the overall picture remains positive with possible upsides over the medium term.

Strong support at 13,000-13,200 seems very difficult to break at the moment. Should consolidation occur at this range, we could then expect a reversal to the upside.

MACD and RSI correctly describe the negative period of the index. MACD below the 0 line (bearish momentum) and the RSI, breaking the trend line, now approaching the oversold area.

The proximity of the RSI to the oversold area makes us exclude a possible bearish continuation, rather favoring a possible rise in the short to medium term.

We are positive on the index and believe that it may be close to a "bottoming" phase in the area of 13,600.

Support at 14.350

Resistance at 15,000

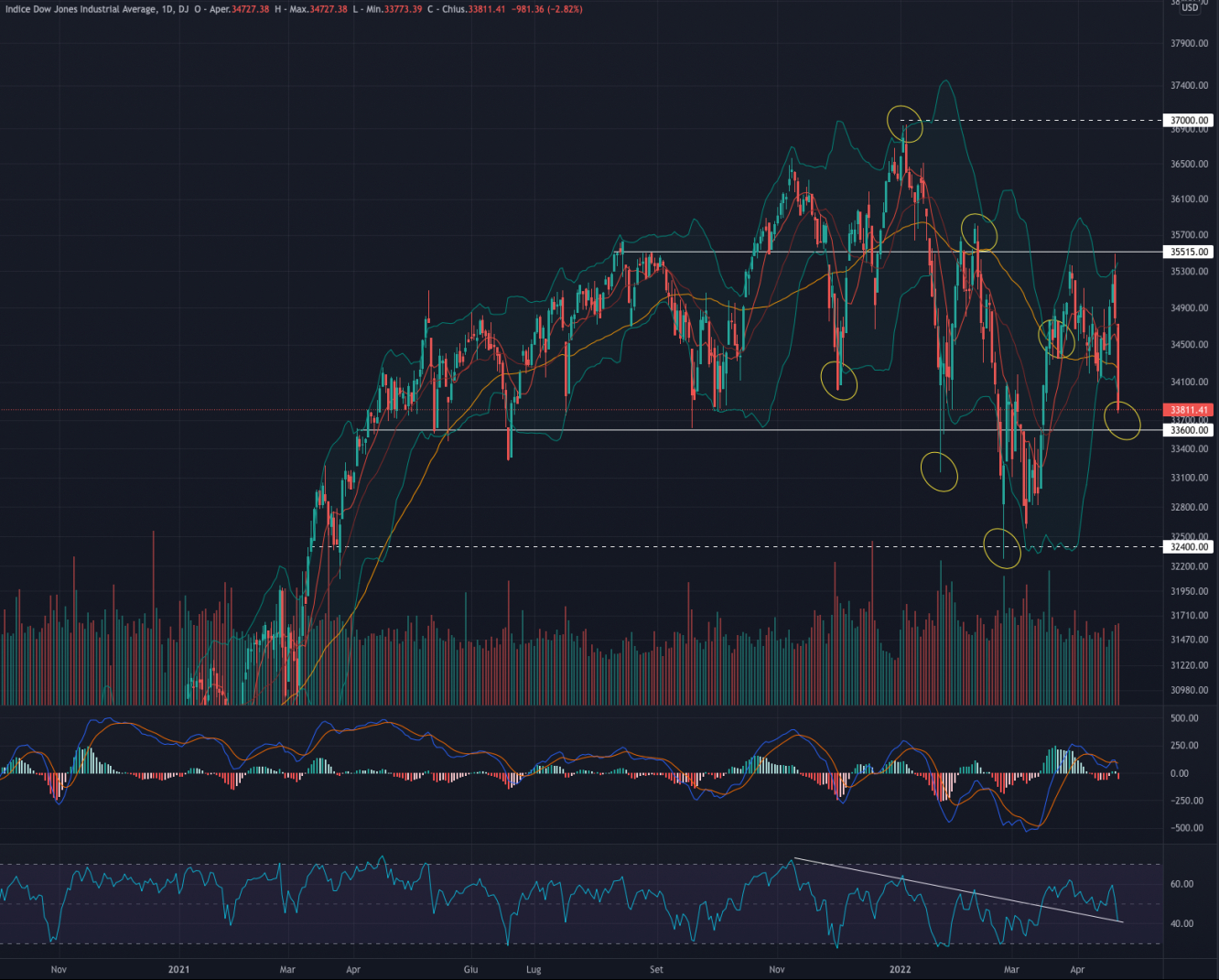

Dow Jones

The Dow Jones Industrial Average was down by -2.17%. This coming week, we expect a consolidation between 34,000 - 34,500.

Indicators

The index continues to fluctuate on the upper part of the broad bearish channel (yellow points on the chart) and within the wide side band 33.600 - 35.515 (support and resistance) in place since April 2021.

The consolidation above the channel keeps us very positive for a medium-term bullish scenario despite the strong swings at the end of the week.

The index is now in conjunction with a strong support and the crossing of the bearish channel which makes us hypothesize a possible consolidation rather than a bearish continuation.

MACD and RSI are both pointing lower, with MACD continuing to stay above the 0 line and RSI now in bearish territory.

Looking at previous swings, the DJI is now in a range that has always led to an upside reversal, so we will wait for a price confirmation before considering long positions.

Support at 33,600

Resistance 35.515