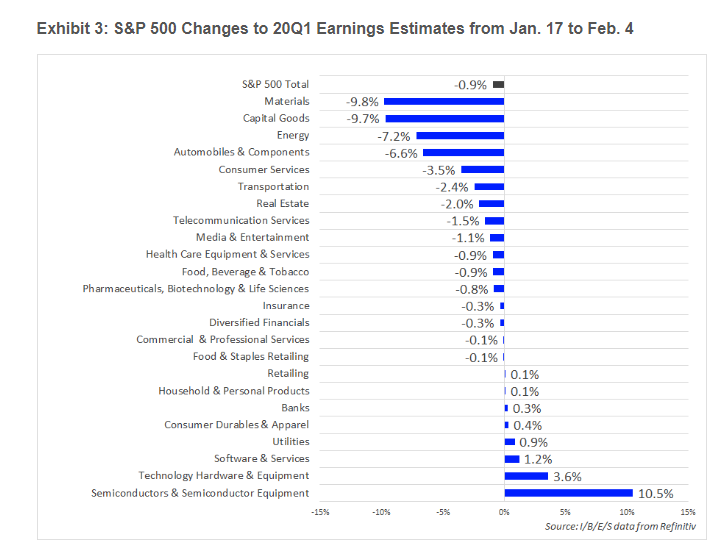

Below is a great graph from David Aurelio of IBES by Refintiv on S&P 500 subsectors seeing an earnings revision impact, some of which is undoubtedly due to the coronavirus.

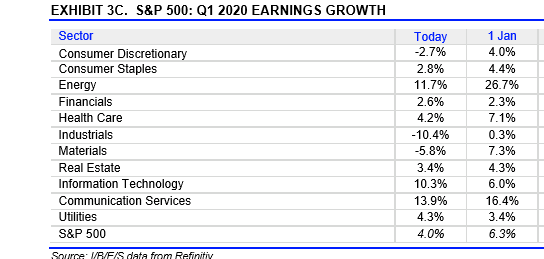

Here is the typical chronological table from IBES showing the same data as the bar chart, in a different way.

Note the strength in the Financial sector earnings, and Technology since January 1, ’20. That’s a 60% jump in Technology sector earnings since January 1, undoubtedly helped by Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT). Microsoft hit an all-time-high Friday on better-than-average volume.

If the yield curve would steepen a little, I think Financials could really outperform. The positive earnings revisions are there.

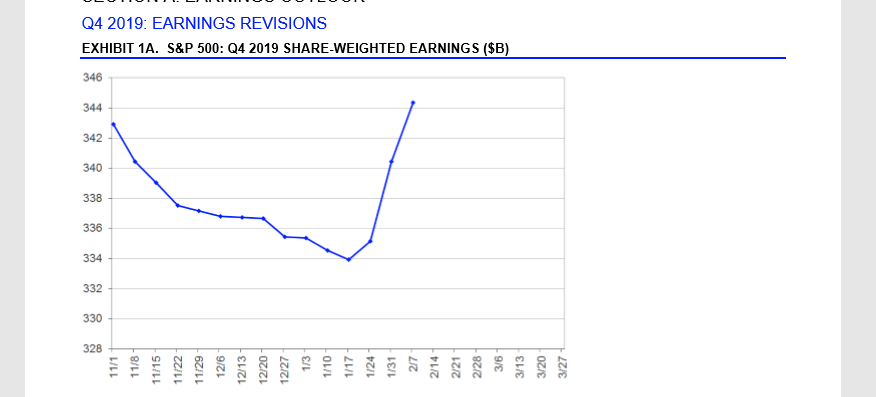

If readers are looking for a graphical representation for what a typical earnings season looks like, here is the graph off the first page of “This Week in Earnings” from IBES by Refinitiv:

There is your quintessential S&P 500 EPS diagram showing the estimate revised lower into earnings season, and then the upward revision to the S&P 500 EPS estimate once earnings start.

Summary / conclusion: The hard S&P 500 earnings data will be out this weekend, but I thought this might be of interest to readers. Will the coronavirus impact S&P 500 earnings? Sure, not surprisingly in sectors like Transports, Energy, Basic Materials, but you know all that already.

For Q1 ’20 earnings, note where there is strength and that looks right now like Financials and Technology.

Neither the S&P 500 nor Apple finished above either’s respective all-time-highs this week, so play accordingly.