VIX tested Long-term resistance at 14.17 before closing beneath Short-term support/resistance at 12.99. The probe above critical support/resistance may have triggered a probable buy signal in the VIX. The Cycles Model shows a likely surge strength for the VIX through mid-October.

(Bloomberg) U.S. stocks have been on a tear over the past week. So why has the market’s “fear gauge” barely budged?

The stickiness of the Cboe Volatility Index, which tracks the 30-day implied volatility of the S&P 500 Index based on out-of-the-money options, eerily echoes conditions that prevailed in early 2018.

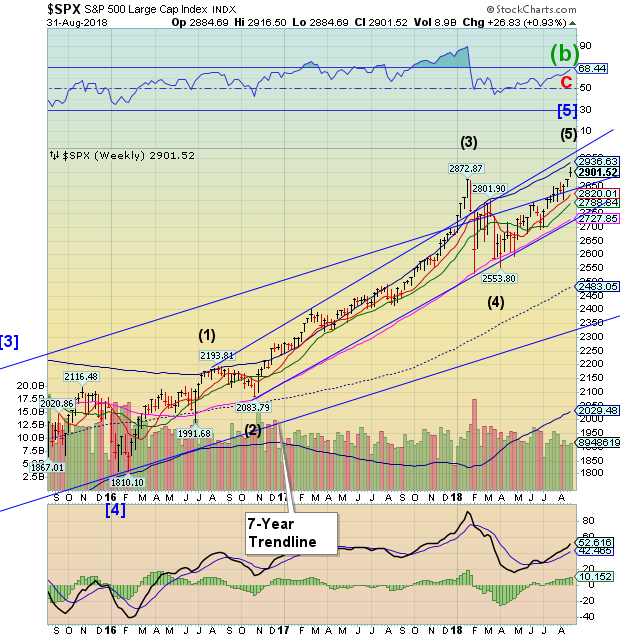

SPX tops out at a Fibonacci targets on Wednesday.

SPX made a new all-time high late Thursday after noon while hitting two Fibonacci targets at 2916.40 in an inverted Cycle high. Both price and time targets have been met. This begs the question, what will the markets do for an encore? The last time the SPX made an inverted high, it had a 10-market-day sell-off. Food for thought.

(CNBC) U.S. stocks dropped Friday as the United States and Canada put off resolving their trade dispute. Several indexes closed with historic highs for the month of August, as both the Nasdaq Composite and the S&P 500 notched all-time highs this week.

The Dow Jones Industrial average closed down 22 points, with losses in Boeing (NYSE:BA) and Goldman Sachs (NYSE:GS) offsetting gains in Apple (NASDAQ:AAPL) and Nike (NYSE:NKE). The S&P 500 rose 0.01 percent while the tech-heavy NASDAQ Composite traded up 0.26 percent.

To read the entire report Please click on the pdf File Below: