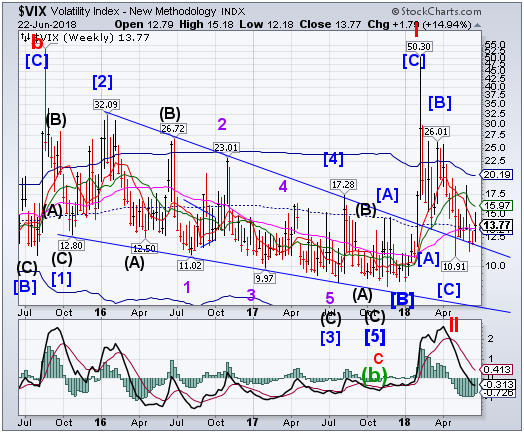

VIX rallied through the mid-cycle at 13.21 and short-term resistance at 13.46 to close right on long-term support/resistance at 13.77. It is now on a buy signal.The Cycles Model shows great strength next week for the VIX.

(Bloomberg) Trading patterns associated with the volatility buyer nicknamed “50 Cent” have returned to the markets.

Throughout 2017, this trader made massive buys of out-of-the-money calls on the CBOE Volatility Index for $0.50 apiece as protection against a plunge in the S&P 500 Index. That strategy paid off spectacularly when volatility went haywire in February.

SPX retreats from the two-year trend line.

SPX declined from its 2-year trend line at 2790.00, closing closing at a loss for the week. A decline beneath its upper 7-year trend line and short-term support at 2721.37 creates a sell signal. Equities are entering their negative season, so care should be taken to protect profits.

(Reuters) - US stocks rose on Friday with the Dow Jones Industrial Average looking to snap its 8-day losing streak, powered by a surge in oil prices, but losses in technology stocks curbed some gains.

The benchmark Brent crude jumped $1.83 to $74.88 a barrel, following three days of losses, after OPEC agreed to modest crude output increases to compensate for losses in production at a time of rising global demand.

Exxon Mobil (NYSE:XOM) rose 2.4 percent and Chevron (NYSE:CVX) gained 2.7 percent, lending the biggest boost to the S&P 500 and the Dow. The S&P Energy index was up 2.9 percent, eyeing its best day in nearly a month.

To read the entire report Please click on the pdf File Below: