U.S. economic data and European risk to guide markets

The U.S. dollar is mixed as it gained against the EUR, CHF, NZD and JPY, but lost ground against the CAD, GBP and AUD. Political risk continues to impact markets as U.S. uncertainty, the official triggering of Brexit and the upcoming French elections make investors anxious even as energy markets rebound thanks to a possible extension to the Organization of the Petroleum Exporting Countries (OPEC) production cut deal.

On the diplomatic front Chinese President Xi Jinping will visit the U.S. and is scheduled to meet U.S. President Donald Trump for the first in-person meeting on April 6–7.

Following a week with scarce data, the first week of April will feature the Reserve Bank of Australia (RBA) rate decision on Tuesday, April 4 at 12:30 am EDT and the releases of the meeting minutes from the March meetings from the U.S. Federal Reserve on Wednesday, April 5 at 2:00 pm EDT and the European Central Bank (ECB) on Thursday, April 6 at 7:30 am EDT.

U.S. data will grab the spotlight as manufacturing and non-manufacturing PMIs, crude inventories and jobs data are released.

U.S. employment data will be released this week with the ADP private payrolls leading the charge on Wednesday, April 5 at 8:15 am EDT (12:15 pm GMT). After a strong reading last month of 298,000 forecasters are expecting the number of jobs to slow down, but to remain above 200,000. The U.S. non farm payrolls (NFP) to be published on Friday, April 7 at 8:30 am (12:30 pm GMT) is expected add 180,000 jobs to the U.S. economy keeping the unemployment rate at 4.7 percent with a slight rise in wages of 0.2 percent. The jobs component has been validating the decision of the Fed to move rates higher, but as inflation becomes central to the conversation the wage growth indicator will be key on Jobs Friday.

The EUR/USD lost 1.018 in the last five trading days. The single currency is trading at 1.0697 after the USD has recovered from political shocks as the Trump administration is reassessing its strategy to push pro-growth policies into other branches of the government. The partisan divide in the U.S. will continue to restrain any forward momentum resulting from positive economic indicators. The EUR has gained from U.S. uncertainty, but has lost ground as U.S. fundamentals remain strong and Fed speakers continue to fan the flames of further rate hikes in 2017.

Germany continues to be the engine of the EU and strong retail sales (1.8 percent) beat the estimate, but inflation in the Union was lower than the estimate at 1.5 percent which puts less pressure on the European Central Bank (ECB) as it has put itself in a position where it might still have a QE program while needing to hike rates if inflation keeps climbing rapidly.

Next week will be more U.S. focused as employment indicators will be releases as well as the meeting notes from the March Federal Open Market Committee (FOMC) which resulted in a 25 basis points interest rate hike. The U.S. non farm payrolls (NFP) report is the biggest economic release and could end up helping the dollar get out of the current funk due to political stagnation.

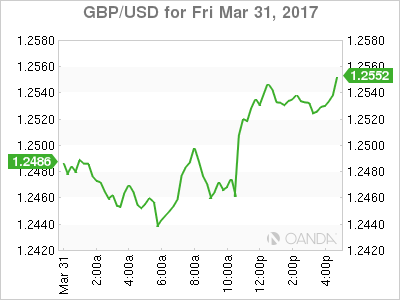

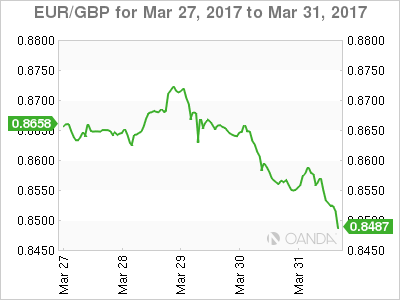

The GBP/USD gained 0.349 percent in the last week. The pound is trading at 1.2535 higher than the lows of the week at 1.2377 which is a good sign considering Article 50 kickstarted the Brexit process on Wednesday. The estimated two year length of the process and the fact that it is the response and negotiations with Europe that will drive markets have kept the GBP at current levels. The currency will remain tied to political events as there is still a gap between what the UK think it can negotiate and what Europe considers fair for a nation leaving its Union.

The European parliament will make an official statement regarding Brexit on April 4 with a deadline later in the month to prepare a joint document on the Union’s points to negotiate. Final approval of the document is on April 29 when the European Commission will outline the rules for the negotiation. Given that the currency market has already priced in the initial Brexit move last year the spotlight now moves on the negotiation and on the potential impact of the French elections on the EUR. Given the rise of Marine Le Pen and her National Front even though a Frexit looks like an unlikely outcome worse was said about Brexit.

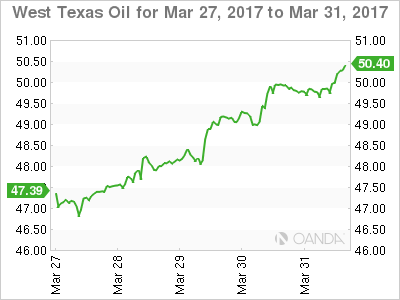

Oil rose 5.582 percent in the last five days. West Texas is trading at $49.95 and has broken above the $50 price level awaiting more details on a possible extension of the Organization of the Petroleum Exporting Countries (OPEC) production cut agreement. The original deal was only for six months, but given a combination of the effects of the agreement and the oversupply in the market the price of energy has bounced from the lowest levels since producers started reducing their output in January.

The price is still far from 2017 highs of 54.53 but the threat of U.S. shale producers and others who are not part of the OPEC and non-OPEC agreement continues as they are ramping up production and reactivating drilling sites. The OPEC will meet in May 25 with the deal extension sure to be on the agenda.

Market events to watch this week:

Sunday, April 2

9:30pm AUD Retail Sales m/m

9:45pm CNY Caixin Manufacturing PMI

Monday, April 3

4:30am GBP Manufacturing PMI

10:00am USD ISM Manufacturing PMI

9:30pm AUD Trade Balance

Tuesday, April 4

12:30am AUD Cash Rate

12:30am AUD RBA Rate Statement

4:30am GBP Construction PMI

5:15am AUD RBA Gov Lowe Speaks

8:30am CAD Trade Balance

Tentative NZD GDT Price Index

Wednesday, April 5

4:30am GBP Services PMI

8:15am USD ADP Non-Farm Employment Change

10:00am USD ISM Non-Manufacturing PMI

10:30am USD Crude Oil Inventories

2:00pm USD FOMC Meeting Minutes

Thursday, April 6

7:30 am EUR ECB Meeting Minutes

8:30am USD Unemployment Claims

Friday, April 7

4:30am GBP Manufacturing Production m/m

8:30am CAD Employment Change

8:30am USD Average Hourly Earnings m/m

8:30am USD Non-Farm Employment Change