- Defensive sectors made a comeback on Friday, along with a plunge in yields

- Investors searching for another catalyst to maintain record highs

Friday saw yet another in a string of market records as both the Dow Jones Industrial Average and S&P 500 hit new closing highs, albeit on thin summer trading. It was the 48th record close for the SPX since the start of 2021. Recent rallies have been propelled by the Reflation Trade, but it's unclear whether there's enough momentum for the current market paradigm to continue pushing equities higher in the week ahead.

It will likely depend on this coming week's US retail sales figures and the FOMC minutes, which will reveal the central bank's thinking on whether the economy is strong enough for the Federal Reserve to trim its bond buying program.

Treasuries also accelerated after Friday's Michigan Consumer Sentiment release showed one of the largest drops on record, to the lowest level for the index in almost a decade. Falling yields acted as a drag on the dollar, while boosting gold. However, the weaker greenback didn’t stop crude oil from extending a decline.

Why would investors increase their bets on safe haven Treasuries even while adding to their risk asset positioning, by buying into the most expensive stocks in history? The key clue might be gleaned from the sectors that led that rally.

Consecutive Records, Worried Investors, Thin Summer Trading

The broad, S&P 500 index racked up its the fourth consecutive record in a row. However, the benchmark hit that record by clawing out a less-than-0.2% gain on largely flat trading during the course of the final day of last week's trade, and then with an up-gap, reminiscent of Island Reversals (Evening Stars in Japanese candlesticks).

Significantly, defensive sectors led the rally: Consumer Staples added 0.8%; Utilities gained 0.7%. The Health Care sector moved 0.6% higher. Laggards included Energy shares which tanked, -1.2%, followed by Financials which slumped 0.75%. Industrials declined by 0.3, as did Consumer Discretionary shares.

It was an underwhelming week even though the SPX hit new records. Indeed, all told, the index only gained 0.7% over the previous week's five trading days.

While sectors that outperform during economic growth, aka the Reflation Trade, led the charge higher on a weekly basis—with Materials at the fore, +2.75%, and Financials, including banks see increasing profits in an environment with higher interest rates, climbing 1.9%—investor nervousness was also apparent: defensive Consumer Staples rose 2.2% for the week while Utilities climbed 1.8%.

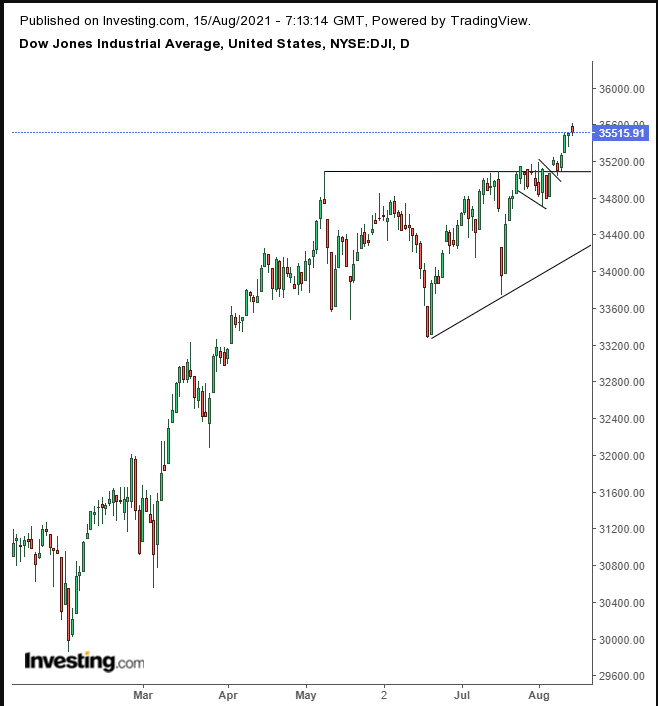

Though the Dow Jones saw a mere 0.04% uptick on Friday, it was enough for the mega-cap index to officially post its fourth consecutive record close as well, during a week when the 30-component benchmark saw a 0.9% gain. While the price closed well off Friday's highs, nearly wiping out any advance, overall, we see the Dow’s chart as considerably stronger than that of its S&P 500 peer.

The Dow recently completed a falling flag, bullish after the preceding jump. The continuation pattern was the device bulls used to complete an even larger bullish pattern, an ascending triangle.

The NASDAQ Composite was almost flat on Friday, eking out a 0.04% gain, while on a weekly basis, the tech-heavy gauge was 0.1% in the negative.

The benchmark may have completed a rising wedge, bearish after its 13% gain in just seven weeks. The psychology behind the pattern is trader disappointment based on unrealistic expectations of continued robust returns.

The small-cap, domestically-focused Russell 2000 underperformed on Friday. It was the only major US index in the red, down 1%, as its selloff extended for a second day. The benchmark was down for the week as well, -1.1%. Indeed, the gauge could be facing more trouble ahead.

The Russell 2000 is currently the only major index that hasn’t scored a record since March. Instead, it's been moving sideways.

Friday’s drop may have completed a rising flag, bearish after the preceding 10% plunge in just three weeks. Should the pattern’s bearish implications follow through, it will also help bears complete a march larger bearish pattern—a top—in place since the beginning of the year.

An additional noteworthy development, as mentioned above, yields, including for the 10-year benchmark Treasury note, which are normally positively correlated with stocks, dropped on Friday, even as equities continued their record streak.

Yields fell through the neckline of a would-be small double bottom, having found resistance by a Death Cross.

The University of Michigan’s preliminary Sentiment index plunged to 70.2, dropping by 11 points to its lowest level since December 2011. This tumble in confidence is likely the product of continuously rising prices and escalating, persistent COVID cases in the US and globally, which have the potential to create a slowdown in growth if consumers curtail spending, which makes up 70% of the US's GDP.

A vicious cycle could be setting up: if Americans hold back on spending because they’re afraid the pandemic will disrupt the recovery, it likely will.

Another possible indication of trouble ahead is coming into focus via the S&P 500’s Energy sector. The Select Sector SPDR® Fund (NYSE:XLE), an ETF proxy for energy shares, was the only sector fund in the red for the week, after ending a 19-day streak on Tuesday, during which no component of the ETF managed to cross the 50 DMA, for the second-longest period since the late 1950s.

The longest period when this occurred was in 2001, when energy company Enron’s accounting fraud imploded, dragging the entire sector down with it.

Meanwhile, the energy sector may be developing a large H&S top.

The latest COVID wave, fueled by the Delta variant leading to tighter social restrictions, is limiting travel and hitting summer demand. Goldman Sachs is betting the lower demand will only be temporary, but the International Energy Agency lowered its demand prediction for the remainder of the year.

The Week Ahead

All times listed are EDT

Sunday

19:50: Japan – GDP: expected to rise to 0.2% from -1.0% on a quarterly basis and to surge to 0.7% from -3.9% YoY.

22:00: China – Industrial Production: seen to have edged down to 7.8% from 8.3% in July.

Monday

8:30: US – Empire State Manufacturing Index: anticipated to have slumped to 29.00 from 43.00.

21:30: Australia – RBA Meeting Minutes

Tuesday

2:00: UK – Claimant Count Change: previous print came in at -114.8K.

8:30: US – Core Retail Sales: forecast to drop to 0.2% from 1.3%.

8:30: US – Retail Sales: likely fell to -0.2% from 0.6%.

13:30: US – Fed Chair Powel Speaks

22:00: New Zealand – RBNZ Interest Rate Decision: a hike to 0.50% from 0.25% is predicted.

Wednesday

2:00: UK – CPI: expected to edge down to 2.3% from 2.5% YoY.

5:00: Eurozone – CPI: liable to have remained flat in July, at 2.2% YoY.

8:30: US – Building Permits: predicted to rise to 1.610M from 1.594M.

8:30: Canada – Core CPI: likely to have ticked down to 0.1% from 0.3%.

10:30: US – Crude Oil Inventories: previous reading showed a drawdown of -0.447M.

14:00: US – FOMC Meeting Minutes

21:30: Australia – Employment Change: seen to plunge to -45.0K from 21.1K.

Thursday

8:30: US – Initial Jobless Claims: expected to shift lower, to 360K from an upwardly revised 375K.

8:30: US – Philadelphia Fed Manufacturing Index: to rise to 25.0 from 21.9.

Friday

2:00: UK – Retail Sales: forecast to remain flat at 0.5%.

8:30: Canada – Core Retail Sales: anticipated to surge to 4.4$ from -2.1%.

21:20: Australia – Retail Sales: previously printed at 0.1%.