The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Wednesday higher.

- ES pivot 2053.75. Holding below is bearish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- Single stock trader: VZ may be a buy in the next day or two.

Recap

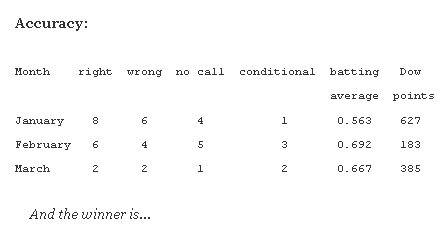

Whoa! I'm sure glad I called Tuesday lower because Mr. Market had a major snit and dumped 333 Dow points in a cascade that ended only because the bell finally rang at 4 PM in Wall St.'s equivalent of the Mercy Rule. And all this because of the strength of the dollar, interest rate fears, phase of the moon, blah blah doesn't matter, all we need to do is pay attention to the charts. So let's see how this sets us up for Wednesday.

The Technicals

The Dow: On Tuesday the Dow had its worst day since October 9th with a 1.85% swan dive that plunged right through the lower BB® with a giant angry red marubozu taking out two support lines in the process. And even at that we're still not yet down to extreme oversold levels. There's nothing on this chart to call a reversal right now.

The VIX: Bang zoom! The VIX took off like a skyrocket Tuesday with a gap-up 10.82% pop to remain firmly in a steep rising RTC. Indicators have now hit highly overbought levels but we've not yet hit the upper BB at 17.13. We have a hanging man but that requires confirmation so I can't call this one lower yet. I'll note though that VVIX punched up through its 200 day MA - not a good sign.

Market index futures: Last night all three futures were higher at 12:37 AM EDT with ES up 0.31% ES of course was pounded badly on Tuesday breaking key support at 2056 and continuing right on down through its lower BB. But that has driven all the indicators quite oversold and the stochastic is finally starting to come around into position for an eventual bullish crossover. And there was a hint of a rally in the overnight, though we've already seen that movie twice before in the past week - a leg down followed by a small bounce, lather rinse repeat. But this time we're a lot more oversold than back then so the selling may be nearing the end.

ES daily pivot: Last night the ES daily pivot tanked from 2075.42 to 2053.75. And even after that massive dump, we're still below the new pivot so this indicator remains bearish.

Dollar index: The dollar just keeps on its inexorable trend to infinity - and beyond with another 1% gap up yesterday. We've now broken all 2009 resistance lines. In fact, the dollar is now so high, I can't even scroll back far enough in eSignal to find the last time it was higher - the chart ends in 2007; It does look like it's starting to go exponential though but there's no telling when the blow-off top will come.

Euro: And of course the euro took another big hit Tuesday, closing this time down to 1.0698. Less that seven cents left to Parityville. At its current rate, we're still on track to pull into that station by the end of March. Look out below!

Transportation: Everything I wrote about the Dow applies here too. Big downtrend, no reversal in sight.

The SPX Hi-Lo index at 31.5 is now down to levels from which previous reversals have come. And all the charts are looking bearish with the exception of the VIX which is showing a reversal warning and ES which made a non-trivial move higher in the overnight. I never like to go against the futures and I think the current move lower may be have been overdone. It's possible we could get, if not an actual bottom, then something of a DCB on Wednesday so I'm going to go way out on the limb and call today (Wednesday) higher.

Single Stock Trader

Monday night I wrote of Verizon Communications (NYSE:VZ), "I'm not quite ready to get back in just yet.". Good thing too because VZ was down another 72 cents Tuesday in action that traded entirely under the lower BB. This is starting to look like early last December so we're not getting back on this bus until we see some sign that it's going our way - and that isn't just yet. Still, I'll be watching this one intraday on Wednesday. If it looks to be turning around and the rest of the market is up, I may hop on board for the quick swing.