Investing.com’s stocks of the week

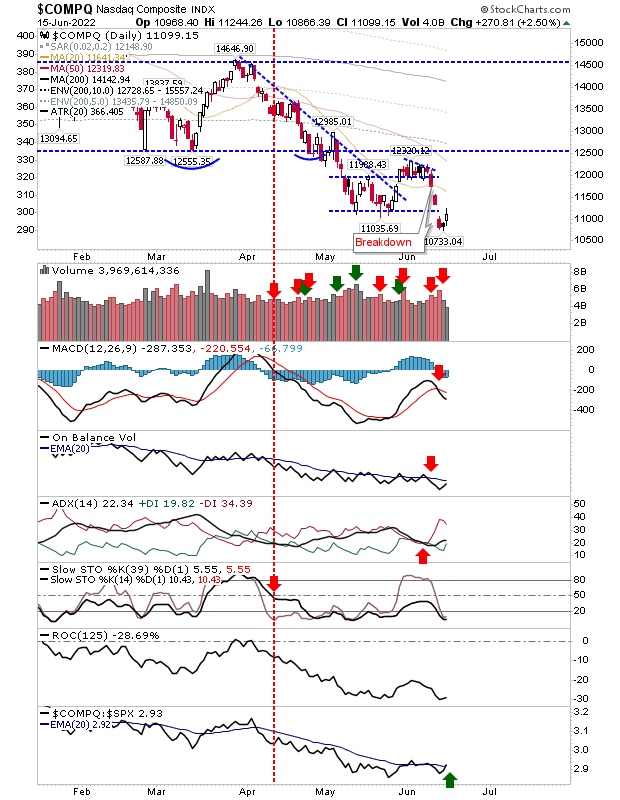

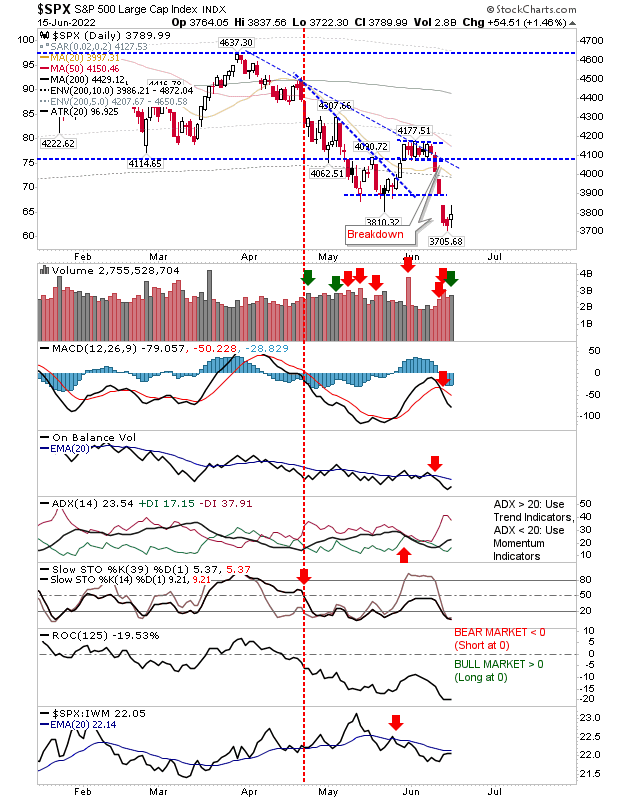

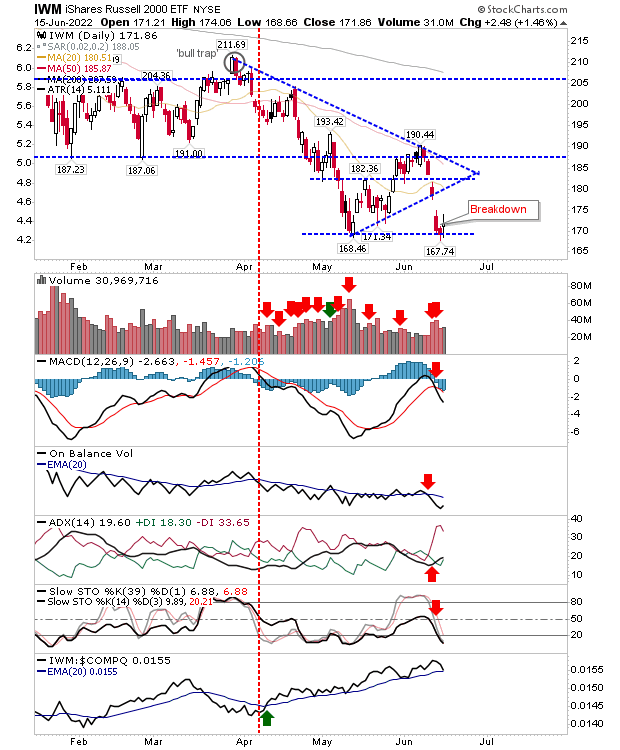

On Wednesday, buyers stepped up to the plate and recovered some of Tuesday's losses, but buying volume yesterday was down on Tuesday's for some indices—and there were some losses end-of-day to keep the gains in check. I wouldn't expect much from indices today. But slow, steady gains over coming days would be good.

The S&P 500 did manage to register an accumulation day but technicals are net bearish. If there is going to be a 'bear trap' it will need to do a lot more. Bears hold the advantage in the near term.

The Russell 2000 (via IWM) finished with a 'spinning top', which is a more neutral outlook for the index. With the undercut of the May lows in the S&P and NASDAQ, the likelihood for the same happening here is increased. Yesterday's close also saw a loss in relative performance to the aforementioned indices.

We can't say a whole lot about Wednesday's action. The candlesticks were neutral and volume was on the light side. This has the look of a weak bounce. To reverse this we have to see an increase in buying volume and ideally, wide range candlesticks. Lets see what Thursday brings.