The Stock market has been under pressure from upcoming interest rate hikes, inflation, and a worrying overseas situation in Ukraine. However, Monday’s gap lower was followed by a late-day rally in all four major indices. With that said, has this created a key support level to hold and will the market continue to run higher based on Monday’s price action?

Though the market is not out of the woods, watching for short-term support to hold could be the play of the week.

However, looking past this week could be a completely different story as we’ve seen rallies quickly flip in the other direction. Therefore, let us use two symbols to guide us through the week as both can give insight into the risk on/off environment.

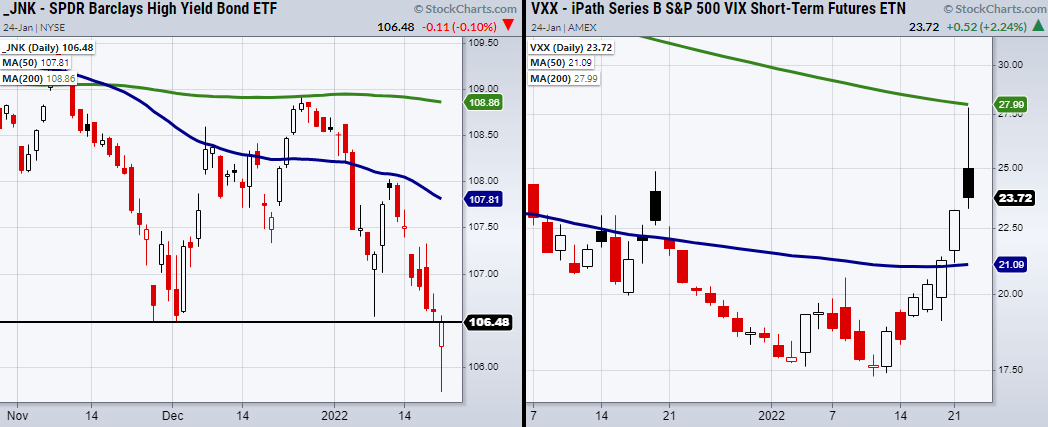

In the above chart, the volatility index (VXX) traded up to its 200-Day moving average before pulling back. Another risk-on/off indicator we frequently watch is high yield corporate debt (JNK) which is sitting at a pivotal price level of $106.48.

If we are looking for the market to continue higher, JNK should hold over $106.48 and VXX should not clear its 200-DMA at $27.99.

With that said, since we have focused on a rangebound market theme, trading within a smaller timeframe based on recent support or resistance areas has been a great way to capture profits in this choppy time.

ETF Summary

- S&P 500 (SPY) Watching to get back over the 200-DMA at 442 and hold.

- Russell 2000 (IWM) Looking for Monday’s rally to continue.

- Dow (DIA) 340 needs to hold.

- NASDAQ (QQQ) 350 to hold.

- KRE (Regional Banks) Flirting with the 50-DMA at 72.63.

- SMH (Semiconductors) Look for second close over the 200-DMA at 269.24.

- IYT (Transportation) 254.20 minor support.

- IBB (Biotechnology) 122.94 new support.

- XRT (Retail) 82.92 the 10-DMA to clear.

- Junk Bonds (JNK) 106.48 pivotal.

- SLV (Silver) 22.83 resistance.

- USO (US Oil Fund) 58 support.

- TLT (iShares 20+ Year Treasuries) 140 support.

- DBA (Agriculture) 20.37 resistance area.