Investing.com’s stocks of the week

Bears won the dog fight with the bulls and the agnostics yesterday. However, was this the dip to buy or the start of a way more major selloff?

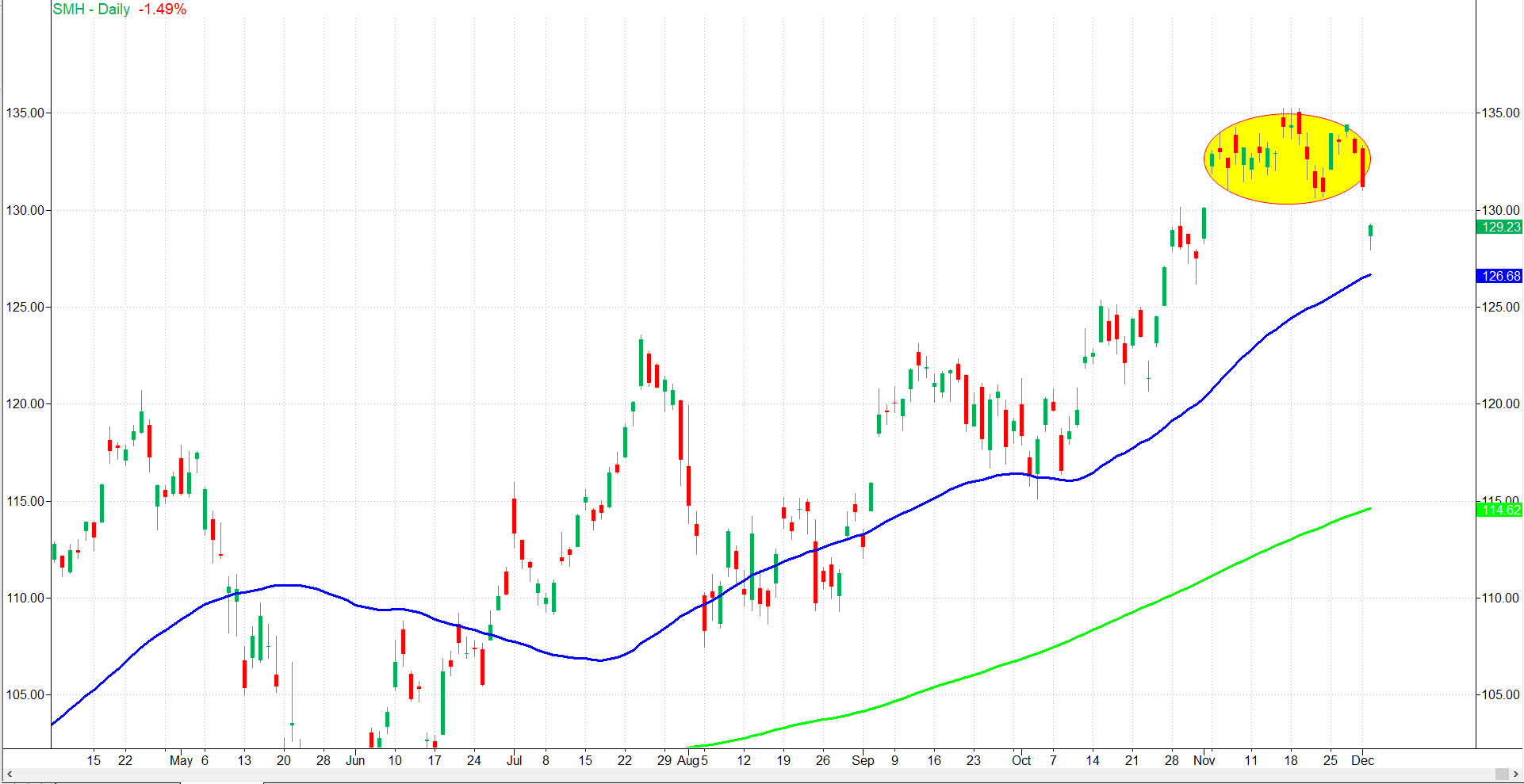

Semiconductors, via VanEck Vectors Semiconductor ETF (NYSE:SMH), might have the most interesting chart pattern. They should also hold the key to the next move in the overall market.

On November 4th, SMH gapped higher and, since it was a new all-time high, that made the pattern a clean breakaway gap. Since then and until yesterday, that gap held. What makes yesterday’s move interesting, is that we now have a potential island top.

If the gap to 130.60 (the low until yesterday) is not filled, then one can assume that more selling is in store. The 50-DMA is the blue line at 126.68. That could turn out as support.

However, if SMH cannot rally above 130 or so in the next 2-3 days, then bears and many agnostics will have sunk their sharp teeth into the bulls.