US stock markets are looking very bullish. In fact they have generally been bullish for 6 years.

Still, there always seems to be someone who thinks that the top is in and markets are about to crash. If that has been you over all this time, I feel sorry for you. The signs have all pointed higher except for a few brief tenuous moments. So, if you are one of those perma top callers, here's an idea. It's a way to express your opinion with real money, but without losing your shirt.

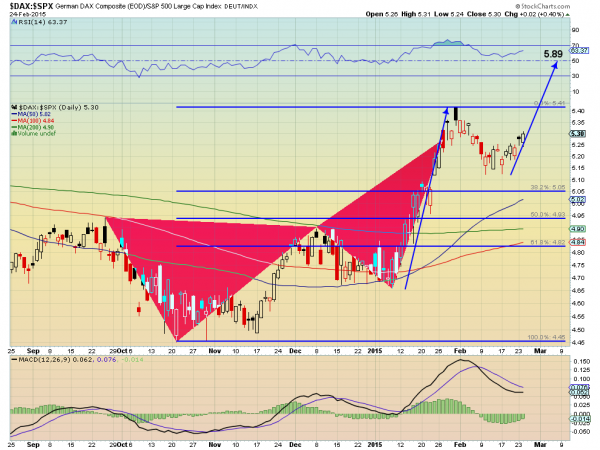

The chart above shows the ratio between the German DAX against the S&P 500. And it holds the key to betting against the US markets. The ratio has built a Deep Crab harmonic since late September. That completed in January and started to reverse. But look at the reversal. Not even to the 38.2% retracement before turning back up. This is a strong pair. And with it moving higher there is now a target on a Measured Move to 5.89. That is 11% higher than where it currently stands.

By buying the German DAX (or its proxy iShares Currency Hedged MSCI Germany (NYSEArca:HEWG) and selling the S&P 500 (via SPDR S&P 500 (ARCA:SPY)) you can express your view while still making money as the ratio rises. Just watch for a move below a ratio of 5.15 as a stop out level, and dream on bears.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.