(Tuesday Market Open) Long-time traders have a saying: “Buy the rumor; sell the fact.” But with the ongoing trade war between the U.S. and China, it’s been hard to distinguish the two. Over the last 18 months there’s been at times plenty of buying and selling pressure, sometimes on rumor, sometimes on what looks like concrete progress. What we do know is that markets are sitting near all-time highs, waiting for the next move.

Although an easing of trade tensions is one of the reasons that has helped lift stocks to records recently, a much-discussed partial deal has yet to be signed. So investors will likely be tuning in to President Trump’s speech later today when he’s expected to address the Economic Club of New York at a luncheon.

They’re probably hoping that the menu includes a helping of clarity on the trade war with China that has dogged the market for more than a year. Recently, U.S. and Chinese officials said both sides had agreed to roll back tariffs in phases, but Trump on Friday said he hadn’t agreed to the easing. Then, on Saturday, he told reporters that“the level of tariff lift is incorrect” but didn’t elaborate, according to Reuters.

In other words, this first phase of the trade deal is starting to feel a bit like a microcosm for the larger agreement Wall Street has been hoping for. There seems to be lots of talk but an absence of pen being put to paper to ease some of the uncertainty about trade between the world’s two largest economies that has already affected billions of dollars in goods flowing around the globe and cast a shadow over the global and domestic economies.

Equities Mixed; Dow Hits Record

If there’s one thing Wall Street doesn’t like, its uncertainty. And the back-and-forth trade headlines helped weigh on the market in the first trading day of the week, as did continuing protests in Hong Kong, a major financial and transportation hub that has been rocked by demonstrations for months.The Nasdaq Composite (COMP) and S&P 500 Index (SPX) were both in the red all day, but declines weren’t that large as investors and traders didn’t seem to see anything warranting a huge selloff. Both indices remain near all-time highs, apparently as market participants are viewing overall progress on phase one of the trade deal positively, as well as a recently accommodative Fed, and the winding-down of a better-than-expected earnings season.While equity losses were kept in check Monday for the COMP and SPX, the Dow Jones Industrial Average (DJI) managed to erase its losses and end slightly in the green to notch another record-high close.Boeing (NYSE:BA), Walgreens in Company News

There were a couple of standout stories within the 30-stock DJI, with Boeing (NYSE:BA) and Walgreens Boots Alliance (NASDAQ:WBA) both rising around 5% for the day while the next biggest gainer was up only 0.79%. It’s another example of how, because of the small number of companies comprising the index, plus the way in which companies are weighted within it, one or two outsized moves can skew one of the big three U.S. indices to an extent where it may not match the wider market.

In the case of BA, which is the most heavily weighted company in the $DJI, the aircraft manufacturer’s stock took off after it said it’s possible that deliveries of the 737 Max to customers could resume next month and it expects the airliner to re-enter commercial service in January. Still, American Airlines Group (NASDAQ:AAL) and Southwest Airlines (NYSE:LUV) have said they don’t plan to fly the 737 Max until March.

Meanwhile, WBA shares popped after Bloomberg reported that private-equity firm KKR (NYSE:KKR) has formally approached the drugstore company about a leveraged buyout. If a such a take-private deal happened for WBA’s $56 billion in market cap and nearly $17 billion in debt, that size would make it the biggest leveraged buyout ever, the news outlet said.

Despite the bright spots, volume on all three of the main U.S. indices was on the low side, perhaps unsurprising given that it was Veteran’s Day. The U.S. bond market was closed.

https://tickertapecdn.tdameritrade.com/assets/images/pages/md/vix-gc-11-12-19.png 800w" media="(min-width: 36em)" sizes="(min-width: 36em) 33.3vw, 100vw" />

https://tickertapecdn.tdameritrade.com/assets/images/pages/xs/vix-gc-11-12-19.png 2x" />

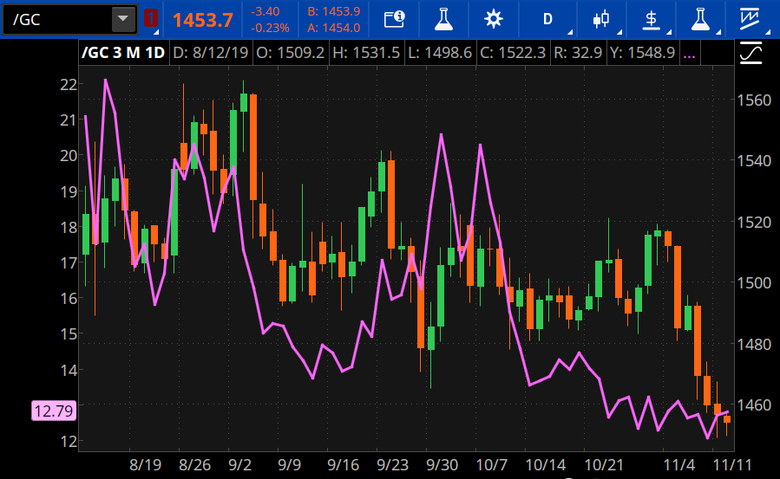

CHART OF THE DAY: CALMER SEAS.Aside from gains in the stock market, other indicators also suggest that Wall Street may be hitting the pause button on risk appetite rather than switching it off. Gold futures (/GC - candlestick) finished yesterday lower as investors apparently didn’t feel much of the need for the metal’s safe-haven function. And even though the Cboe Volatility Index (VIX - purple line) ticked up, it still ended below 13, well below the long-term average of around 18. Data sources: CME Group (NASDAQ:CME), Cboe Global Markets. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Low Rates, Late Cycle: Reduced interest rates in the U.S. are one reason equities have notched a series of all time highs in recent days. One argument for lowering rates is to stimulate the economy. But the economy goes in cycles, and recently we’ve been hearing worry about a recession. While such a contraction might be a ways away, both expansion and contraction are natural parts of the business cycle. But what happens if an economic downturn happens and the Fed—as well as European and Japanese monetary policy makers—doesn’t have much room to lower rates further? Boston Fed President Eric Rosengren talked about this in a speech in Oslo, Norway, yesterday, and we thought some of his insights were worth sharing. See below.

A Capital Buffer: With diminished room to come to the rescue amid short-term interest rate cuts, policy makers need other fiscal, regulatory, and financial-stability tools, Rosengren said. One such tool would be for banks to increase capital, especially as low interest rate environments challenge their profitability, he said. Increased capital would put financial institutions in a better position to help compensate for the narrower monetary and fiscal policy buffers, according to Rosengren. “Capital buffers should be rising now so that there is more room for them to decline if the economy falters,” he said.

Why the Next Recession Could Be Different: With low interest rates and without additional buffers, recessions might be deeper and recoveries slower than what we’ve seen historically, Rosengren said. That’s because low interest rates encourage companies and households to borrow money even as market participants pursue higher yields and create “a ready market for highly leveraged loans,” he said. “This excessive leverage could amplify the economic problems that arise in a downturn,” Rosengren added.

In other words, recent Fed policy maneuvers to “smooth out the business cycle” by lowering rates leave the central bank with less ammunition to mute the effects of a recession. And a potential unintended consequence of all this smoothing could be encouraging people to take on too much debt.

Good Trading