After many months of speculation, the Federal Reserve finally took away the punch bowl. This ended speculation of "when" and followed their action of reducing an accommodating stance. They began to reduce their bond buying a few months back, so the inevitable Fed Fund raise was just a matter of time.

Most economists believed the Fed should have taken this action several months back. As we have discussed here over the past few months, inflation is soaring. Raising interest rates is one of the fastest and most powerful methods used to slow down the economy and eventually lessen inflation.

Inflation was exacerbated by the recent incursion by Russia into Ukraine. As illuminated by us previously, the battle in Ukraine slowed—if not stopped—the exporting of many agricultural products including fertilizer, wheat and other cooking oils and necessary food sources by numerous European countries, like Hungary and Italy, afraid they will not have enough food for their own citizens.

Due to the out of control rising prices in just about every category, many had expected a much more aggressive action by the Fed. Estimates ranged from a quarter of a point to a full point. With the first interest rate rise in more than 4 years, the Fed voted to raise the Fed Fund rate by a quarter of a point.

They also broadcasted as many as 6 more raises during 2022. The Fed Chairman Powell also reiterated that if they eventually get to their target rate of 1.75% or higher in Fed Funds, the economy is strong and resilient enough to withstand the brakes being put on with little to no chance of a recession.

The Stock Market Reaction. Is It Time To Buy?

The relief that the Fed was beginning a cycle of tightening, but not too fast, along with a prognostication that the economy could withstand these rises, gave investors something to cheer about. Traders covered their shorts and put cash to work.

This news helped propel stocks to have one of the best weeks since November 2020. Fresh buying power lifted stocks out of correction territory and up over 5% for the week on the S&P 500 (SPY) as well as small cap stocks (IWM). The NASDAQ 100 (QQQ) did even better and rallied up over 8% for the week. See charts below:

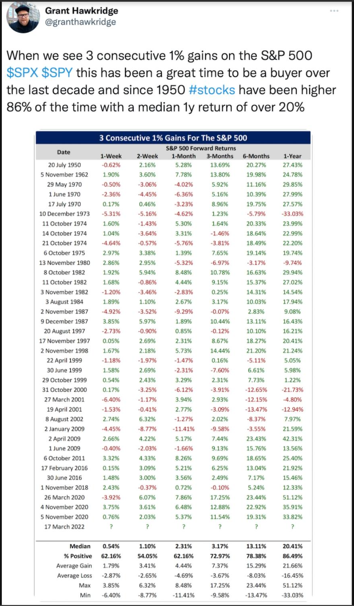

There is a historical precedent that when you have at least 3 days of the S&P 500 being up more than 1%, it is predictive of a good market in the future. Please review the following table to gain insight into this historical phenomenon.

Interest Rates Moving Forward

Will this be the right medicine for rising inflation? Will these moves begin to slow down the economy with the correct dose? Will rising and high (and harmful) prices begin to come down? Will the average consumer be able to navigate in this red-hot economy? When will gas prices level off or even begin to recede?

These are important questions that the Federal Reserve will have to weigh carefully as they determine if more—not less—Fed Fund increases will do the trick. We at MarketGauge were surprised that the Fed only chose to do a 25-basis point (quarter of a point) increase. We, like many others, thought a larger initial increase was warranted. However, we are reminded that when you go from zero in Fed Fund rates (with accommodation in bond buying) to a quarter point, this is perceived as a large jump. But is it large enough?

The Federal Reserve now walks a very narrow tightrope. While their greater interest is in stopping the rate of inflation, they don’t want to send the economy into too fast of a slowdown that could cause a recession. The Federal Reserve is charged with keeping inflation in check. That rate is still targeted at 2.0% annual. If they only bring it down to 4.0% or 4.5%, which is expected later this year, will they have to slam on the brakes more? Will that send us into a recession?

Suggested Steps For Managing Money In A Rising Interest Rate Environment

The period we now enter can be quite tricky for managing money. Rising interest rates can have a profound effect on slowing the growth rate of certain industries. Higher borrowing costs coupled with lower growth rates usually has a dampening effect on the multiples that investors are willing to pay for growth-oriented companies.

Here are a few suggestions for helping you navigate this environment:

- Include value stocks in your portfolio. This includes consumer staples, oil, basic material, and financial stocks that may react more favorable to the new market construct.

- If you have money in fixed income, shorten the duration and mitigate rising interest rate risk.

- Take profits if you get a quick move in your stocks. This is much more of a trader’s market, and we will see wild swings.

- Keep some powder dry. Having cash that you can put to work after the next swoon may be helpful to dollar cost average down.

- Use Alpha Rotation to help you make shorter-term decisions of when it is a more desirable time to put money to work.

- Use Big View and review Sector Plus to see the most recent areas of strength in the market. We caught energy, agricultural and commodities in a big way. Our systems identify these areas early on and you can take advantage of themes that are working.

- Engage in conversation with a professionally trained Financial Planner to see how you can mitigate some of your risk. If you are not working with one, let us know and we will connect you to Certified Planners that understand our work and may be able to assist you.

Risk On/Bullish

- There was a major rally this week across all 4 key indices, with SPY, IWM, and DIA all up at least +5% and QQQ leading +8.4% (+)

- The S&P regained its 50-week moving average and a bullish phase, the first key equity index to go back to bullish on a weekly basis (+)

- Consumer Discretionary (XLY) +9.1%, Semiconductors (SMH) +9.5%, and Technology (XLK) +7.6% were the leading sectors this week, all of which are very much Risk-On sectors (+)

- Chinese Stocks (FXI) along with several European funds—EWN, EWD—mean-reverted this week, making a +14% recovery after last week’s terrible performance in foreign equities (+)

- Risk Gauges dramatically shifted to fully Risk-On across the board (+)

- The number of stocks above key moving averages improved across the board, with the number of stocks above their 50-day moving average back to neutral levels. (+)

- For the first time this year, Growth Stocks (VUG) is in the lead over Value Stocks (VTV) according to our Triple Play indicator, a significant Risk-On indication. (+)

- The most interesting sector in Mish’s Modern Family is Transportation (IYT), which moved back into a bullish phase (+)

- Gold (NYSE:GLD) backed off this week, still leaving a potential island top in play from 2 weeks ago. (+)

Risk Off/Bearish

- Both QQQ and SPY look to be running a bit rich and potentially overbought according to the McClellan oscillator. (-)

- The most ominous market indicator right now is the flatness of the 2-10 year yield curve. (-)

- Despite the huge rally in Semiconductors (SMH) +9.5%, it still moved into a death cross that could serve as significant upside resistance. (-)

- Growth Stocks (VUG) have hit declining moving averages in both price and Real Motion, testing important resistance levels. (-)

Neutral

- Despite the strong comeback, all 4 indices are still negative year-to-date (=)

- The New High/New Low ratios marginally improved for both QQQ and SPY despite the strong weekly price action. (=)

- The Volatility Ratio improved marginally but shows that short-term volatility is essentially equal to long-term volatility, a signal that the market still needs to digest this week's runup. (=)

- Oil (NYSE:USO) bounced off of key support at the 200-week moving average after mean reverting from the explosive move seen at the beginning of the war in Ukraine. (=)

- Soft Commodities (DBA) seem to be flagging after a dramatic runup, and has a golden cross on Real Motion, However, on a short-term basis DBA appears to have lost its leadership vs the SPY. (=)

- Longer term treasury bonds (TLT) got oversold and is in the process of reverting back to the upside thanks to the Fed's rate increase last week, while short-term treasuries (SHY) did not get nearly as oversold and remains under pressure. (=)

- Foreign Equities including emerging markets and larger cap foreign stocks all rallied and mean-reverted after being extremely oversold last week but are still underperforming US Equities on a relative basis. (=)