In updating our month-end portfolio for subscribers last Wednesday I wrote, in bold lettering:

"Next we have to see if this [January's fabulous gain] marks a melt-up leading to a decline, as many pundits say, or if the market digests these gains with a slight correction and moves forward—as I believe it will."

As happened last Friday, just days after my subscriber missive went out, 666 points down in a single day sounds horrific—but for perspective we must remember that the Dow was up 1,430 points just in January. A (nearly) 50% retracement is not unusual: parabolic rises often result in parabolic declines. Even after yesterday's additional losses it's still important to maintain perspective.

Bull markets usually last longer than bear markets and are more measured in their advance. Bear markets are usually shorter in duration but much more vicious in amplitude. The same is often true of the smaller-cycle moves up, as happened in January and down, as so far has been the case in February.

Is there any good news from last week? Yes, in what didn't happen. It seems most traders did not add to short positions, they simply stepped aside. If there is any good news this week I imagine there will be some bargain-hunting that could stabilize the markets.

If not? I would rather not see "the Bear" start here but if it does we will adapt. That's what rational investors do.

I think the best thing I can do for regular readers to place this in perspective is to reproduce here an excerpt of the charts I use in our Investors Edge newsletter

Reading this article first will give you the “big picture” of what we do and how our approach differs from others. We diversify across asset classes first, THEN decide which investments within them make the most sense. This means, instead of owning the one flavor everyone is suddenly dumping, you always have a finger in the pies we believe will become, or remain, most in demand.

Our first step is asset allocation. There may be months or even years where we don't even consider a particular asset class, then switch into it for some considerable time.We hew to our asset allocation first, then and only then we select what to buy within that class.

A new Investor's Edge subscriber asked me recently why our firm works so hard at this rather than simply buying the index fund with the lowest expenses. (We often get this question well into or at the end of a bull market when passive works best!)

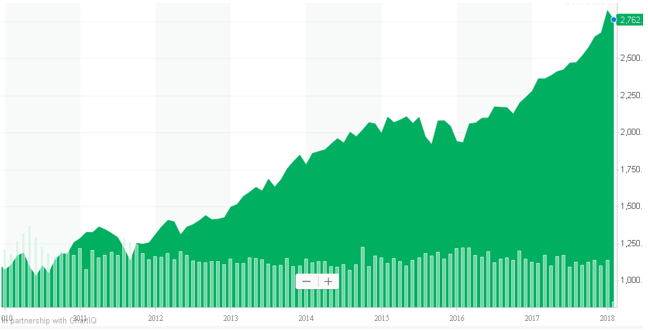

I explained to him that if you follow such an approach you will do well as long as the index does well, but you will suffer dearly when the index goes down. You can see the results of such an investment "plan" below. Just five charts show pretty much the entire market history of the past 20 years. I'll use the S&P 500, since most people think this represents "the market."

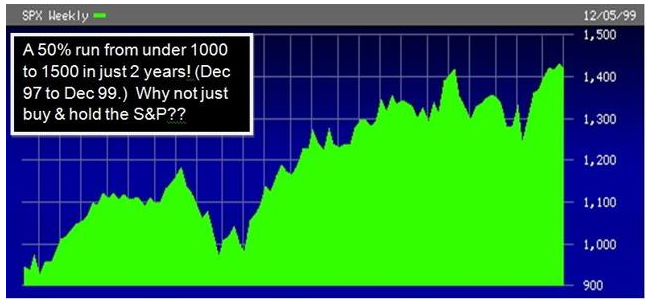

December 1997 to December 1999:

Source for all charts: Author, using Yahoo) Finance

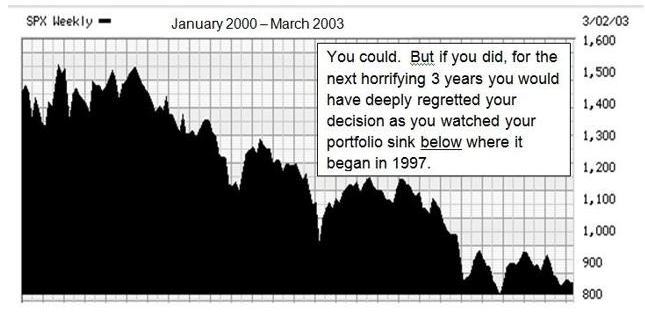

Then came January 2000 to March 2003:

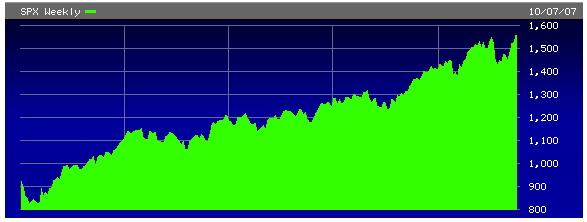

March 2003 - October 2007:

Here's the market cycle that followed: What a great market! You would have doubled your money in less than 5 years!

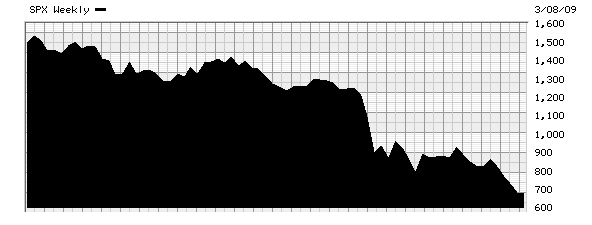

November 2007 - March 2009

Regrettably, you would have, again, given it all back (and more) if you owned an S&P index fund. By March 2009 you were below where you were in 1997.

This is not intelligent investing; it is buying just one subset of all the choices you could have had, all too often after it has already appreciated beyond the price or value metrics that makes it worth buying. And this only if you had perfect timing, as well!

If you like roller coasters, enjoy them in a theme park, not your portfolio.

Which brings us to last week:

We have now enjoyed the 2nd-longest bull market in history. Does January 2018 represent a market topping area, a warning one is near, or a small pause to a gift that keeps on giving? I don't know, you don't know, Junie Moon doesn't know, and Warren Buffett doesn't know either.

“To everything there is a season.” I strongly recommend that you learn to use trailing stops. As your profits rise, tighten the stops. That is what we do. On Friday we took smaller profits than we would have taken if a little bluebird landed on my shoulder Thursday and whispered, “The Dow is going to decline 666 points tomorrow.” But since that has never happened (to me, at least) I must instead rely upon…

* Intelligent asset class diversification

* Rational stock, fund and ETF selection, and

* A stressless, emotionless exit strategy based upon using our trailing stops.

Like I said above, I would rather not see "the Bear" start here but if it does we will adapt. That's what rational investors do.

Good investing.

Disclaimer: Do your due diligence! What's right for me may not be right for you; what's right for you may not be right for me. Past performance is no guarantee of future results. Rather an obvious statement, but too many people look only at past performance instead of seeking the alpha that comes from solid research and due diligence.