The S&P 500 finished the day higher, and it is frustrating because the index is trading based on the options market, and the VIX expiration today once again. I get the feeling it is going to be like this the rest of the year with just big price swings driven by the VIX rising and falling and options guys playing games.

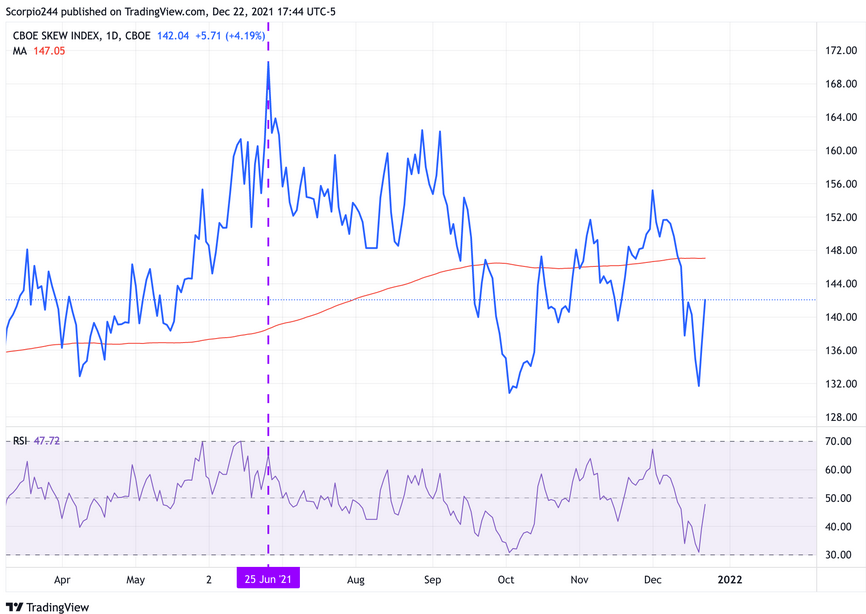

The chart below is pretty self-explanatory and easy to trace out the relationship.

If the intention is to continue to sell volatility into year-end, nothing will stand in the way of the market rising and giving everyone their end-of-year melt-up. If volatility is too low to sell, then the S&P 500 will stall out like the four times it has gotten to the 4700 prior.

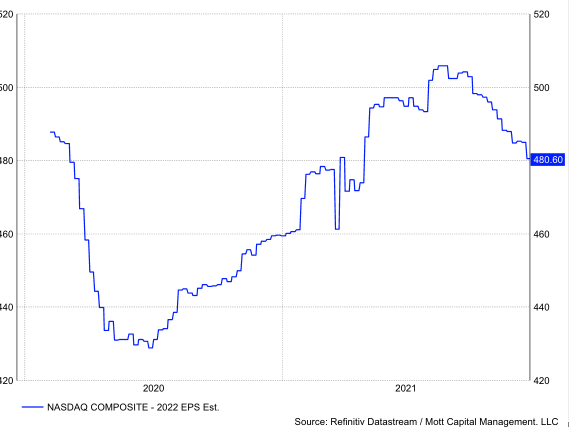

There is zero that is magical about the rally. The SKEW Index moved up again, confirming Wednesday's Vanna rally. The fundamental backdrop continues to deteriorate as NASDAQ earnings estimates continue to drop.

And remember, volatility works both ways, so just because the VIX is falling doesn’t mean volatility has subsided. A 2% drop followed by a 2% rise is still volatility.

The fundamental backdrop continues to deteriorate as NASDAQ earnings estimates for 2022 continue to drop.

Tesla

Tesla (NASDAQ:TSLA) rallied sharply yesterday and filled the gap at $1016 after Elon Musk noted that he had sold enough shares to reach his 10% target. But then, after the close, he clarified that statement and said now that he is almost done selling.

Welcome to my world over the last seven years, being a shareholder in this stock. I’d be cautious of the stock reversing lower and filling the gap at $937.