COVID-19’s devastating economic impact has hit the financial lives of people in the U.S. in a huge way. While secondary to health and wellness, what’s happening with our money matters.

Companies are feeling the pinch, too. Cash flows are strained, and solvency concerns are running high despite support from the Federal Reserve and vast fiscal moves to help people and firms get through this tough time.

How is the Utilities sector handling the crisis? Perhaps better than most.

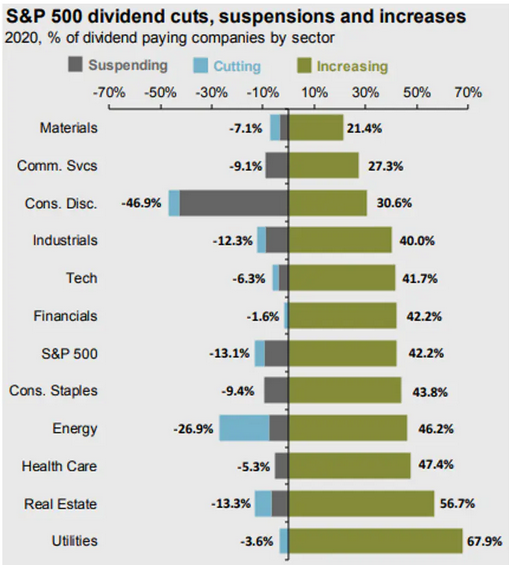

It’s not too surprising given that the sector is known to be less susceptible to wild market and economic swings as, say, the Consumer Discretionary arena. A recent report by JPMorgan (NYSE:JPM) displays the S&P 500’s dividend situation by sectors.

What’s interesting is that the Utilities sector has seen a whopping 68% of constituents raise their dividend so far in 2020. Just 4% of companies within the rather small-sized sector have cut dividends. No utilities stocks have suspended their dividend.

So that’s good news for investors in the space, but it’s also a good sign for the industry. There are ongoing concerns that municipalities will struggle to collect bill payments from customers as the unemployment rate has skyrocketed from just last February. Certainly, the actions by the federal government to lend a hand to struggling individuals and families have helped near-term cash flow.

But now we face a potential problem. The important $600 federal unemployment benefit is set to expire later this month. What will that mean for working families who were directly affected by COVID-19 in terms of losing a job? Hard to say, but there certainly is uneasiness among those who are out of work with bills to pay.

Utilities could be at risk if those in the U.S. are suddenly strained to pay their monthly bills.